GCC Automotive Lighting Market Research Report: Forecast (2023-28)

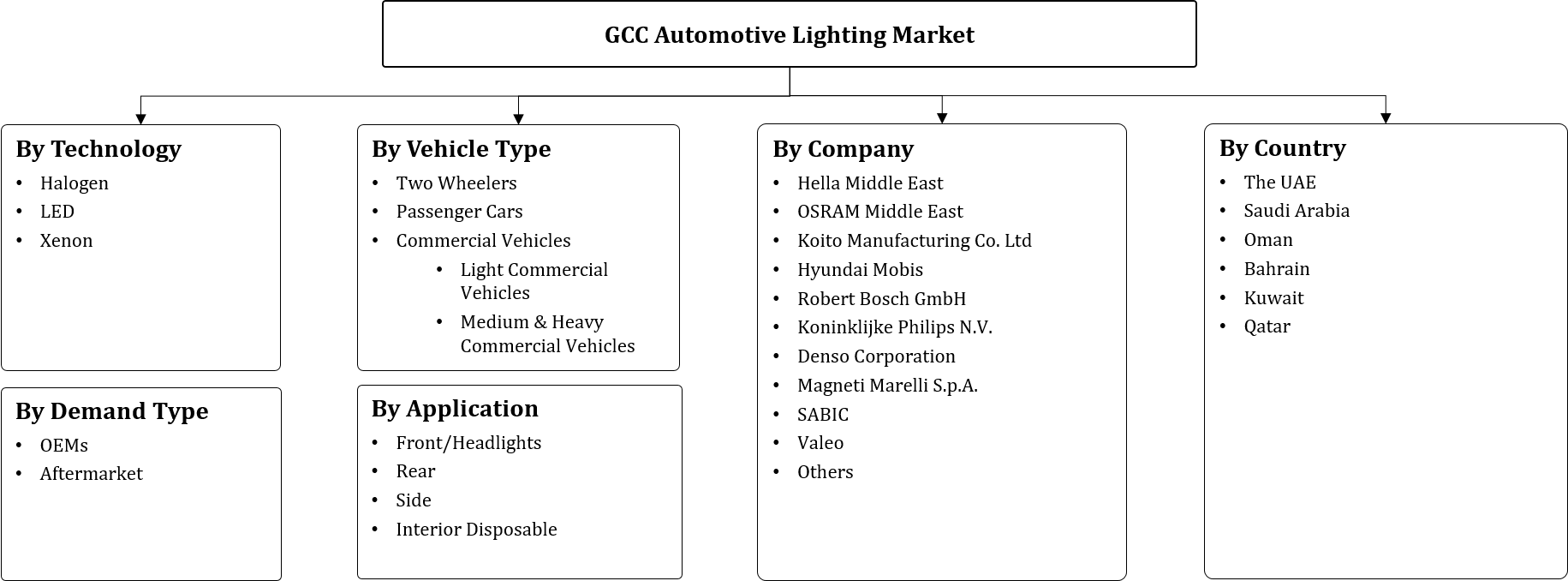

By Technology (Halogen, LED, Xenon), By Application (Front/Headlights, Rear, Side, Interior Disposable), By Vehicle Type (Two Wheelers, Passenger Cars, Commercial Vehicles, Light C...ommercial Vehicles, Medium & Heavy Commercial Vehicles), By Demand Type (OEMs, Aftermarket), By Country (The UAE, Saudi Arabia, Oman, Bahrain, Kuwait, Qatar), By Company (Hella Middle East, OSRAM Middle East, Koito Manufacturing Co. Ltd, Hyundai Mobis, Robert Bosch GmbH, Koninklijke Philips N.V., Denso Corporation, Magneti Marelli S.p.A., SABIC, Valeo, Others) Read more

- Automotive

- Feb 2023

- 134

- AT22009

Market Definition

Automotive lighting is used in vehicles to allow drivers to illuminate the lane and significantly reduce road accidents by illuminating the oncoming traffic and viewing objects & disruptions on the way. The increasing number of road accidents is one of the prominent concerns across GCC, owing to which governments of different countries in the region are imposing stringent safety standards. It is compelling the people to provide timely inspection, maintenance & replacement to their vehicles & components, including the lighting systems, which, as a result, is leading to the swiftly expanding automotive lighting industry in the GCC.

Market Insights & Analysis: GCC Automotive Lighting Market (2023-28)

The GCC Automotive Lighting Market is projected to grow at a CAGR of around 6.50% during the forecast period, i.e., 2023-28. The growth of the market is driven primarily by the burgeoning vehicle sales across different countries in GCC and the rapidly increasing road accidents & stringent government regulations to reduce them.

| Report Coverage | Details |

|---|---|

| Study Period | Historical Data: 2018-21 |

| Base Year: 2022 | |

| Forecast Period: 2023-28 | |

| CAGR (2021-2026) | 6.50% |

| Region Covered | UAE, Saudi Arabia, Oman, Bahrain, Kuwait, Qatar |

| Key Companies Profiled | Hella Middle East, OSRAM Middle East, Koito Manufacturing Co. Ltd, Hyundai Mobis, Robert Bosch GmbH, Koninklijke Philips N.V., Denso Corporation, Magneti Marelli S.p.A., SABIC, Valeo, Others |

| Unit Denominations | USD Million/Billion |

Besides, the region is witnessing a swift escalation in the car rental sector, i.e., displaying a growing inclination of consumers toward timely maintenance & replacement of different vehicle components and, in turn, mounting demand for automotive lighting. Moreover, the active participation of governments in imposing stringent safety standards on vehicles is another prominent aspect contributing to the market growth.

Furthermore, the leading players in the industry are conducting various research & development activities throughout the GCC on technologically advanced & intelligent lighting systems for vehicles in order to equip them with sensors for benefits like object detection, illuminating approaching traffic, driver assistance, & proximity, i.e., another prominent aspect that projects remunerative opportunities for the market during 2023-28.

.png)

Market Dynamics

Key Driver: Escalating Demand for Electric Vehicles Boosted the Sales of Automotive Lighting

The demand for electric vehicles are increasing considerably across the GCC countries like the UAE, Saudi Arabia, etc., during the past few years, which has enhanced the sales of automotive lighting. The major factor contributing to the enhanced adoption of an electric vehicles is the advancing charging infrastructure across these countries. Several companies like Siemens, ABB E-mobility, etc. have been installing electric charging infrastructures across the region, which is enhancing the adoption of EVs among consumers. For instance,

- In 2023, GO TO-U and FYSH EVC LLC are partnering to provide a seamless charging experience across Dubai, to improve its charging infrastructure.

- In 2022, ABB E-mobility installed EV chargers for electric vehicles across 100 strategic locations in Saudi Arabia.

Consequently, with the improvement of charging infrastructure across the region, and amplified sales of electric vehicles, the GCC Automotive Lighting Market is anticipated to increase further in the forecasted years.

Possible Restraint: Shortage of Semiconductor Chip to Hamper the Sales of Automotive Lighting Across GCC

The global shortage of semiconductors especially initiated during Covid-19 due to the reduction in wafer fabrication units has negatively impacted the manufacturing & sales of vehicles in GCC region over the past few years. With the reduction in the manufacturing & sales of vehicles, the demand for automotive lighting also decreased substantially across the GCC region during the historical years. During Covid-19, most companies involved in wafer fabrication of semiconductor chips like Global Foundries, United Microelectronics Corporation (UMC), etc., had paused their procedure due to the lack of demand for the same. This has negatively affected the supply & sales of automobiles in the GCC region, as semiconductor chips are an integral part of vehicles.

Moreover, the shortage of semiconductors persisted even after the resumption of activities after Covid-19, owing to the fact that it takes almost 26 weeks to complete the production of wafers from start to completion after the production unit comes online. Henceforth, with arising factors affecting the supply chain of semiconductor chips have been negatively affecting the sales of automobiles, which further reduced the aftermarket demand for automotive lighting in the GCC region during 2023-2028.

Key Trend: Integration of Sensors into Autonomous Lighting Systems

There has been escalated adoption of sensor-enabled autonomous lighting systems across the country, which has improved their market growth during the historical years. The sensor-enabled automotive lighting optimizes the light distribution from the vehicle, based on driving and road circumstances. The sensors-enabled automotive lighting systems provide information to the system, which allows the vehicle to change the intensity and direction of the car accordingly. Hence, with the upcoming presence of new vehicles that provides adaptive lighting systems, their sales have increased significantly in GCC. The companies like een offering vehicles with sensor-enabled adaptive headlights across the region.

As a result, with the growing awareness of theAudi, BMW, etc., have b safety features of sensor-enabled headlights, and amplified demand among consumer to change their automotive parts with upcoming trends, the sales of automotive lighting is expected to uplift further among customers across the GCC Countries, especially the UAE and Saudi Arabia in the forecasted years.

Market Segmentation

Based on Application:

- Front/Headlights

- Rear

- Side

- Interior

Here, the Rear application acquired the largest share in the GCC Automotive Lighting Market in previous years, and their dominance is likely even during 2023-2028. It attributes principally to the growing number of road accidents and, in turn, an increasing need for enhanced lighting in the rear of vehicles to avoid such situations.

Besides, with the growing inclination of lighting system manufacturers toward bringing innovations & efficiency in their products, the burgeoning development & extensive availability of headlamps, DRLs, & LEDs are also playing a crucial role in driving the market. Since LEDs emit more noticeable & vibrant colors and illuminate instantly, automakers are making all of their vehicles fitted with these lighting systems, and thus positively influencing the overall market growth.

Country Landscape

Geographically, the GCC Automotive Lighting Market expands across:

- The UAE

- Saudi Arabia

- Oman

- Bahrain

- Kuwait

- Qatar

Of all countries in GCC, Saudi Arabia is expected to dominate the Automotive Lighting Market with the largest share during 2023-2028. It owes principally to the rapidly increasing automotive sales, especially passenger vehicles, across the country due to the improving economic conditions, changing living standards, & growing inclination of people toward private vehicle ownership.

It, in turn, is directly influencing the demand for automotive lighting and instigating manufacturers to increase their production capacities to meet the mounting consumer demand across Saudi Arabia. Besides, automobiles are more like a status symbol than a need for the Saudi people. Hence, they are playing a significant role in rapidly increasing vehicle sales and the mounting demand for lighting components across Saudi Arabia, which, in turn, is fueling the overall market growth.

Gain a Competitive Edge with Our GCC Automotive Lighting Market Report

- GCC Automotive Lighting Market Report by MarkNtel Advisors provides a detailed & thorough analysis of market size & share, growth rate, competitive landscape, and key players. This comprehensive analysis helps businesses gain a holistic understanding of the market dynamics & make informed decisions.

- This report also highlights current market trends & future projections, allowing businesses to identify emerging opportunities & potential challenges. By understanding market forecasts, companies can align their strategies & stay ahead of the competition.

- GCC Automotive Lighting Market Report aids in assessing & mitigating risks associated with entering or operating in the market. By understanding market dynamics, regulatory frameworks, and potential challenges, businesses can develop strategies to minimize risks & optimize their operations.

Frequently Asked Questions

- Market Segmentation

- Introduction

- Product Definition

- Research Process

- Assumptions

- Executive Summary

- Impact of COVID-19 on the GCC Automotive Lighting Market

- GCC Automotive Lighting Market Trends & Insights

- GCC Automotive Lighting Market Dynamics

- Growth Drivers

- Challenges

- GCC Automotive Lighting Market Supply Chain Analysis

- GCC Automotive Lighting Market Policies, Regulations & Product Standards

- GCC Automotive Lighting Market Hotspots & Opportunities

- GCC Automotive Lighting Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenues (USD Million)

- By Unit Sold (Thousand Units)

- Market Share & Analysis

- By Technology

- Halogen

- LED

- Xenon

- By Application

- Front/Headlights

- Rear

- Side

- Interior Disposable

- By Vehicle Type

- Two Wheelers

- Passenger Cars

- Commercial Vehicles

- Light Commercial Vehicles

- Medium & Heavy Commercial Vehicles

- By Demand Type

- OEMs

- Aftermarket

- By Country

- The UAE

- Saudi Arabia

- Oman

- Bahrain

- Kuwait

- Qatar

- By Company

- Competition Characteristics

- Revenue Share & Analysis

- By Technology

- Market Size & Analysis

- The UAE Automotive Lighting Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenues (USD Million)

- By Unit Sold (Thousand Units)

- Market Share & Analysis

- By Technology

- By Application

- By Vehicle Type

- By Demand Type

- Market Size & Analysis

- Saudi Arabia Automotive Lighting Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenues (USD Million)

- By Unit Sold (Thousand Units)

- Market Share & Analysis

- By Technology

- By Application

- By Vehicle Type

- By Demand Type

- Market Size & Analysis

- Oman Automotive Lighting Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenues (USD Million)

- By Unit Sold (Thousand Units)

- Market Share & Analysis

- By Technology

- By Application

- By Vehicle Type

- By Demand Type

- Market Size & Analysis

- Bahrain Automotive Lighting Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenues (USD Million)

- By Unit Sold (Thousand Units)

- Market Share & Analysis

- By Technology

- By Application

- By Vehicle Type

- By Demand Type

- Market Size & Analysis

- Kuwait Automotive Lighting Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenues (USD Million)

- By Unit Sold (Thousand Units)

- Market Share & Analysis

- By Technology

- By Application

- By Vehicle Type

- By Demand Type

- Market Size & Analysis

- Qatar Automotive Lighting Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenues (USD Million)

- By Unit Sold (Thousand Units)

- Market Share & Analysis

- By Technology

- By Application

- By Vehicle Type

- By Demand Type

- Market Size & Analysis

- GCC Automotive Lighting Market Key Strategic Imperatives for Success & Growth

- Competition Outlook

- Competition Matrix

- Product Portfolio

- Brand Specialization

- Target Markets

- Target End Users

- Research & Development

- Strategic Alliances

- Strategic Initiatives

- Company Profiles (Business Description, Product Segments, Business Segments, Financials, Strategic Alliances/ Partnerships, Future Plans)

- Hella Middle East

- OSRAM Middle East

- Koito Manufacturing Co. Ltd

- Hyundai Mobis

- Robert Bosch GmbH

- Koninklijke Philips N.V.

- Denso Corporation

- Magneti Marelli S.p.A.

- SABIC

- Valeo

- Others

- Competition Matrix

- Disclaimer