Press Release Description

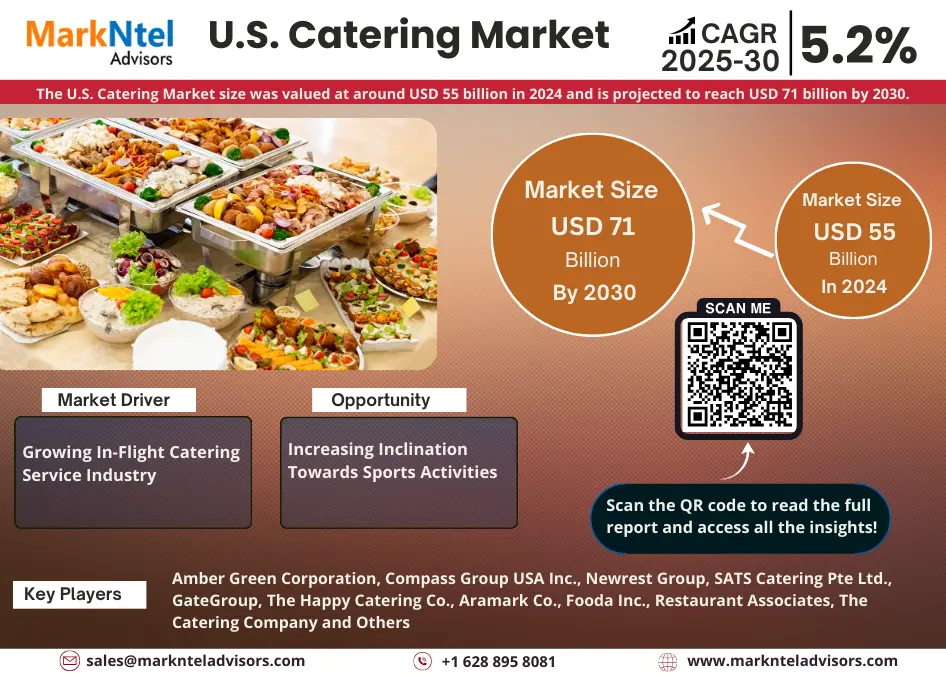

A USD 55 Billion U.S. Catering Market to Surge at a CAGR of Around 5.2% During 2025-30

The U.S. Catering Market size was valued at around USD 55 billion in 2024 and is projected to reach USD 71 billion by 2030. Along with this, the market is estimated to grow at a CAGR of around 5.2% during the forecast period, i.e., 2025-30, cites MarkNtel Advisors in its recent research report. Delivering meal services in commercial spaces, colleges, and universities, corporate events, sports events, and personal events like; weddings, family gatherings, etc., and servicing in medical facilities are known as catering. In the U.S., over 100,000 small, medium-sized, and big enterprises are engaged in the catering industry.

Office catering business is popular in the U.S. owing to the increase in workforce from past few years. The number of employees in professional and business services has risen to around 22.5 million in 2023, compared to about 20.3 million in 2020. Also, the number of corporate events, meetings, conferences, etc. is on the rise in the country. Together with this, the U.S. is home to the headquarters of corporations including the UN's humanitarian bodies, and financial organizations like; IMF, World Bank, etc. contributing to hosting a large variety of diplomatic activities and growing demand for professional catering services.

Furthermore, college enrollments increased from 18.93 million in 2023 to approximately 19.25 million in 2024, contributing to the growth of the education sector, which is another supporting industry for the U.S. Catering Market. Additionally, the U.S. government's National School Lunch Program (NSLP) aims to provide lunch services to more than 95,000 educational organizations and schools. Furthermore, the demand for catering with enhanced nutritional value is fueled increasing focus on healthy eating habits.

In addition, the expanding healthcare industry and the growing participation in sports led to further expansion in the industry. Over 900,000 available beds in conjunction with more than 33 million patients admitted in U.S. hospitals in 2023. Moreover, the requirement for efficient catering services has been boosted by strict laws regarding nutritional guidelines for healthcare institutions. In addition, the United States government has provided aid to boost student involvement in sports activities from around 50% in 2024 to 60% by 2030. This shall further support growth opportunities for catering businesses in the sports industry, further states the research report, “U.S. Catering Market Analysis, 2025.”

Outsourced Catering Holds the Largest Market Share

Based on the type, the market is further bifurcated into, outsourced and in-house. Outsourced catering is further divided into contractual and non-contractual catering. Among both of these catering types, outsourced catering leads the market by accounting for more than 90% market share. Furthermore, in outsourced catering, the contractual type of catering dominates the market, in terms of profitability and input cost specifically in organizations where regular catering is required such as educational institutions, medical institutions & hospitals, corporate offices, in-flight, etc. With regular requirements and a large consumer base, contract-based catering emerges as a fixed solution for the catering needs of these organizations.

Moreover, the non-contractual market also has a significant share in events hosting, celebrations, weddings, etc. Weddings are the major source of non-contractual catering in the country, with more than 2 million weddings in a year.

Corporate Offices are the Best End-User of Catering Services

Among all the end-user sectors, the U.S. Catering Industry is dominated by the corporate sector with more than 30% market share. This large share is attributed to the large number of corporate offices, MNCs established, and highly developed infrastructure & strategic location of the country for emerging businesses and corporations. Also, catering services in healthcare and medical institutions are quite necessary to fulfill the dietary and nutritional requirements of the patients in the hospital. Therefore, the price per plate in healthcare is comparatively 25% higher than normal plates in other end-user industries.

Competitive Landscape

With strategic initiatives such as mergers, collaborations, and acquisitions, the leading market companies, including Amber Green Corporation, Compass Group USA Inc., Newrest Group, SATS Catering Pte Ltd., GateGroup, The Happy Catering Co., Aramark Co., Fooda Inc., Restaurant Associates, The Catering Company, Occasions Caterers, Savoie Catering, Sodexo, and others are looking forward to strengthening their market positions.

Key Questions Answered in the Research Report

- What are the industry’s overall statistics or estimates (Overview, Size- By Value, Forecast Numbers, Segmentation, Shares)?

- What are the trends influencing the current scenario of the market?

- What key factors would propel and impede the industry across the nation?

- How has the industry been evolving in terms of geography & solution adoption?

- How has the competition been shaping up across the country?

- How have buying behavior, customer inclination, and expectations from product manufacturers been evolving during 2020-30?

- Who are the key competitors, and what strategic partnerships or ventures are they coming up with to stay afloat during the projected time frame?

We offer flexible licensing options to cater to varying organizational needs. Choose the pricing pack that best suits your requirements:

Buy NowNeed Assistance?

WRITE AN EMAIL

sales@marknteladvisors.comCustomization Offered

100% Safe & Secure

Strongest encryption on the website to make your purchase safe and secure