Japan Agriculture Equipment Market Research Report: Forecast (2024-2030)

Japan Agriculture Equipment Market Report - By Machinery (Farm Tractors, Harvesting Machinery, Plowing & Cultivation Machinery, Planting & Fertilizing Machinery, Haying Machinery, ...Others (Irrigation Equipment, Crop Processing Equipment, etc.)), By Application (Land Development, Sowing & Planting, Plowing & Cultivation, Threshing & Harvesting, Others (Plant Protection, Irrigation, etc.)), and Others Read more

- Environment

- May 2024

- Pages 133

- Report Format: PDF, Excel, PPT

Market Definition

Agricultural equipment is equipment like tractors, harvesters, etc., that is utilized for the mechanization of agricultural activities. With the growing improvements in agriculture practices, these machines allow farmers to correctly improve their productivity.

Market Insights & Analysis: Japan Agriculture Equipment Market (2024-30):

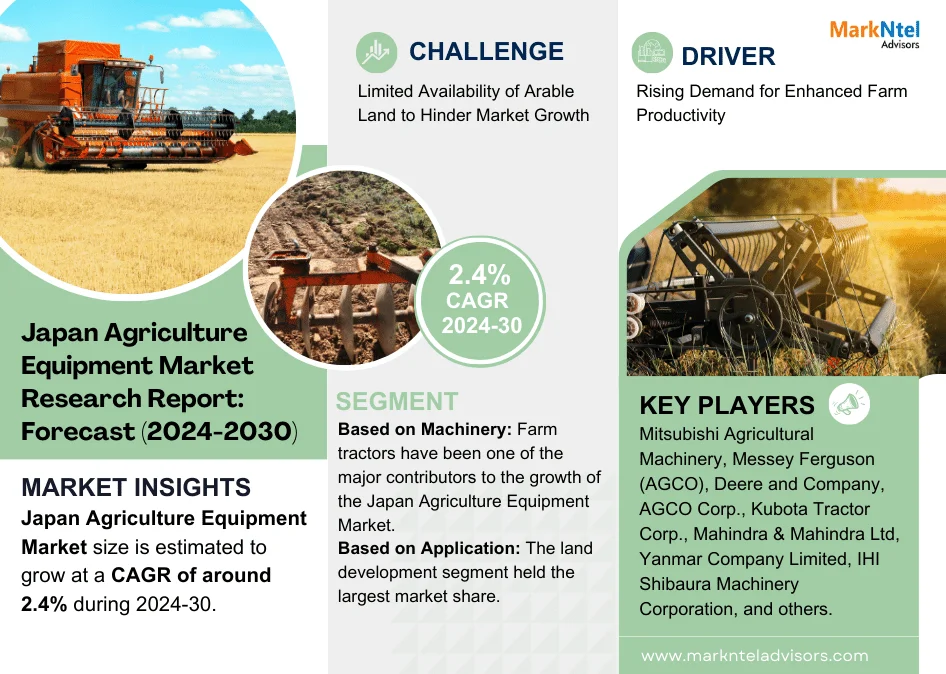

Japan Agriculture Equipment Market size is estimated to grow at a CAGR of around 2.4% during the forecast period, i.e., 2024-30. In Japan, the agriculture equipment market is gaining a considerable increment in size, driven by increasing production activities, enhanced government efforts to boost production, etc. Recently, the government of Japan has been making efforts to boost its agriculture production activities to meet the rising export demand for products like rice, soybeans, etc. Also, the demand for agricultural products is increasing across Japan itself, owing to the increasing population and growing tourism activities, which have amplified the demand for derivative foods. Hence, this has led to increased agricultural activities, consequently increasing the usage of equipment in the Japanese farming industry.

Also, the Japanese agriculture industry is experiencing substantial technological advancement, and hence, the demand for equipment like Japanese tractors, Japanese farm tools, etc., is increasing. Such equipment, specifically the tractors from Japanese tractor brands, allows for improving the productivity of the farms. Also, as more farmers across the country are moving toward mechanization, the demand for agriculture equipment has increased across the country, which has largely driven market growth & expansion.

| Report Coverage | Details |

|---|---|

| Study Period | Historical Data: 2019-22 |

| Base Year: 2023 | |

| Forecast Period: 2024-30 | |

| CAGR(2024-30) | 2.4% |

| Regions Covered | Hokkaido, Tohoku, Kanto, Chubu, Rest of Japan |

| Key Companies Profiled | Mitsubishi Agricultural Machinery, Messey Ferguson (AGCO), Deere and Company, AGCO Corp., Iseki & Co., Ltd., Taiyo Co., Ltd., Kubota Tractor Corp., Mahindra & Mahindra Ltd, Yanmar Company Limited, IHI Shibaura Machinery Corporation, and others |

| Unit Denominations | USD In Billion/Million |

In addition to this, the Japanese government is also trying to upscale the usage of advanced equipment across its farms, primarily to improve its production activity in light of the reduction in the number of farmers across the country. Hence, as mechanization would be able to close the gap in production activities, the demand for advanced agriculture equipment would improve, which would augment the size & volume of the Japan Agriculture Equipment Market during the forecast period.

Japan Agriculture Equipment Market Driver:

Rising Demand for Enhanced Farm Productivity – The rising demand for farm productivity has been a prominent factor in the development of the Japan Agriculture Equipment Industry. With the rising necessity of higher yields and more efficient farming practices, farmers were more inclined toward the use of sophisticated equipment and technology to meet these objectives. Japan, famous for its inventiveness and technological excellence, has been a leader in the use of modern farming tools, robots, and other latest equipment. This shift toward mechanization in agriculture has not only been used to meet labor shortages and rising operational costs but has also supported the country's main projects to modernize the agricultural sector and ensure sustainability. Further, as farmers are looking for solutions to increase the productivity and competitiveness of agriculture, the need for the latest agricultural equipment is also increasing. Thus, this has been a significant growth driver for the agricultural equipment industry in the country.

Japan Agriculture Equipment Market Opportunity:

Rising Popularity of Smart Agriculture to Offer Lucrative Market Opportunities – A steadily increasing tendency towards smart agriculture would emerge as a prominent opportunity for the growth of the Japan Agricultural Equipment Market. Smart agriculture techniques are anticipated to witness considerable growth in the coming years, owing to their good productivity and sustainability. Also, the adoption of smart agriculture techniques is projected to increase with incoming government efforts to boost their adoption. For instance,

- In 2024, the Japanese government announced that it is preparing a “Smart Agriculture Promotion Act," which would aim to reduce barriers and escalate the adoption of smart farming solutions in the future.

Smart farming essentially utilizes modern-day technologies like IoT sensors, drones, etc., as well as AI algorithms and data analytics, to evaluate and optimize crop monitoring, irrigation, and livestock. By implementing modern agriculture techniques, Japanese farmers would solve difficulties like the restriction of cultivable land, labor deficiency, and the necessity for precision farming. This revolution would also fit in with Japan's reputation for high-tech infrastructure and inventiveness. Hence, there would be a huge opportunity for the agricultural equipment sector to cater to this rising demand for smart agriculture solutions, as the demand for machinery and equipment designed for implementing smart farming techniques would improve.

Japan Agriculture Equipment Market Challenge:

Limited Availability of Arable Land to Hinder Market Growth – The limited presence of arable land in Japan has been a prominent obstacle to the market growth of agricultural equipment. The thin population and hard terrain of Japan have been responsible for the reduction in the area of fertile land for farming. Hence, this limited supply of available farmland makes the agricultural industry shrink, and the need for related equipment goes down.

In addition, intensive farming activity has been affecting the presence of arable land across the country, leading to a scarce supply of arable land. Also, farmers in densely populated areas are compelled to seek ways to exploit the native land available to upscale their production activities. Hence, as the country faces a reduction in arable land, agriculture activity is affected, which is a challenge that is negatively impacting the demand for agricultural equipment.

Japan Agriculture Equipment Market Trend:

Emergence of Automation Technology in Agricultural Practices – The rise of automation technology in agricultural practices is proving to be a major market trend that has been propelling the growth of the Japan Agriculture Equipment Market. Automation has emerged as the only savior for the country when it is struggling with labor insufficiency. Hence, advancement has technically become a critical tool for enhancing farming productivity and efficiency. Thus, the latest technologies in agriculture equipment, like robotics, automation, etc., have been helping farmers increase their yield and are driving Japan agricultural sector’s growth. They help with better yields and reduce the involvement of manual labor.

Consequently, there's a mounting demand for sophisticated agriculture equipment equipped with automation capabilities, driving market expansion and nurturing innovation within agricultural technology. This market trend would continue to evolve in the coming years as well, as agriculture equipment manufacturers would focus on market growth in the forecast years.

Japan Agriculture Equipment Market (2024-30): Segmentation Analysis

The Japan Agriculture Equipment Market study of MarkNtel Advisors evaluates & highlights the major trends and influencing factors in each segment. It includes predictions for the period 2024–2030 at the national level. According to the analysis, the market has been further classified as:

Based on Machinery:

- Farm Tractors

- Harvesting Machinery

- Plowing & Cultivation Machinery

- Planting & Fertilizing Machinery

- Haying Machinery

- Others (Irrigation Equipment, Crop Processing Equipment, etc.)

Farm tractors have been one of the major contributors to the growth of the Japan Agriculture Equipment Market. The increase in sales of tractors across Japan has been driven by the boost in farming activities and the increasing production of commodities like rice, wheat, soybeans, etc. For instance,

- The USDA mentioned that in 2023, wheat production has increased by 12.5% and soybean production has increased by 6.3%, as compared to 2022.

Hence, as production activities have increased, the demand for tractors required during the farming process has also amplified in recent years. Moreover, Japanese tractor manufacturers, like Yanmar, Kubota, etc., are making efforts to further make advancements in their agriculture equipment technologies by introducing tractors with high power efficiency. These companies are also planning to introduce tractors that run on renewable fuel sources, like hydrogen fuel-cell-powered tractors. Thus, with the advancement in Japanese tractors from Japanese tractor manufacturers, the segment is expected to follow a similar market trend in the future.

Based on Application:

- Land Development

- Sowing & Planting

- Plowing & Cultivation

- Threshing & Harvesting

- Others (Plant Protection, Irrigation, etc.)

The land development segment held the largest market share. Land development has been one of the major applications of the Japan Agriculture Equipment Market in recent years. This has been primarily because of the low availability of arable land, owing to which the farmers need to frequently prepare the available land area for production. In addition, land development is a labor-intensive process, and with the increasing rate of the elderly population involved in farming practices, the demand for mechanization equipment for this purpose has substantially improved. Nonetheless, as the government of Japan is focusing on techniques to increase its agricultural yield, the need for land development would propel it, as it is one of the basic steps in farming. Consequently, this would help drive the segment’s growth in the forthcoming years as well.

Japan Agriculture Equipment Industry Recent Development:

- In 2024, Kubota Tractor Corp., a leading Japanese agricultural equipment manufacturer, revealed its plans to produce batteries internally for the development of electric variants of farm machinery. These batteries would be equipped with internal cooling solutions, which would be required for Kubota tractors.

- In 2023, Mahindra & Mahindra Ltd, in collaboration with Mitsubishi Agriculture Machinery, announced the launch of OJA, which is a lightweight tractor designed for the future.

Gain a Competitive Edge with Our Japan Agriculture Equipment Market Report

- Japan Agriculture Equipment Market Report by MarkNtel Advisors provides a detailed & thorough analysis of market size & share, growth rate, competitive landscape, and key players. This comprehensive analysis helps businesses gain a holistic understanding of market dynamics & make informed decisions.

- This report also highlights current market trends & future projections, allowing businesses to identify emerging opportunities & potential challenges. By understanding market forecasts, companies can align their strategies & stay ahead of the competition.

- The Japan Agriculture Equipment Market Report aids in assessing & mitigating risks associated with entering or operating in the market. By understanding market dynamics, regulatory frameworks, and potential challenges, businesses can develop strategies to minimize risks & optimize their operations.

Frequently Asked Questions

- Market Segmentation

- Introduction

- Product Definition

- Research Process

- Assumptions

- Executive Summary

- Japan Agriculture Equipment Market Trends & Insights

- Japan Agriculture Equipment Market Dynamics

- Growth Drivers

- Challenges

- Japan Agriculture Equipment Market Hotspot & Opportunities

- Japan Agriculture Equipment Market Regulation & Policy, By Country

- Japan Agriculture Equipment Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Machinery

- Farm Tractors- Market Size & Forecast 2019-2030, USD Million

- Harvesting Machinery- Market Size & Forecast 2019-2030, USD Million

- Plowing & Cultivation Machinery- Market Size & Forecast 2019-2030, USD Million

- Planting & Fertilizing Machinery- Market Size & Forecast 2019-2030, USD Million

- Haying Machinery- Market Size & Forecast 2019-2030, USD Million

- Others (Irrigation Equipment, Crop Processing Equipment, etc.) - Market Size & Forecast 2019-2030, USD Million

- By Application

- Land Development- Market Size & Forecast 2019-2030, USD Million

- Sowing & Planting- Market Size & Forecast 2019-2030, USD Million

- Plowing & Cultivation- Market Size & Forecast 2019-2030, USD Million

- Threshing & Harvesting- Market Size & Forecast 2019-2030, USD Million

- Others (Plant Protection, Irrigation, etc.) - Market Size & Forecast 2019-2030, USD Million

- By Region

- Hokkaido

- Tohoku

- Kanto

- Chubu

- Rest of Japan

- By Competitors

- Competition Characteristics

- Revenue Shares

- By Machinery

- Market Size & Analysis

- Japan Farm Tractor Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Units Sold (Thousand)

- Market Share & Analysis

- By Type

- General Purpose Tractors- Market Size & Forecast 2019-2030, USD Million

- Row Crop Tractors- Market Size & Forecast 2019-2030, USD Million

- Specialty Tractors- Market Size & Forecast 2019-2030, USD Million

- By Power

- Below 20HP

- 21 - 30 HP

- 31 - 50 HP

- Above 50 HP

- By Region

- By Type

- Market Size & Analysis

- Japan Harvesting Machinery Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Units Sold (Thousand)

- Market Share & Analysis

- By Type

- Combine Harvester- Market Size & Forecast 2019-2030, USD Million

- Forage Harvester- Market Size & Forecast 2019-2030, USD Million

- Reaper- Market Size & Forecast 2019-2030, USD Million

- Others - Market Size & Forecast 2019-2030, USD Million

- By Region

- By Type

- Market Size & Analysis

- Japan Ploughing & Cultivating Machinery Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Units Sold (Thousand)

- Market Share & Analysis

- By Type

- Ploughs- Market Size & Forecast 2019-2030, USD Million

- Harrows- Market Size & Forecast 2019-2030, USD Million

- Cultivators & Tillers- Market Size & Forecast 2019-2030, USD Million

- Others (Rotavator, Subsoiler, etc.) - Market Size & Forecast 2019-2030, USD Million

- By Region

- By Type

- Market Size & Analysis

- Japan Planting & Fertilizing Machinery Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Units Sold (Thousand)

- Market Share & Analysis

- By Type

- Seed Drills- Market Size & Forecast 2019-2030, USD Million

- Planters- Market Size & Forecast 2019-2030, USD Million

- Spreaders- Market Size & Forecast 2019-2030, USD Million

- Others (Sprayers, Granular Fertilizer Applicator, etc.)- Market Size & Forecast 2019-2030, USD Million

- By Region

- By Type

- Market Size & Analysis

- Japan Haying Machinery Market Outlook, 2019-2030F

- Market Size & Analysis

- By Revenues (USD Million)

- Units Sold (Thousand)

- Market Share & Analysis

- By Type

- Balers- Market Size & Forecast 2019-2030, USD Million

- Mower-Conditioner- Market Size & Forecast 2019-2030, USD Million

- Tedders & Rakes- Market Size & Forecast 2019-2030, USD Million

- By Type

- By Region

- Market Size & Analysis

- Japan Agriculture Equipment Market Key Strategic Imperatives for Success & Growth

- Competition Outlook

- Company Profiles

- Mitsubishi Agricultural Machinery

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Messey Ferguson (AGCO)

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Deere and Company

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- AGCO Corp.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Iseki & Co., Ltd.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Taiyo Co., Ltd.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Kubota Tractor Corp.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Mahindra & Mahindra Ltd

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Yanmar Company Limited

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- IHI Shibaura Machinery Corporation

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Others

- Mitsubishi Agricultural Machinery

- Company Profiles

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making