Global Aircraft Digital Cockpit Market Research Report: Forecast (2022-27)

By Aircraft Type (Commercial Aircraft, Military Aircraft), By Display Type (Primary Flight Display, Engine-Indicating and Crew-Alerting System (EICAS) Display, Multi-Function Displ...ay, Others (Mission Display)), By Display Size (Less than 5 Inches, 5-10 Inches, Greater than 10 Inches), By Region (North America, South America, Europe, Middle East & Africa, Asia-Pacific) By Company ((Astronautics Corporation of America, Elbit Systems Ltd, TransDigm Group Inc., Honeywell International Inc., Garmin Ltd, Collins Aerospace (United Technologies Corporation), Thales Group, Safran SA, Leonardo S.P.A., L3Harris Technologies Inc.)) Read more

- Aerospace & Defense

- Apr 2022

- Pages 195

- Report Format: PDF, Excel, PPT

Market Definition

Digital cockpit systems are also known as Electronic Flight Information Systems (EFIS) or Cockpit Display Systems (CDS). These systems consist of LCD screens that display information associated with the various flight aspects required by pilots. With constant developments in cockpit technology, these systems are gaining immense popularity across the aviation sector. Additionally, the introduction of new generations of digital cockpits that provide a plethora of information in just a few clicks is anticipated to present profitable opportunities to the industry in the coming years.

Market Insights

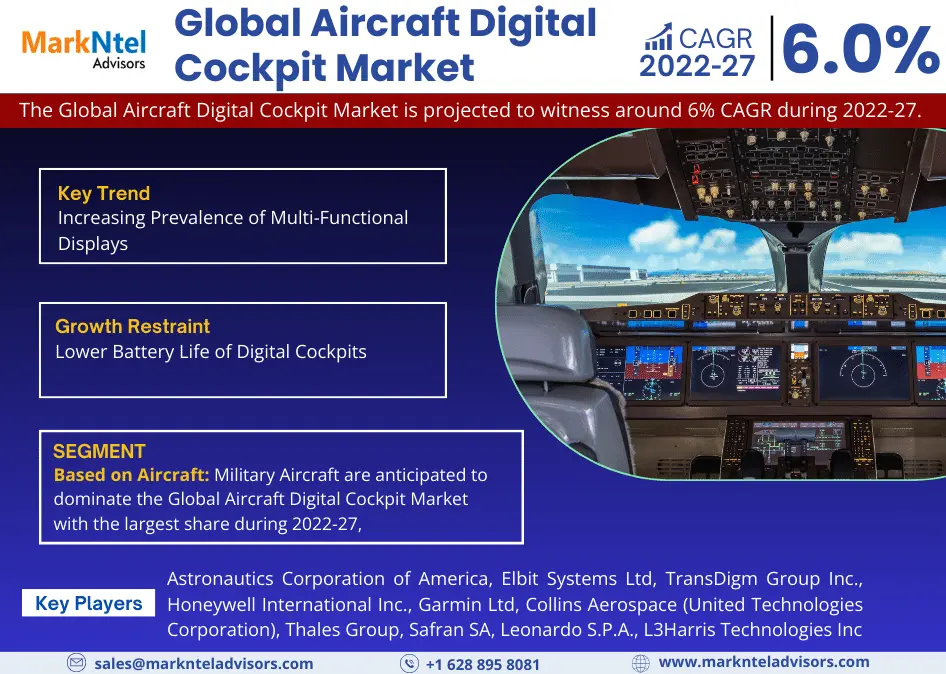

The Global Aircraft Digital Cockpit Market is projected to witness around 6% CAGR during the forecast period, i.e., 2022-27. The growth of the market is likely to be driven primarily by the mounting demand for digital cockpits to simplify different operations & navigations of an aircraft for the pilots & allow them to focus only on the relevant information. This escalating requirement for the digital cockpit in aircraft for accuracy, enhanced safety, situational awareness, & automation for the pilots, among others, is driving the global market.

| Report Coverage | Details |

|---|---|

| Study Period | Historical Data: 2017-20 |

| Base Year: 2021 | |

| Forecast Period: 2022-27 | |

| CAGR(2022-2027) | 6% |

| Regions Covered | North America: The US, Canada, Mexico |

| Europe: Germany, The UK, France, Russia | |

| Asia-Pacific: China, Japan, India, South Korea | |

| South America: Brazil, Argentina | |

| Middle East & Africa: UAE, Saudi Arabia, South Africa | |

| Key Companies Profiled |

Astronautics Corporation of America, Elbit Systems Ltd, TransDigm Group Inc., Honeywell International Inc., Garmin Ltd, Collins Aerospace (United Technologies Corporation), Thales Group, Safran SA, Leonardo S.P.A., L3Harris Technologies Inc. |

| Unit Denominations | USD Million/Billion |

Besides, the aviation industry seeks lightweight aircraft with fewer components. Consequently, this augments the demand for multi-functional displays that can show information about the different areas of the aircraft instead of requiring individual systems, which is another crucial aspect generating lucrative growth opportunities for the leading players in the market.

Moreover, military aircraft are amongst the largest consumers of digital cockpits since they eliminate the need for a flight engineer & reduce costs. Furthermore, an increasing inclination of different countries worldwide toward the procurement & modernization of military aircraft with advanced systems shall further fuel the demand for digital cockpits & drive the global market in the coming years

Key Trend in the Global Aircraft Digital Cockpit Market

- Increasing Prevalence of Multi-Functional Displays

With the mounting need for building lightweight aircraft & integrating them with multiple features, there's increasing adoption of multi-functional displays to enhance the overall video & imaging from external sources like sensors, processors, cameras, etc. It, in turn, is likely to stimulate the demand for digital cockpit technology & generate significant opportunities for its leading manufacturers.

Impact of Covid-19 on the Global Aircraft Digital Cockpit Market

The Covid-19 pandemic in 2020 had a decelerating impact on most industries worldwide, where the aviation sector witnessed catastrophic effects. The Global Aircraft Digital Cockpit Market was no exception and observed several unprecedented challenges amidst the crisis since governments of different countries imposed stringent movement limitations, travel bans, & lockdowns to curb the spread of this dreadful disease.

As a result, challenges like supply chain disruptions, delayed deliveries of pre-produced goods, reduced demand for digital cockpits, reduced expenditure on aviation, etc., further generated demand-supply gap and resulted in massive financial loss to the leading market players.

However, since 2021, there's been a gradual decline in the number of Covis-19 patients. The governments have uplifted the restrictions & allowed the recommencement of business operations. It has resumed the expenditure on the aviation sector, i.e., generating growth opportunities for the leading players to deploy technologically advanced cockpits.

Market Segmentation

Based on Aircraft:

- Commercial Aircraft

- Military Aircraft

Of both, Military Aircraft are anticipated to dominate the Global Aircraft Digital Cockpit Market with the largest share during 2022-27, primarily due to massive expenditure on the defense sector by governments of different countries worldwide. It, in turn, is augmenting the demand for technologically advanced systems & features like Digital Cockpits in their aircraft to attain an abundance of relevant information for pilots.

Additionally, aircraft like military helicopters have the most high-tech machines and are increasingly deploying digital cockpits to enhance their effectiveness. Besides, the growing integration of multi-functional features to improve video & imaging options in cockpits from resources like external display processors & video sensors, including FLIR, radar, weapons, cameras, etc., are further augmenting the market growth. For instance:

- In July 2021, Russia officially launched its latest Checkmate Fighter deployed with large & several small color multi-functional displays & a standard head-up display in the cockpit. The first flight is projected to take off in 2023, with series production in 2026.

Based on Display Type:

- Primary Flight Display

- Engine-Indicating and Crew-Alerting System (EICAS) Display

- Multi-Function Display

Here, the Primary Flight Display is anticipated to observe the fastest market growth during the forecast period. It owes principally to the growing inclination toward integrating primary display systems into cockpits due to their capabilities of bringing relevant flight-related information like the altitude, speed, & turn coordinator, among others.

Additionally, they are used for combining instrument readings from six-pack gauges at one display instead of having to monitor them individually. Besides, advantages like virtually displaying all kinds of information to the pilot are further soaring their demand and, in turn, positively influencing the overall market growth.

Regional Landscape

Geographically, the Global Aircraft Digital Cockpit Market expands across:

- North America

- South America

- Europe

- Middle East & Africa

- Asia-Pacific

Of all regions globally, North America is anticipated to dominate the market with the largest share during 2022-27. North America is an early adopter of technologically advanced systems in commercial & military aviation sectors, i.e., stimulating the demand for digital cockpits in aircraft. In addition, the massive focus of countries like the US & Canada on strengthening their national security & deploying digitally upgraded systems like a digital cockpit for better insights into the aircraft & situation awareness to pilots is also driving the regional market.

Across the region, the US is expected to generate significant growth opportunities for the leading market players owing to its massive financial capabilities & increasing procurement of military aircraft like new generation fighters, critical mission aircraft, & helicopters, among others, integrated with digital cockpits.

On the other hand, Asia-Pacific is projected to display the fastest market growth & emerge as an area of remunerative opportunities for the leading players through 2026. It owes principally to the massive air passenger traffic in the region, coupled with the rapidly expanding commercial aviation sector. It is leading to the increasing production of aircraft to suffice the burgeoning traffic requirements and, in turn, escalating the deployment of digital cockpits.

Market Dynamics:

Key Driver & Opportunity: Growing Inclination of Aerospace & Defense Sector toward Digital Cockpits & Rising Commercial Aircraft Production

With exponentially rising air traffic globally, border security threats are increasing swiftly. Hence, the governments of different countries are actively participating in procuring technologically advanced systems in their defense aircraft to strengthen their border security. Additionally, the rapidly increasing number of air passengers is stimulating the production of commercial aircraft & fueling the demand for technologically advanced Digital Cockpits. Asia-Pacific is anticipated to generate a plethora of growth opportunities for the leading players in the global market, owing to the massive air passenger in the region, i.e., driving the production of commercial aircraft and positively influencing the demand for Digital Cockpits.

Growth Restraint: Lower Battery Life of Digital Cockpits

The low battery life of digital cockpits is the prominent aspect that might act as a growth restraint for the Global Aircraft Digital Cockpit Market in the coming years. Since lower battery life would give pilots less time to address problems during an emergency, it would be challenging for them to switch to an analog system as a backup, especially if they aren't trained for those systems.

Key Questions Answered in the Market Research Report:

- What are the overall statistics or estimates (Overview, Size- By Value, Forecast Numbers, Segmentation, Shares) of the Global Aircraft Digital Cockpit Market?

- What are the region-wise industry size, growth drivers, and challenges?

- What are the key innovations, opportunities, current & future trends, and regulations in the Global Aircraft Digital Cockpit Market?

- Who are the key competitors, their key strengths & weaknesses, and how do they perform in the Global Aircraft Digital Cockpit Market based on the competitive benchmarking matrix?

- What are the key results derived from surveys conducted during the Global Aircraft Digital Cockpit Market study?

Frequently Asked Questions

- Introduction

- Product Definition

- Research Process

- Assumptions

- Market Segmentation

- Preface

- Executive Summary

- Impact of COVID-19 on Global Aircraft Digital Cockpit Market

- Global Aircraft Digital Cockpit Market Government Regulations and Policies

- Global Aircraft Digital Cockpit Market Trends & Insights

- Global Aircraft Digital Cockpit Market Dynamics

- Growth Drivers

- Challenges

- Global Aircraft Digital Cockpit Market Hotspot & Opportunities

- Global Aircraft Digital Cockpit Market Outlook, 2017-2027

- Market Size & Analysis

- Market Revenues

- Market Share & Analysis

- By Aircraft Type

- Commercial Aircraft

- Military Aircraft

- By Display Type

- Primary Flight Display

- Engine-Indicating and Crew-Alerting System (EICAS) Display

- Multi-Function Display

- Others (Mission Display)

- By Display Size

- Less than 5 Inches

- 5-10 Inches

- Greater than 10 Inches

- By Region

- North America

- South America

- Europe

- Middle East & Africa

- Asia-Pacific

- By Competitors

- Competition Characteristics

- Market Share & Analysis

- Competitive Metrix

- By Aircraft Type

- Market Size & Analysis

- North America Aircraft Digital Cockpit Market Outlook, 2017-2027

- Market Size & Analysis

- Market Revenues

- Market Share & Analysis

- By Aircraft Type

- By Display Type

- By Display Size

- By Country

- The US

- Canada

- Mexico

- The US Aircraft Digital Cockpit Market Outlook, 2017-2027

- Market Size & Analysis

- Market Revenues

- Market Share & Analysis

- By Aircraft Type

- By Display Type

- Market Size & Analysis

- Canada Aircraft Digital Cockpit Market Outlook, 2017-2027

- Market Size & Analysis

- Market Revenues

- Market Share & Analysis

- By Aircraft Type

- By Display Type

- Market Size & Analysis

- Mexico Aircraft Digital Cockpit Market Outlook, 2017-2027

- Market Size & Analysis

- Market Revenues

- Market Share & Analysis

- By Aircraft Type

- By Display Type

- Market Size & Analysis

- Market Size & Analysis

- South America Aircraft Digital Cockpit Market Outlook, 2017-2027

- Market Size & Analysis

- Market Revenues

- Market Share & Analysis

- By Aircraft Type

- By Display Type

- By Display Size

- By Country

- Brazil

- Argentina

- Others

- Brazil Aircraft Digital Cockpit Market Outlook, 2017-2027

- Market Size & Analysis

- Market Revenues

- Market Share & Analysis

- By Aircraft Type

- By Display Type

- Market Size & Analysis

- Argentina Aircraft Digital Cockpit Market Outlook, 2017-2027

- Market Size & Analysis

- Market Revenues

- Market Share & Analysis

- By Aircraft Type

- By Display Type

- Market Size & Analysis

- Market Size & Analysis

- Europe Aircraft Digital Cockpit Market Outlook, 2017-2027

- Market Size & Analysis

- Market Revenues

- Market Share & Analysis

- By Aircraft Type

- By Display Type

- By Display Size

- By Country

- Germany

- The UK

- France

- Russia

- Others

- Germany Aircraft Digital Cockpit Market Outlook, 2017-2027

- Market Size & Analysis

- Market Revenues

- Market Share & Analysis

- By Aircraft Type

- By Display Type

- Market Size & Analysis

- The UK Aircraft Digital Cockpit Market Outlook, 2017-2027

- Market Size & Analysis

- Market Revenues

- Market Share & Analysis

- By Aircraft Type

- By Display Type

- Market Size & Analysis

- France Aircraft Digital Cockpit Market Outlook, 2017-2027

- Market Size & Analysis

- Market Revenues

- Market Share & Analysis

- By Aircraft Type

- By Display Type

- Market Size & Analysis

- Russia Aircraft Digital Cockpit Market Outlook, 2017-2027

- Market Size & Analysis

- Market Revenues

- Market Share & Analysis

- By Aircraft Type

- By Display Type

- Market Size & Analysis

- Market Size & Analysis

- Middle East & Africa Aircraft Digital Cockpit Market Outlook, 2017-2027

- Market Size & Analysis

- Market Revenues

- Market Share & Analysis

- By Aircraft Type

- By Display Type

- By Display Size

- By Country

- UAE

- Saudi Arabia

- South Africa

- Others

- UAE Aircraft Digital Cockpit Market Outlook, 2017-2027

- Market Size & Analysis

- Market Revenues

- Market Share & Analysis

- By Aircraft Type

- By Display Type

- Market Size & Analysis

- Saudi Arabia Aircraft Digital Cockpit Market Outlook, 2017-2027

- Market Size & Analysis

- Market Revenues

- Market Share & Analysis

- By Aircraft Type

- By Display Type

- Market Size & Analysis

- South Africa Aircraft Digital Cockpit Market Outlook, 2017-2027

- Market Size & Analysis

- Market Revenues

- Market Share & Analysis

- By Aircraft Type

- By Display Type

- Market Size & Analysis

- Market Size & Analysis

- Asia-Pacific Aircraft Digital Cockpit Market Outlook, 2017-2027

- Market Size & Analysis

- Market Revenues

- Market Share & Analysis

- By Aircraft Type

- By Display Type

- By Display Size

- By Country

- China

- India

- Japan

- South Korea

- Others

- China Aircraft Digital Cockpit Market Outlook, 2017-2027

- Market Size & Analysis

- Market Revenues

- Market Share & Analysis

- By Aircraft Type

- By Display Type

- Market Size & Analysis

- India Aircraft Digital Cockpit Market Outlook, 2017-2027

- Market Size & Analysis

- Market Revenues

- Market Share & Analysis

- By Aircraft Type

- By Display Type

- Market Size & Analysis

- Japan Aircraft Digital Cockpit Market Outlook, 2017-2027

- Market Size & Analysis

- Market Revenues

- Market Share & Analysis

- By Aircraft Type

- By Display Type

- Market Size & Analysis

- South Korea Aircraft Digital Cockpit Market Outlook, 2017-2027

- Market Size & Analysis

- Market Revenues

- Market Share & Analysis

- By Aircraft Type

- By Display Type

- Market Size & Analysis

- Market Size & Analysis

- Global Aircraft Digital Cockpit Market Key Strategic Imperatives for Success & Growth

- Competition Outlook (Whichever Applicable)

- Competition Matrix

- Target Markets

- Research & Development

- Collaborations & Strategic Alliances

- Key Business Expansion Initiatives

- Business Restructuring- Mergers, Acquisitions, JVs

- Strategic Initiatives

- Company Profiles (Business Description, Product Segments, Business Segments, Financials, Strategic Alliances/ Partnerships, Future Plans)

- Astronautics Corporation of America

- Elbit Systems Ltd

- TransDigm Group Inc.

- Honeywell International Inc.

- Garmin Ltd

- Collins Aerospace (United Technologies Corporation)

- Thales Group

- Safran SA

- Leonardo S.P.A.

- L3Harris Technologies Inc.

- Competition Matrix

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making