Africa Air Conditioner Market Research Report: Forecast (2024-2030)

Africa Air Conditioner Market- By Product Type (Window, Split, Floor Standing, Cassette, Packaged, Ducted Split, Condensing units/VRF, Chillers, AHU/FCU), By End-User (Residential,... Commercial) and others Read more

- Environment

- Apr 2023

- Pages 178

- Report Format: PDF, Excel, PPT

Market Definition

An air conditioner is a central heating and cooling system that cools a space by eliminating heat and controlling the temperature & humidity of the air within that space.

Market Insights & Analysis: Africa Air Conditioner Market (2024-30)

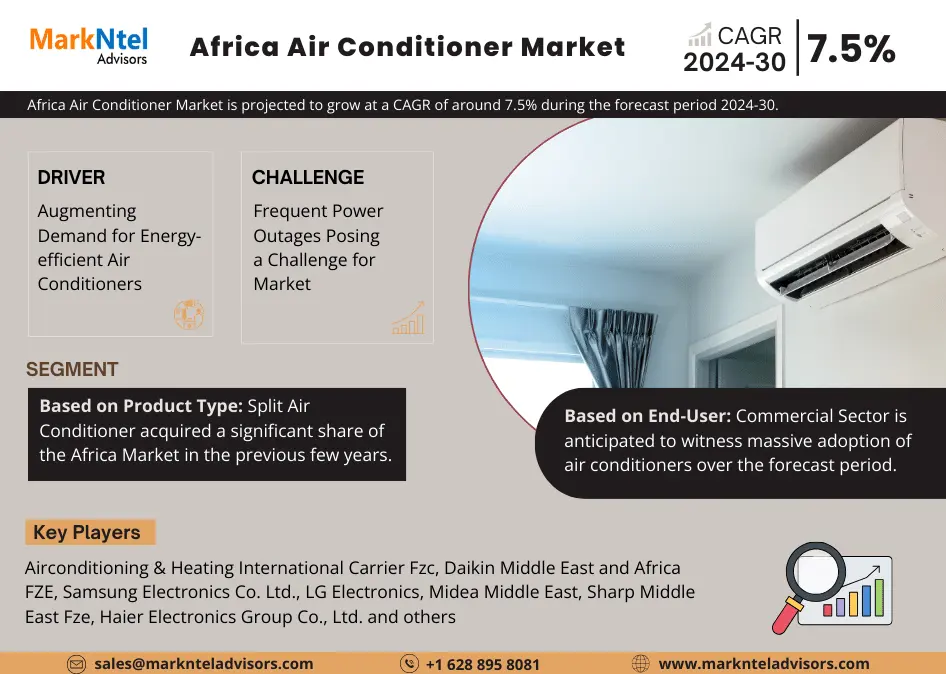

The Africa Air Conditioner Market is projected to grow at a CAGR of around 7.5% during the forecast period, i.e., 2024-30. The market is driven by the rapidly growing home ownership across the continent, particularly in established nations like South Africa, Kenya, and Nigeria. Further, climate change, a growing market trend for better lifestyles, and advancements in the power grid system are other factors that could aid the Africa Air Conditioner market in gaining traction. In fact, as per the International Energy Agency, the electricity demand for ACs is likely to jump 10-fold across Africa by 2040, clearly hinting at their upward graph in the coming years.

However, they witnessed a significant decline in their demand due to the worldwide lockdown imposition, thereby interrupting production & sales due to the closure of manufacturing & disruptions in the income cycle of consumers. But, after the upliftment of the lockdown, the market has revived & is flourishing at a fast pace. Furthermore, in the subsequent years, as consumer disposable income rises & household ownership of electronic equipment rises, there will be a greater need for air conditioners throughout Africa, opening up a wide range of opportunities for the market for these products to expand.

| Report Coverage | Details |

|---|---|

| Study Period | Historical Data: 2019-22 |

| Base Year: 2023 | |

| Forecast Period: 2024-30 | |

| CAGR (2024-2030) | 7.5% |

| Country Covered | South Africa, Nigeria, Kenya, Algeria, Morocco, and Others |

| Key Companies Profiled | Airconditioning & Heating International Carrier Fzc, Daikin Middle East and Africa FZE, Samsung Electronics Co. Ltd., LG Electronics, Midea Middle East, Sharp Middle East Fze, Haier Electronics Group Co., Ltd., Dunham-Bush International (Africa) (PTY) Ltd, Trane Inc., Gree Electric Appliances, Inc. Of Zhuhai, etc. |

| Unit Denominations | USD Million/Billion |

For instance, in 2018, Daikin, the top producer of heating, cooling, and refrigerant products worldwide, announced the release of GTKL-TV1, the first wall-mounted inverter split unit created specifically for the African market. With this new introduction, Daikin made a significant advancement in its commitment to creating environmentally friendly goods for global markets. In addition, the new range uses R-32, an alternative refrigerant with no potential to deplete the ozone layer compared to the previously used R-22 and less potential to cause global warming than R-410A.

Africa Air Conditioner Market Driver:

Augmenting Demand for Energy-efficient Air Conditioners - The need for environment-friendly & energy-efficient products is increasing in a bid to reduce the energy footprint created by air conditioners & electricity consumption. Similarly, to curb greenhouse gas emissions by 40 million tons by 2040, strict air conditioning efficiency standards are being adopted by African countries. Thus, investing in sustainable & energy-efficient conditioners would benefit the market players, thus influencing the market size in the forecast years.

Africa Air Conditioner Market Possible Restraint:

Frequent Power Outages Posing a Challenge - Since African countries are still evolving in terms of advancements, frequent power outages have been a major concern for the residents, who are compelled to withdraw from adopting air conditioners. Although the government has taken numerous initiatives to ensure an uninterrupted power supply, it might take time to achieve such targets. Thus, for the market for electrical products to grow more quickly in Africa, there are still several obstacles to be solved in terms of grid connectivity and electricity production.

Africa Air Conditioner Market Growth Opportunity:

Proliferating Hospitality Industry Across African Countries - The Hospitality sector is projected to expand in African countries by garnering attention from international hospitality brands such as Hyatt, Radisson, and Marriott, raising consumers' interest. This expansion would quicken the sales of ACs, citing Africa's warm climate. In addition, it would aid in expanding the air conditioner supply by generating additional demand for VRF and chillers to support their infrastructural needs. According to the study, the investments made in Africa to build the nation and infrastructure also increase the disposable income of many people, resulting in the continued growth of the industry across the region.

Africa Air Conditioner Market (2024-30): Segmentation Analysis

The Africa Air Conditioner Market study of MarkNtel Advisors evaluates & highlights the major trends & influencing factors in each segment & includes predictions for the period 2024–2030 at the global, regional, and national levels. Based on the analysis, the market has been further classified as:

Based on Product Type,

- Window, Split

- Floor Standing

- Cassette

- Packaged

- Ducted Split

- Condensing units/VRF

- Chillers

- AHU/FCU

Split Air Conditioner acquired a significant share of the Africa Market in the previous few years. The deployment of these products in residential and small commercial buildings is burgeoning at a rapid pace. Split types, being cost-effective and easy to install, help lower household energy expenditure. Moreover, the significantly rising housing development projects and the increasing adoption rate of AC in the hospitality sector are crucial factors likely to accelerate market growth in the coming years.

Based on End-User,

- Residential

- Commercial

Here, Commercial Sector is anticipated to witness massive adoption of air conditioners over the forecast period. It is primarily because robust growth in the construction industry is expected on the African continent, notably in the Sub-Saharan region, supported by government measures to revive the infrastructure sector. Over the ensuing years, the outlook for construction in nations like Nigeria, Ethiopia, and Kenya would remain favorable, driving the adoption of air conditioners. Likewise, consumer awareness regarding their use in various industries, including the residential and hospitality sectors, is growing, resulting in a significant surge in the sales of ACs in the coming years. In addition, government attempts to increase the residential supply in these nations and close the demand-supply gap would also boost real estate development, stimulating their adoption in Africa.

Africa Air Conditioner Market Regional Projection

Geographically, the Africa Air Conditioner Market expands across following countries,

- South Africa

- Nigeria

- Kenya

- Algeria

- Morocco

- Others

Among others, South Africa is expected to attain a sizable share in the African air conditioner market on account of shifting environmental patterns and escalating degrees of global warming each year. As a result, the market is expected to generate potential revenues and witness a significant surge over the following years, owing to the rising levels of heat and humidity around the region. In addition, the growing acceptance of air conditioning systems as utility products rather than luxury goods further accelerates market adoption. Moreover, the increase in the sales of a range of air conditioning systems that are energy-efficient and technically advanced has positively influenced market growth.

Africa Air Conditioner Industry Recent Developments

- In September 2022, Japanese firm Daikin Industries Ltd. announced that the company is all set to restart an expansion into Africa that the COVID-19 outbreak had halted by starting to assemble air conditioners in Nigeria.

- In July 2022, Dunham-Bush introduced a new high-efficiency chiller series for applications requiring a small capacity range. With inverter scroll compressors and EC fans, the new ZEUS series air-cooled scroll compressor, model number ACDSV-E, can provide quiet performance and improved part load efficiency.

Gain a Competitive Edge with Our Africa Air Conditioner Market Report

- Africa Air Conditioner Market Report by Markntel Advisors provides a detailed & thorough analysis of market size & share, growth rate, competitive landscape, and key players. This comprehensive analysis helps businesses gain a holistic understanding of the market dynamics & make informed decisions.

- This report also highlights current market trends & future projections, allowing businesses to identify emerging opportunities & potential challenges. By understanding market forecasts, companies can align their strategies & stay ahead of the competition.

- Africa Air Conditioner Industry Report aids in assessing & mitigating risks associated with entering or operating in the market. By understanding market dynamics, regulatory frameworks, and potential challenges, businesses can develop strategies to minimize risks & optimize their operations.

Frequently Asked Questions

- Introduction

- Product Definition

- Research Process

- Assumptions

- Market Segmentation

- Preface

- Executive Summary

- Impact of COVID-19 on Africa Air Conditioner Market

- Expert Verbatim-Interview Excerpts of industry experts

- Africa Air Conditioner Market Analysis, 2019-2030F

- Market Size & Analysis

- Revenues in (USD Billion)

- Units Sold in Million

- Market Share & Analysis

- By Product Type

- Window, Split

- Floor Standing

- Cassette

- Packaged

- Ducted Split

- Condensing units/VRF

- Chillers

- AHU/FCU

- By End-User

- Residential

- Commercial

- By Country

- South Africa

- Nigeria

- Kenya

- Algeria

- Morocco

- Others

- By Company

- Market Shares, By Revenue

- Strategic Factorial Indexing

- Competitor Placement in MarkNtel Quadrant

- By Product Type

- Market Attractiveness Index

- By Product Type

- By End-User

- By Country

- By Competitors

- Total Units Sold

- Market Share

- Market Size & Analysis

- South Africa Air Conditioner Market Analysis, 2024

- Market Size & Analysis

- Units Sold in Million

- Revenues in USD Billion

- Market Share & Analysis

- By Product Type

- By End-User

- Market Size & Analysis

- Nigeria Air Conditioner Market Analysis, 2024

- Market Size & Analysis

- Units Sold in Million

- Revenues in USD Billion

- Market Share & Analysis

- By Product Type

- By End-User

- Market Size & Analysis

- Kenya Air Conditioner Market Analysis, 2024

- Market Size & Analysis

- Units Sold in Million

- Revenues in USD Billion

- Market Share & Analysis

- By Product Type

- By End-User

- Market Size & Analysis

- Algeria Air Conditioner Market Analysis, 2024

- Market Size & Analysis

- Units Sold in Million

- Revenues in USD Billion

- Market Share & Analysis

- By Product Type

- By End-User

- Market Size & Analysis

- Morocco Air Conditioner Market Analysis, 2024

- Market Size & Analysis

- Units Sold in Million

- Revenues in USD Billion

- Market Share & Analysis

- By Product Type

- By End-User

- Market Size & Analysis

- Africa Air Conditioner Market Value Chain Analysis

- Key Stakeholders in Value Chain

- Margin at Various Levels

- Africa Air Conditioner Market Regulations, Policies, Regulation, Product Benchmarks

- Africa Air Conditioner Market Trends & Insights

- Africa Air Conditioner Market Dynamics

- Drivers

- Challenges

- Impact Analysis

- Africa Air Conditioner Market Hotspot & Opportunities

- Africa Air Conditioner Market Key Strategic Imperatives for Success & Growth

- Africa Air Conditioner Market Import & Export Statistics

- Competition Outlook

- Competition Matrix

- Product Portfolio

- Target Markets

- Research & Development

- Strategic Alliances

- Strategic Initiatives

- Company Profiles of Top Companies (Business Description, Product Segments, Business Segments, Financials, Strategic Alliances/ Partnerships, Future Plans)

- Airconditioning & Heating International Carrier Fzc

- Daikin Middle East and Africa FZE

- Samsung Electronics Co. Ltd.

- LG Electronics

- Midea Middle East

- Sharp Middle East Fze

- Haier Electronics Group Co., Ltd.

- Dunham-Bush International (Africa) (PTY) Ltd

- Trane Inc.

- Gree Electric Appliances, Inc. Of Zhuhai

- Competition Matrix

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making