Press Release Description

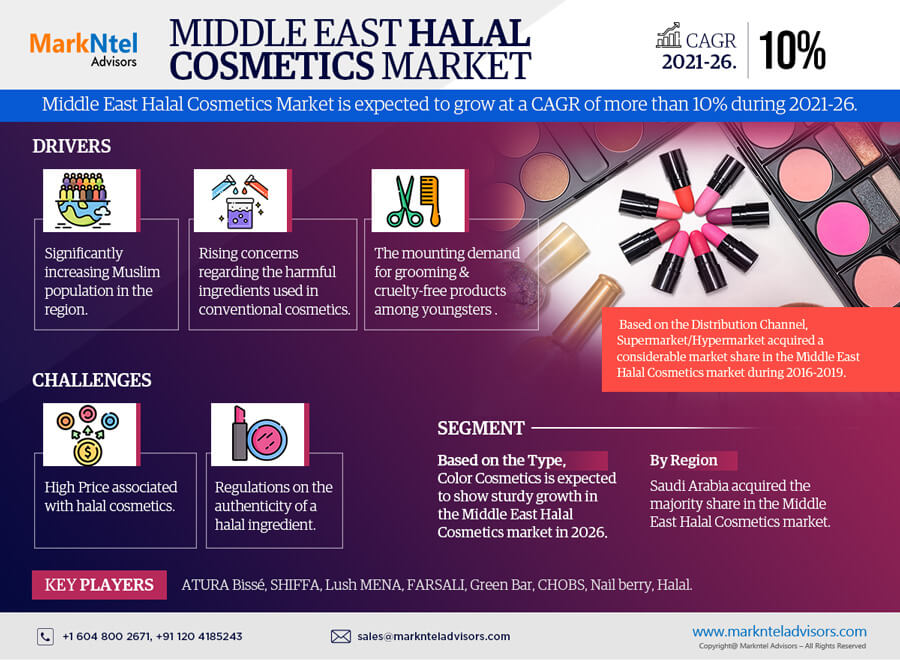

Middle East Halal Cosmetics Market to Witness Over 10% CAGR During 2021-26

According to MarkNtel Advisors, the Middle East Halal Cosmetics Market is expecting more than 10% CAGR during 2021-26. With approx. 85% of the Middle East populace is Muslims, halal cosmetic products have gained massive popularity among them. The major factor driving the halal cosmetics market across the Middle East is the growing trend of natural, effective, & animal cruelty-free cosmetic products, especially among the young population, i.e., learning about the harmful ingredients used in conventional cosmetics.

Further, mounting awareness among the Muslim populace regarding their religious obligations entwined with socioeconomic factors & cultural proximity across the Middle East also contributes to the soaring demand for halal cosmetic products across the region.

Moreover, the rapidly growing e-commerce sector and the burgeoning supply of halal-certified cosmetic products, owing to strict norms associated with them, are other prominent aspects projected to augment the market growth in the coming years, further states the research report, “Middle East Halal Cosmetics Market Analysis, 2021.”

Increasing Popularity of Color Cosmetics across the Middle East to Boost the Market

The key ingredients in conventional color cosmetics are animal fat and alcohol, which are not allowed for use among the Muslim population. As a result, the demand for halal color cosmetics is rapidly increasing across the Middle East, comprising countries with the maximum Muslim population. Additionally, the mounting interest of young Muslims toward the latest make-up trends that adhere to their religious beliefs would also boost the demand for halal color cosmetics in the coming years.

Moreover, more and more millennials & Generation-Z Muslims & non-Muslims are inclining toward halal cosmetics, and there's an increasing availability of a large variety of such products for people of different ages. Consequently, the demand for halal-certified color cosmetics is significantly rising across the region and accelerating the overall market growth.

With Muslim Dominance, Saudi Arabia Acquired the Largest Share of the Halal Cosmetics Market

Saudi Arabia is primarily a Muslim-populated country. Hence, the country is witnessing a burgeoning preference for halal cosmetic products, owing to their hassle-free accessibility as well as growing awareness about the benefits they offer.

Halal cosmetic products are free from materials forbidden by Islamic Law. As a result, animal, pork, & alcoholic constituents are not incorporated while manufacturing such products. With the expanding availability of halal cosmetics across the country, people are gradually shifting to cosmetic products free from prohibited materials.

Additionally, the increasing health concerns due to the harmful effects of substances present in conventional cosmetic products have further surged the need for halal cosmetic products in Saudi Arabia, reveals MarkNtel Advisors in their research report, "Middle East Halal Cosmetics Market Analysis, 2021."

Competitive Landscape

According to MarkNtel Advisors, the leading players in the Middle East Halal Cosmetics Market include ATURA Bissé, SHIFFA, Lush MENA, FARSALI, Green Bar, CHOBS, Nail berry, & Halal.

Key Questions Answered in the Study

- What are the current & future trends in the Middle East Halal Cosmetics Market?

- How has the industry been evolving in terms of geography & product adoption?

- How has the competition been shaping across the Middle East, followed by their comparative factorial indexing?

- What are the key growth drivers & challenges for the Middle East Halal Cosmetics Market?

- What are the customer orientation, purchase behavior, and expectations from halal cosmetic manufacturers across the Middle East?

Market Segmentation:

- By Type (Color Cosmetics {Face, Eyes, Lips, Nails}, Personal Care {Hair Care, Skin Care, Fragrances})

- By Distribution Channel (Online, Supermarket/Hypermarket, Others {Pharmacy, etc.})

- By Gender (Male, Female)

- By Country (Saudi Arabia, Oman, Bahrain, Kuwait, UAE, Qatar, Turkey, Egypt, Others)

- By Competitors (ATURA Bissé, SHIFFA, Lush MENA, FARSALI, Green Bar, CHOBS, Nail berry, Halal, Others)

We offer flexible licensing options to cater to varying organizational needs. Choose the pricing pack that best suits your requirements:

Buy NowNeed Assistance?

WRITE AN EMAIL

sales@marknteladvisors.comCustomization Offered

100% Safe & Secure

Strongest encryption on the website to make your purchase safe and secure