Thailand Diesel Generator Market Research Report: Forecast (2023-2028)

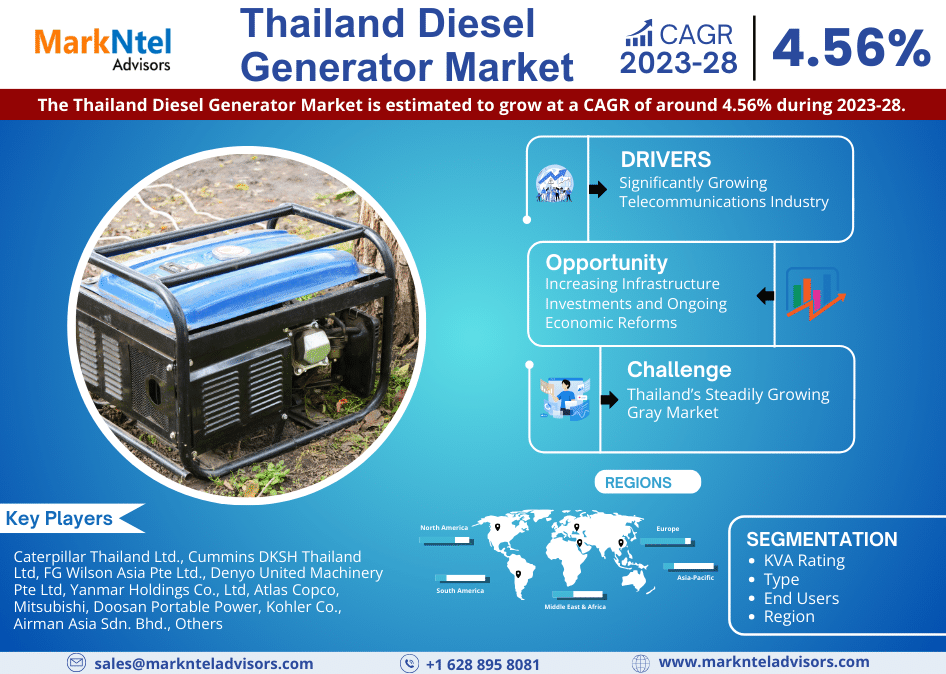

By KVA Rating (Up to 75KVA, 75.1 KVA to 375 KVA, 375.1 to 750 KVA, 750.1 KVA to 1000 KVA, Above 1000 KVA), By Type (Stand By, Prime & Continuous Power, Peak Shaving), By End Users ...(Residential Commercial (Hospitality, Retail, Educational Institutions, etc.), Healthcare, Government & Transport, Industrial (Manufacturing Facilities, Assembly Units, etc.), Equipment Rental Companies)), By Region (Midwest, Northeast, South, West), By Company (Caterpillar Thailand Ltd., Cummins DKSH Thailand Ltd, FG Wilson Asia Pte Ltd., Denyo United Machinery Pte Ltd, Yanmar Holdings Co., Ltd, Atlas Copco, Mitsubishi, Doosan Portable Power, Kohler Co., Airman Asia Sdn. Bhd., Others). Read more

- Energy

- Aug 2023

- Pages 108

- Report Format: PDF, Excel, PPT

Market Insights & Projections: Thailand Diesel Generator Market (2023-28):

The Thailand Diesel Generator Market is estimated to grow at a CAGR of around 4.56% during the forecast period, i.e., 2023-28. The growth is attributed to the ever-growing electricity consumption, the rising number of data centers, the flourishing commercial sector, and the increasing number of residential societies. The mounting electricity demand in Thailand owes to the increasing consumption rates within industrial, household, & business sectors, backed by extreme weather conditions, increased economic activities, and the high use of cooling appliances.

According to the Energy Regulatory Commission (ERC), Thailand is causing an upsurge in electricity consumption, which led to a record high of around 34,826.5 megawatts in 2023. As a result, rising temperatures and peak load periods pose challenges in meeting the high electricity demand, putting strain on the grid infrastructure and increasing the risk of blackouts or power failures. Hence, in order to ensure a stable & uninterrupted power supply, businesses, industries, & even households are turning to diesel generators as reliable backup power solutions, thereby driving the market.

| Report Coverage | Details |

|---|---|

| Study Period | Historical Data: 2018-21 |

| Base Year: 2022 | |

| Forecast Period: 2023-28 | |

| CAGR(2023-28) | 4.56% |

| Region Covered | Midwest, Northeast, South, West |

| Key Companies Profiled | Caterpillar Thailand Ltd., Cummins DKSH Thailand Ltd, FG Wilson Asia Pte Ltd., Denyo United Machinery Pte Ltd, Yanmar Holdings Co., Ltd, Atlas Copco, Mitsubishi, Doosan Portable Power, Kohler Co., Airman Asia Sdn. Bhd., Others |

| Unit Denominations | USD Million/Billion |

Furthermore, Thailand has been witnessing significant growth in the number of data centers, owing to the rapidly growing digital economy of the country and the mounting dependency on cloud computing & other online services. The majority of these users also engage in social media, spending a daily average of roughly three hours on these platforms. Additionally, the BOI (Board of Investment) promotion scheme is significant, which offers a range of tax incentives & other benefits to companies investing in data centers in Thailand. As a result, several major players, like STT GDC, TCC Technology Group, CAT Telecom, etc., in the industry are investing heavily in the country.

- In 2022, AWS announced its plan to invest USD5 billion in the next 15 years to expand its cloud service capacity in Thailand.

Hence, growing investments in data centers are set to accelerate the demand for diesel generators in the forthcoming years. Moreover, the country's commercial sector is experiencing significant growth due to several factors, including the country's economic recovery, increasing government focus on economic development as well as promoting industrial development & infrastructure projects in the Eastern Economic Corridor (EEC). The growth in the export of goods and the expansion of investments, particularly in the EEC, are likely to create new business opportunities and boost commercial activities in the country, spurring growth in the diesel generators market over the coming years.

Thailand Diesel Generator Market Driver

Significantly Growing Telecommunications Industry: The growth of the telecommunications sector in Thailand due to the rapid deployment of 5G networks, rising demand fix broadband services, and increasing popularity of OTT services has pushed the need for a reliable power supply. As a result, the key telecom companies in the country like AIS, DTAC, TrueMove, etc., are increasingly deploying 5G networks to cater to varied customer requirements, subsequently supporting the government's action plan for promoting the adoption of 5G Technology to boost the country's economy in the coming years. This is resulting in the ever-increasing construction of telecom towers in the country and thus elevating the demand for diesel generators as power backups.

Moreover, Thailand's commitment to embracing IoT & smart city applications under its Thailand 4.0 policy is propelling the transformation of urban centers into smart & sustainable cities. The initiative aims to establish the country as a well-developed digital hub in Southeast Asia. Smart cities are a core pillar of this policy, focused on enhancing the digital capacity of city management. In order to realize this vision, the country is developing smart blocks in municipalities like Chiang Mai, Nakhon Sawan, and Udon City, equipped with "smart poles" embedded with IoT sensors for data collection, in which a robust telecom infrastructure, including telecom towers, is crucial for connecting various devices, sensors, & systems. Hence, as the number of smart cities increases, the need for telecom infrastructure, and consequently diesel generators, is expected to rise in the forecast period.

Thailand Diesel Generator Market Opportunity

Increasing Infrastructure Investments and Ongoing Economic Reforms: The government of Thailand launched Eastern Economic Corridor (EEC) in 2019 to push the country's industrialization by modernizing infrastructures like rail, air, land, & rail network and improving the country's connectivity with Cambodia, Laos, Vietnam, etc. The government has started the bidding on several projects, and some are close to being awarded to the bidders.

- In 2023, the government of Thailand announced its plan to invest USD 40.5 billion in transforming the Eastern Economic Corridor (EEC) into a regional financial hub and a world-class smart city by 2037.

As a result of these growing investments by the government, the demand for diesel generators in various sectors, including construction, transportation, manufacturing, & commercial establishments, is set to surge notably in the coming years. Moreover, the BRI (Belt and Road Initiative) that aims to enhance connectivity between Thailand and its neighboring countries shall further result in market growth for diesel generators. For instance, in 2021, as part of BRI, China & Thailand signed the China-Thailand railway project. Thailand's strategic location in Southeast Asia, bordered by Myanmar, Laos, Cambodia, Malaysia, & the Gulf of Thailand, already positions it as a significant trade hub in the region. With the BRI's expected improvement in connectivity, trade activities are likely to increase and, consequently, create the demand for diesel generators during the forecast period.

Thailand Diesel Generator Market Challenge

Thailand’s Steadily Growing Gray Market: The prevalence of unauthorized gray market products, which are imported & distributed without proper authorization, has been a noteworthy concern in Thailand. These products enter the market through channels that bypass official distribution networks and are sold at prices lower than products distributed through authorized channels, leading to issues related to quality & safety, as well as regulatory compliance and, consequently, posing a significant challenge for the legitimate players in the diesel generator market to offer their systems in the country. As gray market products lack official manufacturer support, customers might face difficulties in obtaining warranty services, technical assistance, and genuine replacement parts. Some of these differences could affect the safe operation of the equipment, thereby hampering the market growth.

Thailand Diesel Generator Market Trend

Rising Prevalence for Digitally-Controlled Diesel Generators: Digital control systems in diesel generators, such as TPEM (Total Plant Energy Management) systems, control panels, & automatic remotes, are gaining traction among residential, commercial, & industrial customers. This is due to their ability to enable consumers to monitor, manage, & enhance generator operations, resulting in optimized performance and low maintenance costs. Along with this, customers can even monitor running hours, temperature, and coolant & fuel levels by incorporating digitally controlled diesel generators, leading to a better user experience. Prominent manufacturers like Cummins, Caterpillar, & MHI, are joining forces with IoT companies like Tomoni, Elevat, Gmmco, etc., for integrating advanced digital control systems into their diesel generators, allowing users to conveniently monitor & manage their diesel generators through mobile phones. This aspect is projected to accelerate the overall growth of the diesel generator market in Thailand over the coming years.

Thailand Diesel Generator Market (2023-28): Segmentation Analysis

Thailand Diesel Generator Market study of MarkNtel Advisors evaluates & highlights the major trends & influencing factors in each segment & includes predictions for the period 2023–2028 at the global, regional, and national levels. Based on the analysis, the market has been further classified as:

Based on Type:

- Standby

- Prime & Continues Power

- Peak Shaving

Here, standby diesel generators hold a major market share, owing to the growing infrastructure projects, coupled with rising FDI investments across the country. As Thailand continues to attract foreign investments in its infrastructure developments, there is a growing need for dependable backup power in various projects & construction sites, driving the demand for standby diesel generators that offer a reliable & cost-effective solution for providing temporary power in such scenarios. According to the UNESCAP, Thailand recorded an average annual FDI inflow growth of around 45.5% from 2017 to 2021, which was higher than the Asia-Pacific's 3.8% average annual FDI inflow growth.

- In 2023, Department of Business Development (DBD) announced 274 foreign investors were granted permission under the Foreign Business Act to set up in Thailand from January to May.

As a result of these growing FDI investments, the country is witnessing the increasing number of mega infrastructure projects associated with oil well control, electrical system design for trains, etc., creating the demand for standby diesel generators in various projects & construction sites in the country.

Based on End User:

- Residential

- Commercial (Hospitality, Retail, Educational Institutions, etc.)

- Healthcare

- Government & Transport

- Industrial (Manufacturing Facilities, Assembly Units, etc.)

- Equipment Rental Companies

Here, the commercial sector is projected to acquire the major market share in the coming years, owing to the rapidly growing number of retail spaces and the booming tourism industry. According to the World Bank Thailand's economy is projected to accelerate to around 3.9 percent in 2023 from 2.6 percent last year, backed by stronger-than-expected economic growth, i.e., encouraging retailers in the country to expand their operations, open new stores, or upgrade existing ones in order to cater to ever-evolving consumer requirements. As a result, the country is witnessing various ongoing construction projects associated with commercial areas, shopping malls, & high-traffic locations, creating the demand for diesel generators to ensure uninterrupted power supply for construction activities.

- In 2022, Thailand's Central Retail Corporation Pcl (CRC) announced it plans to invest baht USD3.03 billion over the next five years to expand its retail businesses in the country and other Southeast Asian Countries.

Thailand Diesel Generator Industry Recent Development:

- In 2023, Caterpillar Inc., announced the introduction of the Cat XQ330 mobile diesel generator set, a new power solution for standby and prime power applications that meets U.S. EPA Tier 4 Final emission standard.

Gain a Competitive Edge with Our Thailand Diesel Generator Market Report

- Thailand Diesel Generator Market Report by Markntel Advisors provides a detailed & thorough analysis of market size, growth rate, competitive landscape, and key players. This comprehensive analysis helps businesses gain a holistic understanding of the market dynamics & make informed decisions.

- This report also highlights current market trends & future projections, allowing businesses to identify emerging opportunities & potential challenges. By understanding market forecasts, companies can align their strategies & stay ahead of the competition.

- Thailand Diesel Generator Market Report aids in assessing & mitigating risks associated with entering or operating in the market. By understanding market dynamics, regulatory frameworks, and potential challenges, businesses can develop strategies to minimize risks & optimize their operations.

Frequently Asked Questions

- Market Segmentation

- Introduction

- Product Definition

- Research Process

- Assumptions

- Executive Summary

- Macroeconomic Outlook

- Thailand Power Industry Outlook, 2022

- Total Installed Power Generating Capacity in MW

- Government Initiatives to Increase Power Generation Capacity by 2040

- Three Main Themes for Energy in Thailand

- Power Trade Hub of Southeast Asia

- Regional LNG Trading Hub

- Energy for all Sectors

- Thailand Diesel Generator Market Supply Chain Analysis

- Thailand Diesel Generator Market Trends & Development

- Thailand Diesel Generator Market Dynamics

- Drivers

- Challenges

- Thailand Diesel Generator Market Growth Opportunities & Hotspots

- Thailand Diesel Generator Market Policy & Regulations

- Thailand Diesel Generator Market Outlook, 2018-2028

- Market Size & Outlook

- Revenues (USD Million)

- Units Sold (Thousands)

- Market Share & Outlook

- By KVA Rating

- Up to 75KVA- Market Size & Forecast 2018-2028, (Units Sold)

- 75.1 KVA to 375 KVA- Market Size & Forecast 2018-2028, (Units Sold)

- 375.1 to 750 KVA- Market Size & Forecast 2018-2028, (Units Sold)

- 750.1 KVA to 1000 KVA- Market Size & Forecast 2018-2028, (Units Sold)

- Above 1000 KVA- Market Size & Forecast 2018-2028, (Units Sold)

- By Type

- Stand By- Market Size & Forecast 2018-2028, (Units Sold)

- Prime & Continuous Power- Market Size & Forecast 2018-2028, (Units Sold)

- Peak Shaving- Market Size & Forecast 2018-2028, (Units Sold)

- By End Users

- Residential- Market Size & Forecast 2018-2028, (Units Sold)

- Commercial (Hospitality, Retail, Educational Institutions, etc.) - Market Size & Forecast 2018-2028, (Units Sold)

- Healthcare- Market Size & Forecast 2018-2028, (Units Sold)

- Government & Transport- Market Size & Forecast 2018-2028, (Units Sold)

- Industrial (Manufacturing Facilities, Assembly Units, etc.) - Market Size & Forecast 2018-2028, (Units Sold)

- Equipment Rental Companies- Market Size & Forecast 2018-2028, (Units Sold)

- By Region

- Midwest

- Northeast

- South

- West

- By Company

- Market Share & Analysis

- Competition Characteristics

- By KVA Rating

- Market Size & Outlook

- Up to 75KVA Diesel Generator Market Outlook, 2018-2028

- Market Size & Outlook

- Revenues (USD Million)

- Units Sold (Thousands)

- Market Share & Outlook

- By Type- Market Size & Forecast 2018-2028, (Units Sold)

- By End Users- Market Size & Forecast 2018-2028, (Units Sold)

- By Company- Market Size & Forecast 2018-2028, (Units Sold)

- Market Size & Outlook

- 75.1 KVA to 375KVA Diesel Generator Market Outlook, 2018-2028

- Market Size & Outlook

- Revenues (USD Million)

- Units Sold (Thousands)

- Market Share & Outlook

- By Type- Market Size & Forecast 2018-2028, (Units Sold)

- By End Users- Market Size & Forecast 2018-2028, (Units Sold)

- By Company- Market Size & Forecast 2018-2028, (Units Sold)

- Market Size & Outlook

- 375.1 KVA to 750KVA Diesel Generator Market Outlook, 2018-2028

- Market Size & Outlook

- Revenues (USD Million)

- Units Sold (Thousands)

- Market Share & Outlook

- By Type- Market Size & Forecast 2018-2028, (Units Sold)

- By End Users- Market Size & Forecast 2018-2028, (Units Sold)

- By Company- Market Size & Forecast 2018-2028, (Units Sold)

- Market Size & Outlook

- 750.1 KVA to 1,000 KVA Diesel Generator Market Outlook, 2018-2028

- Market Size & Outlook

- Revenues (USD Million)

- Units Sold (Thousands)

- Market Share & Outlook

- By Type- Market Size & Forecast 2018-2028, (Units Sold)

- By End Users- Market Size & Forecast 2018-2028, (Units Sold)

- By Company- Market Size & Forecast 2018-2028, (Units Sold)

- Market Size & Outlook

- Above 1000 KVA Diesel Generator Market Outlook, 2018-2028

- Market Size & Outlook

- Revenues (USD Million)

- Units Sold (Thousands)

- Market Share & Outlook

- By Type- Market Size & Forecast 2018-2028, (Units Sold)

- By End Users- Market Size & Forecast 2018-2028, (Units Sold)

- By Company- Market Size & Forecast 2018-2028, (Units Sold)

- Market Size & Outlook

- Thailand Diesel Generator Market Key Strategic Imperatives for Growth & Success

- Competitive Benchmarking

- Company Profiles

- Caterpillar Thailand Ltd.

- Business Description

- Facility Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Cummins DKSH Thailand Ltd

- Business Description

- Facility Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- FG Wilson Asia Pte Ltd.

- Business Description

- Facility Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Denyo United Machinery Pte Ltd

- Business Description

- Facility Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Yanmar Holdings Co., Ltd

- Business Description

- Facility Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Atlas Copco

- Business Description

- Facility Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Mitsubishi

- Business Description

- Facility Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Doosan Portable Power

- Business Description

- Facility Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Kohler Co.

- Business Description

- Facility Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Airman Asia Sdn. Bhd.

- Business Description

- Facility Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Others

- Caterpillar Thailand Ltd.

- Company Profiles

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making