North America Gas Detection Equipment Market Research Report: Forecast (2022-2027)

By Type (Fixed, Portable) By Gas Detector (Single-Gas Detector, Multi-Gas Detector) By Gas Type (Combustibles & Flammables, Toxics & Exotic Gases, Oxygen Enrichment/Deficiency) By ...Technology (Infrared (IR), Semiconductor, Laser-based Detection, Photo-Ionization Detector (PID), Others (Electrochemical, Catalytic, etc.)) By End-User (Oil & Gas, Chemical, Healthcare, Building/HVAC, Consumer Goods, Automotive, Others (Environment, Food & Beverages, etc.)) By Country (The US, Canada, Mexico) By Company (MSA Safety Incorporated, Honeywell International Inc., Teledyne Technologies Inc., General Electric Co., Emerson Electric Co., Thermo Fisher Scientific, Inc., RKI Instruments, Inc., Sensor Electronics Corporation, ENMET Corporation, Fortive Corporation (Industrial Scientific), Critical Environment Technologies, Comco Canada Inc., Others) Read more

- Energy

- Jun 2022

- Pages 145

- Report Format: PDF, Excel, PPT

Market Definition

The gas detection system detects the presence of gases in the area & acts as an early warning system to ensure the area’s safety. It is used to monitor & measure single or mixed gas concentration in industrial units, oil & gas refineries, automobiles, and many more. The major factors driving the market for gas detection system includes a growing awareness of occupational dangers in the workforce. Moreover, owing to rising government regulations regarding workforce safety & security as well as environmental safety standards have positively influenced the market for gas detection equipment.

Market Insights

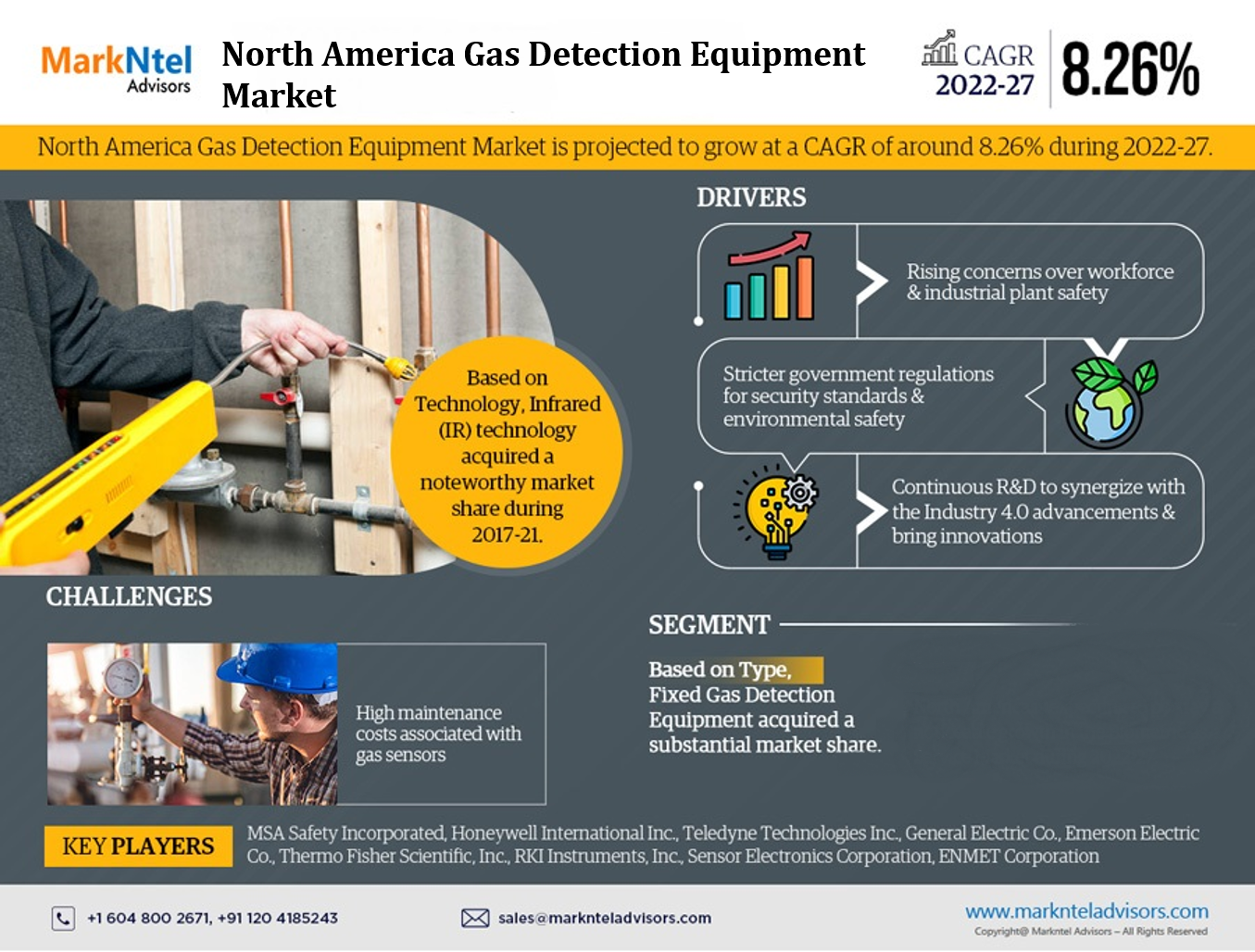

The North America Gas Detection Equipment market is projected to grow at a CAGR of around 8.26% during the forecast period, i.e., 2022-27. The North America Gas Detection Equipment market has witnessed notable growth during the historical period. The factors that have driven the growth of the Gas Detection Equipment market are the rising concerns about the workforce & industrial plant safety as well as stricter government regulations regarding security standards & environmental safety. Notably, the rising gas leak incidents in the region have mandated the deployment of gas detection equipment to prevent any fatal accidents.

| Report Coverage | Details |

|---|---|

| Study Period | Historical Data: 2017-20 |

| Base Year: 2021 | |

| Forecast Period: 2022-27 | |

| CAGR (2022-2027) | 8.26% |

| Countries Covered | USA, Canada, Mexico |

| Key Companies Profiled | MSA Safety Incorporated, Honeywell International Inc., Teledyne Technologies Inc., General Electric Co., Emerson Electric Co., Thermo Fisher Scientific, Inc., RKI Instruments, Inc., Sensor Electronics Corporation, ENMET Corporation |

| Unit Denominations | USD Million/Billion |

For instance:

- In 2021, a methane gas leak incident was reported in the Gulf of Mexico due to a ruptured underwater pipeline, which led to five hours of sea surface fire.

Additionally, the manufacturers have also been engaged in continuous R&D to synergize with the Region's Industry 4.0 advancements & bring innovation to the Gas Detection Equipment market. The shifting emphasis toward the implementation of innovative wireless technology, and robust integration of artificial intelligence (AI) & big data technologies, have surged the demand for gas detection equipment in the region.

Furthermore, the countries such as the US & Canada are considered to be leading countries in the adoption & integration of gas detection equipment in their various industrial settings. These countries are spending heavily on the development of their industrial units and thus providing lucrative opportunities for the gas detection equipment during the forecast period.

Key Trends in the Market

- Rapid Adoption of Smart Gas Detection Equipment

The manufacturers in North America are introducing innovative concepts to enhance the sensitivity & efficiency of sensors for detecting harmful gases to ensure real-time data monitoring & alerts. Further, to receive real-time alerts about the concentration of harmful gases in the atmosphere, the facility owners are rapidly adopting smart gas detection equipment to integrate into their manufacturing units. Consequently, the growing use of smart gas detection equipment should enable remote notification features, which is likely to have a major impact on the growth of the North American Gas Detection Equipment market in the near future.

Impact of Covid-19 on the North America Gas Detection Equipment Market

With the advent of COVID-19, the industrial facilities in various sectors, including chemicals, healthcare, consumer goods, automotive, etc., halted their operations across the region during the first half of 2020. This resulted in a notable decline in the sales of gas detection equipment as there was a contraction in the investments allocated towards the establishment of new facilities & the owners of the facilities postponed their plans for renovation & up-gradation, including installation of safety equipment, the existing facilities. However, in the latter half of 2020, when mobility restrictions were eased, the gas detection equipment witnessed a surge in demand.

On the contrary, after the shockwaves of the COVID-19 pandemic globally, the demand for crude oil & natural gas increased in the US as a result of high demand from many oil & gas importing countries, such as China, India, Germany, Italy, the Netherlands, South Korea, etc. Subsequently, the production of crude oil & hydrocarbon gas-liquid saw an acceleration in the US, thus elevating the demand for gas detection equipment in the US as companies invested in expanding their production facilities to cater to the growing demand around the globe. This is expected to cement the market growth of gas detection equipment in the upcoming year.

Market Segmentation

Based on Type:

- Fixed

- Portable

Among them, Fixed Gas Detection Equipment acquired a substantial share in the North America Gas Detection Equipment market during the historical period, owing to its major deployment around the pipelines, industrial chambers, large chemical storage facilities, etc. Moreover, fixed gas detection equipment is designed to detect any exotic or dangerous presence of gases in a specific area & to warn the user in the event of potential hazards. Therefore, this equipment is deployed in areas where high chances of gas leakage are observed.

However, the demand for portable gas detection equipment has also shown remarkable growth in recent years. Additionally, the market is primarily driven by factors such as providing remote monitoring features to the industrial & commercial units via cloud connectivity as well as other data analysis feature. Thus, it is expected that portable gas detectors would further register a high growth rate in the years to come.

Furthermore, the manufacturers have assessed the growing demand for portable gas detection equipment & have strategically positioned their product offering by expanding their product portfolio through new product launches, strategic acquisitions, investing in R&D, etc. Consequently, this has expanded the scope of portable gas detection equipment in the region.

Based on the Technology:

- Infrared (IR)

- Semiconductor

- Laser-based Detection

- Photo-Ionization Detector (PID)

- Others (Electrochemical, Catalytic, etc.)

Of them all, Infrared (IR) technology acquired a noteworthy share in the North America Gas Detection Equipment market during 2017-21. This equipment is generally used in fixed gas detection systems to constantly monitor a specific area by sending an infrared beam, to select the proper wavelength & an optical infrared receiver to detect combustibles/flammables. These types of equipment can detect all hetero-atomic gases, such as carbon dioxide & hydrocarbon compounds, which makes its adoption even farther in industries, including oil & gas and petrochemicals.

Additionally, due to their long-range & high efficiency, the owners of industrial facilities select infrared gas detection equipment to avoid any accidents. Moreover, the ability of laser-based gas detectors to detect very low concentrations of hazardous gases, such as methane, by even penetrating through the flames has made it a preferable choice for the oil & gas sector. Therefore, the demand for laser-based gas detectors is expected to flourish in the coming years.

Regional Landscape

Geographically, the North America Gas Detection Equipment market expands across:

- The US

- Canada

- Mexico

Of all the countries in the North American region, the US captured the major market share in the gas detection market. The factors contributing to its growth are the rising industrial activities in the US, the high awareness of industrial safety among industrial facility owners, government interventions to control air quality, and extensive R&D in the gas detection technology, among others, have proliferated the demand for gas detection equipment in the US, during the past few decades. In addition, as per the US Environmental Protection Agency (EPA), the US oil & gas industry is the largest industrial source of methane emissions, which discharges more methane gas compared to the total emissions of all the greenhouse gases from 164 countries.

Consequently, to cater to this problem, the installation of gas detection equipment in industrial facilities has become a necessity in the country due to which the demand for gas detection equipment has registered commendable growth in the historical years. Further, it is expected that the growing need for safety & control of the quality of air would escalate the demand for gas detection systems in the near future.

Recent Developments by the Leading Companies

- In 2021, Teledyne Technologies Incorporated acquired FLIR Systems, Inc., in a deal of around USD8.2 billion. This strategic acquisition would deepen Teledyne's reach in the North American region as FLIR Systems specializes in portable imaging & detection systems.

- In 2017, Honeywell launched a new Bluetooth-enabled Sensepoint XRL fixed gas detector that monitors industrial operations for specific hazardous gases, such as carbon monoxide or methane.

Market Dynamics:

Key Driver: Increasing Stringent Government Regulations for Industrial Safety

The increasing imposition of government regulations to solidify the safety measures for the industrial workforce as well as infrastructure has escalated the demand for gas detection equipment during the historical period. The regulatory authorities, such as the American Society of Heating Refrigeration & Air Conditioning Engineers, and the Occupational Safety & Health Administration, among various others, have made it mandatory to install the gas detection equipment to maintain safety & security around the industrial settings.

As a result, many research institutes & health organizations in the region are concerned about worker safety due to deteriorating air quality in industrial plants, which is driving the demand for gas detection equipment in the region. For instance, the American Conference of Governmental Industrial Hygienists (ACGIH) has provided a threshold limit of 25 parts per million (ppm) for an 8-hour workday. Consequently, the demand for gas detection equipment has experienced flourished demand in North America.

Possible Restraint: High Maintenance Cost of Gas Sensors to Hamper the Market Growth

Gas detection equipment is majorly used in oil & gas, chemical industry, pharmaceutical sector, etc., to protect personnel & machinery from harmful gases. However, the high maintenance costs associated with gas sensors act as a major deterrent to its growth. Moreover, the gas detectors operate in temperatures that range from –30°C to +50°C. If the temperature goes beyond +50°C, it negatively impacts the sensitivity of sensors, which requires frequent replacement of sensors.

Hence, varied temperature fluctuations in the industries like oil & gas, pharmaceutical, mining, etc., imposed high maintenance costs of gas sensors, thus hampering the growth of the gas detection equipment market in North America.

Growth Opportunity: Adoption of Cloud-based Technologies in Gas Detection Equipment

The rising adoption of innovative wireless technology, including data monitoring, cloud connectivity, and big data analytics features, provides new lucrative opportunities to gas detection equipment companies, which leads to the rapid growth of gas detection equipment in the North American region. Furthermore, gas detection equipment manufacturers are continuously promoting research & development activities that contribute to the early detection of leaks & monitoring variables such as pressure, temperature, and deformations of the pipeline infrastructure.

Thus, the adoption of cloud-based technologies in advanced & integrated gas detection systems enables companies to track real-time output & automated control systems that help minimize potential factory maintenance costs in the future.

Key Questions Answered in the Market Research Report:

- What are the overall statistics or estimates (Overview, Size- By Value, Forecast Numbers, Segmentation, Shares) of the North America Gas Detection Equipment Market?

- What are the region-wise industry size, growth drivers, and challenges?

- What are the key innovations, opportunities, current & future trends, and regulations in the North America Gas Detection Equipment Market?

- Who are the key competitors, their key strengths & weaknesses, and how do they perform in the North America Gas Detection Equipment Market based on the competitive benchmarking matrix?

- What are the key results derived from surveys conducted during the North America Gas Detection Equipment Market study?

Frequently Asked Questions

- Introduction

- Research Process

- Assumption

- Market Segmentation

- Market Definition

- Executive Summary

- Impact of COVID-19 on North America Gas Detection Equipment Market

- Impact of Industry 4.0 on North America Gas Detection Equipment Market

- North America Gas Detection Equipment Market Trends & Insights

- North America Gas Detection Equipment Market Dynamics

- Growth Drivers

- Challenges

- North America Gas Detection Equipment Market Hotspot and Opportunities

- North America Gas Detection Equipment Government Regulation, Policies & Standards

- North America Gas Detection Equipment Market Outlook, 2017-2027

- Market Size and Analysis

- By Revenues (USD Million)

- Market Share and Analysis

- By Type

- Fixed

- Portable

- By Gas Detector

- Single-Gas Detector

- Multi-Gas Detector

- By Gas Type

- Combustibles & Flammables

- Toxics & Exotic Gases

- Oxygen Enrichment/Deficiency

- By Technology

- Infrared (IR)

- Semiconductor

- Laser-based Detection

- Photo-Ionization Detector (PID)

- Others (Electrochemical, Catalytic, etc.)

- By End-User

- Oil & Gas

- Chemical

- Healthcare

- Building/HVAC

- Consumer Goods

- Automotive

- Others (Environment, Food & Beverages, etc.)

- By Country

- The US

- Canada

- Mexico

- By Company

- Competition Characteristics

- Revenue Shares

- By Type

- Market Size and Analysis

- The US Gas Detection Equipment Market Outlook, 2017- 2027

- Market Size and Analysis

- By Revenues

- Market Share and Analysis

- By Type

- By Gas Detector

- By Gas Type

- By Technology

- By End-User

- Market Size and Analysis

- Canada Gas Detection Equipment Market Outlook, 2017- 2027

- Market Size and Analysis

- By Revenues

- Market Share and Analysis

- By Type

- By Gas Detector

- By Gas Type

- By Technology

- By End-User

- Market Size and Analysis

- Mexico Gas Detection Equipment Market Outlook, 2017- 2027

- Market Size and Analysis

- By Revenues

- Market Share and Analysis

- By Type

- By Gas Detector

- By Gas Type

- By Technology

- By End-User

- Market Size and Analysis

- North America Gas Detection Equipment Market Key Strategic Imperatives for Success and Growth

- Competitive Outlook

- Competition Matrix

- Application Portfolio

- Brand Specialization

- Target Markets

- Target Applications

- Research & Development

- Strategic Alliances

- Strategic Initiatives

- Company Profiles (Business Description, Application Segments, Business Segments, Financials, Strategic Alliances/ Partnerships, Future Plans)

- MSA Safety Incorporated

- Honeywell International Inc.

- Teledyne Technologies Inc.

- General Electric Co.

- Emerson Electric Co.

- Thermo Fisher Scientific, Inc.

- RKI Instruments, Inc.

- Sensor Electronics Corporation

- ENMET Corporation

- Fortive Corporation (Industrial Scientific)

- Critical Environment Technologies

- Comco Canada Inc.

- Others

- Competition Matrix

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making