Global Carbon Dioxide Removal Market Research Report: Forecast (2023-2028)

By Technology (Direct Air Capture (DAC), Biocha, Enhanced Mineralization, Ocean Alkalization, Others (Solid Sorbent, etc.)), By Application (Industrial, Transportation, Buildings &... Infrastructure), By Region North America, Europe, The Middle East & Africa, Asia-Pacific, By Company (Climeworks AG, Global Thermostat, Carbon Engineering Ltd., Mitsubishi Heavy Industries, Cella Mineral Storage, Shell, Arca Climate, ExxonMobil, Carbon Clean Solutions, Equinor, Carbofex Ltd., Carbon Cure Technologies Inc., Blue Planet System, Bessume Energy AB, and others) Read more

- Environment

- Jun 2023

- Pages 192

- Report Format: PDF, Excel, PPT

Market Definition

Carbon Dioxide Removal refers to different approaches used for removing carbon dioxide from the atmosphere including direct air capture, enhanced mineralization, ocean-based carbon capture, etc. These approaches are adopted by different industries to reduce carbon emissions to balance their carbon footprint and solve the problem of climate change.

Market Insights & Analysis: Global Carbon Dioxide Removal Market (2023-28)

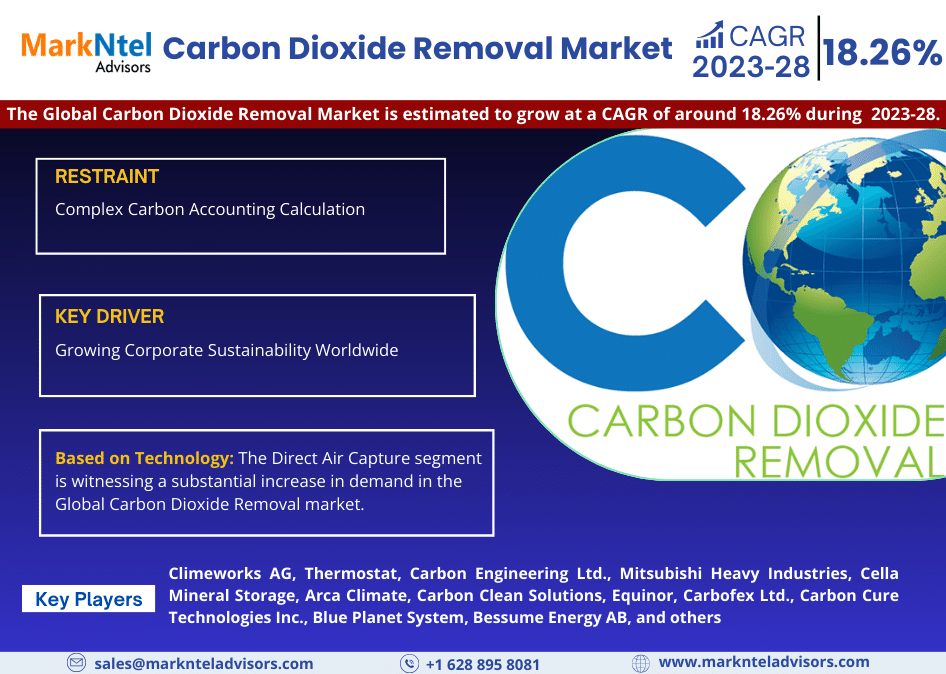

The Global Carbon Dioxide Removal Market size is valued at around USD 1.2 billion in 2024 and is estimated to grow at a CAGR of around 18.26% during the forecast period, i.e., 2023-28. The market is still in its early stages & is predicted to grow significantly in the coming years as countries & companies seek to reduce greenhouse gas emissions & meet their climate goals owing to the rising effects of carbon emissions, such as climate change, biodiversity loss, etc., and increasing government focus on protecting the environment. Thus, various international & national efforts, like coalitions, conventions for climate change, and others, are being taken by countries across the world to reduce the growth of global warming by lowering carbon emissions initially. For instance:

- In 2022, the US, in collaboration with the United Nations Climate Change Conference of the Parties (COP27), launched the Net-Zero Government Initiative to invite countries to help the US reduce emissions from government operations & achieve net emission neutrality by 2050.

| Report Coverage | Details |

|---|---|

| Study Period | Historical Data: 2018-21 |

| Base Year: 2022 | |

| Forecast Period: 2023-28 | |

| CAGR (2023-2028) | 18.26% |

| Regions Covered | North America: US, Canada, Mexico |

| Europe: Germany, The UK, France, Germany, Spain, Italy, Nordic Countries, Rest of Europe | |

| Asia-Pacific: China, India, Japan, South Korea, Australia, Rest of Asia-Pacific | |

| South America: Brazil, Argentina, Rest of South America | |

| Middle East & Africa: UAE, Saudi Arabia, South Africa, Egypt, Rest of MEA | |

| Key Companies Profiled | Climeworks AG, Thermostat, Carbon Engineering Ltd., Mitsubishi Heavy Industries, Cella Mineral Storage, Arca Climate, Carbon Clean Solutions, Equinor, Carbofex Ltd., Carbon Cure Technologies Inc., Blue Planet System, Bessume Energy AB, and others |

| Market Value (2024) | USD 1.2 billion |

Moreover, with the limited progress on rapidly cutting global GHG emissions over the past few years, countries are now recognizing CDR as a critical component for achieving ambitious climate goals like a net zero GHG economy by 2050. To achieve these goals, Fossil Energy and Carbon Management (FECM) increases the deployment of diverse CDR approaches to facilitate gigatonne-scale carbon removal in the coming years. Such initiatives are raising awareness about the importance of reducing carbon dioxide emissions in saving the environment & the planet, as CO2 emissions form the major portion of overall greenhouse gas emissions. For instance:

- According to International Energy Agency, in 2022, CO2 emissions were responsible for around 89.96% of total greenhouse gas emissions emitted from the energy sector, amounting to about 37.2 Giga tons.

Thus, governments & companies are concentrating more on making their economies & operations carbon neutral, consequently generating demand for carbon dioxide removal solutions. In addition, the emergence of new methods to put CO2 to use in different industries & purposes, such as the production of fuels, chemicals & building materials, is growing the popularity of carbon capture storage & utilization(CCS), which involves technologies such as direct air capture. Government, private parties, and investors are taking a step forward to support start-ups involved in carbon capture, utilization, and storage (CCUS) from diverse sectors, like fuels & chemicals, building materials, etc., in the form of funding. For instance:

- In 2022, the total global value of venture capital funding for CCUS start-ups reached nearly USD223 million, up from around 101 million in 2018.

Further, governments & companies such as Climeworks, and Carbon Engineering Ltd., are constantly engaged in elevating their research & development activities to come up with technological innovations & advancements to improve the efficiency of the carbon removal process to achieve faster carbon neutrality, supporting the growth of the Global Carbon Dioxide Removal Market. Therefore, continuous innovative developments coupled with mounting awareness of individuals & businesses underpinned by government initiatives to limit carbon emissions would drive the market in the future years.

Global Carbon Dioxide Removal Market Key Driver:

Growing Corporate Sustainability Worldwide - Environmental concerns such as climate change, biodiversity loss, etc., owing to increasing greenhouse gas emissions from various industries such as automotive, power generation, and transportation, have been necessitating the adoption of sustainable solutions. Thus, global governments have started framing regulatory provisions to address these environmental challenges leading to augmented awareness about the importance of carbon mitigation among corporate players. Carbon-intensive companies such as electricity & heat, transportation, oil & gas, and others have started setting up ambitious goals, including targets for carbon neutrality or net-zero emissions. The role of carbon removal technologies to make a positive impact on the environment & meet carbon neutrality targets has been raising the popularity of such methods. For instance:

- In 2023, Apple Inc., announced its additional financial commitment of USD200 million to its carbon removal fund formed in 2021 to invest in projects that remove carbon from the atmosphere to meet its goal of removing about 1 million metric tons of carbon dioxide per year.

Further, government support to companies in the form of subsidies, tax rebates, and other favorable policies to adopt sustainable practices combined with the role of carbon removal technologies in building long-term resilience would continue to create the demand for carbon dioxide removal solutions in the upcoming years.

Global Carbon Dioxide Removal Market Possible Restraint:

Complex Carbon Accounting Calculation - The primary issue in the Global Carbon Dioxide Removal Market has been a lack of knowledge of carbon accounting calculations, as estimating the levels of carbon offset during the production process is extremely complex, hence delaying the adoption process of carbon removal methods. Nonetheless, quantifying the number of carbon emissions from multiple processes of a complete manufacturing unit has proven difficult for companies in recent years. As a result, when original equipment manufacturers are unable to demonstrate the emission-free product that they are offering, the market's complete development is hampered.

Global Carbon Dioxide Removal Market Key Trend:

R&D Investment & Surging Innovation in Emerging BECCS Technologies for Carbon Removal - In recent years, rising technological advancement in bioenergy with carbon capture & storage, such as advanced gasification for hydrogen production or low-energy-penalty capture technologies, could reduce costs & enhance efficiency & flexibility. Along with this, increasing R&D to develop sustainable low-carbon energy vectors is encouraged by climate mitigation policies in those countries committed to achieving net-zero emission performance by 2050, leading to propelling market growth in the coming years. For instance,

- In 2023, GE Gas Power, part of GE Vernova and Svante, a carbon capture & removal solutions provider announced their collaboration to develop & evaluate solid sorbent-based carbon capture technology for natural gas power generation applications. This was part of GE’s energy transition strategy under which it is developing & commercializing different technologies, including carbon capture through industrial and technology research collaborations.

This has led to the diversification of technologies & approaches to carbon dioxide removal to meet the varying needs of different industries. Thus, companies have started indulging in partnerships & agreements to explore the suitability of new methods for diverse industries.

Global Carbon Dioxide Removal Market (2023-28): Segmentation Analysis

Based on Technology:

- Direct Air Capture

- Biochar

- Enhanced Mineralization

- Ocean Alkalization

- Others

Of these, the Direct Air Capture segment is witnessing a substantial increase in demand in the Global Carbon Dioxide Removal market. This is due to the location flexibility of this method, which captures carbon directly from the source of emissions, making it appealing to a wide range of industries. Direct air capture (DAC) technologies extract CO2 directly from the atmosphere. The CO2 can be permanently stored in deep geological formations, thereby achieving carbon dioxide removal (CDR).

Thus, the high potential for carbon removal by DAC, when compared to other methods & high storage permanence, and a limited land & water footprint led to enhancing the market growth. Also, the option of using the captured CO2 in processing industries, such as food processing or combining it with hydrogen to produce synthetic fuels, is expected to promote the adoption of this method in the forthcoming years.

Global Carbon Dioxide Removal Market Regional Projection

Geographically, the Global Carbon Dioxide Removal market expands across:

- North America

- South America

- Europe

- The Middle East & Africa

- Asia-Pacific

Of all the regions across the globe, North America is experiencing an upsurge in demand for carbon dioxide removal infrastructure owing to the presence of policy measures & initiatives taken by countries such as the US & Canada to achieve the goals set up for mitigating the effect of climate change, including CarbonSafe, Low Carbon Economy Fund, and others. The large number of investments made by regional governments in carbon capture projects are improving the market growth in the geography. For instance:

- In 2023, the US Energy Department awarded USD93 million to 11 carbon storage projects, which would involve capturing & storing carbon beneath the seafloor in the US Gulf of Mexico. This funding is a part of the government’s goal to store at least 50mn metric tons of CO2 over the next 30 years.

In addition, there is a high level of engagement of academic institutions, research organizations, and government agencies such as Woods Hole Oceanographic Institution, Columbia University, etc., in research & development for carbon dioxide removal technologies in North America. This has been widening the scope for companies to adopt CDR technologies with ease compared to other regions. Further, the rising number of partnerships between the private sector, research institutions, and government organizations to come up with new ways & methods to enhance the performance of the region in terms of carbon footprint would support the Carbon Dioxide Removal market of North America in the ensuing years.

Global Carbon Dioxide Removal Industry Recent Developments

- 2023: Climeworks signed a 13-year agreement with Partners Group Holding, a private equity firm, to capture & store more than 7,000 metric tons of CO2 from the atmosphere on behalf of Partners Group. It is part of Partners Group's plan to become carbon neutral by 2030.

- 2023: Global Thermostat unveiled the largest direct air capture unit in the US with a capacity of capturing over 1,000 tons of carbon per year in Commerce City, Colorado.

Gain a Competitive Edge with Our Global Carbon Dioxide Removal Market Report

- Global Carbon Dioxide Removal Market Report by Markntel Advisors provides a detailed & thorough analysis of market size, growth rate, competitive landscape, and key players. This comprehensive analysis helps businesses gain a holistic understanding of the market dynamics & make informed decisions.

- This report also highlights current market trends & future projections, allowing businesses to identify emerging opportunities & potential challenges. By understanding market forecasts, companies can align their strategies & stay ahead of the competition.

- Global Carbon Dioxide Removal Market Report aids in assessing & mitigating risks associated with entering or operating in the market. By understanding market dynamics, regulatory frameworks, and potential challenges, businesses can develop strategies to minimize risks & optimize their operations.

Frequently Asked Questions

Global Carbon Dioxide Removal Market Research Report (2023-2028) - Table of Contents

- Market Segmentation

- Introduction

- Product Definition

- Research Process

- Assumptions

- Executive Summary

- Global Carbon Dioxide Emissions Overview, 2023

- Carbon Emissions

- By Region

- By Industries

- Power

- Industry

- Transport

- Buildings

- By Energy Source

- Oil

- Coal

- Natural Gas

- Methane

- Others

- Carbon Emissions

- By Regional Government Role

- Targets

- Initiatives

- Others

- Global Carbon Dioxide Capture & Storage (CCS) Overview, 2023

- Current Scenario

- Global Carbon Projects Pipeline, By Facilities

- Operating

- Under Construction

- Others

- Venture Capital Investments in CCU Start-Ups, By Sector

- Fuels & Chemicals

- Building Material

- Others

- Global Carbon Projects Pipeline, By Facilities

- Government Policies, By Region

- Future Scenario

- CO2 Carbon Capture Operating & Planned Facilities

- By Region

- By Application

- CO2 Carbon Capture Operating & Planned Facilities

- Others

- Current Scenario

- Global Carbon Dioxide Removal Market Trends & Insights

- Global Carbon Dioxide Removal Market Dynamics

- Drivers

- Challenges

- Global Carbon Dioxide Removal Market Hotspot & Opportunities

- Global Carbon Dioxide Removal Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Size & Analysis

- By Technology

- Direct Air Capture (DAC)- Market Size & Forecast 2018-2028, USD Million

- Biochar- Market Size & Forecast 2018-2028, USD Million

- Enhanced Mineralization- Market Size & Forecast 2018-2028, USD Million

- Ocean Alkalization- Market Size & Forecast 2018-2028, USD Million

- Others (Solid Sorbent, etc.)- Market Size & Forecast 2018-2028, USD Million

- By Application

- Industrial- Market Size & Forecast 2018-2028, USD Million

- Energy- Market Size & Forecast 2018-2028, USD Million

- Power Generation- Market Size & Forecast 2018-2028, USD Million

- Oil & Gas- Market Size & Forecast 2018-2028, USD Million

- Manufacturing- Market Size & Forecast 2018-2028, USD Million

- Heavy Industries (Steel, Cement, etc.)- Market Size & Forecast 2018-2028, USD Million

- Chemicals- Market Size & Forecast 2018-2028, USD Million

- Others (Food Processing, Pulp & Paper, etc.)- Market Size & Forecast 2018-2028, USD Million

- Others (Waste Management, Mining, etc.)- Market Size & Forecast 2018-2028, USD Million

- Energy- Market Size & Forecast 2018-2028, USD Million

- Transportation- Market Size & Forecast 2018-2028, USD Million

- Aviation- Market Size & Forecast 2018-2028, USD Million

- Shipping- Market Size & Forecast 2018-2028, USD Million

- Buildings & Infrastructure- Market Size & Forecast 2018-2028, USD Million

- Industrial- Market Size & Forecast 2018-2028, USD Million

- By Region

- North America

- Europe

- The Middle East & Africa

- Asia-Pacific

- By Competition

- Competition Characteristics

- Market Share of Top Companies

- By Technology

- Market Size & Analysis

- North America Carbon Dioxide Removal Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Technology- Market Size & Forecast 2018-2028, USD Million

- By Application- Market Size & Forecast 2018-2028, USD Million

- By Country

- The US

- Canada

- Mexico

- Market Size & Analysis

- South America Carbon Dioxide Removal Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Technology - Market Size & Forecast 2018-2028, USD Million

- By Application - Market Size & Forecast 2018-2028, USD Million

- By Country

- Brazil

- Argentina

- Rest of South America

- Market Size & Analysis

- Europe Carbon Dioxide Removal Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Technology - Market Size & Forecast 2018-2028, USD Million

- By Application - Market Size & Forecast 2018-2028, USD Million

- By Country

- The UK

- France

- Germany

- Italy

- Spain

- Nordic Countries

- Rest of Europe

- Market Size & Analysis

- The Middle East & Africa Carbon Dioxide Removal Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Product- Market Size & Forecast 2018-2028, USD Million

- By Application - Market Size & Forecast 2018-2028, USD Million

- By Country

- The UAE

- Saudi Arabia

- Egypt

- South Africa

- Rest of The Middle East & Africa

- Market Size & Analysis

- Asia-Pacific Carbon Dioxide Removal Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Product- Market Size & Forecast 2018-2028, USD Million

- By Application - Market Size & Forecast 2018-2028, USD Million

- By Country

- China

- India

- Japan

- Australia

- South Korea

- Rest of Asia Pacific

- Market Size & Analysis

- Competitive Outlook

- Company Profiles

- Climeworks AG

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Global Thermostat

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Carbon Engineering Ltd.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Arca

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Cella Mineral Storage Inc.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Bussme Energy AB

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Carbofex Ltd.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Oregon Biochar Solutions

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Wakefield BioChar

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Novocarbo GmbH

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Carbicrete

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Neustark Ag

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Ebb Carbon

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- CarbonCure Technologies Inc.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- CarbonFree

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Carbfix hf.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Blue Planet Systems

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Pacific Biochar Benefit Corporation

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- HEIMDAL

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Charm Industrial

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Climeworks AG

- Company Profiles

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making