GCC Power Rental Market Research Report: Forecast (2025-2030)

GCC Power Rental Market - By Type (Generator [Up to 100 KVA, 100.1 KVA-350 KVA, 350.1-750 KVA, 750.1-1000KVA, Above 1,000 KVA], Loadbanks, Transformers), By End User (Power Utiliti...es, Oil & Gas, Construction, Manufacturing, Metal & Mining, Others (Events, etc.)), By Country (The UAE, Saudi Arabia, Qatar, Kuwait, Oman, Bahrain), By Company (ENERGIA, Aggreko, Byrne Equipment Rental, Sudhir Rental, Altaaqa Global, Hertz Dayim Equipment Rental, Energy Equipment Rental Co., Atlas Copco Rental, Saudi Diesel Equipment Company (SDEC), Modern Energy Pvt. Ltd., Rental Solutions & Services, and others) Read more

- Energy

- Oct 2025

- Pages 152

- Report Format: PDF, Excel, PPT

Market Definition

Power rental refers to the renting of temporary power generation equipment, such as generators, transformers, and load banks, to meet the temporary power needs of various industries & sectors. The temporary power solutions are primarily used to provide backup power in emergencies, supplement power during peak demand periods, and support construction projects, industrial operations, events, and other activities that require a reliable & uninterrupted power supply. The market of the GCC energy industry provides flexible & cost-effective solutions for temporary power needs while reducing the capital expenditure & operational risks associated with owning & maintaining power generation equipment.

Market Insights & Analysis: GCC Power Rental Market (2025-30):

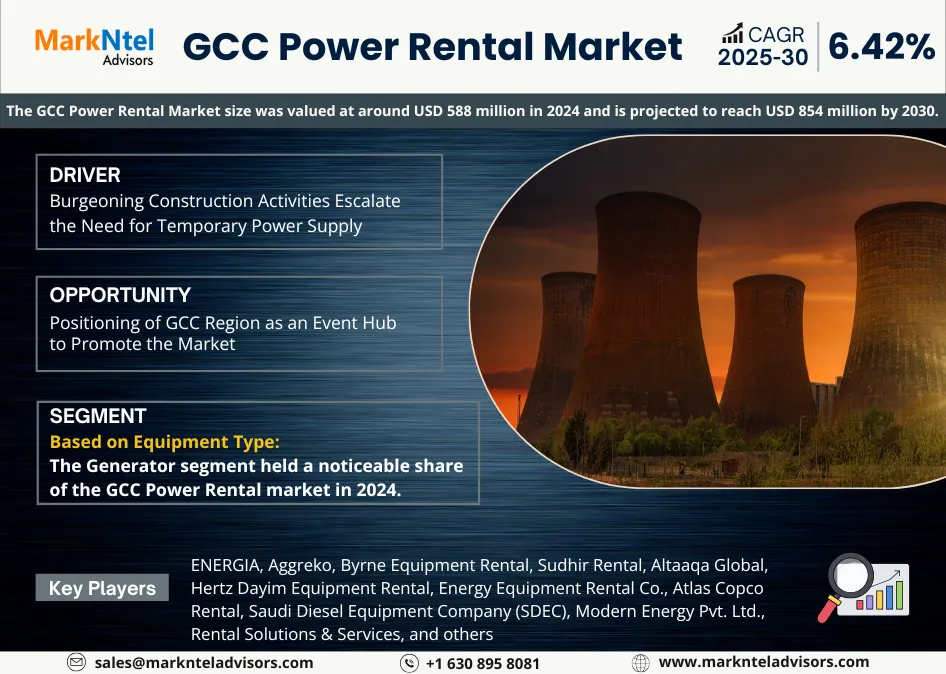

The GCC Power Rental Market size was valued at around USD 588 million in 2024 and is projected to reach USD 854 million by 2030. Along with this, the market is estimated to grow at a CAGR of around 6.42% during the forecast period, i.e., 2025-30.

The market growth is significantly attributed to the rising demand for temporary power solutions in various industries such as construction, oil & gas, etc. Also, during the summers & the peak season, the non-availability of the national grid puts pressure on the grids in the major countries of the GCC, such as Saudi Arabia & the UAE, among others. Hence, to cater to the rising electricity demand, these energy rental solutions play a major role in the GCC region.

Additionally, real estate is one of the fast-growing sectors in the GCC region, paramount to the overall economic diversification plans of the government of Saudi Arabia, the UAE & Qatar. The government plans for diversification have benefitted various sectors such as hospitality, healthcare, education, commercial businesses, manufacturing, etc. This has created a positive economic outlook for the country & helped to attract Foreign Direct Investment (FDI) & government investment in real estate, thereby resulting in improved demand for them to enhance the operational activities during the construction period. For instance, the National Tourism Strategy has raised the tourism sector’s contribution from 3% to 10% by 2030, and emphasized more towards growing investments for tourism, commercial, and residential projects. Many of the under-construction real estate projects in Saudi Arabia are expected to increase the demand for these solutions in the forecast years.

Moreover, the growing adoption of renewable energy sources is further generating the requirement for power rental solutions to support their integration into the power grid, as the GCC countries are facing high pressure to reduce their dependence on fossil fuels. This is driven by various factors, such as rising concerns about climate change, the need to meet growing energy demand, and the desire to reduce reliance on volatile global oil prices. Renewable energy sources, such as solar & wind power, provide an attractive alternative to fossil fuels, as they are abundant, sustainable, and cost-competitive.

Additionally, the GCC governments have launched several initiatives & programs to promote the development of renewable energy sources. Along with this, the UAE has launched the Dubai Clean Energy Strategy, which aims to generate 75% of the city's energy from clean sources by 2050. Henceforth, the burgeoning government initiatives towards the adoption of renewable resources to meet the energy demand are anticipated to escalate the demand for power rental in the forthcoming years.

GCC Power Rental Market Scope:

| Category | Segments |

|---|---|

| By Type | Generator [Up to 100 KVA, 100.1 KVA-350 KVA, 350.1-750 KVA, 750.1-1000KVA, Above 1,000 KVA], Loadbanks, Transformers) |

| By End User | Power Utilities, Oil & Gas, Construction, Manufacturing, Metal & Mining, Others (Events, etc. |

| By Country | The UAE, Saudi Arabia, Qatar, Kuwait, Oman, Bahrain |

| By Company | ENERGIA, Aggreko, Byrne Equipment Rental, Sudhir Rental, Altaaqa Global, Hertz Dayim Equipment Rental, Energy Equipment Rental Co., Atlas Copco Rental, Saudi Diesel Equipment Company (SDEC), Modern Energy Pvt. Ltd., Rental Solutions & Services, and others) |

GCC Power Rental Market Driver:

Burgeoning Construction Activities Escalate the Need for Temporary Power Supply – Real estate is one of the rapidly growing sectors in the GCC region that is dominant to the overall economic diversification plans of the government of Saudi Arabia & the UAE, etc. The government of Saudi Arabia, the UAE, etc., is facing several challenges, especially in controlling the fiscal deficit, diversifying revenues, and minimizing dependence on oil. Therefore, to mitigate the dependence, the government is investing & encouraging infrastructure development, such as the construction of hotels, theme parks, art galleries, metro lines, and others.

The development of the hospitality sector is aided by expanded tourism demand, as Saudi Arabia welcomes millions of pilgrims each year. According to the World Tourism Organization, over 29.7 million tourists traveled to Saudi Arabia in 2024, making it the most visited country in the Gulf region. Therefore, to further aggrandize tourism in the country, the government is largely focusing on building hotels & leisure attractions. Thus, the construction of hotels & various real estate projects is presumed to augment the demand for power rental in the GCC during the forecast years.

GCC Power Rental Market Opportunity:

Positioning of GCC Region as an Event Hub to Promote the Market – GCC countries, such as Saudi Arabia, the UAE, and Qatar, have long been a global hub for hosting & organizing major international events. With the rise of the UAE & Qatar as event hubs, the number of power rental companies such as Hertz Dayim Equipment Rental, Saudi Diesel Equipment Company (SDEC), and others has augmented. The rental power providers can offer a cost-effective solution to meet this growing demand, especially during peak usage periods or in remote locations. Major sporting events, such as football matches & motorsports events, require a reliable power supply for broadcasting, lighting, and other purposes. This equipment can provide the necessary backup or supplemental power to ensure uninterrupted broadcasting & event operations.

Moreover, the upcoming large number of events represents a great opportunity for power rental companies & to capitalize on these opportunities, as well as the UAE government is pushing its capabilities to boost the number of events held in the country each year. For instance, the DBE (Dubai Business Events) captured around 120 events in 2021 and now plans to capture over 400 global events in 2025. Hence, the GCC government's ambitious targets would present a lucrative opportunity for the providers & encourage market growth in the future.

GCC Power Rental Market Challenge:

Stringent Government Regulations on Carbon Emission to Impede the Market – Stringent government regulations on carbon emissions have a significant impact on the Diesel Generator Power Rental industry. These regulations are planned to reduce the number of greenhouse gases emitted by power generators, including diesel generators, to mitigate the effects of climate change. As a result of these regulations, diesel generator rental companies, are required to invest in new technologies & equipment to reduce carbon emissions. It could inflate the cost of operation & make diesel generators less competitive compared to other power sources, such as solar or wind. Hence, diesel generator rental companies explore alternative power sources, such as renewable energy, or invest in newer, more efficient diesel generators that meet stricter emissions standards, which would hamper the demand for existing diesel generators, further impeding the market growth in the years ahead.

GCC Power Rental Market Trend:

Escalating Government Investment in Renewable Energy – In recent years, the rising government initiatives to increase renewable energy capacity to reduce dependence on fossil fuels. This has led to a rise in the demand for rental power solutions to bridge the gap between the intermittent nature of renewable energy sources & the constant requirement for electricity. The construction of renewable energy infrastructure requires significant investment, and power rental solutions are used throughout the construction phase to provide temporary power until the permanent infrastructure is completed. For instance: Abu Dhabi funds AED 752 million for GCC power grid expansion, boosting UAE-Saudi link capacity to 3,500 MW. The project enhances energy security and enables renewables.

Furthermore, renewable energy sources can cause fluctuations in the grid due to their intermittent nature, which can affect the stability of the grid. Moreover, these solutions are mainly used to provide additional power during periods of high demand & help stabilize the grid. Hence, the rising government initiatives toward the construction of renewable plants are further anticipated to propel the demand for power rental solutions in the forecast period.

GCC Power Rental Market (2025-30): Segmentation Analysis

The GCC Power Rental Market study of MarkNtel Advisors evaluates & highlights the major trends & influencing factors in each segment & includes predictions for the period 2025–2030 at the regional level. Based on the analysis, the market has been further classified as:

Based on Equipment Type:

- Generators

- Up to 100 KVA

- 100.1 KVA-350 KVA

- 350.1-750 KVA

- 750.1-1000KVA

- Above 1,000 KVA

- Loadbanks

- Transformers

The Generator segment held a noticeable share of the GCC Power Rental market in 2024 due to the increased demand for generators for power generation across a large number of industries, including manufacturing, oil & gas, construction, government sector, etc. Furthermore, the higher power efficiency provided due to the elevated compression ratio in engines by the respective diesel generators over their gas counterparts is expected to upgrade the demand graph of the market in the coming years. However, with the stringent regulations concerning carbon emissions by diesel generators, many of the project developers have started shifting towards gas generators to reduce their carbon footprint. Hence, it is presumed that the generator segment would contribute to influencing the market growth during 2025-30 due to the high emergence of gas generators.

Based on End User:

- Power Utilities

- Oil & Gas

- Construction

- Manufacturing

- Metal & Mining

- Others (Events, etc.)

Oil & Gas sector has a crucial relevance in the GCC economy due to its high share in government revenue. With the growing demand for crude oil across the globe, the governments of Saudi Arabia & the UAE have emphasized the need to explore new oil & gas fields as well as enhance the existing crude oil extraction & purification capacity. Furthermore, with the increased international prices of crude oil & gas, the fossil fuel sector has immensely benefited in previous years.

Also, oil & gas exploration & production often take place in remote locations with limited or no access to the grid. Hence, this generates the requirement for off-grid power solutions, such as diesel generators, to power the operations, as power rental companies provide temporary power solutions for these remote locations. Along with this, the UAE, Kuwait, etc., have discovered untapped new oil & gas reserves in recent years, which has positively impacted the demand for these solutions. Hence, the ongoing research & developments related to the discovery of new oil wells in the region would lead to market growth during the forecast period.

GCC Power Rental Market (2025-30): Regional Projection

Geographically, the GCC Power Rental Market expands across:

- The UAE

- Saudi Arabia

- Qatar

- Kuwait

- Oman

- Bahrain

Of all the countries, Saudi Arabia is projected to attain a significant market share during 2025-30. Apart from many factors supporting the market growth in the past years, the absence of a single national grid supplying power to the whole country in Saudi Arabia is the most prominent one. In the summer season, the non-availability of the national grid puts pressure on the grid manufacturers during peak electricity demand in the major regions of the kingdom.

Also, real estate is another rapidly growing industry in Saudi Arabia, as the government, under its Saudi Vision 2030, announced to boost in the share of residential home ownership. According to the government, the homeownership rate in Saudi Arabia has risen to approximately 65.4% by the end of 2024, up from 60% in 2020. Some other projects are also under construction, which would further promote residential construction, subsequently promoting the demand for power rental among the various construction developers to ensure operational efficiency in the forthcoming years.

GCC Power Rental Industry Recent Development:

- 2024: Byrne Equipment Rental, a leading provider of rental equipment, has successfully delivered a solar-powered camp designed to accommodate 500 personnel on Sir Baniyas Island on behalf of NMDC Dredging & Marine, a leader in dredging, reclamation, and construction services.

Gain a Competitive Edge with Our GCC Power Rental Market Report

- GCC Power Rental Market Report by MarkNtel Advisors provides a detailed & thorough analysis of market size & share, growth rate, competitive landscape, and key players. This comprehensive analysis helps businesses gain a holistic understanding of the market dynamics & make informed decisions.

- This report also highlights current market trends & future projections, allowing businesses to identify emerging opportunities & potential challenges. By understanding market forecasts, companies can align their strategies & stay ahead of the competition.

- GCC Power Rental Market Report aids in assessing & mitigating risks associated with entering or operating in the market. By understanding market dynamics, regulatory frameworks, and potential challenges, businesses can develop strategies to minimize risks & optimize their operations.

*Reports Delivery Format - Market research studies from MarkNtel Advisors are offered in PDF, Excel and PowerPoint formats. Within 24 hours of the payment being successfully received, the report will be sent to your email address.

Frequently Asked Questions

- Market Segmentation

- Introduction

- Product Definition

- Research Process

- Assumptions

- Executive Summary

- GCC Macroeconomic Outlook, 2023

- GCC Power Industry Analysis, 2023

- Power Generation Mix, By Source, By Country

- Non-Renewable

- Renewable

- Power Distribution & Transmission Network Scenario, By Country

- Others

- Power Generation Mix, By Source, By Country

- GCC Power Rental Market Value Chain Analysis

- GCC Power Rental Market Trends & Insights

- GCC Power Rental Market Dynamics

- Growth Drivers

- Challenges

- GCC Power Rental Market Hotspots & Opportunities

- GCC Power Rental Market Policies & Regulations

- GCC Power Rental Market YoY Rental Analysis

- Generator

- Load bank

- Transformer

- GCC Power Rental Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Type

- Generator- Market Size & Forecast 2020-2030, USD

- Up to 100 KVA - Market Size & Forecast 2020-2030, USD Million

- 100.1 KVA-350 KVA- Market Size & Forecast 2020-2030, USD Million

- 350.1-750 KVA- Market Size & Forecast 2020-2030, USD Million

- 750.1-1000KVA- Market Size & Forecast 2020-2030, USD Million

- Above 1,000 KVA- Market Size & Forecast 2020-2030, USD Million

- Loadbanks- Market Size & Forecast 2020-2030, USD

- Transformers- Market Size & Forecast 2020-2030, USD Million

- Generator- Market Size & Forecast 2020-2030, USD

- By End User

- Power Utilities- Market Size & Forecast 2020-2030, USD Million

- Oil & Gas- Market Size & Forecast 2020-2030, USD Million

- Construction- Market Size & Forecast 2020-2030, USD Million

- Manufacturing- Market Size & Forecast 2020-2030, USD Million

- Metal & Mining- Market Size & Forecast 2020-2030, USD Million

- Others (Events, etc.)- Market Size & Forecast 2020-2030, USD Million

- By Country

- The UAE

- Saudi Arabia

- Qatar

- Kuwait

- Oman

- Bahrain

- By Competitors

- Competition Characteristics

- Market Share & Analysis

- By Type

- Market Size & Analysis

- The UAE Power Rental Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Type- Market Size & Forecast 2020-2030, USD Million

- By End User- Market Size & Forecast 2020-2030, USD Million

- Market Size & Analysis

- Saudi Arabia Power Rental Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Type- Market Size & Forecast 2020-2030, USD Million

- By End User- Market Size & Forecast 2020-2030, USD Million

- Market Size & Analysis

- Qatar Power Rental Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Type- Market Size & Forecast 2020-2030, USD Million

- By End User- Market Size & Forecast 2020-2030, USD Million

- Market Size & Analysis

- Kuwait Power Rental Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Type- Market Size & Forecast 2020-2030, USD Million

- By End User- Market Size & Forecast 2020-2030, USD Million

- Market Size & Analysis

- Oman Power Rental Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Type- Market Size & Forecast 2020-2030, USD Million

- By End User- Market Size & Forecast 2020-2030, USD Million

- Market Size & Analysis

- Bahrain Power Rental Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Type- Market Size & Forecast 2020-2030, USD Million

- By End User- Market Size & Forecast 2020-2030, USD Million

- Market Size & Analysis

- Competitive Outlook

- Company Profiles

- ENERGIA

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Aggreko

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Byrne Equipment Rental

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Sudhir Rental

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Altaaqa Global

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Hertz Dayim Equipment Rental

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Energy Equipment Rental Co.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Atlas Copco Rental

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Saudi Diesel Equipment Company (SDEC)

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Modern Energy Pvt. Ltd.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Rental Solutions & Services

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Others Potential Players

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- ENERGIA

- Company Profiles

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making