Press Release Description

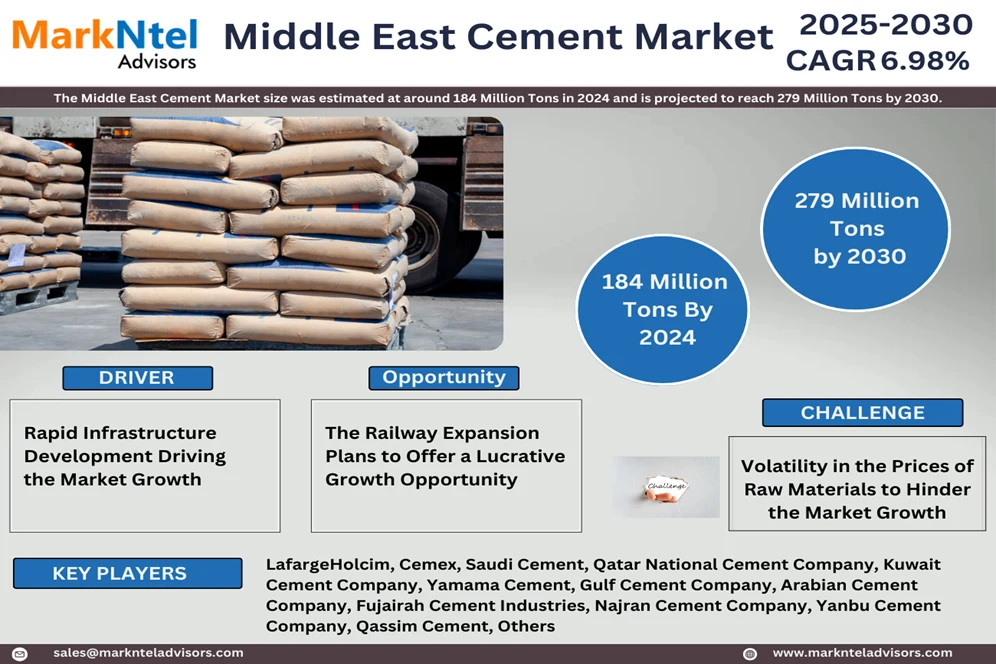

Middle East Cement Market to Surge at a CAGR of 6.98% During 2025-30 Due to Rapid Infrastructure Development

The Middle East Cement Market size was estimated at around 184 Million Tons in 2024 and is projected to reach 279 Million Tons by 2030. Along with this, the market is estimated to grow at a CAGR of around 6.98% during the forecast period, i.e., 2025-30, cites MarkNtel Advisors in the recent research report. This growth is mainly attributed to the increasing number of constructions in this region, which is fueled by the expanding population, increasing FDIs in real estate, and expansion of rail and road networks. This is because cement is the major component required in such constructions to ensure the strength and durability of the infrastructure. As a result, this evolution of infrastructure has created a high demand for cement.

Moreover, the market is highly supported by the government in this region. This consists of the efforts made by them to reduce their dependency on oil by attracting multiple international companies through tax benefits and other perks. This results in the increased demand for the establishment of workspaces for these companies, including business complexes, factories, etc., which further increases the demand for cement. In addition to this, they are making their countries the major tourist attractions, thus investing heavily in smart city projects, the amusement & entertainment industry, etc., all of which require cement for their construction. Overall, the government plays a major role in increasing the construction activities that are highly dependent on cement.

In Addition, businesses in recent years have emphasized maintaining their operations efficiently and also reducing carbon dioxide emissions from their factories by using renewable energy and embracing carbon capture technology, using dried raw materials, among other things. LafargeHocim, for instance, makes a line of cement called "ECOPlanet" that is manufactured using 30% less carbon dioxide compared to other cement varieties. This cement is manufactured using recycled materials and has superior performance. Thus, the market has grown much in previous years as construction projects have become more numerous in numbers with continuous government support, rising FDIs, and fast infrastructure development. All this adds to the demand for cement in the region and shall continue in the forecast period, further states the research report, “Middle East Cement Market Analysis, 2025.”

Segmentation Analysis

Portland is the Most Preferred Cement Type

Based on the type of cement, the market is further bifurcated into Portland, Blended, and others. Here, the Portland segment leads the market with a share of around 75%. The main reason behind this dominance is the wider and easier availability of raw materials required for Portland cement manufacturing, which further helps companies reduce prices due to the adjusted production as per the demand. In 2022, the UAE exported limestone worth around USD695 million, which makes it the largest exporter of limestone in the world. Similarly, other compounds, including clay, shell, gypsum, etc., are also present in vast quantities in this region. As a result, this segment has attracted a wide consumer base.

Moreover, Portland cement comprises optimum strength and durability for constructions, which makes it the best choice in normal constructions where advanced properties like heat resistance, sulfur resistance, etc., are not required. Therefore, due to wider availability and the desired characteristics offered by Portland cement at low prices, this segment leads the market.

UAE Leads the Middle East Cement Industry

Regionally, the UAE dominates the market with a share of around 26%. This is because the UAE has undergone high infrastructural development in recent years, thus using the highest quantity of cement in constructing and establishing them. This includes various iconic structures such as Burj Khalifa, Palm Jumeirah, etc., and a very high number of luxurious hotels and resorts. Moreover, the government of this country is highly focused on expanding tourism, which will increase the construction of hotels, resorts, amusement places, smart cities, etc., thus increasing the demand for cement.

Additionally, the UAE has attracted huge FDI in the real estate sector, which creates a high demand for cement to expand the range of luxury properties. Therefore, the UAE has established the highest number of constructions, thus using the highest quantity of cement, which makes it the segment leader.

Competitive Landscape

With strategic initiatives such as mergers, collaborations, and acquisitions, the leading market companies, including LafargeHolcim, Cemex, Saudi Cement, Qatar National Cement Company, Kuwait Cement Company, Yamama Cement, Gulf Cement Company, Arabian Cement Company, Fujairah Cement Industries, Najran Cement Company, Yanbu Cement Company, Qassim Cement, and others are looking forward to strengthening their market positions.

Key Questions Answered in the Research Report

- What are the industry’s overall statistics or estimates (Overview, Size- By Value, Forecast Numbers, Segmentation, Shares)?

- What are the trends influencing the current scenario of the market?

- What key factors would propel and impede the industry across the region?

- How has the industry been evolving in terms of geography & product adoption?

- How has the competition been shaping up across the countries?

- How have buying behavior, customer inclination, and expectations from products been evolving during 2020-30?

- Who are the key competitors, and what strategic partnerships or ventures are they coming up with to stay afloat during the projected time frame?

We offer flexible licensing options to cater to varying organizational needs. Choose the pricing pack that best suits your requirements:

Buy NowNeed Assistance?

WRITE AN EMAIL

sales@marknteladvisors.comCustomization Offered

100% Safe & Secure

Strongest encryption on the website to make your purchase safe and secure