Global Static Equipment Market Research Report: Forecast (2024-2030)

Static Equipment Market Report - By Type of Equipment (Heat Exchangers, Valves, Boilers, Furnaces, Others), By Industry Oil & Gas, [By Application, Upstream, Midstream, Downstream]..., By Location [Onshore, Offshore], Power, Chemicals, Others), By Companies (Competition Characteristics, Market Share), and Others Read more

- Energy

- Oct 2024

- Pages 201

- Report Format: PDF, Excel, PPT

Market Definition

Static equipment is one of the essential components of industries, especially the oil and gas industry. The equipment comprises no moving parts and usually does not have a redundant/standby system. The components primarily include heat exchangers (shell and tubes, plate and frame, air coolers) and pressure vessels (drums, columns, reactors, filters). To assure the safety requirements and commercial competitiveness, the reliability and quality of this equipment are crucial.

Market Insights & Analysis: Static Equipment Market (2024-30)

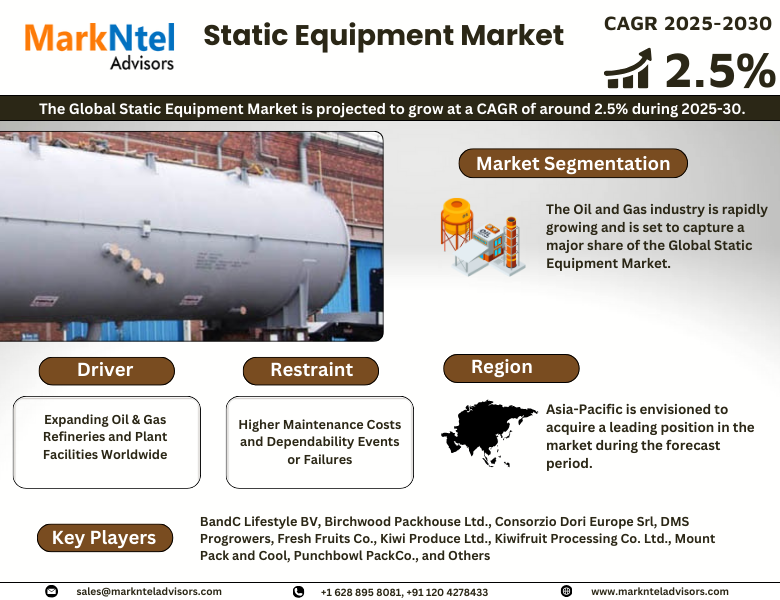

The Global Static Equipment Market is projected to grow at a CAGR of around 2.5% during the forecast period, i.e., 2024-30. The market for equipment has witnessed a swift upsurge since the onset of the industrial revolution as the industrial sector has been backing economic prosperity for ages. As per the World Bank analysis, the manufacturing industry added around 17.01% of value to the global economy in 2021. The steady growth in the number of manufactured products, along with the substantial presence of the industrial sector, has significantly encouraged the need for industrial equipment worldwide.

| Report Coverage | Details |

|---|---|

| Historical Years | 2019-22 |

|

Base Years

|

2023

|

|

Forecast Years

|

2024-30

|

| CAGR (2024-30) | 2.5% |

| Top Key Players | Technip, Alfa Laval, Atlas Copco, General Electric, Siemens AG, Metso Oyj, Sulzer Ltd, Pentair Plc, Flowserve Corporation, Wartsila Oyj, OAO TMK, Doosan Group, Mitsubishi Heavy Industries, Others. |

| Key Report Highlights |

|

*Boost strategic growth with in-depth market analysis - Get a free sample preview today!

As such, static industrial equipment such as heat exchangers, boilers, valves, and furnaces have witnessed wide adoption in industrial establishments over the few years. These types of equipment aid industries in achieving and enhancing their operational targets. Since they demonstrate direct co-relation with industries, their growth pattern is likely to imitate those of industries such as oil & gas, power, chemicals, food, beverages, and others.

Moreover, with industries remaining the spine of economically developed countries such as the United States, China, Japan, and others, the market for static equipment is anticipated to fly high in the forecast period. As per the United Nations Statistics Division (UNSD), the value added by the manufacturing industry to the GDP of the United States, Japan, and Germany amounted to USD 2,272 billion, USD 1.033.6 billion, and USD 697.3 billion, respectively. Besides, several governments coming up with favorable industrial regulations again paves the way for more notable investment, which, in turn, stimulates market growth in the coming years.

Static Equipment Market Key Driver:

Expanding Oil & Gas Refineries and Plant Facilities Worldwide - The rising global burden and migrating population from rural to urban areas have put forth the need for more energy resources in almost every application sector. Since renewable resources are in their crawling stage, the dependency for energy and power generation is still on oil and gas, which is why the procurement of static equipment has become crucial. This is likely to boost the global demand for static equipment to even higher levels during the forecast period.

Static Equipment Market Possible Restraint:

Higher Maintenance Costs and Dependability Events or Failures - Due to the sheer number of equipment parts and quantity of stored fluid, the risks related to fixed equipment are higher than those of other equipment types. In a typical refinery or petrochemical facility, fixed equipment accounts for a sizable share of the capital/maintenance costs and dependability events or failures. A sizable portion of business accidents regarding property damage or injury has also involved static equipment. Further, since fixed equipment does not have complex sensors to monitor for corrosion and deterioration in real time, they require frequent inspection and a reliability plan.

Static Equipment Market (2024-30): Segmentation Analysis

The Static Equipment Market study of MarkNtel Advisors evaluates & highlights the major trends and influencing factors in each segment. It includes predictions for the period 2024–2030 at the national level. Based on the analysis, the market has been further classified as:

Based on Industry

- Oil & Gas

- By Location

- Onshore

- Offshore

- By Application

- Upstream

- Midstream

- Downstream

- By Location

- Power

- Chemicals

- Others

Here, the Oil and Gas industry has rapidly gained traction worldwide in recent years and is projected to acquire a sizeable share of the Global Static Equipment Market during the forecast period. The credit for its growth primarily goes to the technological advancements in exploration and refining equipment that have prompted oil & gas companies to execute in-depth exploration and production activities, and that too under severe climatic conditions. Besides, the unexplored areas with vast reserves of natural gas or crude oil again curate the way for more operating refineries and plants, thereby necessitating the need for these equipment in the oil and gas industry.

Based on Type of Equipment

- Heat Exchangers

- Valves

- Boilers

- Furnaces

- Others

Of them all, the Heat exchanger has gained maximum popularity and is likely to maintain its dominance in the market during the projected time frame. The popularity can be attributed to the wide adoption of static equipment, particularly heat exchangers, in downstream activities. With that said, the heat exchanger is utilized in the distillation and separation process to regulate the energy input. The most used type of valve is the blow-off valve to control the pressure, the gate valve, the plug valve, and the check valve to monitor the transmission. Generally, water tube boilers, horizontal furnace tubes, and process heaters form the component in refineries.

Static Equipment Market Regional Projection

Geographically, the Global Static Equipment Market expands across:

- North America

- South America

- Europe

- Middle East & Africa

- Asia-Pacific

Here, Asia-Pacific is envisioned to acquire a leading position in the market during the forecast period. It primarily attributes to vast population, favorable government regulations, and the availability of low-cost labor enticing global players to set up their base across the region. As such global players like Atlas Copco, Siemens AG, Metso Oyj, and Sulzer Ltd have already set their eyes on countries like India, China, Taiwan, etc. For instance,

According to the Department for Promotion of Industry and Internal Trade (DPIIT), the total foreign direct investment (FDI) obtained by India in the financial years 2021-22 amounted to USD 83.57 billion. The FDI received by the drug and pharmaceutical industry amounted to USD 19.41 billion, the automotive industry received USD 32.84 billion, and the chemical manufacturing sector received USD 19.45 billion. Likewise, in September 2022, The Malaysian Investment Development Authority (MIDA) revealed that the government has enticed approved investment worth USD 27.5 billion in its manufacturing, services, and primary sectors in the first half of 2022.

Static Equipment Industry Recent Developments

July 2022 - Alfa Laval, in partnership with a global Swedish steel company SSAB, seeks to develop and commercialize the world’s first heat exchanger based on fossil-free steel. In this regard, the company expects its first hydrogen-reduced steel unit by 2023. The partnership shall bring Alfa Laval one step closer to achieving carbon neutrality by 2030.

March 2022 - AVK Group unveiled a new line of premium 100 gate valves. The valves make a perfect fit for places where longer shelf life is required while ensuring safety and also where the excavation is unattainable. These places might include public and tourist attractions, busy roads, coastal areas, or areas contaminated with oil or gasoline.

Gain a Competitive Edge with Our Static Equipment Market Report

- Static Equipment Market Report by Markntel Advisors provides a detailed & thorough analysis of market size, growth rate, competitive landscape, and key players. This comprehensive analysis helps businesses gain a holistic understanding of market dynamics & make informed decisions.

- This report also highlights current market trends & future projections, allowing businesses to identify emerging opportunities & potential challenges. By understanding market forecasts, companies can align their strategies & stay ahead of the competition.

- Static Equipment Market Report aids in assessing & mitigating risks associated with entering or operating in the market. By understanding market dynamics, regulatory frameworks, and potential challenges, businesses can develop strategies to minimize risks & optimize their operations.

*Reports Delivery Format - Market research studies from MarkNtel Advisors are offered in PDF, Excel and PowerPoint formats. Within 24 hours of the payment being successfully received, the report will be sent to your email address.

Frequently Asked Questions

- Market Segmentation

- Introduction

- Product Definition

- Research Process

- Assumptions

- Executive Summary

- Global Static Equipment Market Trends & Development

- Global Static Equipment Market Dynamics

- Drivers

- Challenges

- Global Static Equipment Market Regulations & Policies

- Global Static Equipment Market Supply Chain Analysis

- Global Static Equipment Market Hotspots & Opportunities

- Global Static Equipment Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Segmentation & Analysis

- By Type of Equipment

- Heat Exchangers- Market Size & Forecast 2019-2030, USD Million

- Valves- Market Size & Forecast 2019-2030, USD Million

- Boilers- Market Size & Forecast 2019-2030, USD Million

- Furnaces- Market Size & Forecast 2019-2030, USD Million

- Others- Market Size & Forecast 2019-2030, USD Million

- By Industry

- Oil & Gas- Market Size & Forecast 2019-2030, USD Million

- By Application- Market Size & Forecast 2019-2030, USD Million

- Upstream- Market Size & Forecast 2019-2030, USD Million

- Midstream- Market Size & Forecast 2019-2030, USD Million

- Downstream- Market Size & Forecast 2019-2030, USD Million

- By Location- Market Size & Forecast 2019-2030, USD Million

- Onshore- Market Size & Forecast 2019-2030, USD Million

- Offshore- Market Size & Forecast 2019-2030, USD Million

- By Application- Market Size & Forecast 2019-2030, USD Million

- Power- Market Size & Forecast 2019-2030, USD Million

- Chemicals- Market Size & Forecast 2019-2030, USD Million

- Others- Market Size & Forecast 2019-2030, USD Million

- Oil & Gas- Market Size & Forecast 2019-2030, USD Million

- By Companies

- Competition Characteristics

- Market Share

- By Region

- North America

- South America

- Europe

- Middle East & Africa

- Asia Pacific

- By Type of Equipment

- Market Size & Analysis

- North America Static Equipment Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Segmentation & Analysis

- By Type of Equipment- Market Size & Forecast 2019-2030, USD Million

- By Industry- Market Size & Forecast 2019-2030, USD Million

- By Country

- The United States

- Canada

- The United States Static Equipment Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Segmentation & Analysis

- By Type of Equipment- Market Size & Forecast 2019-2030, USD Million

- By Industry- Market Size & Forecast 2019-2030, USD Million

- Market Size & Analysis

- Canada Static Equipment Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Segmentation & Analysis

- By Type of Equipment- Market Size & Forecast 2019-2030, USD Million

- By Industry- Market Size & Forecast 2019-2030, USD Million

- Market Size & Analysis

- Market Size & Analysis

- South America Static Equipment Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Segmentation & Analysis

- By Type of Equipment- Market Size & Forecast 2019-2030, USD Million

- By Industry- Market Size & Forecast 2019-2030, USD Million

- By Country

- Brazil

- Argentina

- Rest of South America

- Brazil Static Equipment Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Segmentation & Analysis

- By Type of Equipment- Market Size & Forecast 2019-2030, USD Million

- By Industry- Market Size & Forecast 2019-2030, USD Million

- Market Size & Analysis

- Argentina Static Equipment Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Segmentation & Analysis

- By Type of Equipment- Market Size & Forecast 2019-2030, USD Million

- By Industry- Market Size & Forecast 2019-2030, USD Million

- Market Size & Analysis

- Market Size & Analysis

- Europe Static Equipment Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Segmentation & Analysis

- By Type of Equipment- Market Size & Forecast 2019-2030, USD Million

- By Industry- Market Size & Forecast 2019-2030, USD Million

- By Country

- Germany

- France

- The UK

- Italy

- Norway

- Rest of Europe

- Germany Static Equipment Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Segmentation & Analysis

- By Type of Equipment- Market Size & Forecast 2019-2030, USD Million

- By Industry- Market Size & Forecast 2019-2030, USD Million

- Market Size & Analysis

- France Static Equipment Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Segmentation & Analysis

- By Type of Equipment- Market Size & Forecast 2019-2030, USD Million

- By Industry- Market Size & Forecast 2019-2030, USD Million

- Market Size & Analysis

- The UK Static Equipment Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Segmentation & Analysis

- By Type of Equipment- Market Size & Forecast 2019-2030, USD Million

- By Industry- Market Size & Forecast 2019-2030, USD Million

- Market Size & Analysis

- Italy Static Equipment Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Segmentation & Analysis

- By Type of Equipment- Market Size & Forecast 2019-2030, USD Million

- By Industry- Market Size & Forecast 2019-2030, USD Million

- Market Size & Analysis

- Norway Static Equipment Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Segmentation & Analysis

- By Type of Equipment- Market Size & Forecast 2019-2030, USD Million

- By Industry- Market Size & Forecast 2019-2030, USD Million

- Market Size & Analysis

- Market Size & Analysis

- Middle East & Africa Static Equipment Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Segmentation & Analysis

- By Type of Equipment- Market Size & Forecast 2019-2030, USD Million

- By Industry- Market Size & Forecast 2019-2030, USD Million

- By Country

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of Middle East & Africa

- Saudi Arabia Static Equipment Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Segmentation & Analysis

- By Type of Equipment- Market Size & Forecast 2019-2030, USD Million

- By Industry- Market Size & Forecast 2019-2030, USD Million

- Market Size & Analysis

- UAE Static Equipment Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Segmentation & Analysis

- By Type of Equipment- Market Size & Forecast 2019-2030, USD Million

- By Industry- Market Size & Forecast 2019-2030, USD Million

- Market Size & Analysis

- Egypt Static Equipment Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Segmentation & Analysis

- By Type of Equipment- Market Size & Forecast 2019-2030, USD Million

- By Industry- Market Size & Forecast 2019-2030, USD Million

- Market Size & Analysis

- South Africa Static Equipment Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Segmentation & Analysis

- By Type of Equipment- Market Size & Forecast 2019-2030, USD Million

- By Industry- Market Size & Forecast 2019-2030, USD Million

- Market Size & Analysis

- Market Size & Analysis

- Asia Pacific Static Equipment Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Segmentation & Analysis

- By Type of Equipment- Market Size & Forecast 2019-2030, USD Million

- By Industry- Market Size & Forecast 2019-2030, USD Million

- By Country

- China

- India

- Japan

- Australia

- South Korea

- Rest of Asia Pacific

- China Static Equipment Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Segmentation & Analysis

- By Type of Equipment- Market Size & Forecast 2019-2030, USD Million

- By Industry- Market Size & Forecast 2019-2030, USD Million

- Market Size & Analysis

- India Static Equipment Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Segmentation & Analysis

- By Type of Equipment- Market Size & Forecast 2019-2030, USD Million

- By Industry- Market Size & Forecast 2019-2030, USD Million

- Market Size & Analysis

- Japan Static Equipment Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Segmentation & Analysis

- By Type of Equipment- Market Size & Forecast 2019-2030, USD Million

- By Industry- Market Size & Forecast 2019-2030, USD Million

- Market Size & Analysis

- Australia Static Equipment Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Segmentation & Analysis

- By Type of Equipment- Market Size & Forecast 2019-2030, USD Million

- By Industry- Market Size & Forecast 2019-2030, USD Million

- Market Size & Analysis

- South Korea Static Equipment Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Segmentation & Analysis

- By Type of Equipment- Market Size & Forecast 2019-2030, USD Million

- By Industry- Market Size & Forecast 2019-2030, USD Million

- Market Size & Analysis

- Market Size & Analysis

- Global Static Equipment Market Key Strategic Imperatives for Growth & Success

- Competitive Outlook

- Company Profiles

- Technip

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Alfa Laval

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Atlas Copco

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- General Electric

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Siemens AG

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Metso Oyj

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Sulzer Ltd

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Pentair Plc

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Flowserve Corporation

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Wartsila Oyj

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- OAO TMK

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Doosan Group

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Mitsubishi Heavy Industries

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Others

- Technip

- Company Profiles

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making