Global LTE and 5G Broadcast Market Research Report: Forecast (2023-2028)

By End-Use (Video on Demand, Connected Vehicles, Advertising, Content/Data Delivery, Public Safety, Live Event Streaming, Mobile TV Streaming, Other Applications), By Region (North... America, South America, Europe, Middle East & Africa, Asia-Pacific), By Company (AT&T Inc., Athonet, China Unicom, Cisco, Enensys Technologies, Huawei, Nokia Corporation, Qualcomm, Reliance [Jio], Samsung Electronics, SK Telecom, Telstra, T-Mobile, Verizon Wireless, ZTE, Other) Read more

- ICT & Electronics

- Jun 2023

- Pages 208

- Report Format: PDF, Excel, PPT

Market Insights & Analysis: Global LTE and 5G Broadcast Market (2023-28)

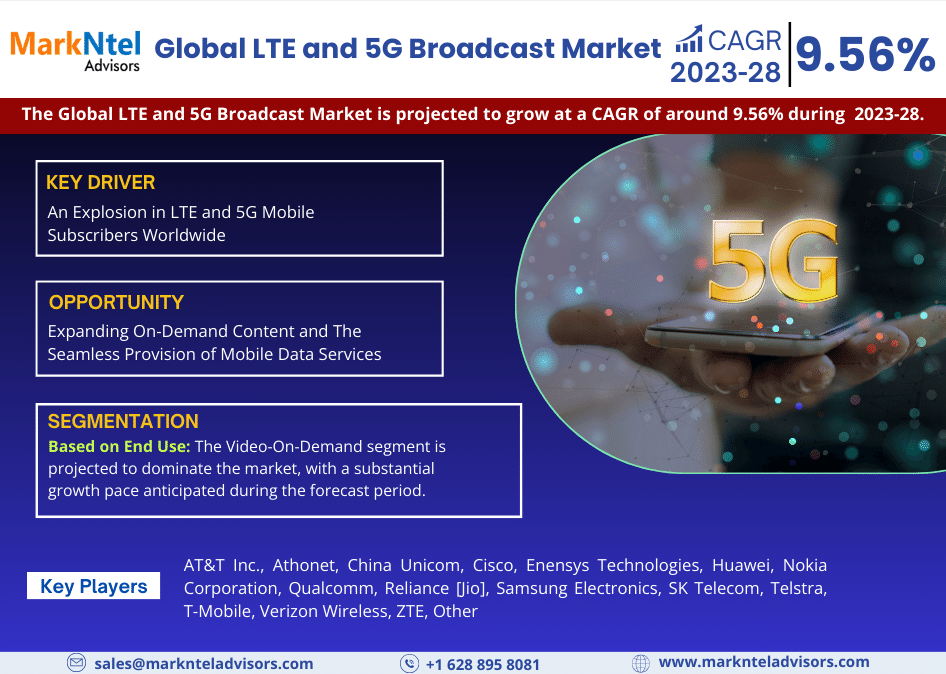

The Global LTE and 5G Broadcast Market is valued at USD 759.93 Million in 2022 and is projected to grow at a CAGR of around 9.56% during the forecast period, i.e., 2023-28. The market predominantly derives its growth from advancing communication systems and increasing internet penetration worldwide, resulting in a substantial surge in 5G and LTE subscribers worldwide.

As more consumers embrace OTT services, such as video-on-demand, mobile TV, and digital radio, along with the live-event broadcast, and online gaming, the demand for faster and more reliable network connectivity continues to witness a swift surge. This has presented market players with lucrative opportunities as LTE and 5G technologies facilitate the immersive experience, and users can enjoy uninterrupted streaming in high-definition without buffering or lagging issues.

Moreover, the development of Narrow-Band IoT (NB-IoT) in the 3rd Generation Partnership Project is also likely to aid in massive machine connectivity across wide-area applications, in turn creating a lucrative prospect for the market. LTE and 5G broadcasts provide mobile network operators significant revenue generation and cost-saving possibilities. Operators can use and monetize their media and network assets and engage with content and media partners for new services.

| Report Coverage | Details |

|---|---|

| Study Period | Historical Data: 2018-21 |

| Base Year: 2022 | |

| Forecast Period: 2023-28 | |

| CAGR (2023-2028) | 9.56% |

| Regions Covered | North America: US, Canada, Mexico |

| Europe: Germany, The UK, France, Spain, Italy, Rest of Europe | |

| Asia-Pacific: China, India, Japan, South Korea, Australia, Rest of Asia-Pacific | |

| South America: Brazil, Argentina, Rest of South America | |

| Middle East & Africa: UAE, Saudi Arabia, South Africa, Rest of MEA | |

| Key Companies Profiled | AT&T Inc., Athonet, China Unicom, Cisco, Enensys Technologies, Huawei, Nokia Corporation, Qualcomm, Reliance [Jio], Samsung Electronics, SK Telecom, Telstra, T-Mobile, Verizon Wireless, ZTE, Other |

| Unit Denominations | USD 759.93 Million |

On the contrary, high upfront deployment expenses associated with the core and radio networks pose a barrier to overlaying LTE broadcast on existing 4G core networks, hampering the market expansion.

Global LTE and 5G Broadcast Market Driver:

An Explosion in LTE and 5G Mobile Subscribers Worldwide - The market has witnessed a sudden expansion driven mainly by the swift surge in LTE and 5G mobile subscribers globally. According to the Global System for Mobile Communications (GSMA), there were 5.5 billion LTE subscribers worldwide as of the end of 2022. Likewise, with approximately 1.77 billion 5G subscribers worldwide in 2023, expected to reach 2.8 billion by 2024 and 5.9 billion by 2027, the market is poised for expansion.

Moreover, the commercial availability of 5G in various countries adds to the momentum. These advancements enable mobile network operators to monetize network bandwidth through innovative business models, offering services like digital signage, emergency alerts, and content delivery. This revenue-generating potential, along with the increasing subscriber base, drives the growth of the LTE and 5G broadcast market.

Global LTE and 5G Broadcast Market Possible Restraint:

Transition Dilemmas Arise from High Upfront Deployment Expenses Associated with The Core and Radio Networks - Despite the numerous factors aiding in the market's extensive growth, a few restraints may impede its growth in the long run. One of these is the elevated upfront deployment expenses associated with the core and radio networks, posing a barrier to overlaying LTE broadcast on existing 4G core networks. Likewise, the complexity of synchronizing the existing radio network infrastructure with the new LTE broadcast infrastructure adds to the high initial investment. Another challenge is the hesitancy of telecom operators to transition from legacy infrastructure. Legacy systems are complex, inefficient, and costly, leading to skill shortages and compatibility issues. Operators fear incomplete conversions and the potential fallout of services, impacting the customer experience and, consequently, market growth.

Global LTE and 5G Broadcast Market Growth Opportunity:

Expanding On-Demand Content and The Seamless Provision of Mobile Data Services - The mounting popularity of on-demand content and the seamless provision of mobile data services are anticipated to open up new avenues for the market. For instance, streaming platforms like Netflix and Amazon Prime Video provide users instant access to a vast catalog of movies and TV shows, which can be streamed seamlessly on mobile devices. Cutting-edge technologies such as LTE and 5G offer significant improvements in data speeds, reduced latency, and enhanced network capacity, making them suitable for delivering high-quality on-demand content.

Similarly, with the surge in the popularity of online gaming, the demand for networks providing low latency and high data speeds has heightened as multiplayer games require fast and reliable connections. With the rising appetite for such services, the LTE and 5G technology broadcasting market is poised for substantial growth.

Global LTE and 5G Broadcast Market Key Trend:

Proliferation of Wireless and Mobile Devices - The ever-increasing affinity for wireless and mobile devices in recent years has influenced the expansion of the LTE and 5G spectrum. End-users benefit from LTE broadcast services as they experience improved Quality of Experience (QoE) while downloading rich content and streaming HD videos on their mobile devices. Operators strive to enable their devices for evolved Multimedia Broadcast Multicast Service (eMBMS) streams, aiming for cost-effective solutions.

Further, LTE Broadcast technology has the potential to allow a wide range of services and applications across wireless operator networks. In a bid to realize this potential fully, collaboration among network equipment vendors, operators, chipset manufacturers, middleware providers, device vendors, and standardization bodies has become prominent. The global investment and deployment of eMBMS by various operators further contribute to the growing demand for diverse end-user applications.

Global LTE and 5G Broadcast Market (2023-28): Segmentation Analysis

The Global LTE and 5G Broadcast Market study from MarkNtel Advisors analyzes the major trends in each sub-segment and includes predictions for the period 2023–28 at the global, regional, and national levels. The market has been segmented in our analysis based on End Use:

Based on End Use

- Video on Demand

- Connected Vehicles

- Advertising

- Content/Data Delivery

- Public Safety

- Live Event Streaming

- Mobile TV Streaming

- Other Applications

The Video-On-Demand segment is projected to dominate the market, with a substantial growth pace anticipated during the forecast period. It can be attributed primarily to the sudden rise in consumer interest in Online Streaming and OTT platforms such as Netflix, Disney+, Hulu, HBO Max, and thousands more, setting a suitable stage for Video on Demand to witness extensive adoption. The growth of these services has extended the market maturation for LTE and 5G broadcast as they ensure quicker, smoother, and more powerfully immersive video streaming from mobile devices.

Global LTE and 5G Broadcast Market Regional Projection

Geographically, the Global LTE and 5G Broadcast Market expands across:

- North America

- South America

- Europe

- Middle East & Africa

- Asia-Pacific

Geographically, Asia-Pacific is poised for tremendous growth at the premium end of the market with the substantial contribution of China, South Korea, Japan, India, and Australia. The expansion predominantly ascribes to constant cross-collaboration, acquisition, and mergers exhibited by the leading industry players, including China Unicom, Samsung, and others.

In January 2023, KDDI CORPORATION initiated the commercial deployment of O-RAN compliant1 5G Open Virtual Radio Access Network sites in collaboration with Samsung Electronics Co., Ltd. and Fujitsu Limited in Osaka City, Japan.

Similarly, in partnership, Wuhan Iron and Steel, China Unicom, and ZTE have successfully established a fully connected 5G factory, the first in Hubei Province to deploy a 5G dedicated core and bearer networks within an enterprise park. 63 5G shared base stations have been deployed with a 95% 5G coverage rate, making it one of the largest 5G enterprise private networks in China.

Moreover, the countless field tests and trials of the LTE and 5G broadcast network have been conducted, backed by the ongoing R&D activities and bulk investments made by the respective government across the region. Further, 5G has been witnessing quicker rollout and adoption than previous technologies across Asia. For example, after pandemic-driven delays in October 2022, India experienced the rollout of 5G Spectrum, currently provided by Reliance Jio and Bharti Airtel. Thus, the ongoing effort and initiatives to realize utmost connectivity through unprecedented speeds achieved with cutting-edge communication technologies are anticipated to take the region's growth to the next level during the forecast period.

Global LTE and 5G Broadcast Industry Recent Developments

- In order to demonstrate the potential of 5G Broadcast/Multicast to spur new business models and alter the way content is distributed, Qualcomm Technologies, Rohde & Schwarz, and Claro, the largest mobile provider in Brazil and Latin America, joined together with tennis tournament Rio Open 2023.

Gain a Competitive Edge with Our Global LTE and 5G Broadcast Market Report

- Global LTE and 5G Broadcast Market report provides a detailed and thorough analysis of market size, growth rate, competitive landscape, and key players. This comprehensive analysis helps businesses gain a holistic understanding of the market dynamics and make informed decisions.

- This report also highlights current market trends and future projections, allowing businesses to identify emerging opportunities and potential challenges. By understanding market forecasts, companies can align their strategies and stay ahead of the competition.

- Global LTE and 5G Broadcast Market report aids in assessing and mitigating risks associated with entering or operating in the market.

- The report would help in understanding market dynamics, regulatory frameworks, and potential challenges, businesses can develop strategies to minimize risks and optimize their operations.

Frequently Asked Questions

Global LTE and 5G Broadcast Market Research Report (2023-2028) - Table of Contents

- Market Segmentation

- Introduction

- Product Definition

- Research Process

- Assumptions

- Executive Summary

- Global LTE and 5G Broadcast Market Regulations and Policy

- Global LTE and 5G Broadcast Market Trends & Developments

- Global LTE and 5G Broadcast Market Dynamics

- Drivers

- Challenges

- Global LTE and 5G Broadcast Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By End Use

- Video on Demand- Market Size & Forecast 2018-2028, USD Million

- Connected Vehicles- Market Size & Forecast 2018-2028, USD Million

- Advertising - Market Size & Forecast 2018-2028, USD Million

- Content/Data Delivery - Market Size & Forecast 2018-2028, USD Million

- Public Safety- Market Size & Forecast 2018-2028, USD Million

- Live Event Streaming- Market Size & Forecast 2018-2028, USD Million

- Mobile TV Streaming- Market Size & Forecast 2018-2028, USD Million

- Other Applications- Market Size & Forecast 2018-2028, USD Million

- By Region

- North America

- South America

- Europe

- Asia-Pacific

- The Middle East and Africa

- By End Use

- Market Size & Analysis

- North America LTE and 5G Broadcast Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By End-Use- Market Size & Forecast 2018-2028, USD Million

- By Country

- The US

- Canada

- Mexico

- The US LTE and 5G Broadcast Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By End-Use- Market Size & Forecast 2018-2028, USD Million

- Market Size & Analysis

- Canada LTE and 5G Broadcast Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By End-Use- Market Size & Forecast 2018-2028, USD Million

- Market Size & Analysis

- Mexico LTE and 5G Broadcast Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By End-Use- Market Size & Forecast 2018-2028, USD Million

- Market Size & Analysis

- Market Size & Analysis

- South America LTE and 5G Broadcast Market Outlook, 2018-2028F

- South America LTE and 5G Broadcast Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By End-Use- Market Size & Forecast 2018-2028, USD Million

- By Country

- Brazil

- Argentina

- Rest of South America

- Market Size & Analysis

- Brazil LTE and 5G Broadcast Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By End-Use- Market Size & Forecast 2018-2028, USD Million

- Market Size & Analysis

- Argentina LTE and 5G Broadcast Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By End-Use- Market Size & Forecast 2018-2028, USD Million

- Market Size & Analysis

- South America LTE and 5G Broadcast Market Outlook, 2018-2028F

- Europe LTE and 5G Broadcast Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By End-Use- Market Size & Forecast 2018-2028, USD Million

- By Country

- Germany

- The UK

- France

- Italy

- Spain

- Rest of Europe

- Germany LTE and 5G Broadcast Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By End-Use- Market Size & Forecast 2018-2028, USD Million

- Market Size & Analysis

- The UK LTE and 5G Broadcast Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By End-Use- Market Size & Forecast 2018-2028, USD Million

- Market Size & Analysis

- France LTE and 5G Broadcast Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By End-Use- Market Size & Forecast 2018-2028, USD Million

- Market Size & Analysis

- Italy LTE and 5G Broadcast Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By End-Use- Market Size & Forecast 2018-2028, USD Million

- Market Size & Analysis

- Spain LTE and 5G Broadcast Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By End-Use- Market Size & Forecast 2018-2028, USD Million

- Market Size & Analysis

- Market Size & Analysis

- Asia-Pacific LTE and 5G Broadcast Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By End-Use- Market Size & Forecast 2018-2028, USD Million

- By Country

- China

- Japan

- Australia

- India

- South Korea

- Rest of Asia Pacific

- China LTE and 5G Broadcast Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By End-Use- Market Size & Forecast 2018-2028, USD Million

- Market Size & Analysis

- Japan LTE and 5G Broadcast Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By End-Use- Market Size & Forecast 2018-2028, USD Million

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By End-Use- Market Size & Forecast 2018-2028, USD Million

- Market Size & Analysis

- Australia LTE and 5G Broadcast Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By End-Use- Market Size & Forecast 2018-2028, USD Million

- Market Size & Analysis

- India LTE and 5G Broadcast Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By End-Use- Market Size & Forecast 2018-2028, USD Million

- Market Size & Analysis

- South Korea LTE and 5G Broadcast Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By End-Use- Market Size & Forecast 2018-2028, USD Million

- Market Size & Analysis

- Market Size & Analysis

- Middle East and Africa LTE and 5G Broadcast Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By End-Use- Market Size & Forecast 2018-2028, USD Million

- By Country

- South Africa

- The UAE

- Saudi Arabia

- Rest of Middle East and Africa

- South Africa LTE and 5G Broadcast Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By End-Use- Market Size & Forecast 2018-2028, USD Million

- Market Size & Analysis

- The UAE LTE and 5G Broadcast Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By End-Use- Market Size & Forecast 2018-2028, USD Million

- Market Size & Analysis

- Saudi Arabia LTE and 5G Broadcast Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By End-Use- Market Size & Forecast 2018-2028, USD Million

- Market Size & Analysis

- Market Size & Analysis

- Competitive Outlook

- Company Profiles

- Verizon Wireless

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Reliance (Jio)

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Qualcomm

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Samsung Electronics

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Huawei

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Cisco

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- ZTE

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- AT&T Inc.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- SK Telecom

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- T-Mobile

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Nokia Corporation

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Telstra

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- China Unicom

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Athonet

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Enensys Technologies

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Verizon Wireless

- Company Profiles

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making