Global Car Rental Market Research Report: Forecast (2025-2030)

By Booking Mode (Offline, Online), By Application (Leisure, Business), By Vehicle Type (Luxury, Economy Cars, Executive Cars, Sports Utility Vehicles [SUVs], Multi Utility Vehicles... [MUVs]), By Rental Category (Local, Airport, Outstation), By Driver Type (Self-Driving, Chauffeur), By Rental Duration (Short Term, Long Term), By Region (North America, South America, Europe, The Middle East & Africa, Asia-Pacific), By Company (Avis Budget Group, Sixt SE, Enterprise Holdings (Alamo), Hertz Corp., Europcar, Localiza, Carzonrent India Pvt. Ltd. (CIPL), ZoomCar, Inc., Dollar Rent a Car, Green Motion, Buchbinder, Others) Read more

- ICT & Electronics

- Oct 2024

- Pages 189

- Report Format: PDF, Excel, PPT

Market Definition

Car rental service provides rental cars, ranging from small economy cars to luxury cars, SUVs, and vans. The market bifurcates into airport rentals, leisure rentals, and business rentals. It’s a highly competitive market due to the presence of global brands & small regional players.

Market Insights & Analysis: Global Car Rental Market (2025-30)

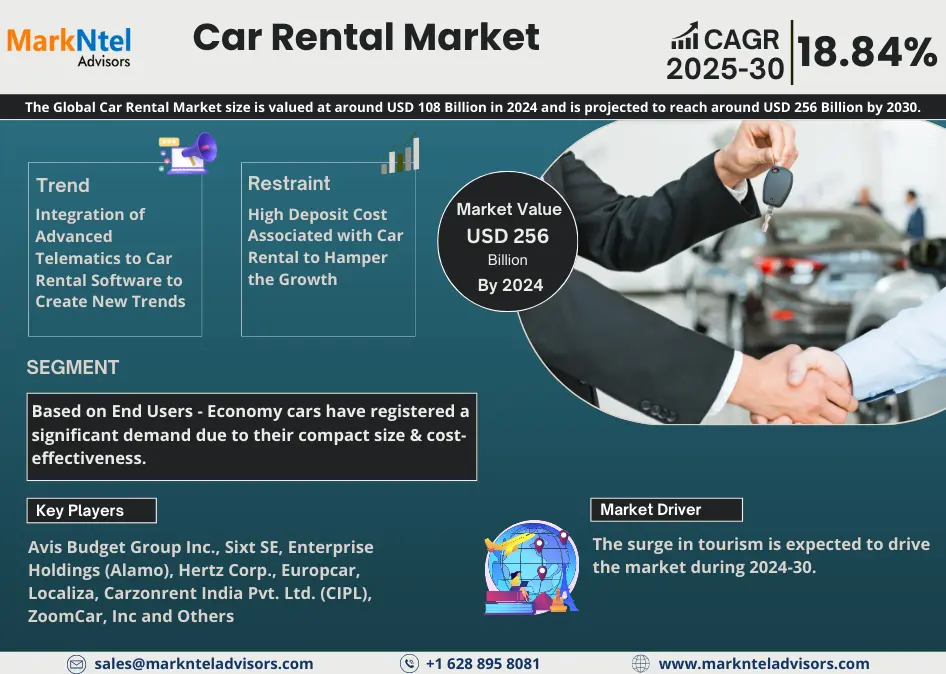

The Global Car Rental Market size is valued at around USD 108 Billion in 2024 and is projected to reach around USD 256 Billion by 2030. Along with this, the market is estimated to grow at a CAGR of around 18.84% during the forecast period i.e., 2025-30. Various factors, including the diversification of services, increasing urbanization, rising disposable income, ascending preference for on-demand transportation, and growth of tourism, have played a major role in the market growth & would continue to support the market expansion.

With the global upsurge in the price of vehicles, individuals are switching towards on-demand transportation, hence this has been complemented by surging internet penetration. As of 2022, there are approximately 4.95 billion internet-users & around 4.62 billion active internet-users across the globe.

| Report Coverage | Details |

|---|---|

| Historical Years | 2020-23 |

|

Base Years

|

2024

|

|

Forecast Years

|

2025-30

|

| Market Value in 2024 | USD 108 Billion |

| Market Value 2030 | USD 256 Billion |

| CAGR (2025-30) | 18.84% |

| Leading Region | North America |

| Top Key Players | Avis Budget Group Inc., Sixt SE, Enterprise Holdings (Alamo), Hertz Corp., Europcar, Localiza, Carzonrent India Pvt. Ltd. (CIPL), ZoomCar, Inc., Dollar Rent a Car, Green Motion, Buchbinder, etc |

| Key Report Highlights |

|

*Boost strategic growth with in-depth market analysis - Get a free sample preview today!

On-demand transportation services offer online booking & payment systems and similarly use social media for marketing & reaching out to potential customers, which supported the growth of on-demand transportation services. As more customers turned towards these services, individuals became more familiar with the idea of renting cars for a short duration of time, which supported the upscaling of the Car Rental market share.

Moreover, many car rental companies are now operating in partnership with ride-hailing services by providing vehicles that are helping them to boost the demand for their rental services & generate additional revenues. For instance, in 2023, Uber partnered with Hertz to offer 25,000 EV rentals to Uber drivers in Europe. The partnership between them is expected to grow as both are types of companies that want to stay competitive in the rapidly evolving transporting industry, which subsequently would support the market growth during the forecast period.

Global Car Rental Market Key Drivers:

Expansion of Global Tourism to Augment the Market Growth - Tourism is a rapidly growing industry, especially in countries like China, the UAE, France, etc., and this has been a major driver for the Car Rental market across the globe. According to World Travel and Tourism Council, the growth rate of the global travel & tourism sector outpaced the growth of the global economy for nine consecutive years prior to the COVID-19 pandemic. During the pandemic, the industry witnessed a downfall of 50.4%, and later on, it recovered by 21.7% in 2021. As more individuals travel globally, they seek convenient means of transportation, owing to which they opt for these services.

Moreover, many countries, like Saudi Arabia, Qatar, Thailand, Singapore, etc., are implementing plans to boost their sector. For instance,

- In 2022, Saudi’s Ministry of Tourism launched 10 new regulations to develop the tourism sector. The regulation covers tourism hospitality facilities, traveling & tourism services, tourist guides, tourism hospitality facilities management, tourism consultancy, private tourist hospitality facility, etc.

Consequently, the plans by different countries to boost tourism are leading to enhanced investment in theme parks, new hotels, resorts, etc., & as the number of tourists surges, there would be an increase in car rental demand to explore these places, which would aid in enhancing the Car Rental market share during the forecast period.

Global Car Rental Market Possible Restraint:

High Deposit Cost Associated with Car Rental to Hamper the Growth - Car rental companies often take a huge amount of deposit from the customers, which discourages some customers from renting cars. All rental car companies have different deposit charges. However, on average, in the US, around USD200 to USD500 is charged as a deposit fee by car rental companies. For instance, as of 2022, Hertz charges a minimum deposit fee of about USD200 for credit cards & USD500 if using a debit card, and similarly, Fox requires a deposit of between USD150 to USD400 when renting a vehicle with them.

Along with this, there have been many instances where customers lost deposit money due to factors like failure to return the car on time, additional charges, failure to pick up a car on time, etc. For instance, in 2023, in the US, a 54 years old individual lost his rental car reservation & around USD249 advanced fee to hold the vehicle due to delayed flight arrival at Orlando Airport. Hence, these factors are boosting the popularity of ride-hailing services as an alternative to traditional car renting services, therefore negatively affecting the market growth.

Global Car Rental Market Growth Opportunities

Declining Private Car Ownership in Some European Countries to Open New Doors for the Market Players - In countries such as Sweden, the Netherlands, and part of the UK, private car ownership is declining, especially in urban areas & this is presenting a multifaceted opportunity for the market players. According to KiM Netherlands Institute for Transport Policy Analysis, private car ownership per resident in highly urbanized areas declined in the past decade, but there was a surge in car ownership in the more rural areas of the Netherlands. Meanwhile, rates of car ownership in London are significantly lower than in the rest of the UK, which is approximately 0.74 cars per household as of 2022.

Moreover, these countries are focusing to reduce carbon emissions & reach net zero between 2030 and 2040. Owing to this, they are substantially promoting ride-sharing platforms, e-scooter services, and 4-wheeler leasing services. However, this trend is not uniform across Europe, but in countries where private car ownership is declining, it would offer an opportunity for the market players to expand their wings.

Global Car Rental Market Key Trends:

Integration of Advanced Telematics to Car Rental Software to Create New Trends - Currently, car rental companies are increasingly integrating telematics to gain insights into fleet performance, driver behavior, and maintenance needs. For instance, in 2021, RentalMatics announced an integration with TSD Mobility Solutions’ car rental software system. The use of telematics is also helping rental companies to improve their customer's experience as it provides real-time information about estimated arrival time & vehicle location.

Along with this, advanced telematics helps rental companies by alerting the potential risks of thefts, accidents, and unauthorized use. Owing to this, the integration of advanced telematics is expected to continue to be a prominent factor in influencing market growth in the future.

Global Car Rental Market (2025-30): Segmentation Analysis

Global Car Rental Market report by Markntel Advisors includes segmentation analysis based on Vehicle Type, and Booking Mode. This breakdown allows businesses to identify specific market segments and tailor their marketing and product strategies accordingly, maximizing their chances of success in the Car Rental Market.

Based on Vehicle Type:

- Luxury

- Economy Cars

- Executive Cars

- Sports Utility Vehicles (SUVs)

- Multi Utility Vehicles (MUVs)

Economy cars have registered a significant demand due to their compact size & cost-effectiveness. Customers usually prefer these cars for airport & intracity rides, especially in Europe & Asia-Pacific. Furthermore, they are the cheapest option available in the rental fleet line-up & have better mileage which customers who rent care for long journeys prefer them. Owing to these factors, the preference for these cars is anticipated to witness a continuous surge during the forecast period.

Based on Booking Mode:

- Online

- Offline

Rental car booking through Online mode was considerably high across the globe due to factors such as convenience, flexibility, and time-saving. While booking rental cars online, customers get a wide range of options & discounts, in comparison to in-person booking, and along with this, it helps consumers to secure last-minute reservations even during peak hours. As of 2021, approximately 329 million people in North America, i.e., almost 84% of the population, have subscribed to mobile services & along with this, the internet penetration in the region is also substantially high, which supported the market growth.

Furthermore, internet penetration in the region is continuously enhancing due to various government initiatives. For instance, the Government of Canada is connecting around 98% of Canadians to high-speed Internet by 2026 & nearly 100% of Canadians by 2030. These initiates would accelerate the booking through online mode in the region, hence contributing to the market growth in the following years.

Global Car Rental Market Regional Projection

Geographically, the market expands across:

- North America

- South America

- Europe

- The Middle East & Africa

- Asia-Pacific

North America is home to three major economies, the US, Mexico, and Canada, which have a huge number of business establishments, owing to which several domestic business trips are witnessed to be very high within the countries for purposes like client meetings, conferences, etc. The companies & executives both find rental cars, the most cost-effective way for traveling.

Along with this, rental car service providers like Avis Budget Group, Enterprise rent-a-car, etc., have established a wide rental network, making it easier for consumers to rent & return cars, hence supporting the market growth. Additionally, growing environmental concerns among business establishments in the country are further enhancing the demand for electric rental cars, which would further elevate the market growth in the region during the forecast period.

Global Car Rental Industry Recent Developments

- 2022: Hertz, along with private equity firm, Certares, participated in UFODrive's Series A funding round in February 2022, which raised around USD19 million. With this investment, Hertz aims to leverage UFODrive's digital rental & fleet management technology to manage its electric car fleet on a global scale.

Gain a Competitive Edge with Our Global Car Rental Market Report

- Global Car Rental Market report provides a detailed and thorough analysis of market size & share, growth rate, competitive landscape, and key players. This comprehensive analysis helps businesses gain a holistic understanding of the market dynamics and make informed decisions.

- This report also highlights current market trends and future projections, allowing businesses to identify emerging opportunities and potential challenges. By understanding market forecasts, companies can align their strategies and stay ahead of the competition.

- Global Car Rental Market report aids in assessing and mitigating risks associated with entering or operating in the market.

- The report would help in understanding market dynamics, regulatory frameworks, and potential challenges, businesses can develop strategies to minimize risks and optimize their operations.

*Reports Delivery Format - Market research studies from MarkNtel Advisors are offered in PDF, Excel and PowerPoint formats. Within 24 hours of the payment being successfully received, the report will be sent to your email address.

Frequently Asked Questions

- Market Segmentation

- Introduction

- Product Definition

- Research Process

- Assumptions

- Executive Summary

- Evolution of Global Ride Hailing Services Industry

- Global Car Rental Market Trends & Insights

- Global Car Rental Market Dynamics

- Growth Drivers

- Challenges

- Global Car Rental Market Hotspot & Opportunities

- Global Car Rental Market Policies & Regulations

- Global Car Rental Market Key Statistics

- Average Spending Per Transaction, 2020-2030

- Average Utilization Rate 2020-2022

- Brand Wise Utilization Rates 2020-2022

- Global Car Rental Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenue (USD Million)

- Transaction Volume (Million)

- Market Share & Analysis

- By Booking Mode

- Offline

- Online

- By Application

- Leisure

- Business

- By Vehicle Type

- Luxury

- Economy Cars

- Executive Cars

- Sports Utility Vehicles (SUVs)

- Multi Utility Vehicles (MUVs)

- By Rental Category

- Local

- Airport

- Outstation

- By Driver Type

- Self-Driving

- Chauffeur

- By Rental Duration

- Short Term

- Long Term

- By Region

- North America

- South America

- Europe

- The Middle East & Africa

- Asia-Pacific

- By Competitors

- Competition Characteristics

- Market Share & Analysis

- By Revenues

- By Fleet Size

- By Largest Brands

- By Booking Mode

- Market Size & Analysis

- North America Car Rental Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenue (USD Million)

- Transaction Volume (Million)

- Market Share & Analysis

- By Booking Mode

- By Application

- By Vehicle Type

- By Rental Category

- By Driver Type

- By Rental Length

- By Competition

- By Country

- The US

- Canada

- Mexico

- The US Car Rental Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenue (USD Million)

- Transaction Volume (Million)

- Market Share & Analysis

- By Rental Type

- By Rental Category

- By Competition

- Market Size & Analysis

- Canada Car Rental Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenue (USD Million)

- Transaction Volume (Million)

- Market Share & Analysis

- By Vehicle Type

- By Rental Category

- Market Size & Analysis

- Mexico Car Rental Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenue (USD Million)

- Transaction Volume (Million)

- Market Share & Analysis

- By Vehicle Type

- By Rental Category

- Market Size & Analysis

- Market Size & Analysis

- South America Car Rental Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenue (USD Million)

- Transaction Volume (Million)

- Market Share & Analysis

- By Booking Mode

- By Application

- By Vehicle Type

- By Rental Category

- By Driver Type

- By Rental Length

- By Competition

- By Country

- Brazil

- Rest of South America

- Brazil Car Rental Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenue (USD Million)

- Transaction Volume (Million)

- Market Share & Analysis

- By Vehicle Type

- By Rental Category

- By Competition

- Market Size & Analysis

- Market Size & Analysis

- Europe Car Rental Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenue (USD Million)

- Transaction Volume (Million)

- Market Share & Analysis

- By Booking Mode

- By Application

- By Vehicle Type

- By Rental Category

- By Driver Type

- By Rental Length

- By Competition

- By Country

- The UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

- The UK Car Rental Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenue (USD Million)

- Transaction Volume (Million)

- Market Share & Analysis

- By Vehicle Type

- By Rental Category

- By Competition

- Market Size & Analysis

- Germany Car Rental Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenue (USD Million)

- Transaction Volume (Million)

- Market Share & Analysis

- By Vehicle Type

- By Rental Category

- By Competition

- Market Size & Analysis

- France Car Rental Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenue (USD Million)

- Transaction Volume (Million)

- Market Share & Analysis

- By Rental Type

- By Rental Category

- By Competition

- Market Size & Analysis

- Italy Car Rental Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenue (USD Million)

- Transaction Volume (Million)

- Market Share & Analysis

- By Vehicle Type

- By Rental Category

- Market Size & Analysis

- Spain Car Rental Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenue (USD Million)

- Transaction Volume (Million)

- Market Share & Analysis

- By Rental Type

- By Rental Category

- By Competition

- Market Size & Analysis

- Market Size & Analysis

- The Middle East & Africa Car Rental Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenue (USD Million)

- Transaction Volume (Million)

- Market Share & Analysis

- By Booking Mode

- By Application

- By Vehicle Type

- By Rental Category

- By Driver Type

- By Rental Length

- By Country

- GCC

- South Africa

- Rest of Middle East & Africa

- GCC Car Rental Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenue (USD Million)

- Transaction Volume (Million)

- Market Share & Analysis

- By Vehicle Type

- By Rental Category

- By Rental Category

- Market Size & Analysis

- South Africa Car Rental Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenue (USD Million)

- Transaction Volume (Million)

- Market Share & Analysis

- By Vehicle Type

- By Rental Category

- Market Size & Analysis

- Market Size & Analysis

- Asia-Pacific Car Rental Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenue (USD Million)

- Transaction Volume (Million)

- Market Share & Analysis

- By Booking Mode

- By Application

- By Vehicle Type

- By Rental Category

- By Driver Type

- By Rental Length

- By Competition

- By Country

- China

- Japan

- South Korea

- India

- Rest of Asia Pacific

- China Car Rental Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenue (USD Million)

- Transaction Volume (Million)

- Market Share & Analysis

- By Vehicle Type

- By Rental Category

- By Competition

- Market Size & Analysis

- Japan Car Rental Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenue (USD Million)

- Transaction Volume (Million)

- Market Share & Analysis

- By Vehicle Type

- By Rental Category

- By Competition

- Market Size & Analysis

- South Korea Car Rental Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenue (USD Million)

- Transaction Volume (Million)

- Market Share & Analysis

- By Rental Type

- By Rental Category

- By Competition

- Market Size & Analysis

- India Car Rental Market Outlook, 2020-2030F

- Market Size & Analysis

- By Revenue (USD Million)

- Transaction Volume (Million)

- Market Share & Analysis

- By Vehicle Type

- By Rental Category

- By Competition

- Market Size & Analysis

- Market Size & Analysis

- Global Car Rental Market Key Strategic Imperatives for Success & Growth

- Competition Outlook

- Competition Matrix

- Target Markets

- Research & Development

- Collaborations & Strategic Alliances

- Key Business Expansion Initiatives

- Business Restructuring- Mergers, Acquisitions, JVs

- Strategic Initiatives

- Company Profiles (Business Description, Product Segments, Business Segments, Financials, Strategic Alliances/ Partnerships, Future Plans)

- Avis Budget Group

- Sixt SE

- Enterprise Holdings (Alamo)

- Hertz Corp.

- Europcar

- Localiza

- Carzonrent India Pvt. Ltd. (CIPL)

- ZoomCar, Inc.

- Dollar Rent a Car

- Green Motion

- Buchbinder

- Others

- Competition Matrix

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making