UAE Data Center Market Research Report: Forecast (2021-2026)

By IT Infrastructure (Servers {E-mail servers, Proxy Servers, DNS Servers}, Storage {Central SAN (Storage Area Network), DAS (Direct Attached Storage). NAS (Network Attached Stora...ge)}, Network {Routers, Firewalls}), By Electrical and Mechanical Infrastructure (Cabling, Uninterrupted Power Supplies, Cooling Systems, Others (Rack PDU, Switchgears, etc.,)), By Type (Enterprise Data Centers, Colocation Data Centers, Cloud Data Centers, Edge Data Centers), By Tier Standards (Basic site infrastructure (Tier I), Redundant-capacity component site infrastructure (Tier II), Concurrently maintainable site infrastructure (Tier III), Fault-tolerant site infrastructure (Tier IV)), By End Users (Banking, Financial Services & Insurance, Telecommunication & IT, Government, Energy & Utility, Health Care, Others (Retail, Hospitality, Entertainment, & Media)), By Region (Dubai, Abu Dhabi, Sharjah & Northern Emirates), By Competitors (Khazna, Etisalat, Equinix, Oracle, Alibaba Cloud, Microsoft Azure, IBM, Amazon Web Services, MBUZZ, Cisco) Read more

- ICT & Electronics

- Sep 2021

- Pages 118

- Report Format: PDF, Excel, PPT

A data center is a facility businesses use for storing their crucial data & applications. This facility offers shared access through complex networks & storage infrastructure and ensures that the data is highly secure & available.

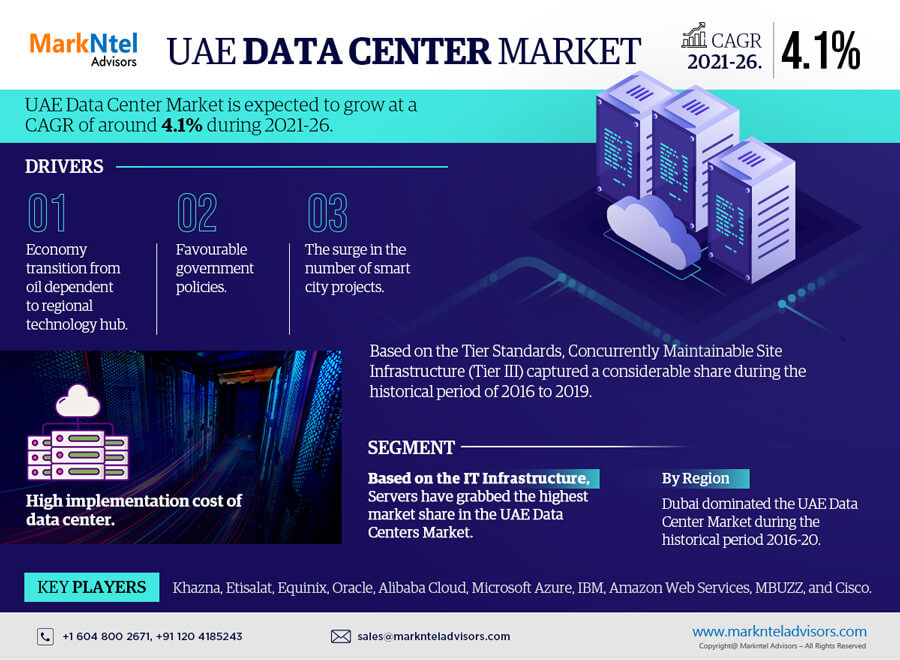

The UAE Data Center Market is anticipated to grow at a CAGR of around 4.1% during the forecast period, i.e., 2021-26, says MarkNtel Advisors. The market growth ascribes to the mounting number of smart city development projects, coupled with rapid digitalization in government services. Additionally, 5G infrastructure deployment and expanding size of the commercial industry requiring to set up their data centers in the country shall further augment the market growth. The shift in the country's focus from being oil-dependent to becoming the regional IT hub is another crucial aspect likely to boost the demand for data centers in the UAE.

UAE Federal Law No. (2) of 2019 (the Health Data Protection Law) states that entities processing data related to healthcare must comply with the new legislation, i.e., establishing a central system (data center) to store, exchange, & collect healthcare data. Also, it has imposed fines for breaches of up to USD 272,259.

Moreover, the country has been proactive in integrating advanced technologies, such as Artificial Intelligence (AI), Machine Learning (ML), Blockchain, Green Finance, 5G, etc., in spaces like financial services, healthcare, transportation, manufacturing, and storage among other industries. Therefore, the need for data centers is significantly increasing in UAE, further states the research report, “UAE Data Center Market Analysis, 2021.”

| Report Coverage | Details |

|---|---|

| Study Period | Historical Data: 2016-19 |

| Base Year: 2020 | |

| Forecast Period: 2021-26 | |

| CAGR (2021-2026) | 4.1% |

| Regions Covered | Dubai, Abu Dhabi, Sharjah & Northern Emirates |

| Key Companies Profiled | Khazna, Etisalat, Equinix, Oracle, Alibaba Cloud, Microsoft Azure, IBM, Amazon Web Services, MBUZZ, and Cisco |

| Unit Denominations | USD Million/Billion |

COVID-19 Outbreak Positively Impacted the UAE Data Center Market

In March 2020, as the Covid-19 pandemic rapidly became a global crisis, most organizations immediately enabled complete Work from Home for all employees to ensure their safety. Due to the restrictions amidst the pandemic, routine business operations of most organizations got adversely affected.

The snowballing adoption of Cloud, Big Data, and IoT (Internet of Things) in the wake of the COVID-19 pandemic has increased the demand for efficient data centers to support storage of & access to a large amount of data through Cloud and Video Conferencing.

Hence, with the surging need to bolster IT performance, flexibility, and security amongst organizations in UAE, the Data Center Market is growing faster than predicted during the pandemic and is expected to grow more significantly in the coming years.

Market Segmentation

By IT Infrastructure:

Servers Dominated the UAE Data Center Market with Largest Share

Based on the IT Infrastructure, the market bifurcates into Servers, Storage, and Networks. Of these three, Servers grabbed the highest share of the UAE Data Center Market in the previous few years, owing to the rising demand for Original Design Manufacturers (ODM) servers in the country.

ODMs are servers customized according to clients’ needs and preferences. Also, the cost of ODM servers is considerably low compared to other branded options, such as CISCO, Dell, HP, IBM, etc. It has shifted the buying pattern of end-users from branded to tailored servers. Thus, the 'Servers' segment is majorly contributing to the overall market growth, cites MarkNtel Advisors in their research report, “UAE Data Center Market Analysis, 2021.”

By Electrical and Mechanical Infrastructure:

The Demand for Uninterruptible Power Supplies (UPS) Witnessed Continuous Growth in the UAE Data Center Market

Based on the Electrical and Mechanical Infrastructure, the UAE Data Center Market bifurcates into Cabling, Uninterrupted Power Supplies, Cooling Systems, and Others, including Rack PDU, Switchgears, etc. Among these segments, the demand for Uninterruptible Power Supplies (UPS) has shown a progressive growth in the UAE Data Center Market in the historical years due to the mounting requirements for backing critical IT infrastructure across sectors, such as Oil & Gas, Government, Large Enterprises, and Healthcare among others. These industries needing maximum uptime to run their critical applications, servers, etc., is the prime aspect that led UPS to attain the continuous demand in the previous few years.

By Tier Standards:

Concurrently Maintainable Site Infrastructure (Tier III) Attained the Largest Share of Data Center Market

Based on the Tier Standards, the UAE Data Center Market segments into Basic Site Infrastructure (Tier I), Redundant-Capacity Component Site Infrastructure (Tier II), Concurrently Maintainable Site Infrastructure (Tier III), and Fault-Tolerant Site Infrastructure (Tier IV) data centers. Of these, Concurrently Maintainable Site Infrastructure (Tier III) data centers captured a considerable market share during 2016-19.

The prime factor behind Concurrently Maintainable Site Infrastructure (Tier III) data centers attaining a considerable market share is that they have 99.98% uptime and can undergo routine maintenance without any notable service disruptions. This type of data center is best suited for developing companies or a business, which is larger than an average SME. It provides an N+1 backup, where N is the amount required for operations and +1 is an additional backup system, which is enough if a system fails/crashes. Hence, the demand for Concurrently Maintainable Site Infrastructure (Tier III) data centers was significant in the past few years.

Regional landscape

Dubai to Witness Highest Growth Rate in the UAE Data Center Market During 2021-26

Dubai dominated the UAE Data Center Market during the historical period, i.e., 2016-20, and is expected to attain the highest CAGR during the forecast years. Rising IT expenditure by the government, mounting number of smart projects, and robust 5G infrastructure setups are the key factors contributing to the Data Center Market growth in the country.

Further, the ICT initiatives led by the Dubai Government, such as Dubai 10X, Dubai Plan 2021, Dubai Internet of Things Strategy, etc., the execution of which would require storing a large volume of information and its access with minimal latency. It would then lead to an elevation in the construction of new data centers in Dubai.

For instance, in Dubai's IoT Strategy, the government aims to protect its digital wealth, encourage government departments toward joining Emirate’s Smart transformation, and achieve the objectives of Smart Dubai 2021, which includes the transition to a 100% paperless government.

Market Driver

Smart City Projects to Amplify the Data Center Demand

The rapid urbanization in UAE has led to the growing number of smart city projects and the surging adoption of smart devices, wireless networking technologies, Cloud Analytics, Big Data, IoT, etc., in the country. It, in turn, has spurred the need for more data centers for reliable network access and the effective functioning of smart cities.

Moreover, the government deals with several complex issues, such as water & wastewater management, mobility, safety & security services, and energy management, the resolution of which requires an integrated approach. Hence, it is another crucial aspect expected to amplify the demand for data centers in UAE during 2021-26.

Market Challenge

High Implementation Cost of Data Centers Might Hamper the Market Growth

Some companies are reluctant to implement data centers because of their high initial implementation costs, despite the long-term benefits they offer. It costs around $1200 per square foot to build a data center, and this cost might vary according to the security features implemented. Hence, the high cost of implementing a data center is the most prominent factor that might hamper the market growth in the coming years.

Competitive Landscape

According to MarkNtel Advisors, the leading industry players in the UAE Data Center market are Khazna, Etisalat, Equinix, Oracle, Alibaba Cloud, Microsoft Azure, IBM, Amazon Web Services, MBUZZ, and Cisco.

Key Questions Answered in the Market Research Report:

- What are the overall market statistics or estimates (Market Overview, Market Size- by Value, Forecast Numbers, Market Segmentation, and Market Shares) of the UAE Data Center Market?

- What are the region-wise industry size, growth drivers, and challenges?

- What are key innovations, opportunities, current & future trends, and regulations in the UAE Data Center Market?

- Who are the key competitors, their key strengths & weaknesses, and how do they perform in the UAE Data Center Market based on a competitive benchmarking matrix?

- What are the key results derived from the market surveys conducted during the UAE Data Center Market study?

Market Outlook, Segmentation, and Statistics

- Impact of COVID-19 on UAE Data Center Market

- Market Size & Analysis

- By Revenue

- Market Share & Analysis

- By IT Infrastructure

- Servers

- E-mail servers

- Proxy Servers

- DNS Servers

- Storage

- Central SAN (Storage Area Network)

- DAS (Direct Attached Storage)

- NAS (Network Attached Storage)

- Network

- Routers

- Firewalls

- Servers

- By Electrical and Mechanical Infrastructure

- Cabling

- Uninterrupted Power Supplies

- Cooling Systems

- Others (Rack PDU, Switchgears, etc.,)

- By Type

- Enterprise Data Centers

- Colocation Data Centers

- Cloud Data Centers

- Edge Data Centers

- By Tier Standards

- Basic site infrastructure (Tier I)

- Redundant-capacity component site infrastructure (Tier II)

- Concurrently maintainable site infrastructure (Tier III)

- Fault-tolerant site infrastructure (Tier IV)

- By End Users

- Banking, Financial Services and Insurance

- Telecommunication & IT

- Government

- Energy & Utility

- Health Care

- Others (Retail, Hospitality, Entertainment, & Media)

- By Region

- Dubai

- Abu Dhabi

- Sharjah & Northern Emirates

- By Competitors

- Competition Characteristics

- Market Share & Analysis

- Competitive Metrix

- By IT Infrastructure

- UAE Data Center Market Hotspots & Opportunities

- UAE Data Center Market Regulations & Policy

- Key Strategic Imperatives for Success and Growth

- UAE Competition Outlook

- Competition Matrix

- Company Profile

Frequently Asked Questions

- Introduction

- Product Definition

- Research Process

- Assumptions

- Market Segmentation

- Executive Summary

- Impact of COVID-19 on UAE Data Center Market

- Expert Verbatim: What our expert says?

- UAE Data Center Market Trends & Insights

- UAE Data Center Market Dynamics

- Growth Drivers

- Challenges

- Impact Analysis

- UAE Data Center Market Hotspot & Opportunities

- UAE Data Center Market Key Strategic Imperatives for Success & Growth

- UAE Data Center Market Analysis, 2016-2026F

- Market Size and Analysis

- By Revenue

- Market Share and Analysis

- By IT Infrastructure

- Servers

- E-mail servers

- Proxy Servers

- DNS Servers

- Storage

- Central SAN (Storage Area Network)

- DAS (Direct Attached Storage)

- NAS (Network Attached Storage)

- Network

- Routers

- Firewalls

- Servers

- By Electrical and Mechanical Infrastructure

- Cabling

- Uninterrupted Power Supplies

- Cooling Systems

- Others (Rack PDU, Switchgears, etc.,)

- By Type

- Enterprise Data Centers

- Colocation Data Centers

- Cloud Data Centers

- Edge Data Centers

- By Tier Standards

- Basic site infrastructure (Tier I)

- Redundant-capacity component site infrastructure (Tier II)

- Concurrently maintainable site infrastructure (Tier III)

- Fault-tolerant site infrastructure (Tier IV)

- By End Users

- Banking, Financial Services, & Insurance

- Telecommunication & IT

- Government

- Energy & Utility

- Health Care

- Others (Retail, Hospitality, Entertainment, & Media)

- By Region

- Dubai

- Abu Dhabi

- Sharjah & Northern Emirates

- By Company

- Competition Characteristics

- Market Share and Analysis

- By IT Infrastructure

- Market Size and Analysis

- Competition Outlook

- Competition Matrix

- Product Portfolio

- Target Markets

- Target End Users

- Manufacturing Units

- Research & Development

- Strategic Alliances

- Strategic Initiatives

- Company Profiles (Business Description, Product Offering, Business Segments, Financials, Strategic Alliances or Partnerships, Future Plans)

- Khazna

- Etisalat

- Equinix

- Oracle

- Alibaba Cloud

- Microsoft Azure

- IBM

- Amazon Web Services

- MBUZZ

- Cisco

- Competition Matrix

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making