GCC Paint Additives Market Research Report: Forecast (2021-2026)

By Formulation (Water, Solvent, Powder Based, Others), By End-User (Automobiles & Transportation, Industrial, Furniture & Woods, Building & Construction), By Product (Rheology Modi...fiers, Biocides, Anti-Foamers, Wetting & dispersing agents, Others), By Country (UAE, GCC, Bahrain, Oman, Qatar, Kuwait), By Competitors (Akzo Nobel., Arkema SA, Asahi Glass Co.Ltd., Ashland Inc., BASF SE, Cabot Corp., Daikin Industries Ltd., Dynaa A.S, Dow, Evonik Industries AG) Read more

- Chemicals

- Dec 2021

- Pages 178

- Report Format: PDF, Excel, PPT

Market Definition

Modern-day paints are rapidly perishing with the addition of cheap materials. Hence, additives are used in small quantities to prevent paints from flowing across a surface or leaving brush marks on walls. These additives are low-level ingredients that enhance the efficacy & performance of paints. With the increasing environmental pollution, paint manufacturers across Saudi Arabia are constantly working on environment-friendly & easiest-to-manufacture formulations with the minimum number of raw materials.

Market insights

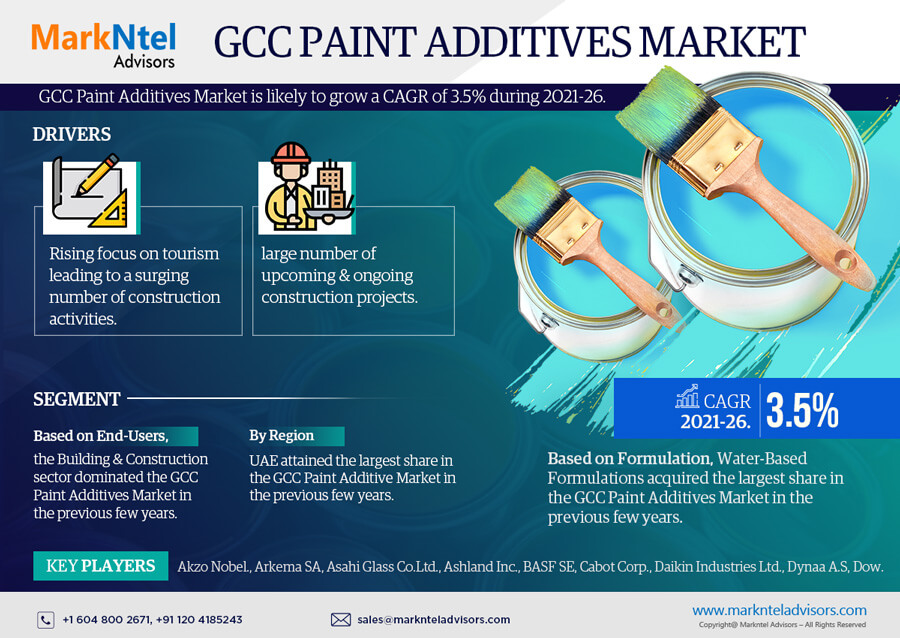

The GCC Paint Additives Market is anticipated to grow at a CAGR of around 3.5% during the forecast period, i.e., 2021-26. The bolstering consumption of paints across the construction sector and increasing inflow of tourists in GCC nations are the primary factors driving the market. Besides, mounting residential & commercial construction activities, coupled with massive investments in the same, are other crucial aspects leading to the burgeoning production & sales of paints, and, consequently, of paint additives.

Paint additives offer numerous properties like enhanced durability, anti-corrosiveness, and better appearance. Owing to these characteristics, their demand across the GCC region is quite significant. Moreover, the surging environmental concerns are encouraging leading market players to invest massively in research & development activities on developing environment-friendly paint additives, which is another crucial aspect driving the overall market.

| Report Coverage | Details |

|---|---|

| Study Period | Historical Data: 2016-19 |

| Base Year: 2020 | |

| Forecast Period: 2021-26 | |

| CAGR (2021-2026) | 3.5% |

| Country Covered | UAE, GCC, Bahrain, Oman, Qatar, Kuwait |

| Key Companies Profiled | Akzo Nobel., Arkema SA, Asahi Glass Co.Ltd., Ashland Inc., BASF SE, Cabot Corp., Daikin Industries Ltd., Dynaa A.S, Dow, Evonik Industries AG |

| Unit Denominations | USD Million/Billion |

Impact of Covid-19 Pandemic on the GCC Paint Additives Market

- The Covid-19 pandemic in 2020 negatively impacted the production & sales of the GCC Paint Additive Market.

- The imposition of lockdown & other stringent restrictions by the governments across the GCC led to the shortage of labor, suspension of construction activities, and reduced expenditure on the construction industry, which made 2020 a tragic year for all countries in the region.

- The temporary ban on imports & exports caused supply chain disruptions, which, in turn, restrained the market expansion.

- Further, the shutdown of automotive & industrial production activities also negatively influenced the market.

- However, the market is expected to recover & grow steadily in the coming future, owing to the resumption of construction activities and increasing demand for paint additives from other end-users.

Market Segmentation

By End-User:

- Automobiles & Transportation

- Industrial

- Furniture & Woods

- Building & Construction

The Building & Construction industry is the major end-user of paint additives. Hence, the increasing usage of paints to protect materials under extreme weather conditions and the surging number of construction projects across GCC nations are the prime aspects projected to boost the market in the building & construction sector during 2021-26.

Further, paint additives also have a wide range of industrial applications, including machinery & metal equipment coatings. Since many industrial activities can cause abrasion to the equipment, using paint additives helps protect these products from damage.

On the other hand, in the automotive industry, the demand for paint additives is witnessing substantial growth to provide scratch resistance, surface protection, texture enhancement, and corrosion resistance to automotive parts.

By Formulation:

- Water

- Solvent

- Powder Based

Water-based paint additives are environment-friendly surface treatment, in which water accounts for 80% of the solvent used. It makes the paint eco-friendly & easy to apply. It is used majorly in closed areas and does not cause any harmful emissions. The adoption of water-based paints is growing dramatically due to the extensive presence of low Volatile Organic Compounds (VOCs).

Hence, they have a less harmful impact on the environment, humans, & animals and can be applied easily to plastic substrates & wood. Moreover, water-based paint additives have high film density, superior adhesion, and quick dry time. Hence, their demand is significantly growing across the GCC region.

Key Trends in the GCC Paint Additives Market

- Increasing demand for multi-functional paint additives that could help resist high-temperature levels

- Mounting demand for water-based paints as they reduce the emission of VOCs making them less harmful.

Country Landscape:

- UAE

- Saudi Arabia

- Bahrain

- Oman

- Qatar

- Kuwait

Among all the GCC nations, Saudi Arabia holds the largest market share since it provides easy access to the regional market & key feedstock. The burgeoning construction of tall & big structures in the country significantly fuels the demand for paints, which, in turn, is propelling the need for paint additives. The paint additive industry is projected to register significant growth in the coming future since the construction sector of Saudi Arabia is poised to experience robust growth in the years to come, thereby accelerating the demand for paint additives.

To keep up with the goals of the National Transformation Program, which intended to establish the necessary infrastructure for enhancing economic growth and growing living standards, Saudi Arabia is on the urge of expanding its construction activities, especially across commercial and industrial sectors, reveals MarkNtel Advisors in their research report, “GCC Paint Additives Market Analysis, 2021.”

Market Dynamics

Key Driver

Growing Infrastructural Developments and Rapid Economy Growth across GCC Nations to Favor the Market Growth

GCC nations are witnessing a rapid surge in construction activities, which, in turn, is fueling the demand for paints and directly impacting the market growth of paint additives, which could help enhance the paint properties & appearance of the building. Further, rapid economic growth can boost the demand for paint additives from different end-use sectors, thereby providing lucrative opportunities for the market to grow significantly in the coming future.

Growth Challenges

- Stringent regulations regarding solvent-based paints that have high Volatile Organic Compounds (VOC) content

- Mounting health & environmental concerns

Competitive Landscape

According to MarkNtel Advisors, the major leading players in the GCC Paint Additives market are Akzo Nobel., Arkema SA, Asahi Glass Co.Ltd., Ashland Inc., BASF SE, Cabot Corp., Daikin Industries Ltd., Dynaa A.S, Dow, and Evonik Industries AG.

Key Questions Answered in the Market Research Report:

- What are the overall statistics or estimates (Overview, Size- By Value, Forecast Numbers, Segmentation, Shares) of the GCC Paint Additives Market?

- What is the country-wise industry size, growth drivers, and challenges?

- What are the key innovations, opportunities, current & future trends, and regulations in the GCC Paint Additives Market?

- Who are the key competitors, their key strengths & weaknesses, and how do they perform in the GCC Paint Additives Market based on a competitive benchmarking matrix?

- What are the key results derived from surveys conducted during the GCC Paint Additives Market study?

Market Outlook, Segmentation, and Statistics

- Impact of COVID-19 on GCC Paint Additives Market

- Market Size & Analysis

- By Value

- By Volume

- Market Share & Analysis

- By Formulation

- Water

- Solvent

- Powder Based

- Others

- By End Users

- Automobiles & Transportation

- Industrial

- Furniture & Wood

- Building & Construction

- Others

- By Product

- Rheology modifiers

- Biocides

- Anti-Foamers

- Wetting & Dispersion Agents

- Others

- By Region

- UAE

- Saudi Arabia

- Bahrain

- Oman

- Qatar

- Kuwait

- By Competitors

- Competition Characteristics

- Market Share & Analysis

- Competitive Metrix

- By Formulation

- GCC Paint Additives Market Hotspots & Opportunities

- GCC Paint Additives Market Regulations & Policy

- Key Strategic Imperatives for Success and Growth

- GCC Competition Outlook

- Competition Matrix

- Company Profile

Frequently Asked Questions

- Introduction

- Product Definition

- Research Process

- Assumptions

- Market Segmentation

- Preface

- Executive Summary

- Egypt Paint Additives Market Dynamics

- Growth Drivers

- Challenges

- Hotspots & Opportunities

- Paint Additives Market Trends & Insights

- Egypt Paint Additives Market Supply Chain Analysis

- Egypt Paint Additives Market Price Trends

- Egypt Paint Additives Market Outlook, 2016-2026F

- Market Size & Analysis

- By Revenues

- By Quantity Sold in Kilo Tons

- Market Share & Analysis

- By Formulation

- Water

- Solvent

- Powder Based

- Others

- By End Users

- Automobiles & Transportation

- Industrial

- Furniture & Wood

- Building & Construction

- Others

- By Product

- Rheology modifiers

- Biocides

- Anti-Foamers

- Wetting & Dispersion Agents

- Others

- By Country

- UAE

- Saudi Arabia

- Bahrain

- Oman

- Qatar

- Kuwait

- By Competitor

- Competition Characteristics

- Key Competitor & Their Capabilities

- Competitor Factorial Indexing

- By Formulation

- Market Size & Analysis

- UAE Paint Additives Market Outlook, 2016-2026F

- Market Size & Analysis

- By Revenues

- By Quantity Sold in Kilo Tons

- Market Share & Analysis

- By Formulation

- By Product

- By Region

- Market Size & Analysis

- Saudi Arabia Industrial Paint Additives Market Outlook, 2016-2026F

- Market Size & Analysis

- By Revenues

- By Quantity Sold in Kilo Tons

- Market Share & Analysis

- By Formulation

- By Product

- By Region

- Market Size & Analysis

- Bahrain Furniture & Wood Additives Market Outlook, 2016-2026F

- Market Size & Analysis

- By Revenues

- By Quantity Sold in Kilo Tons

- Market Share & Analysis

- By Formulation

- By Product

- By Region

- Market Size & Analysis

- Oman Buildings & Construction Paint Additives Market Outlook, 2016-2026F

- Market Size & Analysis

- By Revenues

- By Quantity Sold in Kilo Tons

- Market Share & Analysis

- By Formulation

- By Product

- By Region

- Market Size & Analysis

- Qatar Buildings & Construction Paint Additives Market Outlook, 2016-2026F

- Market Size & Analysis

- By Revenues

- By Quantity Sold in Kilo Tons

- Market Share & Analysis

- By Formulation

- By Product

- By Region

- Market Size & Analysis

- Kuwait Buildings & Construction Paint Additives Market Outlook, 2016-2026F

- Market Size & Analysis

- By Revenues

- By Quantity Sold in Kilo Tons

- Market Share & Analysis

- By Formulation

- By Product

- By Region

- Market Size & Analysis

- Company Profiles

- Akzo Nobel.

- Arkema SA

- Asahi Glass Co.Ltd.,

- Ashland Inc.

- BASF SE

- Cabot Corp.

- Daikin Industries Ltd.

- Dynaa A.S

- Dow

- Evonik Industries AG

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making