GCC Chillers Market Research Report: Forecast (2023-2028)

By Product (Air-Cooled, Water-Cooled), By Compressor Type (Screw Chillers, Scroll Chillers, Reciprocating Chillers, Turbocor Chillers, Centrifugal Chillers, Absorption Chillers), B...y Capacity (Less than 150 Tons, 150-1000 Tons, 1001-2000 Tons, Above 2000 Tons, By Country (The UAE, Saudi Arabia, Qatar, Kuwait, Bahrain, Oman), By Company (Daikin Middle East and Africa FZE, Johnson controls, S.K.M Air Conditioning LLC, Petra Engineering Industries Company, Midea Group, Gami Air Conditioners Manufacturing Company L.L.C., Zamil Air conditioners, Smardt Chiller Group FZE, Dunham-Bush, Carrier Corporation, Other) Read more

- Environment

- Jul 2023

- Pages 178

- Report Format: PDF, Excel, PPT

Market Insights & Analysis: GCC Chillers Market (2023-28)

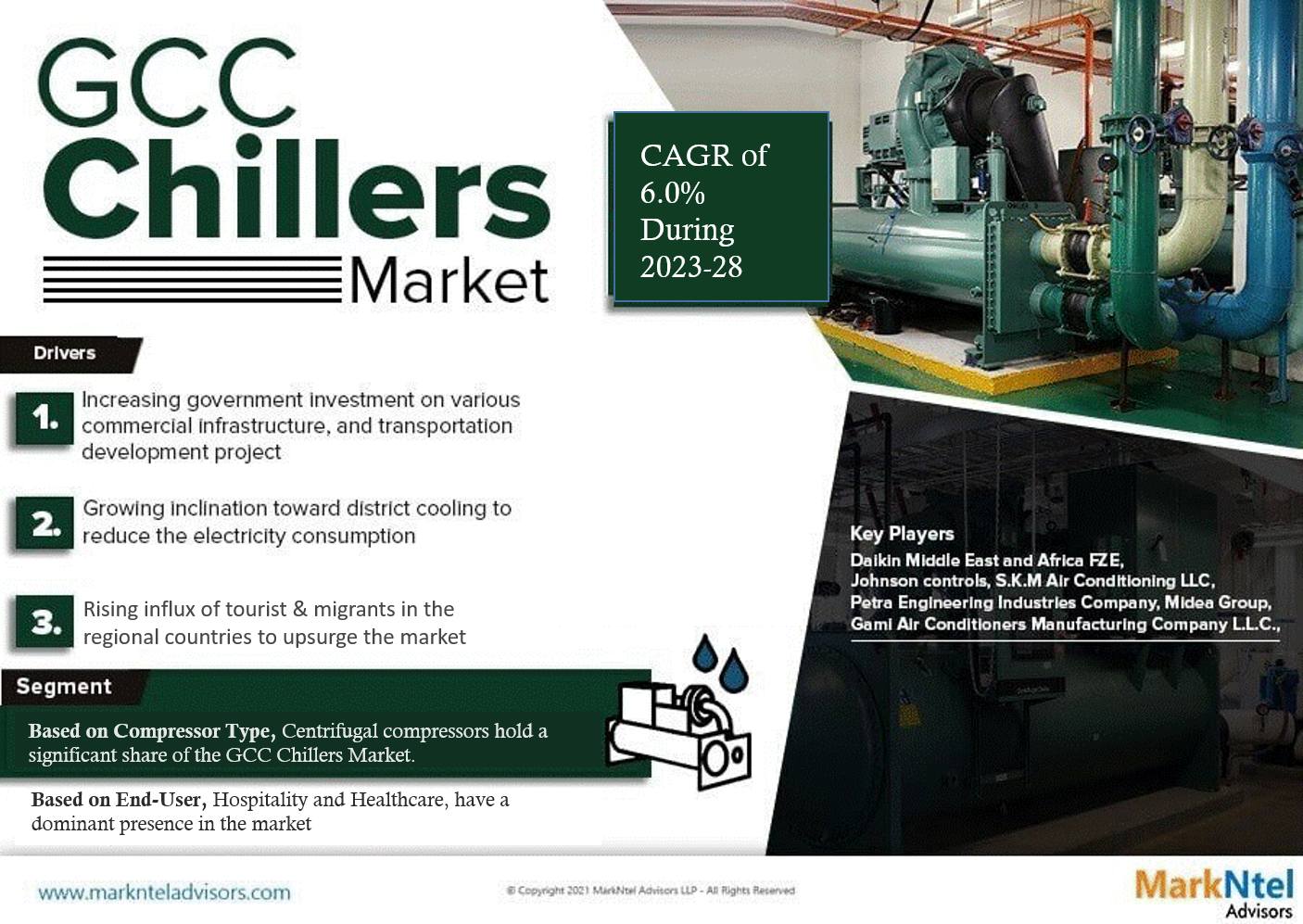

The GCC Chillers Market size is valued at USD 656 million in 2024 & is projected to grow at a CAGR of around 6.0% during the forecast period, i.e., 2023-28. The growth of the market would be driven mainly by rapid urbanization & population growth, extreme climate conditions with high temperatures & humidity levels, and massive investments by various countries in infrastructure development projects associated with commercial buildings, residential complexes, airports, hospitals, & hotels. These aspects create a strong demand for chiller systems to provide efficient & effective cooling solutions in these infrastructures and maintain comfortable indoor environments. More & more cities within the GCC region are expanding with the ever-increasing development of residential buildings, apartments, & housing complexes, i.e., augmenting the demand for cooling systems.

Moreover, with the rising influx of tourists & migrants, particularly in the UAE & Saudi Arabia, the hospitality sector is booming at an unprecedented pace as several hotels, resorts, & entertainment venues are being constructed in these countries, which, in turn, is amplifying the need for efficient & reliable cooling systems, such as chillers, to ensure a comfortable experience for guests.

Moreover, the integration of IoT & advanced control systems into chiller units that allows for real-time monitoring, predictive maintenance, & optimization of cooling operations and offers improved performance, reduced downtime, & better overall system management has been the significant trend propelling the market expansion. Besides, the rising number of data centers in the GCC is pushing the demand for precision cooling solutions to maintain optimal operating temperatures, again contributing to market growth.

| Report Coverage | Details |

|---|---|

| Study Period | Historical Data: 2018-21 |

| Base Year: 2022 | |

| Forecast Period: 2023-28 | |

| CAGR (2023-2028) | 6.0% |

| Country Covered | The UAE, Saudi Arabia, Qatar, Kuwait, Bahrain, Oman |

| Key Companies Profiled | Daikin Middle East and Africa FZE, Johnson controls, S.K.M Air Conditioning LLC, Petra Engineering Industries Company, Midea Group, Gami Air Conditioners Manufacturing Company L.L.C., Zamil Air conditioners, Smardt Chiller Group FZE, Dunham-Bush, Carrier Corporation, Other |

| Market Value (2024) | USD 656 Million |

Furthermore, various initiatives & regulations by governments toward promoting energy efficiency & sustainability are encouraging the use of energy-efficient cooling systems. Thus, energy-efficient chillers that utilize low GWP (Global Warming Potential) refrigerants are gaining traction in the GCC region, owing to the growing focus on sustainability & cost-saving measures, which spurs GCC Chillers Market growth.

Along similar lines, numerous companies exhibiting their unwavering dedication to constructing a sustainable future emphasize the pressing need for collaboration and decisive action. For instance,

- In May 2023, Daikin Middle East and Africa organized a significant "Towards a Sustainable Future" event at the prestigious Armani Hotel Dubai, United Arab Emirates (UAE). This event aimed to bolster UAE partners' confidence in sustainable solutions and rally support for collective efforts to decarbonize cooling systems in the country.

GCC Chillers Market Driver:

Extreme Climate Conditions, characterized by High Temperatures & Humidity Levels: The hot and humid climate in the GCC region creates a high demand for cooling systems, including chillers, making it essential for maintaining comfortable indoor environments in residential, commercial, and industrial buildings. Thus, the extreme heat and humidity levels drive the need for efficient and powerful cooling solutions, leading to an increased demand.

- Daikin chiller for Middle-East EWAD-MZ, an air-cooled screw chiller, is meticulously engineered to thrive in the demanding Middle East environments, effortlessly enduring both the extreme heat prevalent in the region and the corrosive elements that often pose challenges. Using cutting-edge inverter technology, these MZ chillers demonstrate remarkable adaptability to various load demands, regardless of the prevailing conditions. The inverter system continuously fine-tunes the compressor motor's speed, enabling exceptional capacity control, delivering unparalleled efficiency even at partial loads, and generating substantial energy savings in the process.

GCC Chillers Market Growth Opportunity:

Shifting Focus on Developing Environmentally Friendly & Energy-Efficient Cooling Solutions: With cooling systems, particularly in the UAE, being responsible for 60-65% of a building's total energy consumption, critical players in the market are shifting their focus on developing environmentally friendly and energy-efficient chillers that use alternative refrigerants with lower global warming potential (GWP) and incorporate sustainable design principles. In response to such increasing demand, manufacturers seek to develop products that align with future standards. For example,

- The latest York YVAA air-cooled screw chiller model by Daikin, incorporates a variable-speed drive to enhance efficiency and uses lower-GWP refrigerants. With a refrigeration capacity ranging from 150 to 575 tons, it showcases continuous advancements in compressors, heat exchangers, and control technologies.

GCC Chillers Market Possible Restraint:

Evaluating the Repair Versus Replace Dilemma: Energy efficiency standards and refrigerant requirements are subject to change over time. Therefore, building managers need to assess whether their existing chiller complies with the latest regulations or if a replacement would be necessary to meet these standards. Often, older ones require frequent repairs and maintenance, which can be expensive and disruptive to the building's operations. The technological advancements in products make repair or retrofit options impractical. In such cases, replacing the existing ones with a new model incorporating the latest advancements is the more sensible choice.

However, setting up a new chiller requires a substantial capital investment, making the decision-makers swing between the choices. Thus, the choice between repair and replacement represents a significant decision that may shape the future of cooling systems in the region.

GCC Chillers Market Latest Trend:

Advent of Remote Monitoring Cooling Solutions: Remote monitoring has emerged as the GCC Chillers Market latest trend, driven by the need for efficient monitoring and troubleshooting solutions. Industry leaders like Carrier, Daikin Applied, and Johnson Controls have developed advanced systems that enable remote chiller connectivity. With these solutions, facility managers can remotely monitor, predict, and diagnose maintenance and repair needs without dispatching service vehicles, leading to significant time and resource savings, thereby minimizing operational disruptions.

The COVID-19 pandemic has further accelerated the adoption of remote connectivity in the GCC region. The focus on indoor air quality and the need to mitigate virus transmission risks have made remote inspection a critical requirement for customers. By leveraging remote monitoring and virtual inspection technologies, building owners can ensure uninterrupted maintenance while minimizing the risk of exposure to service personnel, thereby contributing to market growth.

GCC Chillers Market (2023-28): Segmentation Analysis

The GCC Chillers Market study from MarkNtel Advisors evaluates & highlights the major trends & influencing factors in each segment & includes predictions for the period 2023–2028. Based on the analysis, the market has been further classified,

Based on Compressor Type:

- Screw

- Scroll

- Reciprocating

- Turbocor

- Centrifugal

- Absorption

Of them all, centrifugal compressors hold a significant share of the GCC Chillers Market. Their wide use in various applications, including commercial buildings, hotels, hospitals, & industrial processes, owes to their higher cooling capacity, energy efficiency, & reliability than other types of compressors.

Centrifugal chillers have a low environmental impact as they are designed to use refrigerants with low GWP (Global Warming Potential) & ODP (Ozone Depletion Potential), thereby aligning with the GCC's focus on sustainability & environmental responsibility and contributing to market growth.

Moreover, the GCC region is known for its ambitious & large-scale construction projects, including tall buildings & expansive developments, and the cooling demands of such projects are efficiently met by centrifugal chillers. Hence, their adaptability to large-scale projects is another notable aspect that contributes to their extensive use and, consequently, bodes well for the overall market growth.

Based on End-User:

- Oil & Gas

- Chemicals

- Food & Beverage

- Healthcare

- Hospitality

- Residential

- Power Utilities

In the GCC region, industries such as hospitality and healthcare, have a dominant presence in the Chillers Market. The rapid expansion of hotels, resorts, and leisure facilities across the gulf countries has increased demand for chillers in the hospitality industry. These cooling systems are essential for maintaining comfortable indoor temperatures and ensuring a pleasant experience for guests. Similarly, the healthcare sector requires precise temperature control for various purposes, such as keeping environments stable in operating theaters, laboratories, and storage facilities for pharmaceuticals and medical equipment. The growth of healthcare infrastructure in the GCC, including hospitals, clinics, and medical centers, has consequently boosted the demand for chillers in the region.

Furthermore, the food and beverage sector has significantly influenced the chillers' market. It is because of their application in refrigerating perishable food items, maintaining food safety standards, and ensuring the freshness of ingredients. As the population across the region continues to explode, accompanied by the growing tourism in the GCC countries, the food and beverage industry has experienced significant growth, driving the demand for chillers to meet the refrigeration requirements of food storage, preparation, and display.

GCC Chillers Market Regional Projection:

Geographically, the GCC Chillers Market expands across:

- The UAE

- Saudi Arabia

- Qatar

- Kuwait

- Bahrain

- Oman

Of all countries in the GCC region, the UAE dominates the Chillers Market, owing mainly to the robust construction sectors in Dubai & Abu Dhabi. The country hosts numerous commercial, residential, & hospitality projects that require these systems for cooling purposes. Dubai is known for its iconic skyscrapers & large-scale infrastructure projects, which contribute to the demand for such systems.

In addition, the UAE is a major tourist & business destination and attracts millions of visitors each year. As a result, the hospitality industry, including hotels, resorts, & entertainment venues, requires effective cooling solutions to provide a comfortable experience to guests, which, in turn, creates an extensive demand for chiller systems within the sector.

Moreover, the country has been making substantial investments in infrastructure development, owing to the government's focus on diversifying the economy away from oil & gas and promoting other sectors like real estate, tourism, & entertainment has resulted in a continuous flow of construction projects, i.e., another prominent aspect creating lucrative prospects for the UAE Chiller Market.

GCC Chiller Industry Recent Development:

- In May 2023, Johnson Controls launched the YORK YVAM air-cooled magnetic-bearing centrifugal chiller for hyperscale and colocation data center cooling. It operates with the low-GWP refrigerant R-1234ze, delivering exceptional efficiency. It eliminates the need for free cooling coils and improves efficiency by 49% compared to traditional air-cooled screw chillers in data center conditions. It offers a sustainable and high-performance solution for data center cooling.

Gain a Competitive Edge with Our GCC Chillers Market Report

- GCC Chillers Market report provides a detailed and thorough analysis of market size, growth rate, competitive landscape, and key players. This comprehensive analysis helps businesses gain a holistic understanding of the market dynamics and make informed decisions.

- This report also highlights current market trends and future projections, allowing businesses to identify emerging opportunities and potential challenges. By understanding market forecasts, companies can align their strategies and stay ahead of the competition.

- GCC Chillers Market report aids in assessing and mitigating risks associated with entering or operating in the market.

- The report would help in understanding market dynamics, regulatory frameworks, and potential challenges, businesses can develop strategies to minimize risks and optimize their operations.

Frequently Asked Questions

GCC Chillers Market Research Report (2023-2028) - Table of Contents

- Market Segmentation

- Introduction

- Product Definition

- Research Process

- Assumptions

- Executive Summary

- GCC Chillers Market Trends & Development

- GCC Chillers Market Dynamics

- Drivers

- Challenges

- GCC Chillers Market Supply Chain Analysis

- GCC Chillers Market Hotspots & Opportunities

- GCC Chillers Market Regulations & Policy Standards

- GCC Chillers Market Outlook, 2018-2028

- Market Size & Analysis

- By Revenues (USD Million)

- By Unit Sold (Thousand Units)

- Market Share & Analysis

- By Compressor Type

- Screw Chillers

- Scroll Chillers

- Reciprocating Chillers

- Turbocor Chillers

- Centrifugal Chillers

- Absorption Chillers

- By Product

- Air-Cooled

- Water-Cooled

- By End Users

- Oil & Gas

- Chemicals

- Food & Beverage

- Healthcare

- Hospitality

- Residential

- Power Utilities

- Others (Government & Transportation, etc.)

- By Capacity

- Less than 150 Tons

- 150-1000 Tons

- 1001-2000 Tons

- Above 2000 Tons

- By Country

- The UAE

- Saudi Arabia

- Qatar

- Kuwait

- Bahrain

- Oman

- By Competitors

- Market Share & Analysis

- Competition Characteristics

- By Compressor Type

- Market Size & Analysis

- The UAE Chillers Market Outlook, 2018-2028

- Market Size & Analysis

- By Revenues (USD Million)

- By Unit Sold (Thousand Units)

- Market Share & Analysis

- By Compressor Type

- By Product

- By End Users

- Market Size & Analysis

- Saudi Arabia Chillers Market Outlook, 2018-2028

- Market Size & Analysis

- By Revenues (USD Million)

- By Unit Sold (Thousand Units)

- Market Share & Analysis

- By Compressor Type

- By Product

- By End Users

- Market Size & Analysis

- Qatar Chillers Market Outlook, 2018-2028

- Market Size & Analysis

- By Revenues (USD Million)

- By Unit Sold (Thousand Units)

- Market Share & Analysis

- By Compressor Type

- By Product

- By End Users

- Market Size & Analysis

- Kuwait Chillers Market Outlook, 2018-2028

- Market Size & Analysis

- By Revenues (USD Million)

- By Unit Sold (Thousand Units)

- Market Share & Analysis

- By Compressor Type

- By Product

- By End Users

- Market Size & Analysis

- Bahrain Chillers Market Outlook, 2018-2028

- Market Size & Analysis

- By Revenues (USD Million)

- By Unit Sold (Thousand Units)

- Market Share & Analysis

- By Compressor Type

- By Product

- By End Users

- Market Size & Analysis

- Oman Chillers Market Outlook, 2018-2028

- Market Size & Analysis

- By Revenues (USD Million)

- By Unit Sold (Thousand Units)

- Market Share & Analysis

- By Compressor Type

- By Product

- By End Users

- Market Size & Analysis

- GCC Chillers Market Key Strategic Imperatives for Success and Growth

- Competition Outlook

- Company Profile

- Daikin Middle East and Africa FZE

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Johnson controls

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- S.K.M Air Conditioning LLC

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Petra Engineering Industries Company

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Midea Group

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Gami Air Conditioners Manufacturing Company L.L.C.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Zamil Air conditioners

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Smardt Chiller Group FZE

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Dunham-Bush

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Carrier Corporation

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Others

- Daikin Middle East and Africa FZE

- Company Profile

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making