Kuwait HVAC After-Market Research Report: Forecast (2021-2026)

By Type (Service & Retrofit, Spare Parts), By Stakeholders (OEMs, In-house Maintenance, Facility Management Companies), By End User (Residential, Healthcare, Commercial & Retail, G...overnment & Transportation, Hospitality, Oil & Gas, Others), By Region (Al Asimah, Al Farwaniya, Hawalli, Al Ahmadi, Al Jahra), By Competitors (Johnson Control, Carrier Kuwait Air Conditioning K.S.C, Trane, Daikin Middle East & Africa FZE, SKM Air Conditioning & Contracting Co. Ltd., United Facility Management, EFS Facilities Services, Fawaz Group, Ecovert FM Kuwait) Read more

- Environment

- Oct 2021

- Pages 143

- Report Format: PDF, Excel, PPT

HVAC after-market is the industry providing after-sales services, such as repair, maintenance, spare parts, etc., for the HVAC systems installed. Stakeholders like OEMs, Facility Management Companies, and In-house Maintenance play a crucial role in the market.

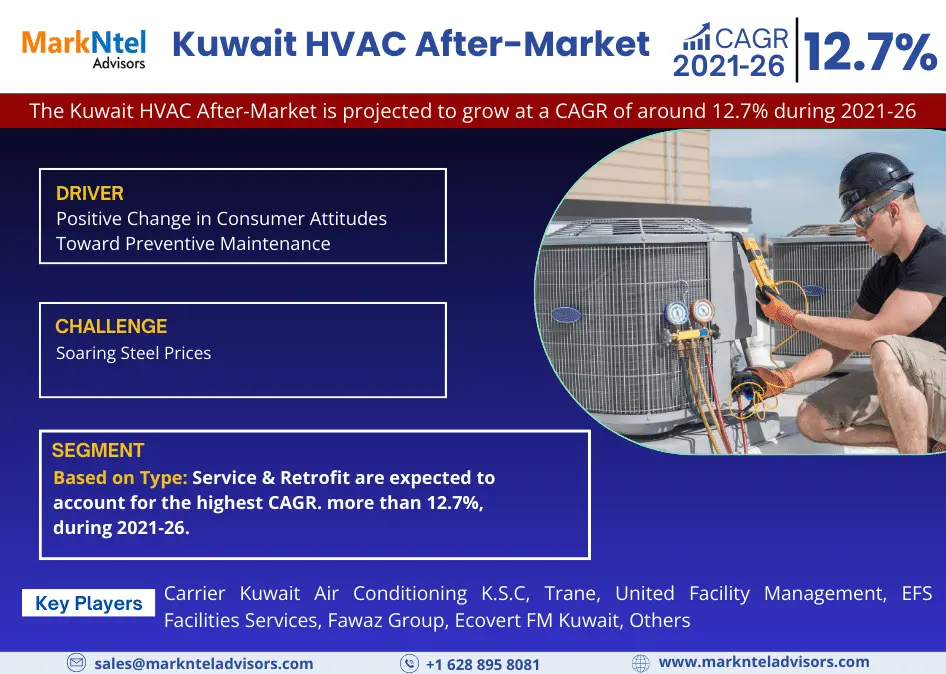

The Kuwait HVAC After-Market is projected to grow at a CAGR of around 12.7% during the forecast period, i.e., 2021-26, says MarkNtel Advisors. The market is driven primarily by the increasing investments in the commercial & hospitality sectors, coupled with various government initiatives toward building Smart cities across Kuwait. Moreover, with new servicing methods, the number of participating companies increased, thereby driving the market.

| Report Coverage | Details |

|---|---|

| Study Period | Historical Data: 2016-19 |

| Base Year: 2020 | |

| Forecast Period: 2021-26 | |

| CAGR (2021-2026) | 12.7% |

| Key Companies Profiled | Carrier Kuwait Air Conditioning K.S.C, Trane, Daikin Middle East & Africa FZE, SKM Refrigeration, Air Conditioning & Contracting Co. Ltd., United Facility Management, EFS Facilities Services, Fawaz Group, Ecovert FM Kuwait |

| Unit Denominations | USD Million/Billion |

COVID-19 Outbreak Minimally Impacted the Kuwait HVAC After-Market

Last year, the Covid-19 pandemic had a minimal impact on the Kuwait HVAC After-Market industry. The imposition of lockdown and movement restrictions halted the servicing of HVAC systems across the hospitality & commercial sectors. However, HVAC systems being an absolute necessity in the country, revenue losses got covered with the ease of norms and lockdown upliftment.

Market Segmentation

Based on type, the Kuwait HVAC After-Market bifurcates into:

- Service & Retrofit

- Spare Parts

Of both, Service & Retrofit are expected to account for the highest CAGR, i.e., more than 12.7%, during 2021-26. It owes to multiple services offered to consumers, such as Annual Maintenance Contract (AMC), predictive maintenance, on-call servicing, retrofitting for chillers, cites MarkNtel Advisors in their research report, "Kuwait HVAC After-Market Analysis, 2021."

Commercial & Retail Sectors Accounted for the Largest Market Share

The burgeoning developments in the commercial & retail sectors predict the future growth & the highest share in the overall market. Under the Kuwait Vision 2035, the government aims to diversify the economy & develop state-art-of-the-art infrastructure for the tourism industry. The Blue Water Mall development plans with an investment of around USD 99.5 million would act as a catalyst for the expansion of commercial & retail sectors in the overall Kuwait HVAC After-Market.

Regional Landscape

Al Ahmadi & Al Farwaniya Attained Highest Market Share

Al Ahmadi & Al Farwaniya held the highest share of more than 25% each in Kuwait HVAC After-Market during 2016-2020 and is likely to continue their dominance in the forecast period. Al Ahamdi is among the country’s largest hubs of the oil & gas sector, and Al Farwaniya is amongst the highly developed & populated regions. The rising construction activities & infrastructure developments in these regions would thrive the HVAC After-Market during 2021-26. The mounting demand for comfortable & unhindered air cooling & ventilation, which, in turn, leads to better HVAC services and fuels the overall market growth.

Market Dynamics:

Key Drivers

Positive Change in Consumer Attitudes Toward Preventive Maintenance

To avoid the sudden breakdown of HVAC systems, the customers have now been focusing on the preventive maintenance of the tools & equipment. Since the swift working of HVAC systems being crucial in Kuwait weather conditions, periodic servicing is also essential. The pressing need for seamless HVAC systems has led to customers being active in system servicing, replacements, retrofitting, etc., thereby driving the market.

Market Challenge

Soaring Steel Prices

Kuwait has faced a 50% increase in steel prices from KD 170(USD 561) to KD 254(USD 838) in 16 months, i.e., from February 2020 to May 2021. The HVAC equipment has a heavy requirement of sheet metal for multiple parts of the HVAC system. Steel, being a necessity for spare parts manufacturing, such as sheet metal ducting fabrication and other accessories, the prices for replacement of spare parts would increase & push consumers to buy low-quality products imported mainly from China. It creates a challenge for companies to place themselves before the substandard parts and lure consumers for authentic spare parts

Competitive Landscape

According to MarkNtel Advisors, the major leading players in the Kuwait HVAC After-market are Carrier Kuwait Air Conditioning K.S.C, Trane, Daikin Middle East & Africa FZE, SKM Refrigeration, Air Conditioning & Contracting Co. Ltd., United Facility Management, EFS Facilities Services, Fawaz Group, Ecovert FM Kuwait, etc.

Key Questions Answered in the Market Research Report:

- What are the overall statistics or estimates (Overview, Size- by Value, Forecast Numbers, Segmentation, and Shares) of the Kuwait HVAC After-market?

- What is the region-wise industry size, growth drivers, and challenges?

- What are the key innovations, opportunities, current & future trends, and regulations in the Kuwait HVAC After-market?

- Who are the key competitors, their key strengths & weaknesses, and how do they perform in the Kuwait HVAC After-market based on a competitive benchmarking matrix?

- What are the key results derived from surveys conducted during the Kuwait HVAC After-market study?

Frequently Asked Questions

- Introduction

- Product Definition

- Research Process

- Assumptions

- Market Segmentation

- Executive Summary

- Macro-Economic Indicators

- Impact of COVID-19 on Kuwait HVAC After-Market

- Short Term

- Long Term

- Kuwait HVAC After-Market Analysis, 2016-2026

- Market Size & Analysis

- Market Revenues

- Market Share & Analysis

- By Type

- Service & Retrofit (Strategies include Contracts, Repairs & Replacement)

- Spare parts

- By End User

- Residential

- Healthcare

- Commercial & Retail

- Government & Transportation

- Hospitality

- Oil & Gas

- Others (Education, Industrial, etc.)

- By Stakeholder

- OEM

- In-house Maintenance

- Facility Management Companies

- By Region

- Al Asimah

- Al Farwaniya

- Hawalli

- Al Ahmadi

- Al Jahra

- By Company (Leading Players in Window AC, Hi-Wall Split AC, Other Splits, VRF, Chillers, Ducted Split AC, Packaged AC)

- Type of Services (Facility Management Vs. Others)

- HVAC Facility Management Market (2016-2026)

- Revenue Share for Top Leading Facility Management Companies Managing HVAC Sector

- By Company (Aftermarket Services)

- Competitor Wise Revenue Share

- Strategic Factorial Indexing

- Competitor Placement on MarkNtel Quadrant

- By Type

- Porter’s Five Forces Model

- Market Size & Analysis

- Kuwait HVAC After-Market Attractive Indexing

- By Type

- By Region

- By End Users

- Kuwait HVAC After-Market Trends & Developments

- Kuwait HVAC After-Market Dynamics

- Impact Analysis

- Drivers

- Challenges

- Consumer Survey

- Voice of customers, By Residential and Non Residential Customer

- Awareness on impact of HVAC on energy bill. (Aware/Not Aware)

- Have they taken any steps to reduce energy wastage from HVAC side? (Yes/No) If yes, then what are these? If not, are they actively looking for solutions to save energy on HVAC side?

- What would be acceptable levels of ROI for HVAC energy saving solutions? (valid for Non-residential customers)

- Top 5 Brand Preferences

- Rate these Brands on the following factors: Quality Response, Service Professionalism, and Delivery Response-Fast/Slow & Overall Satisfaction.

- Voice of customers, By Residential and Non Residential Customer

- Competitive benchmarking

- Competition Matrix

- Brand Specialization

- Target Markets

- Target End Users

- Research & Development

- Strategic Alliances

- Strategic Initiatives

- Company Profiles

- Johnson Control

- Carrier Kuwait Air Conditioning K.S.C

- Trane

- Daikin Middle East & Africa FZE

- SKM Air Conditioning & Contracting Co. Ltd.

- United Facility Management

- EFS Facilities Services

- Fawaz Group

- Ecovert FM Kuwait

- Competition Matrix

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making