Saudi Arabia Electronic Security Market Research Report: Forecast (2023-2028)

By Component (By Hardware (Video Surveillance Security System, Cameras, Analog Cameras, IP Cameras, Thermal Cameras), LCD & LED Monitors, Storage Devices (Digital video recorder (D...VR), Network video recorder (NVR), Direct-attached storage devices, Network-attached storage devices, Others (Hybrid video recorders, IP storage area network, etc.)), Others (Networking Equipment, Video Decoders & Encoders, etc.), Fire Detection & Alarming System (Alarm Panels & Intrusion Detectors, Gas & Flame Detectors, Security Radars, Others (Emergency Alarms, Bells, Voice Alarm Evacuation System, etc.)), Access Control & Attendance System (Card Readers, Electrical Locks, Biometric Readers (Fingerprint Terminals, Face Recognition Terminals, etc.)), Others (Controllers, Keypads, etc.)), Intelligent Systems (Motion Detection Systems, People Counters Others (Audio & Video Aler,t Systems, License Plate Readers, etc.)), Others (Anti-Theft Systems, Scanning & Inspection Equipment, etc.), By Software (Video Management Software, Video Surveillance as a Service (VSaaS), Data Management Software, Analytics Software), By Services (Training & Consulting, Installation & Integration, Maintenance & Support), By Deployment Mode (On-premise, Cloud, Hybrid), By End-User (Commercial, BFSI, Aviation, Oil & Gas, Healthcare, Hospitality, Retail & Commerce, IT & Telecom, Others (Transportation & Logistics, Prisons & Rehabilitation Centres, etc.)), By Region (Central, East, West, South), By Company (Axis Communications FZE, Hikvision FZE, Honeywell Security, Dahua Technology Middle East FZE, Sony Gulf FZE Limited, Avigilon Corporation, Pelco by Schneider Electric, Hanwha Techwin, IDIS Middle East, FLIR Systems, Middle East FZE, Others (AEcom Group, VIVOTEK Inc., etc.) Read more

- ICT & Electronics

- Apr 2023

- Pages 93

- Report Format: PDF, Excel, PPT

Market Definition

Electronic security comprises any electronic system that can perform security operations like surveillance, alarm, access control, or intrusion control in a facility to keep employees & enterprises safe from physical threats. These systems are utilized extensively within corporate spaces, commercial places, shopping centers, hotels, airports, and railway stations, among other public places.

Market Insights & Analysis: Saudi Arabia Electronic Security Market (2023-28)

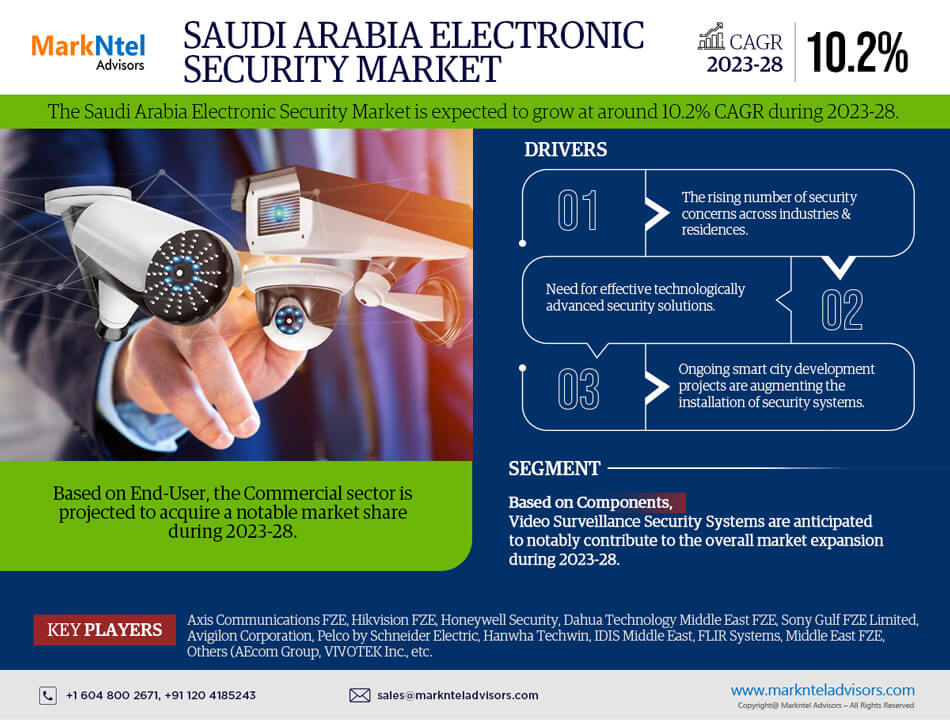

The Saudi Arabia Electronic Security Market is expected to grow at around 10.2% CAGR during the forecast period, i.e., 2023-28. Most of the market expansion would be driven by the ever-increasing need for technologically advanced security solutions in the country in order to effectively tackle the rising number of threats from adversaries, illegal migration, & smuggling, coupled with the growing awareness among several end-users about the importance of high-end security across facilities, and the rising availability of security systems at low prices.

| Report Coverage | Details |

|---|---|

| Study Period | Historical Data: 2018-21 |

| Base Year: 2022 | |

| Forecast Period: 2023-28 | |

| CAGR (2023-2028) | 10.2% |

| Region Covered | Central,East,West,South |

| Key Companies Profiled | Axis Communications FZE, Hikvision FZE, Honeywell Security, Dahua Technology Middle East FZE, Sony Gulf FZE Limited, Avigilon Corporation, Pelco by Schneider Electric, Hanwha Techwin, IDIS Middle East, FLIR Systems, Middle East FZE, Others (AEcom Group, VIVOTEK Inc., etc. |

| Unit Denominations | USD Million/Billion |

Besides, various ongoing smart city development projects due to increasing urbanization are also augmenting the installations of video surveillance, access control, and other security systems for efficient & accurate monitoring of places. Technological innovations and increased government focus on infrastructure developments are resulting in the ever-evolving demand for electronic security equipment across the country. Additionally, digitalization trends across industries and increasing integration of the Blockchain, Internet of Things (IoT), and Artificial Intelligence technologies in security operations are further aiding in the market expansion.

Airports, railways, roads, ports, & land border checkpoints, the most prominent security concern owing to their critical importance to tourism, trade, & commerce, are other major driving forces for the market. Their affinity with other sectors like manufacturing, transportation, and energy production is creating lucrative prospects for the leading companies in the Saudi Arabia Electronic Security Market to bring innovations in their product offerings and improve the country's security measures over the coming years.

Market Segmentation

Based on Component:

- Hardware

- Video Surveillance Security System

- Cameras

- LCD & LED Monitors

- Storage Devices

- Others (Networking Equipment, Video Decoders & Encoders, etc.)

- Fire Detection & Alarming System

- Alarm Panels & Intrusion Detectors

- Gas & Flame Detectors

- Security Radars

- Others (Emergency Alarms, Bells, Voice Alarm Evacuation System, etc.)

- Access Control & Attendance System

- Card Readers

- Electrical Locks

- Biometric Readers (Fingerprint Terminals, Face Recognition Terminals, etc.)

- Others (Controllers, Keypads, etc.)

- Intelligent Systems

- Motion Detection Systems

- People Counters

- Others (Audio & Video Alert Systems, License Plate Readers, etc.)

- Others (Anti-Theft Systems, Scanning & Inspection Equipment, etc.)

- Video Surveillance Security System

- Software

- Video Management Software

- Video Surveillance as a Service (VSaaS)

- Data Management Software

- Analytics Software

- Services

- Training & Consulting

- Installation & Integration

- Maintenance & Support

Of them all, video surveillance security systems hold the dominant share of the Saudi Arabia Electronic Security Market. It owes to the ever-growing end-user requirements for cameras, monitors, & storage devices to address the increasing cases of security breaches & physical security incidents, especially at critical infrastructures like airports, banks, & trade centers of the country. The advent of IP cameras & their ever-increasing adoption has resulted in various hardware-based improvements that have enhanced low-light performance, object tracking, and built-in security features. Some surveillance cameras have become highly specialized and can even be configured to zoom in, detect hazardous equipment, etc.

As a result, the increasing installations of mass surveillance systems by the Saudi government to help concerned authorities track the suspects of crimes, coupled with the growing utilization of advanced technologies like AI (Artificial Intelligence), computer vision, pattern recognition, etc., in the existing systems in order to scan aberrant behavior & patterns in different video recordings, are creating remunerative prospects for the Saudi Arabia Electronic Security Market.

Based on End-User:

- Commercial

- Military & Defense

- Residential

Here, the commercial sector is projected to acquire a notable share of the Saudi Arabia Electronic Security Market during 2023-28. With the mounting influx of foreign investments and growing government efforts toward diversifying the economy from oil & gas, the country is witnessing an increasing number of infrastructure developments and various ongoing & upcoming building & construction projects associated with airports, railway & road networks, hotels, shopping malls, corporate spaces, etc.

The government is actively focusing on infrastructural developments, i.e., in line with Saudi Vision 2030, and thus, taking rigorous steps to enhance the overall security network of the country. Consequently, electronic security systems are in high demand for the close monitoring of critical places like airports, highways, high-risk, busy, & accident-prone zones, public transportation, etc., to ensure public safety and reduce the crime rate.

Moreover, banks & financial institutions are also prominent end-users of the electronic security market in Saudi Arabia. The ever-increasing adoption of high-end surveillance devices in these facilities owes to the increasing prevalence of fraudulent activities & data breaches and the rapid rise in ATM thefts. Hence, these aspects indicate an enormous share of the commercial sector in the Saudi Arabia Electronic Security Market over the coming years.

Gain a Competitive Edge with our Saudi Arabia Electronic Security Market Report

- Saudi Arabia Electronic Security Market Report by MarkNtel Advisors provides a detailed & thorough analysis of market size, share, growth rate, competitive landscape, and key players. This comprehensive analysis helps businesses gain a holistic understanding of the market dynamics & make informed decisions.

- This report also highlights current market trends & future projections, allowing businesses to identify emerging opportunities & potential challenges. By understanding market forecasts, companies can align their strategies & stay ahead of the competition.

- Saudi Arabia Electronic Security Market dynamics, regulatory frameworks, and potential challenges, businesses can develop strategies to minimize risks & optimize their operations.

Frequently Asked Questions

- Market Segmentation

- Introduction

- Research Process

- Assumption

- Market Definition

- Executive Summary

- Saudi Arabia Smart City Development Landscape

- Major Smart City Projects

- Investment Amount

- Opportunity Areas of Electronic Security Implementation

- Impact of Covid-19 on the Saudi Arabia Electronic Security Market

- Saudi Arabia Electronic Security Market Trends & Insights

- Saudi Arabia Electronic Security Market Regulations & Policy

- Saudi Arabia Electronic Security Market Dynamics

- Growth Drivers

- Challenges

- Saudi Arabia Electronic Security Market Hotspot and Opportunities

- Saudi Arabia Electronic Security Market Outlook, 2017- 2027F

- Market Size and Analysis

- By Revenues (USD Million)

- Market Share and Analysis

- By Component

- By Hardware

- Video Surveillance Security System

- Cameras

- Analog Cameras

- IP Cameras

- Thermal Cameras

- LCD & LED Monitors

- Storage Devices

- Digital video recorder (DVR)

- Network video recorder (NVR)

- Direct-attached storage devices

- Network-attached storage devices

- Others (Hybrid video recorders, IP storage area network, etc.)

- Others (Networking Equipment, Video Decoders & Encoders, etc.)

- Cameras

- Fire Detection & Alarming System

- Alarm Panels & Intrusion Detectors

- Gas & Flame Detectors

- Security Radars

- Others (Emergency Alarms, Bells, Voice Alarm Evacuation System, etc.)

- Access Control & Attendance System

- Card Readers

- Electrical Locks

- Biometric Readers (Fingerprint Terminals, Face Recognition Terminals, etc.)

- Others (Controllers, Keypads, etc.)

- Intelligent Systems

- Motion Detection Systems

- People Counters

- Others (Audio & Video Alert Systems, License Plate Readers, etc.)

- Others (Anti-Theft Systems, Scanning & Inspection Equipment, etc.)

- Video Surveillance Security System

- By Software

- Video Management Software

- Video Surveillance as a Service (VSaaS)

- Data Management Software

- Analytics Software

- By Services

- Training & Consulting

- Installation & Integration

- Maintenance & Support

- By Hardware

- By Deployment Mode

- On-premise

- Cloud

- Hybrid

- By End-User

- Commercial

- Residential

- Military & Defense

- By Region

- Central

- East

- West

- South

- By Company

- Competition Characteristics

- Revenue Shares

- By Component

- Market Size and Analysis

- Saudi Arabia Electronic Security Market Key Strategic Imperatives for Success and Growth

- Competitive Outlook

- Competition Matrix

- Product Portfolio

- Brand Specialization

- Target Markets

- Strategic Alliances & Collaborations

- Strategic Initiatives

- Company Profiles (Business Description, By Product Segments, Business Segments, Financials, Strategic Alliances/ Partnerships, Future Plans)

- Axis Communications FZE

- Hikvision FZE

- Honeywell Security

- Dahua Technology Middle East FZE

- Sony Gulf FZE Limited

- Avigilon Corporation

- Pelco by Schneider Electric

- Hanwha Techwin

- IDIS Middle East

- FLIR Systems, Middle East FZE

- Others (AEcom Group, VIVOTEK Inc., etc.)

- Competition Matrix

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making