Global Next Generation Anode Materials Market Research Report: Forecast (2021-2026)

By Product (Silicone/Silicon Oxide Blend, Lithium Titanium Oxide, Silicon-Carbon Composite, Silicon-Graphene, Others), By Application (Transportation, Electrical and Electronics, E...nergy Storage, Others), By Region (North America, South America, Europe, Asia-Pacific, Middle East, and Africa), By Country (U.S, Canada, Mexico, Brazil, Germany, France, Italy, The U.K, China, India, South Korea, Japan, UAE, Saudi Arabia, South Africa), By Competitors (NEXEON LTD., Shanshan Technology, OneD Material, LLC, pH Matter LLC, Altair Nanotechnologies, Inc., HITACHI CHEMICAL CO. LTD., LeydenJar Technologies BV, Amprius, Inc., BTR New Energy Material Ltd., California Lithium Battery, Enevate Corporation, Enovix, NanoGraf Corporation, SC Technologies, Sila Nanotechnologies Inc., Talga Resources Ltd.) Read more

- Chemicals

- Apr 2021

- Pages 211

- Report Format: PDF, Excel, PPT

Market Overview

Anode Materials are negative electrodes commonly used in lithium-ion batteries.

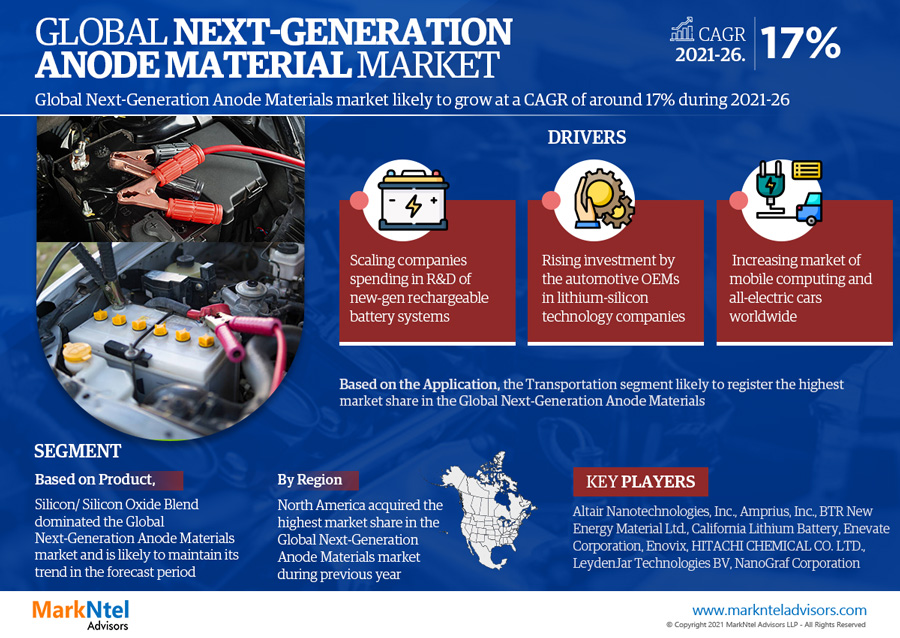

According to the MarkNtel Advisors' research report, "Global Next-Generation Anode Materials Market Analysis, 2021," the market is likely to grow at a CAGR of around 17% during 2021-26. The growth accredits to the increased mobile computing and electric cars market worldwide, rising silicone anode start-ups, and scaling investments by companies in R&D of new gen rechargeable battery systems with high energy density.

Apart from this, rising investment by the automotive OEMs in lithium-silicon technology companies to mount the percentage of silicon in EV batteries and oaring advancements in-cell technology are promulgating the market growth. The launch of silicon anode for next-generation Li-ion batteries and snowballing advancement in the existing Li-ion battery system are the factors promising lucrative growth of the market in the forecast period.

| Report Coverage | Details |

|---|---|

| Study Period | Historical Data: 2016-19 |

| Base Year: 2020 | |

| Forecast Period: 2021-26 | |

| CAGR (2021-2026) | 17% |

| Regions Covered | North America: USA, Canada, Mexico |

| Europe: Germany, UK, France, Italy, Others | |

| Asia-Pacific: China, India, Japan, South Korea, Others | |

| South America: Brazil, Others | |

| Middle East & Africa: UAE, Saudi Arabia, South Africa, Others | |

| Key Companies Profiled | NEXEON LTD., Shanshan Technology, OneD Material, LLC, pH Matter LLC, Altair Nanotechnologies, Inc., HITACHI CHEMICAL CO. LTD., LeydenJar Technologies BV, Amprius, Inc., BTR New Energy Material Ltd., California Lithium Battery, Enevate Corporation, Enovix, NanoGraf Corporation, SC Technologies, Sila Nanotechnologies Inc., Talga Resources Ltd. |

| Unit Denominations | USD Million/Billion |

Impact of COVID-19

The outburst of COVID-19 had significantly obstructed the Global Next-Generation Anode Materials. The automotive industry was adversely affected by the pandemic. The disruptive supply due to lockdown imposition and closed border created a severe shortage of raw material. China controlled a large share of rare earth elements, a mineral used in electric vehicles. Moreover, the declined demand for automobiles has significantly decreased the market for lithium-ion batteries.

However, the market is recovering, uplift of lockdown leading to the resumption of the production unit. Hence, this is likely to fuel the demand for next-generation anode materials for developing advanced Li-ion batteries in the forecast period.

Market Segmentation

Silicon/ Silicon Oxide Blend Dominated the Market

Based on Product, Silicon/ Silicon Oxide Blend dominated the Global Next-Generation Anode Materials market and is likely to maintain its trend in the forecast period due to the growing deployment of silicon oxides in lithium-ion batteries (LIBs) owing to its long cycle life and higher energy density.

The surging silicon in electric vehicle batteries, being environment friendly, and rapidly growing demand for electric vehicles like electric cars, e-bikes, and e-buses can boost the demand for silicon in its global market, reveals MarkNtel Advisors in their research report, "Global Next-Generation Anode Materials Market Analysis, 2021."

Transportation Registers Highest Market Share

Based on the Application, the Transportation segment likely to register the highest market share in the Global Next-Generation Anode Materials market due to the paradigm shift of the automobile companies toward electric vehicle production to mitigate climate change. The ongoing developments in battery technology and rising demand for automotive lithium-based batteries are driving the market growth.

Besides, the growing government's inclination to promote electric cars, snowballing investments by OEMs like BMW Group & Daimler in lithium-silicon technology companies, such as Sila Nanotechnologies, Solid Power, and Enevate, and augmenting demand for cheaper, faster charging, and high-energy-density batteries are factors accelerating the segment growth.

Regional Landscape

North America Acquired the Highest Market Share

North America acquired the highest market share in the Global Next-Generation Anode Materials market in 2019 due to the surging commercialization of lithium-ion batteries. The integration of new materials in the lithium-ion battery to achieve high energy density and burgeoning production of silicon anodes as a replacement to the graphite anodes by the battery manufacturer.

The US dominated the North American region owing to the sturdy presence of giant market players. The increasing demand for consumer electronics products like wearable devices & smartphones and the high adoption of electric vehicles in the country are factors driving the Next-Generation Anode Materials market growth.

Market Driver

Burgeoning Funding in R&D

To replace graphite with silicon-based anode from lithium-ion batteries and various investments made by the market leaders in R&D are surging the need for next-generation anode materials. The growing demand for fast charging &higher energy efficiencies batteries in consumer electronics and burgeoning funding in the development of next-gen Li-ion batteries are the factors driving the global market.

Moreover, escalating innovation in high-capacity silicon anode material for next-generation batteries and snowballing adoption of clean-energy electric vehicles owing to the paradigm shift of the automotive industry towards electrification are factors accelerating the market growth.

Competitive Landscape

According to MarkNtel Advisors, the major leading players in the global Next-Generation Anode Materials market are Altair Nanotechnologies, Inc., Amprius, Inc., BTR New Energy Material Ltd., California Lithium Battery, Enevate Corporation, Enovix, HITACHI CHEMICAL CO. LTD., LeydenJar Technologies BV, NanoGraf Corporation, NEXEON LTD., Shanshan Technology, OneD Material, LLC, pH Matter LLC, SC Technologies, Sila Nanotechnologies Inc., Talga Resources Ltd., etc.

Key Questions Answered in the Market Research Report:

- What are the overall market statistics or estimates (Market Overview, Market Size- By Value, Forecast Numbers, Market Segmentation, Market Shares) of the Global Next-Generation Anode Materials Market?

- What is the region-wise industry size, growth drivers, and challenges?

- What are the key innovations, opportunities, current & future trends, and regulations in the Global Next-Generation Anode Materials Market?

- Who are the key competitors, their key strengths & weakness, and how they perform in the Global Next-Generation Anode Materials Market based on a competitive benchmarking matrix?

- What are the key results derived from the market surveys conducted during the Global Next-Generation Anode Materials Market study?

Market Outlook, Segmentation and Statistics

- Impact of COVID-19 on Global Next-Generation Anode Materials Market

- Market Size & Analysis

- By Revenue

- By Volume

- Market Share & Analysis

- By Product

- Silicon/Silicon Oxide Blend

- Lithium Titanium Oxide

- Silicon-Carbon Composite

- Silicon-Graphene

- Others

- By Application

- Transportation

- Electrical and Electronics

- Energy Storage

- Others

- By Region

- North America Next-Generation Anode Materials Market Outlook, 2016-2026F (USD Million)

- The US Next-Generation Anode Materials Market Outlook, 2016-2026F (USD Million)

- Canada Next-Generation Anode Materials Market Outlook, 2016-2026F (USD Million)

- Mexico Next-Generation Anode Materials Market Outlook, 2016-2026F (USD Million)

- South America Next-Generation Anode Materials Market Outlook, 2016-2026F (USD Million)

- Brazil Next-Generation Anode Materials Market Outlook, 2016-2026F (USD Million)

- Europe Next-Generation Anode Materials Market Outlook, 2016-2026F (USD Million)

- The UK Next-Generation Anode Materials Market Outlook, 2016-2026F (USD Million)

- Germany Next-Generation Anode Materials Market Outlook, 2016-2026F (USD Million)

- France Next-Generation Anode Materials Market Outlook, 2016-2026F (USD Million)

- Italy Next-Generation Anode Materials Market Outlook, 2016-2026F (USD Million)

- Asia-Pacific Next-Generation Anode Materials Market Outlook, 2016-2026F (USD Million)

- China Next-Generation Anode Materials Market Outlook, 2016-2026F (USD Million)

- South Korea Next-Generation Anode Materials Market Outlook, 2016-2026F (USD Million)

- Japan Next-Generation Anode Materials Market Outlook, 2016-2026F (USD Million)

- India Next-Generation Anode Materials Market Outlook, 2016-2026F (USD Million)

- Middle East & Africa Next-Generation Anode Materials Market Outlook, 2016-2026F (USD Million)

- UAE Next-Generation Anode Materials Market Outlook, 2016-2026F (USD Million)

- Saudi Arabia Next-Generation Anode Materials Market Outlook, 2016-2026F (USD Million)

- South Africa Next-Generation Anode Materials Market Outlook, 2016-2026F (USD Million)

- North America Next-Generation Anode Materials Market Outlook, 2016-2026F (USD Million)

- By Competitors

- Competition Characteristics

- Market Share & Analysis

- Competitive Metrix

- By Product

- Global Next-Generation Anode Materials Market Hotspots & Opportunities

- Global Next-Generation Anode Materials Market Supply Chain Analysis

- Global Next-Generation Anode Materials Market Corporate Strategies

- Global Next-Generation Anode Materials Market Regulations & Policy

- Key Strategic Imperatives for Success and Growth

- Global Competition Outlook

- Competition Matrix

- Company Profile

Frequently Asked Questions

- Introduction

- Product Definition

- Research Process

- Assumptions

- Market Segmentation

- Preface

- Executive Summary

- Impact of COVID-19 on Global Next-Generation Anode Materials Market

- Global Next-Generation Anode Materials Market Trends & Insights

- Global Next-Generation Anode Materials Market Dynamics

- Drivers

- Challenges

- Impact Analysis

- Global Next-Generation Anode Materials Market Hotspots & Opportunities

- Global Next-Generation Anode Materials Market Supply Chain Analysis

- Global Next-Generation Anode Materials Market Regulations & Policy

- Global Next-Generation Anode Materials Market Corporate Strategies

- Partnerships and Collaboration

- Business Expansion

- Global Next-Generation Anode Materials Market Outlook, 2016- 2026F

- Market Size & Analysis

- By Revenue

- By Volume (Tons)

- Market Share & Analysis

- By Product

- Silicon/Silicon Oxide Blend

- Lithium Titanium Oxide

- Silicon-Carbon Composite

- Silicon-Graphene

- Others

- By Application

- Transportation

- Electrical and Electronics

- Energy Storage

- Others

- By Region

- North America

- South America

- Europe

- Middle East & Africa

- Asia-Pacific

- By Competitors

- Competition Characteristics

- Market Share & Analysis

- Competitive Metrix

- By Product

- Market Size & Analysis

- North America Next-Generation Anode Materials Market Outlook, 2016-2026F

- Market Size & Analysis

- By Revenue

- By Volume

- Market Share & Analysis

- By Product

- By Application

- By Country

- The US

- Canada

- Mexico

- The US Next-Generation Anode Materials Market Outlook, 2016-2026F

- Market Size & Analysis

- By Revenue

- By Volume

- Market Share & Analysis

- By Product

- By Application

- Market Size & Analysis

- Canada Next-Generation Anode Materials Market Outlook, 2016-2026F

- Market Size & Analysis

- By Revenue

- By Volume

- Market Share & Analysis

- By Product

- By Application

- Market Size & Analysis

- Mexico Next-Generation Anode Materials Market Outlook, 2016-2026F

- Market Size & Analysis

- By Revenue

- By Volume

- Market Share & Analysis

- By Product

- By Application

- Market Size & Analysis

- Market Size & Analysis

- South America Next-Generation Anode Materials Market Outlook, 2016-2026F

- Market Size & Analysis

- By Revenue

- By Volume

- Market Share & Analysis

- By Product

- By Application

- By Country

- Brazil

- Others

- Brazil Next-Generation Anode Materials Market Outlook, 2016-2026F

- Market Size & Analysis

- By Revenue

- By Volume

- Market Share & Analysis

- By Product

- By Application

- Market Size & Analysis

- Market Size & Analysis

- Europe Next-Generation Anode Materials Market Outlook, 2016-2026F

- Market Size & Analysis

- By Revenue

- By Volume

- Market Share & Analysis

- By Product

- By Application

- By Country

- Germany

- The UK

- France

- Italy

- Others

- Germany Next-Generation Anode Materials Market Outlook, 2016-2026F

- Market Size & Analysis

- By Revenue

- By Volume

- Market Share & Analysis

- By Product

- By Application

- Market Size & Analysis

- The UK Next-Generation Anode Materials Market Outlook, 2016-2026F

- Market Size & Analysis

- By Revenue

- By Volume

- Market Share & Analysis

- By Product

- By Application

- Market Size & Analysis

- France Next-Generation Anode Materials Market Outlook, 2016-2026F

- Market Size & Analysis

- By Revenue

- By Volume

- Market Share & Analysis

- By Product

- By Application

- Market Size & Analysis

- Italy Next-Generation Anode Materials Market Outlook, 2016-2026F

- Market Size & Analysis

- By Revenue

- By Volume

- Market Share & Analysis

- By Product

- By Application

- Market Size & Analysis

- Market Size & Analysis

- Middle East & Africa Next-Generation Anode Materials Market Outlook, 2016-2026F

- Market Size & Analysis

- By Revenue

- By Volume

- Market Share & Analysis

- By Product

- By Application

- By Country

- UAE

- Saudi Arabia

- South Africa

- Others

- UAE Next-Generation Anode Materials Market Outlook, 2016-2026F

- Market Size & Analysis

- By Revenue

- By Volume

- Market Share & Analysis

- By Product

- By Application

- Market Size & Analysis

- Saudi Arabia Next-Generation Anode Materials Market Outlook, 2016-2026F

- Market Size & Analysis

- By Revenue

- By Volume

- Market Share & Analysis

- By Product

- By Application

- Market Size & Analysis

- South Africa Next-Generation Anode Materials Market Outlook, 2016-2026F

- Market Size & Analysis

- By Revenue

- By Volume

- Market Share & Analysis

- By Product

- By Application

- Market Size & Analysis

- Market Size & Analysis

- Asia Pacific Next-Generation Anode Materials Market Outlook, 2016-2026F

- Market Size & Analysis

- By Revenue

- By Volume

- Market Share & Analysis

- By Product

- By Application

- By Country

- China

- India

- Japan

- South Korea

- Others

- China Next-Generation Anode Materials Market Outlook, 2016-2026F

- Market Size & Analysis

- By Revenue

- By Volume

- Market Share & Analysis

- By Product

- By Application

- Market Size & Analysis

- India Next-Generation Anode Materials Market Outlook, 2016-2026F

- Market Size & Analysis

- By Revenue

- By Volume

- Market Share & Analysis

- By Product

- By Application

- Market Size & Analysis

- Japan Next-Generation Anode Materials Market Outlook, 2016-2026F

- Market Size & Analysis

- By Revenue

- By Volume

- Market Share & Analysis

- By Product

- By Application

- Market Size & Analysis

- South Korea Next-Generation Anode Materials Market Outlook, 2016-2026F

- Market Size & Analysis

- By Revenue

- By Volume

- Market Share & Analysis

- By Product

- By Application

- Market Size & Analysis

- Market Size & Analysis

- Key Strategic Imperatives for Success and Growth

- Competition Outlook

- Competition Matrix

- Product Portfolio

- Target Markets

- Target End Users

- Research & Development

- Strategic Alliances

- Strategic Initiatives

- Company Profiles

- Altair Nanotechnologies, Inc.

- Amprius, Inc.

- BTR New Energy Material Ltd.

- California Lithium Battery

- Enevate Corporation

- Enovix

- HITACHI CHEMICAL CO. LTD.

- LeydenJar Technologies BV

- NanoGraf Corporation

- NEXEON LTD.

- Shanshan Technology

- OneD Material, LLC

- pH Matter LLC

- SC Technologies

- Sila Nanotechnologies Inc.

- Talga Resources Ltd.

- Competition Matrix

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making