Global Identity Verification Market Research Report: Forecast (2024-2029)

By Component (Solution, Service), By Type (Biometric, Non-Biometric), By Mode of Deployment (Cloud, On-Premises), By Organization Size (Large Enterprises, Small & Medium Enterprise...s), By Application (Access Control and User Monitoring, Know your Customer and Business, Onboarding, Identity Fraud and Compliance and Forensic), By End-User (BFSI, E-commerce & Retail, Defense, Healthcare, IT Services, Others), By Region (North America, South America, Europe, The Middle East & Africa, Asia-Pacific), By Company (LexisNexis Risk Solutions, Experian Information Solution, Inc., Equifax, Thales, GBG Plc., MasterCard, Trans Union LLC, Trulioo, Mitek System Inc., Jumio, Idfy, SigniCat, Veriff, PXL Vision AG , SumSub) Read more

- ICT & Electronics

- Oct 2023

- Pages 192

- Report Format: PDF, Excel, PPT

Market Definition

Identity verification is the process of confirming an individual's identity by verifying the information they provide against reliable & trusted sources. The identity verification method involves checking government-issued identification documents, validating biometric data, or using knowledge-based authentication. The goal of identity verification is to prevent fraud, identity theft, and unauthorized access while ensuring a user's identity is legitimate & secure.

Market Insights & Analysis: Global Identity Verification Market (2024-2029):

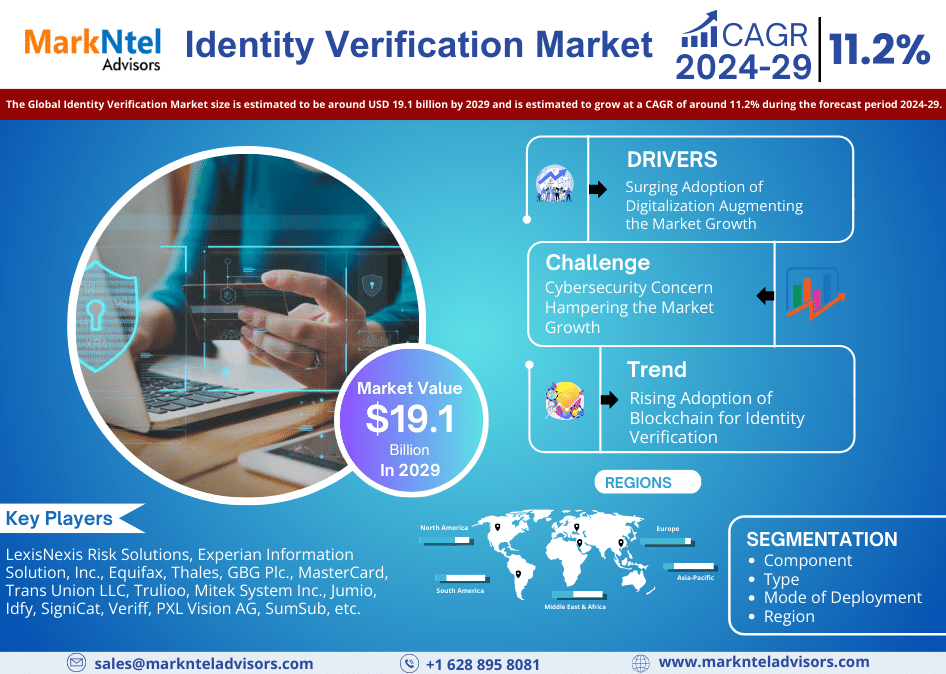

The Global Identity Verification Market size is estimated to be around USD 19.1 billion by 2029 and is estimated to grow at a CAGR of around 11.2% during the forecast period, i.e., 2024-29. The market is undergoing rapid expansion & transformation, driven by the growing importance of digital identity across major industrial domains. Globally, the consumer electronics industry is a key end-user for the industry, owing to the continuously surging sales of mobile devices, laptops, and tablets, among others, requiring the usage of biometric or other identity verification solutions to minimize loss of these devices & consumer data.

| Report Coverage | Details |

|---|---|

| Study Period | Historical Data: 2019-22 |

| Base Year: 2023 | |

| Forecast Period: 2024-29 | |

| CAGR (2024-2029) | 11.2% |

| Regions Covered | North America: US, Canada, Mexico |

| Europe: Germany, The UK, France, Spain, Italy, Rest of Europe | |

| Asia-Pacific: China, India, Japan, South Korea, Australia, Rest of Asia-Pacific | |

| South America: Brazil, Argentina, Rest of South America | |

| Middle East & Africa: UAE, Saudi Arabia, South Africa, Rest of MEA | |

| Key Companies Profiled | LexisNexis Risk Solutions, Experian Information Solution, Inc., Equifax, Thales, GBG Plc., MasterCard, Trans Union LLC, Trulioo, Mitek System Inc., Jumio, Idfy, SigniCat, Veriff, PXL Vision AG , SumSub, |

| Market Value (2029) | USD 19.1 Billion |

Additionally, as businesses & organizations are embracing digital channels for customer interactions, the need to establish trust & securely verify identities has become paramount. This is encouraging organizations to implement identity verification solutions & services for improved business scalability and productivity, as well as to reduce data theft loss. Furthermore, the growing trend to integrate identity verification into the user onboarding process using technologies such as Biometrics, artificial intelligence, and machine learning to fortify security measures and streamline user registration procedures is gaining notable momentum globally.

This has influenced the demand for identity verification systems among various businesses like banking, e-commerce, etc., which impacts the need for identity verification systems in the market. Further, increasing adoption of digitalized services related to healthcare, surging exposure of businesses to introduce KYC, and boost in online transaction activities are uplifting the revenue growth of the Global Identity Verification Market for enhanced risk management and regulatory compliance.

Global Identity Verification Market Driver:

Surging Adoption of Digitalization Augmenting the Market Growth – The rapid shift toward digital services and online interactions across end-user industries has spurred the demand for efficient & secure identity verification solutions. The global market is witnessing a profound transformation fueled by the need to combat identity theft, fraud, and stringent regulatory requirements. As businesses increasingly adopt digital platforms for customer interactions, from e-commerce to financial services & telehealth, the importance of robust identity verification has been growing in recent years.

Also, witnessing the increasing demand, key market players such as DocuSign, iDenfy, etc., are increasingly working to develop cutting-edge identity verification technologies, including Biometric, document authentication, and Blockchain-based solutions, to ensure seamless and frictionless user experiences while ensuring the highest level of security. This rising development in the Identity Verification Market would increase the adoption of technology & enhance the growth in the forecast years.

Global Identity Verification Market Opportunity:

Rising Integration of IoT Security – IoT security represents a compelling market opportunity within the broader identity verification landscape. As the Internet of Things continues its rapid expansion across industries such as healthcare, manufacturing, smart cities, and connected homes, the need to ensure the security of IoT devices and networks has become paramount. Identity verification plays a pivotal role in this context, as it enables secure device authentication & access control.

The opportunity lies in providing robust identity verification solutions tailored to the unique requirements of IoT, such as scalable and efficient methods for verifying the identities of numerous interconnected devices. As IoT deployments grow, the demand for solutions that prevent unauthorized access, data breaches, and cyberattacks on IoT ecosystems is set to increase significantly.

Companies that can offer effective IoT security solutions have the potential to carve out a niche in this burgeoning Identity Verification Market while contributing to the overall integrity & trustworthiness of the IoT landscape.

Global Identity Verification Market Challenge:

Cybersecurity Concern Hampering the Market Growth – Cybersecurity threats represent a critical challenge in the Identity Verification Market, posing significant risks to individuals & organizations alike. As various economic verticals, like banking, manufacturing, healthcare, etc., are increasingly transitioning towards digitalization, the threat landscape is evolving, with malicious actors seeking to exploit vulnerabilities in identification & authentication systems.

These threats encompass a wide range of tactics, including identity theft, data breaches, phishing attacks, ransomware, and advanced persistent threats. Moreover, compliance with data protection regulations adds another layer of complexity, as organizations must ensure to safeguard personal information while delivering efficient & user-friendly identification experiences.

The challenge, therefore, lies in not only developing robust security measures but also in staying vigilant & adaptable in the face of an ever-changing cybersecurity landscape, thereby posing a restraint for identity verification software companies globally.

Global Identity Verification Market Trend:

Rising Adoption of Blockchain for Identity Verification – Blockchain for identity verification has emerged as a prominent trend in the Identity Verification Market, revolutionizing how individuals' identities are managed & secured. Blockchain's decentralized and tamper-resistant ledger technology offers a solution to the challenges of identity verification, especially in a digital and interconnected world.

With traditional centralized identity systems vulnerable to data breaches and privacy concerns, blockchain-based identity verification provides a more secure & user-centric approach. It allows individuals to have greater control over their personal information, granting access to specific details only when necessary.

Moreover, blockchain offers a way to verify identities without relying on a centralized authority, making it highly appealing for applications like online authentication, secure document management, and even voting systems. Nonetheless, the potential for improved security and privacy makes blockchain a compelling force in the evolving Identification Market.

Global Identity Verification Market (2024-2029): Segmentation Analysis

The Global Identity Verification Market study of MarkNtel Advisors evaluates & highlights the major trends & influencing factors in each segment & includes predictions for the period 2024–2029 at the global level. In accordance to the analysis, the market has been further classified as:

Based on Organization Size:

- Large enterprise

- Small & Medium Enterprise

Large enterprise is anticipated to grab a substantial share of the Identity Verification Market. This is primarily due to their extensive customer bases, complex compliance requirements, and a greater need for sophisticated identity verification methods. These enterprises frequently deal with a high volume of transactions both online & offline and are subject to stringent regulatory standards, especially in industries like finance, healthcare, and e-commerce. For instance, according to the E-commerce Tips Organization, as of 2022, the total value of global transactions is around USD 9.4 trillion and is projected to increase by USD 14.79 trillion by 2027.

Thus, the wider adoption of online transactions among consumers globally is heightening security concerns among the concerned business, as a result of a continuous upsurge in transaction thefts. This has further created significant opportunities for players operating in the identity verification market to expand their presence in BFSI and related sectors to gain emerging revenue opportunities.

Based on End User:

- BFSI

- E-commerce & Retail

- Defense

- Healthcare

- IT Service

- Others (Telecom, Gaming, etc.)

The BFSI segment dominated the Identity Verification Market during the historical years and this trend is predicted to be followed in the forecast years as well. This is primarily attributed to the nature of the banking sector, which is heavily regulated, with strict compliance requirements, particularly Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations.

To adhere to these regulations, banks thoroughly verify the identities of their customers during onboarding & throughout their engagement, making identity verification solutions essential. The growing digitalization & adoption of new banking financial services have increased the need for robust & seamless identity verification processes.

To address this demand, financial companies are collaborating with identity verification solutions, providing companies to streamline their process & mitigate the risk of fraud. These strategic collaborations in the banking sector are expected to positively impact the Identity Verification Industry growth.

Global Identity Verification Market (2024-2029): Regional Projections

Geographically, the Global Identity Verification Market expands across:

- North America

- South America

- Europe

- The Middle East & Africa

- Asia-Pacific

North America dominated the Global Identity Verification Market in 2023. The region's robust & highly regulated financial services sector, including banking & FinTech, has been a major driver facilitating this demand. Stricter Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations in the region have necessitated more stringent identity verification processes, pushing financial institutions to invest in advanced verification technologies.

The prevalence of online commerce & digital services in North America, particularly in the United States & Canada, has fueled the demand for seamless & secure customer onboarding experiences. Thus, with the surge in the digitalized economy, the concerns over data privacy & security have heightened in North America, leading to increased awareness & demand for solutions that protect individuals' personal information. The implementation of data protection regulations like CCPA in California, etc., has also influenced the focus on identity verification in the region.

Global Identity Verification Industry Recent Development

- 2023: Thales announced a partnership with Kyndryl to provide French businesses and institutions with better protection for their computer systems, technology, and operational equipment.

- 2023: Equifax announced a strategic partnership with Mitek Systems Inc., to add Mitek’s biometric-based identity verification and liveness detection technology to Equifax’s digital identity software, and strengthen Equifax’s portfolio offering for identity verification globally.

Gain a Competitive Edge with Our Global Identity Verification Market Report

- Global Identity Verification Market Report by MarkNtel Advisors provides a detailed & thorough analysis of market size & share, growth rate, competitive landscape, and key players. This comprehensive analysis helps businesses gain a holistic understanding of the market dynamics & make informed decisions.

- This report also highlights current market trends & future projections, allowing businesses to identify emerging opportunities & potential challenges. By understanding market forecasts, companies can align their strategies & stay ahead of the competition.

- Global Identity Verification Market Report aids in assessing & mitigating risks associated with entering or operating in the market. By understanding market dynamics, regulatory frameworks, and potential challenges, businesses can develop strategies to minimize risks & optimize their operations.

Frequently Asked Questions

Global Identity Verification Market Research Report (2024-2029) - Table of Contents

- Market Segmentation

- Introduction

- Product Definition

- Research Process

- Assumptions

- Executive Summary

- Global Identity Verification Market Trends & Developments

- Global Identity Verification Market Dynamics

- Drivers

- Challenges

- Global Identity Verification Market Start-Up Ecosystem

- Entrepreneurial Activity

- Funding Received by Top Companies

- Key Investors Active in the Market

- Series Wise Funding Received

- Seed Funding

- Angel Investing

- Venture Capitalist (VC) Funding

- Others

- Global Identity Verification Market Porter Five Forces Analysis

- Global Identity Verification Market Regulations, Policies and Product Standards

- Global Identity Verification Market Hotspot and Opportunities

- Global Identity Verification Market Outlook, 2019-2029F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Size & Analysis

- By Component

- Solution- Market Size & Forecast 2019-2029F, (USD Million)

- Service- Market Size & Forecast 2019-2029F, USD Million

- By Type

- Biometric- Market Size & Forecast 2019-2029F, USD Million

- Non-Biometric- Market Size & Forecast 2019-2029F, USD Million

- By Mode of Deployment

- Cloud - Market Size & Forecast 2019-2029F, USD Million

- On-Premises - Market Size & Forecast 2019-2029F, USD Million

- By Organization Size

- Large Enterprises - Market Size & Forecast 2019-2029F, USD Million

- Small & Medium Enterprises - Market Size & Forecast 2019-2029F, USD Million

- By Application

- Access Control and User Monitoring - Market Size & Forecast 2019-2029F, USD Million

- Know your Customer and Business, Onboarding - Market Size & Forecast 2019-2029F, USD Million

- Identity Fraud and Compliance and Forensic- Market Size & Forecast 2019-2029F, USD Million

- By End-User

- BFSI - Market Size & Forecast 2019-2029F, USD Million

- E-commerce & Retail - Market Size & Forecast 2019-2029F, USD Million

- Defense- Market Size & Forecast 2019-2029F, USD Million

- Healthcare- Market Size & Forecast 2019-2029F, USD Million

- IT Services- Market Size & Forecast 2019-2029F, USD Million

- Others (Telecom, Gaming, etc.) - Market Size & Forecast 2019-2029F, USD Million

- By Region

- North America

- South America

- Europe

- The Middle East & Africa

- Asia-Pacific

- By Competition

- Competition Characteristics

- Market Share Analysis

- By Component

- Market Size & Analysis

- North America Identity Verification Market Outlook, 2019-2029F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Component- Market Size & Forecast 2019-2029F, USD Million

- By Type- Market Size & Forecast 2019-2029F, USD Million

- By Mode of Deployment- Market Size & Forecast 2019-2029F, USD Million

- By Organization Size- Market Size & Forecast 2019-2029F, USD Million

- By Application- Market Size & Forecast 2019-2029F, USD Million

- By End-User- Market Size & Forecast 2019-2029F, USD Million

- By Country

- The US

- Canada

- Mexico

- The US Identity Verification Market Outlook, 2019-2029F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Component- Market Size & Forecast 2019-2029F, USD Million

- By Application- Market Size & Forecast 2019-2029F, USD Million

- By End-User- Market Size & Forecast 2019-2029F, USD Million

- Market Size & Analysis

- Canada Identity Verification Market Outlook, 2019-2029F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Component- Market Size & Forecast 2019-2029F, USD Million

- By Application- Market Size & Forecast 2019-2029F, USD Million

- By End-User- Market Size & Forecast 2019-2029F, USD Million

- Market Size & Analysis

- Mexico Identity Verification Market Outlook, 2019-2029F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Component- Market Size & Forecast 2019-2029F, USD Million

- By Application- Market Size & Forecast 2019-2029F, USD Million

- By End-User- Market Size & Forecast 2019-2029F, USD Million

- Market Size & Analysis

- Market Size & Analysis

- South America Identity Verification Market Outlook, 2019-2029F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Component- Market Size & Forecast 2019-2029F, USD Million

- By Type- Market Size & Forecast 2019-2029F, USD Million

- By Mode of Deployment- Market Size & Forecast 2019-2029F, USD Million

- By Organization Size- Market Size & Forecast 2019-2029F, USD Million

- By Application- Market Size & Forecast 2019-2029F, USD Million

- By End-User- Market Size & Forecast 2019-2029F, USD Million

- By Country

- Brazil

- Argentina

- Rest of South America

- Brazil Identity Verification Market Outlook, 2019-2029F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Component- Market Size & Forecast 2019-2029F, USD Million

- By Application- Market Size & Forecast 2019-2029F, USD Million

- By End-User- Market Size & Forecast 2019-2029F, USD Million

- Market Size & Analysis

- Argentina Identity Verification Market Outlook, 2019-2029F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Component- Market Size & Forecast 2019-2029F, USD Million

- By Application- Market Size & Forecast 2019-2029F, USD Million

- By End-User- Market Size & Forecast 2019-2029F, USD Million

- Market Size & Analysis

- Market Size & Analysis

- Europe Identity Verification Market Outlook, 2019-2029F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Component- Market Size & Forecast 2019-2029F, USD Million

- By Type- Market Size & Forecast 2019-2029F, USD Million

- By Mode of Deployment- Market Size & Forecast 2019-2029F, USD Million

- By Organization Size- Market Size & Forecast 2019-2029F, USD Million

- By Application- Market Size & Forecast 2019-2029F, USD Million

- By End-User- Market Size & Forecast 2019-2029F, USD Million

- By Country

- Germany

- The UK

- France

- Spain

- Italy

- Rest of Europe

- Germany Identity Verification Market Outlook, 2019-2029F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Component- Market Size & Forecast 2019-2029F, USD Million

- By Application- Market Size & Forecast 2019-2029F, USD Million

- By End-User- Market Size & Forecast 2019-2029F, USD Million

- Market Size & Analysis

- The UK Identity Verification Market Outlook, 2019-2029F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Component- Market Size & Forecast 2019-2029F, USD Million

- By Application- Market Size & Forecast 2019-2029F, USD Million

- By End-User- Market Size & Forecast 2019-2029F, USD Million

- Market Size & Analysis

- France Identity Verification Market Outlook, 2019-2029F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Component- Market Size & Forecast 2019-2029F, USD Million

- By Application- Market Size & Forecast 2019-2029F, USD Million

- By End-User- Market Size & Forecast 2019-2029F, USD Million

- Market Size & Analysis

- Spain Identity Verification Market Outlook, 2019-2029F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Component- Market Size & Forecast 2019-2029F, USD Million

- By Application- Market Size & Forecast 2019-2029F, USD Million

- By End-User- Market Size & Forecast 2019-2029F, USD Million

- Market Size & Analysis

- Italy Identity Verification Market Outlook, 2019-2029F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Component- Market Size & Forecast 2019-2029F, USD Million

- By Application- Market Size & Forecast 2019-2029F, USD Million

- By End-User- Market Size & Forecast 2019-2029F, USD Million

- Market Size & Analysis

- Market Size & Analysis

- The Middle East & Africa Identity Verification Market Outlook, 2019-2029F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Component- Market Size & Forecast 2019-2029F, USD Million

- By Type- Market Size & Forecast 2019-2029F, USD Million

- By Mode of Deployment- Market Size & Forecast 2019-2029F, USD Million

- By Organization Size- Market Size & Forecast 2019-2029F, USD Million

- By Application- Market Size & Forecast 2019-2029F, USD Million

- By End-User- Market Size & Forecast 2019-2029F, USD Million

- By Country

- The UAE

- Saudi Arabia

- South Africa

- Rest of the Middle East & Africa

- The UAE Identity Verification Market Outlook, 2019-2029F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Component- Market Size & Forecast 2019-2029F, USD Million

- By Application- Market Size & Forecast 2019-2029F, USD Million

- By End-User- Market Size & Forecast 2019-2029F, USD Million

- Market Size & Analysis

- Saudi Arabia Identity Verification Market Outlook, 2019-2029F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Component- Market Size & Forecast 2019-2029F, USD Million

- By Application- Market Size & Forecast 2019-2029F, USD Million

- By End-User- Market Size & Forecast 2019-2029F, USD Million

- Market Size & Analysis

- South Africa Identity Verification Market Outlook, 2019-2029F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Component- Market Size & Forecast 2019-2029F, USD Million

- By Application- Market Size & Forecast 2019-2029F, USD Million

- By End-User- Market Size & Forecast 2019-2029F, USD Million

- Market Size & Analysis

- Market Size & Analysis

- Asia-Pacific Identity Verification Market Outlook, 2019-2029F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Component- Market Size & Forecast 2019-2029F, USD Million

- By Type- Market Size & Forecast 2019-2029F, USD Million

- By Mode of Deployment- Market Size & Forecast 2019-2029F, USD Million

- By Organization Size- Market Size & Forecast 2019-2029F, USD Million

- By Application- Market Size & Forecast 2019-2029F, USD Million

- By End-User- Market Size & Forecast 2019-2029F, USD Million

- By Country

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia-Pacific

- China Identity Verification Market Outlook, 2019-2029F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Component- Market Size & Forecast 2019-2029F, USD Million

- By Application- Market Size & Forecast 2019-2029F, USD Million

- By End-User- Market Size & Forecast 2019-2029F, USD Million

- Market Size & Analysis

- Japan Identity Verification Market Outlook, 2019-2029F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Component- Market Size & Forecast 2019-2029F, USD Million

- By Application- Market Size & Forecast 2019-2029F, USD Million

- By End-User- Market Size & Forecast 2019-2029F, USD Million

- Market Size & Analysis

- India Identity Verification Market Outlook, 2019-2029F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Component- Market Size & Forecast 2019-2029F, USD Million

- By Application- Market Size & Forecast 2019-2029F, USD Million

- By End-User- Market Size & Forecast 2019-2029F, USD Million

- Market Size & Analysis

- South Korea Identity Verification Market Outlook, 2019-2029F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Component- Market Size & Forecast 2019-2029F, USD Million

- By Application- Market Size & Forecast 2019-2029F, USD Million

- By End-User- Market Size & Forecast 2019-2029F, USD Million

- Market Size & Analysis

- Australia Identity Verification Market Outlook, 2019-2029F

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Component- Market Size & Forecast 2019-2029F, USD Million

- By Application- Market Size & Forecast 2019-2029F, USD Million

- By End-User- Market Size & Forecast 2019-2029F, USD Million

- Market Size & Analysis

- Market Size & Analysis

- Global Identity Verification Market Key Strategic Imperatives for Success & Growth

- Competitive Outlook

- Company Profiles

- LexisNexis Risk Solutions

- Business Description

- Technology Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Experian Information Solution, Inc.

- Business Description

- Technology Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Equifax

- Business Description

- Technology Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Thales

- Business Description

- Technology Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- GBG Plc.

- Business Description

- Technology Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- MasterCard

- Business Description

- Technology Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Trans Union LLC

- Business Description

- Technology Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Trulioo

- Business Description

- Technology Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Mitek System Inc.

- Business Description

- Technology Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Jumio

- Business Description

- Technology Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Idfy

- Business Description

- Technology Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- SigniCat

- Business Description

- Technology Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Veriff

- Business Description

- Technology Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- PXL Vision AG

- Business Description

- Technology Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- SumSub

- Business Description

- Technology Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others.

- Others

- LexisNexis Risk Solutions

- Company Profiles

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making