Press Release Description

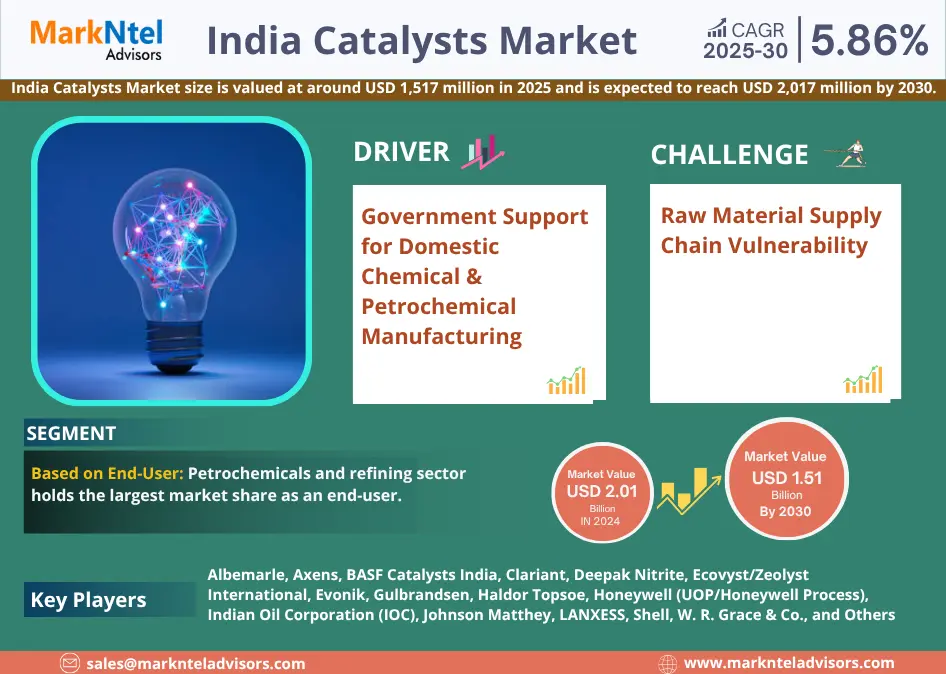

At an Estimated 5.86% CAGR, India Catalysts Market to Touch USD2,017 Million Mark by 2030

India Catalysts Market Overview, Trends, Size and Forecast: 2025-2030

The India Catalysts Market size is valued at around USD 1,517 million in 2025 and is expected to reach USD 2,017 million by 2030. Along with this, the market is estimated to grow at a CAGR of around 5.86% during the forecast period, i.e., 2025-30, cites MarkNtel Advisors in the recent research report. The market growth is driven by the expanding chemicals and petrochemicals sector and government support, among other factors such as regulatory pressures. This includes the Production Linked Incentives (PLI) and mandates under the “Make in India” initiative, both of which are attracting capital in upstream chemical production and support for the localization of catalyst technologies. For instance, recent investments through the Petroleum, Chemicals and Petrochemicals Investment Regions (PCPIR) and PCPIR-type industrial parks are expanding infrastructure and supply chain capabilities in the country.

Moreover, the environmental, social, and governance (ESG) norms and regulatory focus on quality control, waste minimization, and strict emissions norms are driving the demand for catalysts that offer higher selectivity, durability, regenerability, and low emissions. Additionally, the domestic demand is driven by the country’s expanding sectors such as automotive, petrochemicals, specialty chemicals, textiles, and packaging. Further, to reduce dependency on imported feedstocks is pushing local research & development (R&D) and adoption of new nano or bio-based catalyst systems. Therefore, all these factors are augmenting the size & volume of the industry, further states the research report, “India Catalysts Market Analysis, 2025.”

India Catalysts Market Segmentation Insights:

Heterogeneous is the Most Preferred Catalyst Type

Based on the catalyst type, the market is further segmented into heterogeneous and homogeneous. Heterogeneous catalysts hold the largest market share due to the industry favoring solid, separable catalysts. Also, these catalysts are largely used in large-scale operations in ammonia synthesis via the Haber-Bosch route in fertilizer plants and catalytic cracking in refineries. This is because of the ease of separation and recovery after reaction due to them being in a different phase from the reactants, thereby lowering operational costs in large-scale and continuous manufacturing processes and driving the country’s industrial output.

Moreover, there is an increasing demand for heterogeneous catalysts in petroleum refining, petrochemicals, and fertilizer production that can withstand harsh reaction conditions, deliver stability, and enable low maintenance operations. Additionally, there is niche demand for these catalysts in sectors that require high precision and selectivity, particularly in fine chemical, pharmaceutical, or specialty chemical syntheses. This is due to their molecular-level control and ability to drive complex transformations. Therefore, these factors are making heterogeneous catalysts the leading type in the market.

Petrochemicals & Refining Sector Generating Maximum Market Revenue

The petrochemicals & refining sector is leading the market and is estimated to dominate over the forecast period as well. This market lead is driven by the massive refining capacities and increasing downstream integration in the country. For instance, the utilization rate of refineries is high (around 103%), thereby driving strong demand for catalysts in reforming, hydrotreating, cracking, and desulphurization. Also, initiatives by the government to develop Petroleum, Chemicals, and Petrochemicals Investment Regions (PCPIRs) and to incentivize downstream polymer, plastics, and packaging manufacturing are increasing the demand for catalysts based on zeolites, noble metals, and hydrotreating agents in refining and petrochemical processes to reduce emissions, improve yield, and meet the fuel quality norms. Thus, the petrochemicals & refining sector is the primary end-user of Catalysts, ultimately boosting the market size & volume.

Top Companies in the India Catalysts Market

With strategic initiatives, such as mergers, collaborations, and acquisitions, the leading India Catalysts Market companies, including Albemarle, Axens, BASF Catalysts India, Clariant, Deepak Nitrite, Ecovyst/Zeolyst International, Evonik, Gulbrandsen, Haldor Topsoe, Honeywell (UOP/Honeywell Process), Indian Oil Corporation (IOC), Johnson Matthey, LANXESS, Shell, W. R. Grace & Co., and Others are looking forward to increase their market size & share.

Key Questions Answered in the Research Report

- What is the scope, size, value, and forecast of the India Catalysts Market?

- What is the volume and share of each segment in the India Catalysts Market?

- What are the key trends shaping the India Catalysts Market from 2025 to 2030?

- What growth factors and risks impact the India Catalysts Market?

- What are the main challenges faced by players in the India Catalysts Market?

- What are the top opportunities in the India Catalysts Market?

- What does competitive analysis reveal about the India Catalysts Market landscape?

- Who are the key players and companies leading the India Catalysts Market?

- What innovations are transforming the future dynamics of the India Catalysts Market?

- How are partnerships and collaborations driving the India Catalysts Market growth?

- How does the India Catalysts Market differ based on geography and segments?

We offer flexible licensing options to cater to varying organizational needs. Choose the pricing pack that best suits your requirements:

Buy NowNeed Assistance?

WRITE AN EMAIL

sales@marknteladvisors.comCustomization Offered

100% Safe & Secure

Strongest encryption on the website to make your purchase safe and secure