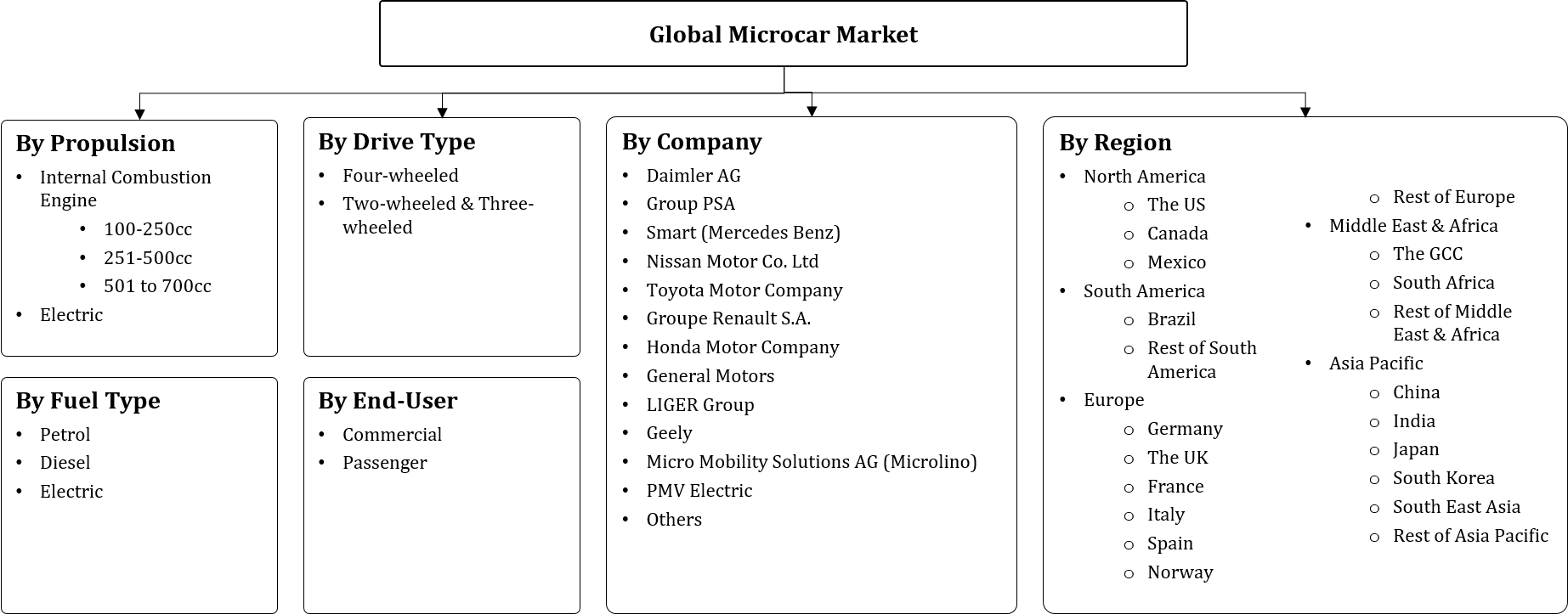

By Propulsion (Internal Combustion Engine, Electric), By Fuel Type (Diesel, Petrol, Electric), By Drive Type (Four-wheeled, Two-wheeled & Three-wheeled), By End-User (Commercial, Passenger), By Region... ... assenger), By Region (North America, South America, Europe, The Middle East & Africa, Asia-Pacific), By Company (Daimler AG, Group PSA, Smart (Mercedes Benz), Nissan Motor Co. Ltd, Toyota Motor Company, Groupe Renault S.A., Honda Motor Company, General Motors, LIGER Group, Geely, Microlino, PMV Electric, Others) Read more

- Automotive

- May 2023

- 191

- PDF, Excel, PPT

Market Definition

Microcars are small-compact vehicles with less than 700cc engine capacity as well as a length of not more than 3 meters. The vehicles usually come in all two, three, and four doors models as per the seating capacity. Cars with a smaller size & displacement have been a lucrative medium of transportation among various developed & developing countries.

Market Insights & Analysis: Global Microcar Market (2023-28)

The Global Microcar market is projected to grow at a CAGR of around 9.24% during the forecast period, i.e., 2023-28. Some factors that have attributed to the growth are a smaller design, which makes it easier to maneuver the vehicle in tightly constrained traffic & lean roads, better fuel efficiency, inexpensive pricing, attractive designs, etc. With the rapid increase in the prices of petrol & diesel due to volatility in the international crude oil prices, many traditional as well as first-time car owners gravitated towards the small-compact-sized cars that could be a better alternative to large vehicles for single-person mobility in city traffic conditions.

| Report Coverage | Details |

|---|---|

| Study Period | Historical Data: 2018-21 |

| Base Year: 2022 | |

| Forecast Period: 2023-28 | |

| CAGR (2023-2028) | 9.24% |

| Regions Covered | North America: US, Canada, Mexico |

| Europe: The UK, Germany, France, Italy, Spain, Norway, Rest of the Europe | |

| Asia-Pacific: China, India, Japan, South Korea, South East Asia, Rest of the Asia-Pacific | |

| South America: Brazil, Rest of South America | |

| Middle East & Africa: The GCC, South Africa, Rest of the South America | |

| Key Companies Profiled | Daimler AG, Group PSA, Smart (Mercedes Benz), Nissan Motor Co. Ltd, Toyota Motor Company, Groupe Renault S.A., Honda Motor Company, General Motors, LIGER Group, Geely, Microlino, PMV Electric, Others |

| Unit Denominations | USD Million/Billion |

Furthermore, the rise of nuclear families that require smaller cars for mobility solutions has also assisted the adoption of these cars among a wide range of customers. The growing environmental consciousness among consumers & the demand for these cars in low- to middle-income economies has led to higher demand, with the affordability factor also playing a crucial role. In many countries, the government restricts the purchase of large-sized cars by imposing additional taxes. This increases the overall price of certain-length cars, discouraging consumers to opt for larger vehicles & shifting toward smaller alternatives.

Hence, with the rise of urban population & increased traffic conditions in several fast developing economies, consumers are expected to shift towards these cars in order to save time & cost of transportation, thereby promoting market growth in the forecast years.

Global Microcar Market Research Report (2023-2028) - Table of Contents

- Market Segmentation

- Introduction

- Research Process

- Assumptions

- Market Definition

- Executive Summary

- Global Microcar Launches by Top Countries, 2018-2022

- By Company

- By Engine Combustion Type

- By Price (USD)

- Global Microcar Market Start-up- Ecosystem

- Entrepreneurial Activity

- Year on Year Funding Received

- Funding Received by Top Companies

- Key Investors Active in the Market

- Series Wise Funding Received

- Seed Funding

- Angel Investing

- Venture Capitalists (VC) Funding

- Others

- Global Microcar Market Trends & Developments

- Global Microcar Market Dynamics

- Drivers

- Challenges

- Global Microcar Market Hotspots & Opportunities

- Global Microcar Market Government Regulations & Policies, 2018-2028F

- Global Microcar Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenues (USD Million)

- By Units Sold (Thousand Units)

- Market Share & Analysis

- By Propulsion

- Internal Combustion Engine

- 100-250cc

- 251-500cc

- 501 to 700cc

- Electric

- Internal Combustion Engine

- By Fuel Type

- Diesel

- Petrol

- Electric

- By Drive Type

- Four-wheeled

- Two-wheeled & Three-wheeled

- By End-User

- Commercial

- Passenger

- By Region

- North America

- South America

- Europe

- The Middle East & Africa

- Asia-Pacific

- By Competitors

- Competition Characteristics

- Market Share & Analysis

- By Propulsion

- Market Size & Analysis

- North America Microcar Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenues (USD Million)

- By Units Sold (Thousand Units)

- Market Share & Analysis

- By Propulsion

- By Fuel

- By Drive Types

- By End-User

- By Country

- The US

- Canada

- Mexico

- The US Microcar Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenues (USD Million)

- By Units Sold (Thousand Units)

- Market Share & Analysis

- By Propulsion

- By Drive Types

- By End-User

- Market Size & Analysis

- Canada Microcar Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenues (USD Million)

- By Units Sold (Thousand Units)

- Market Share & Analysis

- By Propulsion

- By Drive Types

- By End-User

- Market Size & Analysis

- Mexico Microcar Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenues (USD Million)

- By Units Sold (Thousand Units)

- Market Share & Analysis

- By Propulsion

- By Drive Types

- By End-User

- Market Size & Analysis

- Market Size & Analysis

- South America Microcar Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenues (USD Million)

- By Units Sold (Thousand Units)

- Market Share & Analysis

- By Propulsion

- By Fuel

- By Drive Types

- By End-User

- By Country

- Brazil

- Rest of the South America

- Brazil Microcar Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenues (USD Million)

- By Units Sold (Thousand Units)

- Market Share & Analysis

- By Propulsion

- By Drive Types

- By End-User

- Market Size & Analysis

- Market Size & Analysis

- Europe Microcar Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenues (USD Million)

- By Units Sold (Thousand Units)

- Market Share & Analysis

- By Propulsion

- By Fuel

- By Drive Types

- By End-User

- By Country

- The UK

- Germany

- France

- Italy

- Spain

- Norway

- Rest of the Europe

- The UK Microcar Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenues (USD Million)

- By Units Sold (Thousand Units)

- Market Share & Analysis

- By Propulsion

- By Drive Types

- By End-User

- Market Size & Analysis

- Germany Microcar Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenues (USD Million)

- By Units Sold (Thousand Units)

- Market Share & Analysis

- By Propulsion

- By Drive Types

- By End-User

- Market Size & Analysis

- France Microcar Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenues (USD Million)

- By Units Sold (Thousand Units)

- Market Share & Analysis

- By Propulsion

- By Drive Types

- By End-User

- Market Size & Analysis

- Italy Microcar Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenues (USD Million)

- By Units Sold (Thousand Units)

- Market Share & Analysis

- By Propulsion

- By Drive Types

- By End-User

- Market Size & Analysis

- Spain Microcar Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenues (USD Million)

- By Units Sold (Thousand Units)

- Market Share & Analysis

- By Propulsion

- By Drive Types

- By End-User

- Market Size & Analysis

- Norway Microcar Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenues (USD Million)

- By Units Sold (Thousand Units)

- Market Share & Analysis

- By Propulsion

- By Drive Types

- By End-User

- Market Size & Analysis

- Market Size & Analysis

- The Middle East & Africa Microcar Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenues (USD Million)

- By Units Sold (Thousand Units)

- Market Share & Analysis

- By Propulsion

- By Fuel

- By Drive Types

- By End-User

- By Country

- The GCC

- South Africa

- Rest of the South America

- The GCC Microcar Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenues (USD Million)

- By Units Sold (Thousand Units)

- Market Share & Analysis

- By Propulsion

- By Drive Types

- By End-User

- Market Size & Analysis

- South Africa Microcar Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenues (USD Million)

- By Units Sold (Thousand Units)

- Market Share & Analysis

- By Propulsion

- By Drive Types

- By End-User

- Market Size & Analysis

- Market Size & Analysis

- Asia-Pacific Microcar Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenues (USD Million)

- By Units Sold (Thousand Units)

- Market Share & Analysis

- By Propulsion

- By Fuel

- By Drive Types

- By End-User

- By Country

- China

- India

- Japan

- South Korea

- South East Asia

- Rest of the Asia-Pacific

- China Microcar Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenues (USD Million)

- By Units Sold (Thousand Units)

- Market Share & Analysis

- By Propulsion

- By Drive Types

- By End-User

- Market Size & Analysis

- India Microcar Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenues (USD Million)

- By Units Sold (Thousand Units)

- Market Share & Analysis

- By Propulsion

- By Drive Types

- By End-User

- Market Size & Analysis

- Japan Microcar Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenues (USD Million)

- By Units Sold (Thousand Units)

- Market Share & Analysis

- By Propulsion

- By Drive Types

- By End-User

- Market Size & Analysis

- South Korea Microcar Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenues (USD Million)

- By Units Sold (Thousand Units)

- Market Share & Analysis

- By Propulsion

- By Drive Types

- By End-User

- Market Size & Analysis

- South East Asia Microcar Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenues (USD Million)

- By Units Sold (Thousand Units)

- Market Share & Analysis

- By Propulsion

- By Drive Types

- By End-User

- Market Size & Analysis

- Market Size & Analysis

- Global Microcar Market Key Strategic Imperatives for Success & Growth

- Competitive Outlook

- Competition Matrix

- Application Portfolio

- Brand Specialization

- Target Markets

- Target Applications

- Research & Development

- Strategic Alliances

- Strategic Initiatives

- Company Profiles ((Business Description, Application Segments, Business Segments, Financials, Strategic Alliances/ Partnerships, Future Plans)

- Daimler AG

- Group PSA

- Smart (Mercedes Benz)

- Nissan Motor Co. Ltd

- Toyota Motor Company

- Groupe Renault S.A.

- Honda Motor Company

- General Motors

- LIGER Group

- Geely

- Microlino

- PMV Electric

- Others

- Competition Matrix

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making