Saudi Arabia Food Preparation Appliances Market Research Report: Forecast (2026-2032)

Saudi Arabia Food Preparation Appliances Market - By Product Type Primary Appliances (Blenders & Mixers, High-speed blenders, Hand blenders, Stand mixers, Food Processors, Slicing,... Dicing, Chopping, Shredding, Juice Extractors, Centrifugal juicers, Cold press / masticating juicers, Meat Grinders & Mince Machines, Vegetable / Fruit Choppers, Multipurpose Food Preparation Machines), Specialty Appliances, (Dough makers, Nut grinders, Food cutting/shredders, Others), By Technology (Manual Appliances, Semi-Automatic Appliances, Fully Automatic Appliances, Connected / IoT-Enabled Appliances), By Distribution Channel (Offline Retail, Supermarkets / Hypermarkets, Specialty Kitchen Stores, Electronics & Appliance Retailers, Online Retail, Direct Sales, Franchise Outlets, Wholesale Distribution), By Price Range (Low Range, Mid-Range, Premium Range), By Application (Residential Use, Commercial Use, Restaurants & Cafés, Hotels & Hospitality, Catering Services, Quick Service Restaurants (QSRs), Cloud Kitchens), and others Read more

- FMCG

- Jan 2026

- Pages 135

- Report Format: PDF, Excel, PPT

Saudi Arabia Food Preparation Appliances Market

Projected 6.85% CAGR from 2026 to 2032

Study Period

2026-2032

Market Size (2025)

USD 642 Million

Market Size (2032)

USD 1021 Million

Base Year

2025

Projected CAGR

6.85%

Leading Segments

By Product Type: Primary Appliances

Saudi Arabia Food Preparation Appliances Market Report Key Takeaways:

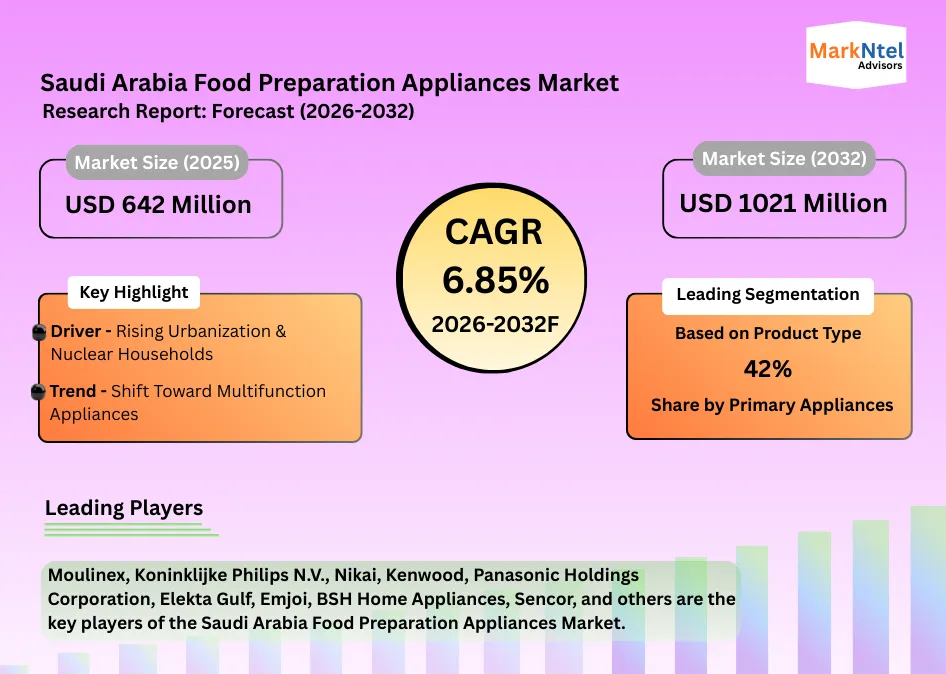

- The Saudi Arabia Food Preparation Appliances Market size was valued at around USD 642 million in 2025 and is projected to reach USD 1,021 million by 2032. The estimated CAGR from 2026 to 2032 is around 6.85%, indicating strong growth.

- By product type, primary appliances dominate the Saudi Arabia Food Preparation Appliances Market in 2025, holding around 42% of total units sold.

- By application, the residential use dominates the Saudi Arabia Food Preparation Appliances Market size in 2025.

- The leading food preparation appliances companies in Saudi Arabia are Moulinex, Koninklijke Philips N.V., Nikai, Kenwood, Panasonic Holdings Corporation, Elekta Gulf, Emjoi, BSH Home Appliances, Sencor, Braun GmbH, Black+Decker, and others.

Market Insights & Analysis: Saudi Arabia Food Preparation Appliances Market (2026-2032):

The Saudi Arabia Food Preparation Appliances Market size was valued at around USD 642 million in 2025 and is projected to reach USD 1,021 million by 2032. Along with this, the market is estimated to grow at a CAGR of around 6.85% during the forecast period, i.e., 2026-32.

The Saudi Arabia Food Preparation Appliances Market is experiencing rapid growth, driven by rising urbanization, the expansion of nuclear households, and the growing shift toward multifunction appliances that deliver greater convenience, efficiency, and space optimization for modern homes.

Official population estimates indicate that about 92.3% of residents lived in urban areas in 2024 (around 31.35 million people), with a similar level projected for 2025. Major cities such as Riyadh and Jeddah continue to absorb most of this growth, concentrating demand for modern housing and compact household infrastructure.

Household composition further reinforces this trajectory. For example, the Saudi Family Statistics Report 2024 (GASTAT) shows that nuclear families account for approximately 70% of multi-member households, reflecting a gradual transition away from extended family living. These smaller family units typically prioritize efficiency and convenience in daily routines, encouraging the adoption of appliances such as blenders, food processors, and juicers that reduce preparation time.

In parallel, 44.9% of Saudi households now live in apartments, compared with 31% in villas. Apartment-based living, especially in dense urban districts, naturally favors space-efficient and multifunction food preparation appliances over bulky single-use devices.

Product availability already mirrors this structural shift. For example, the ALSAIF 800 W multifunction food processor, equipped with a 3.2-liter bowl, 1.5-liter blender, grinder, and chopper, addresses consumer demand for combined preparation functions within a single compact unit.

Similarly, 14-cup multifunction blender and food processor combinations capable of chopping, blending, slicing, kneading, and shredding cater to both nuclear families and larger urban households seeking versatility without kitchen congestion. The growing presence of such products across Saudi e-commerce platforms and electronics retailers highlights increasing mainstream acceptance of multifunction formats.

Looking beyond 2025, large-scale housing and urban development programs are expected to intensify this demand. For instance, in the first half of 2025, the Ministry of Municipal & Rural Affairs and Housing launched around 26,000 off-plan homes under the Sakani initiative, including delivery of 5,000 housing units and 5,200 land plots, with cumulative residential plots exceeding 170,000. This pipeline will continue expanding the urban housing stock in subsequent years, directly increasing the number of newly equipped kitchens.

At the same time, Vision 2030 mega-projects such as New Murabba in Riyadh, planned to include 104,000 residential units across 19 km², will add substantial urban population capacity toward the late 2020s and early 2030s.

Saudi Arabia’s exceptionally high urbanization rate, dominance of nuclear households, and expanding residential developments form a durable foundation for food preparation appliance demand. Combined with the accelerating adoption of multifunction devices, these structural forces are expected to sustain strong market growth well beyond 2025.

Saudi Arabia Food Preparation Appliances Market Recent Developments:

- June 2025: Premium kitchen appliance brand Kuvings announced that its Hands-Free Auto10 slow juicer was recognized as the Best Masticating Juicer of 2025 by lifestyle magazine Taste of Home. Praised for its user-friendly design, hands-free one-touch operation, and efficient cold-press performance, the Auto10 underscores rising demand for health-centric food prep appliances in Saudi kitchens. Professional kitchen reviewers highlighted its convenience and juice quality.

Saudi Arabia Food Preparation Appliances Market Scope:

| Category | Segments |

|---|---|

| By Product Type | Primary Appliances (Blenders & Mixers, High-speed blenders, Hand blenders, Stand mixers, Food Processors, Slicing, Dicing, Chopping, Shredding, Juice Extractors, Centrifugal juicers, Cold press / masticating juicers, Meat Grinders & Mince Machines, Vegetable / Fruit Choppers, Multipurpose Food Preparation Machines), Specialty Appliances, (Dough makers, Nut grinders, Food cutting/shredders, Others |

| By Technology | Manual Appliances, Semi-Automatic Appliances, Fully Automatic Appliances, Connected / IoT-Enabled Appliances |

| By Distribution Channel | Offline Retail, Supermarkets / Hypermarkets, Specialty Kitchen Stores, Electronics & Appliance Retailers, Online Retail, Direct Sales, Franchise Outlets, Wholesale Distribution |

| By Price Range | Low Range, Mid-Range, Premium Range |

| By Application | Residential Use, Commercial Use, Restaurants & Cafés, Hotels & Hospitality, Catering Services, Quick Service Restaurants (QSRs), Cloud Kitchens), and others |

Saudi Arabia Food Preparation Appliances Market Drivers:

Rising Urbanization & Nuclear Households

Saudi Arabia’s changing demographic profile and household composition are emerging as structural growth drivers for the food preparation appliances market. According to GASTAT reports, nearly 86% of households comprise two or more members, with an average size of five people. As families increasingly shift toward smaller, urban homes, preference is rising for time-saving appliances such as blenders, food processors, and multipurpose machines that support faster and more diverse meal preparation.

Demographic momentum reinforces this trend, with 71% of Saudis under 35 and an average age of 26.6 years. This young population readily adopts lifestyle innovations and global food habits, making modern kitchen appliances essential for first-time homeowners and young families in urban settings.

In parallel, single-person households now represent 14% of all households, primarily concentrated in urban centers. This segment, dominated by young professionals and students, exhibits a strong preference for compact, easy-to-use appliances such as hand blenders and mini food processors suited to limited living space and fast-paced lifestyles.

Furthermore, housing expansion reinforces this driver. As GASTAT reported 4.4 million occupied homes in 2024, reflecting an increase of 233,000 units, with approximately 45% classified as apartments. Rising urban density directly expands the installed base for modern kitchen appliances.

Saudi Arabia’s youthful population, expanding housing stock, and shift toward smaller urban households are structurally elevating demand for efficient food preparation solutions. These dynamics will continue to accelerate appliance penetration and sustain long-term market growth.

Saudi Arabia Food Preparation Appliances Market Trends:

Shift Toward Multifunction Appliances

One of the most prominent trends in Saudi Arabia’s food preparation appliances market is the shift toward multifunction devices that combine blending, chopping, kneading, slicing, and juicing in one unit. This reflects rising demand for convenience, efficiency, and space-saving solutions, especially among urban households and apartment residents with limited kitchen space.

Saudi consumers increasingly prefer all-in-one solutions that replace multiple standalone appliances. Multifunction food processors integrate diverse tasks into compact designs, enabling faster meal preparation and supporting varied cuisines, aligning well with the needs of young families and professionals seeking efficient, clutter-free kitchens.

Product availability in the Kingdom demonstrates the strength of this trend. For example, Moulinex’s multifunction food processors, offering 28–31 functions, combine large-capacity bowls, blenders, and multiple attachments to handle tasks ranging from dough kneading to vegetable shredding and juice extraction.

Similarly, the Moulinex 25-function food processor integrates a 2.4-liter bowl with a blender attachment, enabling soups, sauces, doughs, and beverages to be prepared within one compact unit. Such offerings illustrate how manufacturers are responding directly to demand for versatility and efficiency in home kitchens.

The shift toward multifunction food preparation appliances is redefining kitchen consumption patterns in Saudi Arabia. By combining multiple tasks into single units, these devices meet modern expectations for efficiency, space utilization, and culinary flexibility, positioning this segment as a key growth engine for the market.

Saudi Arabia Food Preparation Appliances Market Challenges:

Limited After-Sales Service and Spare Parts Availability

A key challenge constraining the Saudi Arabia food preparation appliances market is the inadequacy of after-sales service infrastructure and the limited availability of genuine spare parts.

Government consumer complaint data show that a large share of disputes in Saudi Arabia relate to after-sales support, warranty execution, maintenance delays, and spare parts access. Ministry of Commerce call center statistics consistently highlight service-related grievances, underscoring persistent structural gaps in post-purchase support.

These challenges are magnified by the fragmented service landscape. For example, in 2025, Saudi Arabia had only 29 dedicated appliance service outlets nationwide, with 82.76% operated by single-owner businesses rather than by manufacturer-backed service networks. Such limited coverage often results in extended repair timelines, inconsistent service quality, and difficulty sourcing original components, particularly for imported or premium brands.

For consumers, these issues increase the total cost of ownership and reduce confidence in higher-value appliances. For manufacturers and retailers, weak service ecosystems limit brand loyalty and repeat purchases.

Inadequate after-sales infrastructure and spare parts constraints undermine consumer trust and slow replacement cycles. Unless service networks expand and parts availability improves, these challenges will continue to restrain market momentum, particularly in premium and multifunction appliance segments.

Saudi Arabia Food Preparation Appliances Market (2026-32) Segmentation Analysis:

The Saudi Arabia Food Preparation Appliances Market Report and Forecast 2026-2032 offers a detailed analysis of the market based on the following segments:

Based on Product Type:

- Primary Appliances

- Blenders & Mixers

- High-speed blenders

- Hand blenders

- Stand mixers

- Food Processors

- Slicing

- Dicing

- Chopping

- Shredding

- Juice Extractors

- Centrifugal juicers

- Cold press / masticating juicers

- Meat Grinders & Mince Machines

- Vegetable / Fruit Choppers

- Multipurpose Food Preparation Machines

- Blenders & Mixers

- Specialty Appliances

- Dough makers

- Nut grinders

- Food cutting/shredders

- Others

The primary appliances segment holds the top spot in the Saudi Arabia Food Preparation Appliances Market with 42% share in the total units sold, reflecting their central role in everyday cooking and meal preparation.

These products, ranging from blenders and mixers to food processors, juicers, meat grinders, and multipurpose machines, address core, recurring kitchen needs across households and foodservice environments. Their versatility, frequency of use, and direct impact on time-saving drive higher replacement cycles and sustained demand. High-speed blenders and food processors have become essential for modern diets emphasizing smoothies, fresh meals, and home cooking, while juice extractors align with rising health consciousness.

Multipurpose machines further strengthen this segment by combining multiple functions in a single device, appealing to space-conscious urban consumers. Price accessibility across entry, mid, and premium tiers expands adoption among diverse income groups.

Additionally, continuous product innovation, such as enhanced motor efficiency, compact designs, and smart features, keeps Primary Appliances at the forefront of consumer spending, reinforcing their leadership in both volume and relevance within the market.

Based on Application:

- Residential Use

- Commercial Use

- Restaurants & Cafés

- Hotels & Hospitality

- Catering Services

- Quick Service Restaurants (QSRs)

- Cloud Kitchens

The residential use category leads the Saudi Arabia Food Preparation Appliances Industry, driven by evolving consumer lifestyles and a strong shift toward home-centric consumption patterns.

Urbanization, rising disposable incomes, and the growing influence of health and wellness trends have transformed households into primary points of demand. Consumers increasingly prefer preparing meals and beverages at home to control quality, ingredients, and costs, accelerating adoption across residential settings.

The post-pandemic normalization of remote work has further reinforced this trend, as time spent at home has increased daily consumption frequency. Modern households are also investing in convenience-oriented and premium solutions that replicate café- and restaurant-style experiences, reducing dependence on out-of-home channels. Digital exposure through social media and e-commerce platforms has heightened awareness of new products and formats, encouraging trial and repeat purchases at the household level.

Additionally, smaller pack sizes, subscription models, and direct-to-consumer distribution have improved accessibility for residential buyers. These factors collectively position households as the most consistent and scalable demand base, underpinning the sustained dominance of residential use across the application landscape.

Gain a Competitive Edge with Our Saudi Arabia Food Preparation Appliances Market Report:

- Saudi Arabia Food Preparation Appliances Market Report by MarkNtel Advisors provides a detailed & thorough analysis of market size & share, growth rate, competitive landscape, and key players. This comprehensive analysis helps businesses gain a holistic understanding of the market dynamics & make informed decisions.

- This report also highlights current market trends & future projections, allowing businesses to identify emerging opportunities & potential challenges. By understanding market forecasts, companies can align their strategies & stay ahead of the competition.

- Saudi Arabia Food Preparation Appliances Market Report aids in assessing & mitigating risks associated with entering or operating in the market. By understanding market dynamics, regulatory frameworks, and potential challenges, businesses can develop strategies to minimize risks & optimize their operations.

*Reports Delivery Format - Market research studies from MarkNtel Advisors are offered in PDF, Excel and PowerPoint formats. Within 24 hours of the payment being successfully received, the report will be sent to your email address.

Frequently Asked Questions

- Market Segmentation

- Introduction

- Product Definition

- Research Process

- Assumptions

- Executive Summary

- Saudi Arabia Food Preparation Appliances Market Policies, Regulations, and Product Standards

- Saudi Arabia Food Preparation Appliances Market Supply Chain Analysis

- Saudi Arabia Food Preparation Appliances Market Import & Export Analysis

- Saudi Arabia Food Preparation Appliances Market Trends & Developments

- Saudi Arabia Food Preparation Appliances Market Dynamics

- Growth Drivers

- Challenges

- Saudi Arabia Food Preparation Appliances Market Hotspot & Opportunities

- Saudi Arabia Food Preparation Appliances Market Outlook, 2022-2032

- Market Size & Outlook

- By Revenues (USD Million)

- By Units Sold (Thousand Units)

- Market Share & Outlook

- By Product Type – Market Size & Forecast 2022-2032, USD Million & Thousand Units

- Primary Appliances

- Blenders & Mixers

- High-speed blenders

- Hand blenders

- Stand mixers

- Food Processors

- Slicing

- Dicing

- Chopping

- Shredding

- Juice Extractors

- Centrifugal juicers

- Cold press / masticating juicers

- Meat Grinders & Mince Machines

- Vegetable / Fruit Choppers

- Multipurpose Food Preparation Machines

- Blenders & Mixers

- Specialty Appliances

- Dough makers

- Nut grinders

- Food cutting/shredders

- Others

- Primary Appliances

- By Technology – Market Size & Forecast 2022-2032, USD Million & Thousand Units

- Manual Appliances

- Semi-Automatic Appliances

- Fully Automatic Appliances

- Connected / IoT-Enabled Appliances

- By Distribution Channel – Market Size & Forecast 2022-2032, USD Million & Thousand Units

- Offline Retail

- Supermarkets / Hypermarkets

- Specialty Kitchen Stores

- Electronics & Appliance Retailers

- Online Retail

- Direct Sales

- Franchise Outlets

- Wholesale Distribution

- By Price Range – Market Size & Forecast 2022-2032, USD Million & Thousand Units

- Low Range

- Mid-Range

- Premium Range

- By Application – Market Size & Forecast 2022-2032, USD Million & Thousand Units

- Residential Use

- Commercial Use

- Restaurants & Cafés

- Hotels & Hospitality

- Catering Services

- Quick Service Restaurants (QSRs)

- Cloud Kitchens

- By Region

- Riyadh

- Jeddah

- Damam

- Mecca & Madinah

- Others

- By Company

- Company Revenue Shares

- Competitor Characteristics

- By Product Type – Market Size & Forecast 2022-2032, USD Million & Thousand Units

- Market Size & Outlook

- Saudi Arabia Primary Food Preparation Appliances Market Outlook, 2022-2032

- Market Size & Outlook

- By Revenues (USD Million)

- By Units Sold (Thousand Units)

- Market Share & Outlook

- By Technology – Market Size & Forecast 2022-2032, USD Million & Thousand Units

- By Distribution Channel – Market Size & Forecast 2022-2032, USD Million & Thousand Units

- By Price Range – Market Size & Forecast 2022-2032, USD Million & Thousand Units

- By Application – Market Size & Forecast 2022-2032, USD Million & Thousand Units

- By Region

- Market Size & Outlook

- Saudi Arabia Specialty Food Preparation Appliances Market Outlook, 2022-2032

- Market Size & Outlook

- By Revenues (USD Million)

- By Units Sold (Thousand Units)

- Market Share & Outlook

- By Technology – Market Size & Forecast 2022-2032, USD Million & Thousand Units

- By Distribution Channel – Market Size & Forecast 2022-2032, USD Million & Thousand Units

- By Price Range – Market Size & Forecast 2022-2032, USD Million & Thousand Units

- By Application – Market Size & Forecast 2022-2032, USD Million & Thousand Units

- By Region

- Market Size & Outlook

- Saudi Arabia Food Preparation Appliances Market Key Strategic Imperatives for Success & Growth

- Competition Outlook

- Company Profiles

- Moulinex

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Koninklijke Philips N.V.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Nikai

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Kenwood

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Panasonic Holdings Corporation

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Elekta Gulf

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Emjoi

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- BSH Home Appliances

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Sencor

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Braun GmbH

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Black+Decker

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Others

- Moulinex

- Company Profiles

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making