Europe Diesel Generator Market Research Report: Forecast (2023-2028)

By KVA Rating (Below 100 KVA, 100.1-500 KVA, 500.1- 1000 KVA, Above 1000 KVA), By Type (Stand By Prime & Continuous Power, Peak Shaving), By End User (Residential, Commercial (Hosp...itality, Retail, Educational Institutions, etc.), Healthcare, Government & Transport (Airports, Metro Stations, Govt. Buildings, Religious Centres, etc.) Industrial (Manufacturing Facilities, Assembly Units, etc.), Equipment Rental Companies), By Country (Russia, Germany, The UK, France, Italy, Spain, Rest of Europe), By Company (Caterpillar Inc., Mitsubishi Heavy Industries Engine & Turbocharger Ltd., Cummins Inc., Atlas Copco, Boudouin, F G Wilson, Kohler Co., Yanmar Holdings Co. Ltd., Aggreko, Himoinsa, Others) Read more

- Energy

- Jan 2023

- Pages 155

- Report Format: PDF, Excel, PPT

Market Definition

A diesel generator is the combination of a diesel engine with an electric generator to generate electrical energy. The main components of diesel generators include a diesel engine, an AC alternator, a fuel tank, a control panel, & radiator. These generators are used either as a power backup system or as a prime electricity source. Further, they are essential for a continuous & uninterrupted supply of electricity, thus the demand for diesel generators witnessed significant growth among the residential, commercial, and industrial sectors of Europe. The need for diesel generators in Europe arises either as a backup source, as the region has nearly 100% access to electrification or as the prime source in new construction projects.

Market Insights

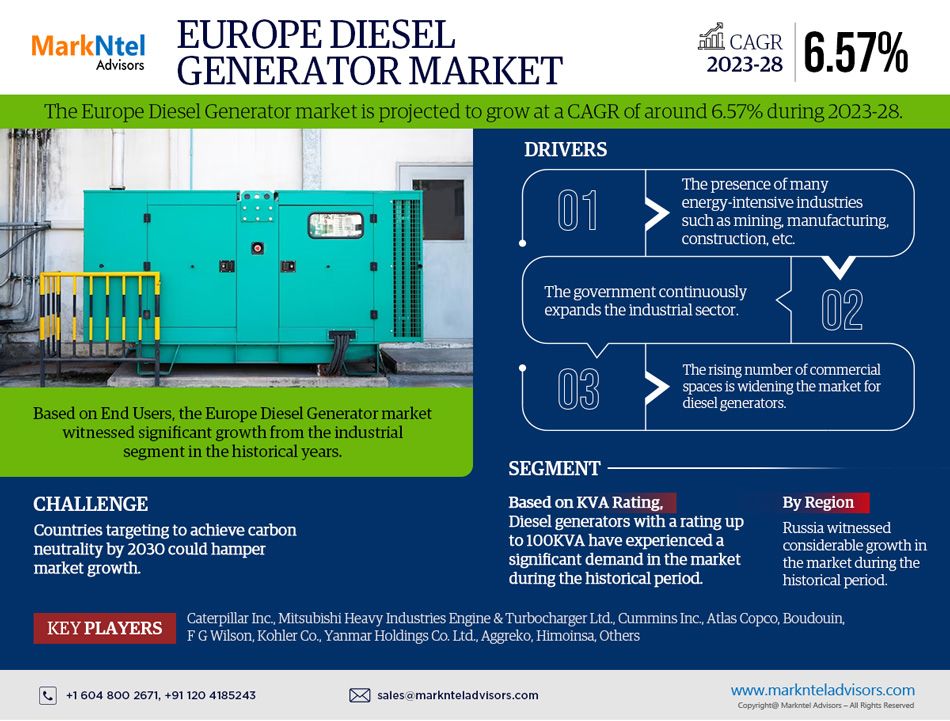

The Europe Diesel Generator market is projected to grow at a CAGR of around 6.57% during the forecast period, i.e., 2023-28. The demand is driven by the presence of a large number of energy-intensive industries such as mining, manufacturing, construction, etc. Also, governments are continuously involved in expanding the industrial sector of the region as the sector contributes highly to European exports. According to the Federal Ministry of Economic Affairs and Climate Action, European Union (EU), the industrial sector accounts for 83% of EU exports and more than 30 million jobs. Thus, the industrial expansion owing to government efforts to strengthen their economies is projected to drive market growth in the upcoming years.

| Report Coverage | Details |

|---|---|

| Study Period | Historical Data: 2018-21 |

| Base Year: 2022 | |

| Forecast Period: 2023-28 | |

| CAGR (2023-2028) | 6.57% |

| Country Covered | Russia, Germany, The UK, France, Italy, Spain, Rest of Europe |

| Key Companies Profiled | Caterpillar Inc., Mitsubishi Heavy Industries Engine & Turbocharger Ltd., Cummins Inc., Atlas Copco, Boudouin, F G Wilson, Kohler Co., Yanmar Holdings Co. Ltd., Aggreko, Himoinsa, Others |

| Unit Denominations | USD Million/Billion |

Furthermore, the region is witnessing a surge in the number of data centers as a result of the growth of internet activity & the entire industry associated with it, particularly in countries such as the UK & Germany, fueling demand for diesel generators in the region. For instance:

- In 2022, Equinix & Digital Realty data centers have increased their power backup source, including diesel generators, in response to the energy crisis generated by the Russia-Ukraine war.

Additionally, the rising number of commercial spaces, which are expected to complete in the upcoming years, is widening the market for diesel generators, affecting the market positively.

Impact of the Russia-Ukraine War on the Europe Diesel Generator Market

The European region is highly dependent on Russia & Ukraine for the energy supply. Forty percent of Europe’s gas comes from Russia, including Yamal-Europe, crossing from Belarus to Poland to Germany & Nord Stream, which goes directly to Germany. However, in 2021, Ukraine became the transit corridor for gas supplies to Slovakia, Austria, and Italy.

The outbreak of war disrupted the energy supply in Europe as the Nord Stream, a 1,200 km gas pipeline under the Baltic Sea, remained non-operational since 2021, as Russia closed it down for maintenance work & the war has worsened the situation. This has impacted the availability of fuel in the region, limiting the availability of diesel and impacting the demand for diesel generators negatively.

However, power plants across Ukraine have been impacted from the capital Kyiv to Odesa in the south & Vinnytsia in the west. In response to this, the European Union has given money to buy equipment such as generators & power cables to restore power supplies through the Ukraine Energy Support Fund.

Key Trend in the Market

- Emerging Use of Diesel Generators in Wind-diesel Microgrid

European countries are witnessing the use of diesel generators in the wind-diesel microgrid. This adoption is attributable to the potential of hybrid diesel-wind power generation systems in providing the energy supply for remote communities & facilities. Compared to the traditional diesel system, hybrid power plants can offer many advantages such as additional capacity, being more environmentally friendly, potential reduction of cost, etc.

The countries with high potential for wind energy, such as Germany & Norway, are exploring options to establish such systems. Moreover, Russia is increasingly making efforts to provide the energy supply in the far north region of the country, resulting in the establishment of such microgrids. For instance:

- In 2022, Yanmar Energy Systems launched a hybrid-wind diesel microgrid in Tiksi, Russia, located on the coast of the Arctic Ocean, where the company has installed a total of 3MW of diesel generator system as part of an IoT-enabled Polar hybrid microgrid.

Thus, the rising adoption of diesel generators as a part of a large wind-diesel microgrid is projected to raise the demand for diesel generators in the region during the forecast period.

Market Segmentation

Based on KVA Rating:

- Up to 100 KVA

- 100.1 KVA to 500 KVA

- 500.1 to 1000 KVA

- Above 1000 KVA

Among them, Diesel generators with a rating up to 100KVA have experienced a significant demand in the Europe Diesel Generator market during the historical period. This is due to the increased requirement for diesel generators with less capacity across sectors, such as residential facilities, commercial spaces, and small industries. The surge in power shortages caused by constant heatwaves has disrupted power transmission lines or caused faults in power grids, increasing demand for diesel generators in the residential & small commercial sectors. Further, the development efforts to expand the number of commercial buildings are anticipated to raise the demand for diesel generators to 100kVA in the forecast period.

Based on Type:

- Stand By

- Prime & Continuous Power

- Peak Shaving

Here, Standby Diesel Generators have grown positively in the Europe Diesel Generator market. The standby diesel generator provides an automatic power supply during power outages in the industrial & commercial sectors. The widespread use of these diesel generators in industries such as manufacturing, utilities, rental, healthcare, telecommunications, government, and transportation to avoid the instant power cut issue, is pushing the demand for standby diesel generators in the region.

In response to this growing demand for standby diesel generators by industrial & commercial sectors, leading manufacturers of diesel generators are raising the development of cost-effective & efficient standby diesel generators for smooth operations. Thus, the rising demand for standby uninterrupted power supply to the various sectors, such as manufacturing, construction, etc., is anticipated to surge the sales of standby diesel generator models in the forecast years.

Based on End User:

- Residential

- Commercial (Hospitality, Retail, Educational Institutions, etc.)

- Healthcare

- Government & Transport (Airports, Metro Stations, Govt. Buildings, Religious Centres, etc.)

- Industrial (Manufacturing Facilities, Assembly Units, etc.)

- Equipment Rental Companies

The Europe Diesel Generator market witnessed significant growth from the industrial segment in the historical years. The region has a prominent presence in the manufacturing industries such as automotive, construction, mining, etc., especially in Germany & Italy, which has led to an increased demand for diesel generators. The significant presence of aircraft building, aerospace production, weapons, and military machinery manufacture has also remained a continuous source of demand for diesel generators in the region. The requirement of an uninterrupted power supply to allow constant operations in the manufacturing units in case of power failure has raised the demand for diesel generators in Europe during 2018-2022.

Moreover, rising government initiatives & investments, such as the UAE-Turkey collaboration, to expand the industrial sector of the region, especially in countries such as the UK & Turkey, are expected to escalate the demand for diesel generators in the region in the upcoming years.

Based on Country:

- Russia

- Germany

- The UK

- France

- Italy

- Spain

- Rest of Europe

Of all the countries, Russia witnessed considerable growth in the Europe Diesel Generator market during the historical period. The major demand for these generators in the country arises from the rising mining operations in Russia as the country is continuously engaged in exploring new sites for mining, especially in northern Russia. The country has one of the largest mineral industries in the world & exports a significant quantity of minerals globally.

Diesel Gensets are necessary to operate the mining units located in the remote parts of the country where the power supply is limited. Hence, with the growth of the mining sector, the demand for diesel gensets in the country is expected to witness expansion, thus driving the Diesel Generator set market in Russia during the forecast period.

Recent Developments by Leading Companies

- 2022: Cummins launched C1000D6RE, a 1MW twin-pack rental diesel generator fitted with a QSX15 engine. It would enable Cummins to meet the EPA targets without needing a Diesel Particulate Filter.

- 2021: Caterpillar announced the addition of 12 new models to the series CAT GC diesel generator sets for stationary standby applications. The range includes an additional six models with power ratings from 450 to 715kVA for 50Hz applications, as well as six from 350 to 600kW for 60Hz applications.

- 2021: Atlas Copco expanded its QES portable generator range up to 500kVA. The latest models in the range are the QES 250, QES 325, QES 400, and QES 500, which are all Stage 3A emission compliant & available in 50Hz or 60Hz versions.

- 2021: Kohler Power System added two new models to the diesel-powered residential generator’s robust line. The new models are 90REOZT4 and 120REOZT4.

Market Dynamics:

Key Driver: Burgeoning Manufacturing Industry to Boost Demand for Diesel Generators

The large presence of various industries such as automotive, construction, and mining has been driving the demand for diesel generators in the region. The requirement for generators to provide uninterrupted power supply in the plants has been raising the demand for diesel generators. Further, over the next several years, advanced manufacturing is expected to provide the excellent export potential for industries such as machine tools/general industrial equipment, robotics as well as electronics industry production equipment, additive manufacturing, advanced materials, and industrial IT. These developments in the manufacturing sector are anticipated to increase the demand for diesel generators in Europe in the forecast years.

Possible Restraint: Countries Target to Achieve Carbon Neutrality by 2030 to Hamper Market Growth

The rising environmental concern of economies due to climate change is restraining the market growth of the Europe Diesel Generator market. The countries present in the region are actively taking initiatives to reduce their carbon emissions to achieve net neutrality, which is threatening the market for diesel generators. For instance:

- Norwegian has set a target to achieve net climate neutrality by 2030, while The European Union, for example, aims to be climate neutral by 2050.

Moreover, the inclination to generate electricity from renewable sources & phasing out of conventional sources is negatively impacting the Diesel Generator market. For instance, according to the World Economic Forum, in 2020, Sweden, Finland, Latvia, Austria, and Portugal generated more than a third of their electricity from renewable sources. Hence, rising environmental awareness & resulting green initiatives are possible restraints in the path of revenue generation in the Europe Diesel Generator market.

Key Questions Answered in the Market Research Report:

- What are the overall statistics or estimates (Overview, Size- By Value, Forecast Numbers, Segmentation, Shares) of the Europe Diesel Generator Market?

- What are the region-wise industry size, growth drivers, and challenges?

- What are the key innovations, opportunities, current & future trends, and regulations in the Europe Diesel Generator Market?

- Who are the key competitors, their key strengths & weaknesses, and how do they perform in the Europe Diesel Generator Market based on the competitive landscape?

- What are the key results derived from surveys conducted during the Europe Diesel Generator Market study?

Frequently Asked Questions

- Market Segmentation

- Introduction

- Product Definition

- Research Process

- Assumptions

- Executive Summary

- Macroeconomic Outlook

- Impact of the Russia-Ukraine War on the Europe Diesel Generator Market

- Europe Diesel Generator Market, Technological Developments

- Europe Diesel Generator Market Porters Five Forces Analysis

- Europe Diesel Generator Market Trends & Insights

- Europe Diesel Generator Market Dynamics

- Drivers

- Challenges

- Europe Diesel Generator Market Regulations & Policies

- Europe Diesel Generator Market Hotspots & Opportunities

- Europe Diesel Generator Market Outlook, 2018-2028

- Market Size & Outlook

- By Revenues (USD Million)

- By Units Sold (Thousands)

- Market Share & Outlook

- By KVA Rating

- Below 100 KVA

- 100.1-500 KVA

- 500.1- 1000 KVA

- Above 1000 KVA

- By Type

- Stand By

- Prime & Continuous Power

- Peak Shaving

- By End User

- Residential

- Commercial (Hospitality, Retail, Educational Institutions, etc.)

- Healthcare

- Government & Transport (Airports, Metro Stations, Govt. Buildings, Religious Centres, etc.)

- Industrial (Manufacturing Facilities, Assembly Units, etc.)

- Equipment Rental Companies

- By Country

- Russia

- Germany

- The UK

- France

- Italy

- Spain

- Rest of Europe

- By Company

- Competition Characteristics

- Market Share & Analysis

- By KVA Rating

- Russia Diesel Generator Market Outlook, 2018-2028

- Market Size & Analysis

- By Revenues (USD Million)

- By Units Sold (Thousands)

- Market Share & Analysis

- By KVA Rating

- By End User

- Market Size & Analysis

- Germany Diesel Generator Market Outlook, 2018-2028

- Market Size & Analysis

- By Revenues (USD Million)

- By Units Sold (Thousands)

- Market Share & Analysis

- By KVA Rating

- By End User

- Market Size & Analysis

- The UK Diesel Generator Market Outlook, 2018-2028

- Market Size & Analysis

- By Revenues (USD Million)

- By Units Sold (Thousands)

- Market Share & Analysis

- By KVA Rating

- By End User

- Market Size & Analysis

- France Diesel Generator Market Outlook, 2018-2028

- Market Size & Analysis

- By Revenues (USD Million)

- By Units Sold (Thousands)

- Market Share & Analysis

- By KVA Rating

- By End User

- Market Size & Analysis

- Italy Diesel Generator Market Outlook, 2018-2028

- Market Size & Analysis

- By Revenues (USD Million)

- By Units Sold (Thousands)

- Market Share & Analysis

- By KVA Rating

- By End User

- Market Size & Analysis

- Spain Diesel Generator Market Outlook, 2018-2028

- Market Size & Analysis

- By Revenues (USD Million)

- By Units Sold (Thousands)

- Market Share & Analysis

- By KVA Rating

- By End User

- Market Size & Analysis

- Market Size & Outlook

- Europe Diesel Generator Market Key Strategic Imperatives for Growth & Success

- Competition Outlook

- Competition Matrix

- Brand Specialization

- Target Markets

- Target End Users

- Research & Development

- Strategic Alliances

- Strategic Initiatives

- Company Profiles

- Caterpillar Inc.

- Mitsubishi Heavy Industries Engine & Turbocharger Ltd.

- Cummins Inc.

- Atlas Copco

- Boudouin

- F G Wilson

- Kohler Co.

- Yanmar Holdings Co. Ltd.

- Aggreko

- Himoinsa

- Others

- Competition Matrix

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making