GCC Water Analytical Instruments Market Research Report: Forecast (2022-2027)

By Product Type (pH Meter & Oxygen Reduction Potential (ORP) Analyzer, Dissolved Oxygen Meter, Conductivity Meter, Turbidity Meter, Flame Photo Meter, Photo Flori Meter, Others (Sp...ectrophotometer, COD Digester, Colorimeter, Leal Test Apparatus, etc.,)), By End User(Power Plants, Water Treatment Plants, Food & Beverage Industries, Oil & Gas, Laboratories & Clinical Applications, Chemical Industries, Others (Automotive, Communication, Pools, etc.)), By Country(The UAE, Saudi Arabia, Bahrain, Kuwait, Oman, Qatar), By Competitors (Honeywell, General Electric, Swan Analytical Middle East FZE, Endress+Hauzer Group Services AG, ABB, Burgan Equipment CO., Hanna Instruments, Hatch, Xylem, Others) Read more

- Environment

- Jun 2022

- Pages 180

- Report Format: PDF, Excel, PPT

Market Definition

A group of measurement instruments, such as pH meters, conductivity meters, and turbidity meters that analyze water quality & composition, is referred to as water analytical instruments. These instruments are used extensively in the food processing industries, laboratories, oil refineries, chemical industries, etc. The mounting need for water in GCC, owing to the rising population, urbanization, and boost in economic activities combined with the depletion of surface & groundwater reserves, have significantly increased the demand for water & wastewater treatment. Consequently, this fueled the revenue growth of the Water Analytical Instruments market in GCC.

Market Insights

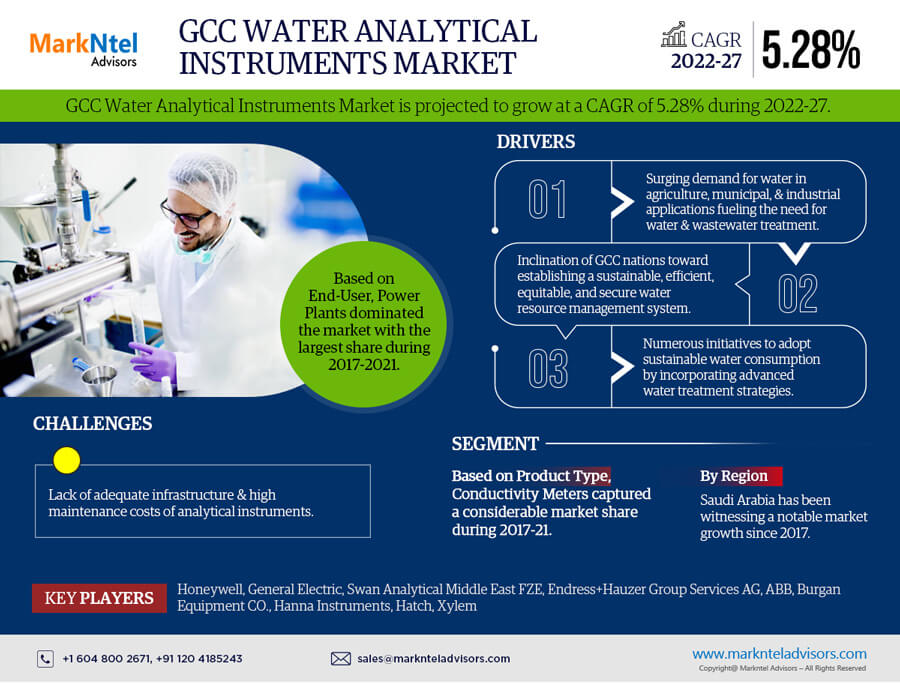

The GCC Water Analytical Instruments Market is projected to grow at a CAGR of 5.28% during the forecast period, 2022-27. The lack of water resource endowment & the rising population of GCC nations have significantly increased the demand for water in agriculture, municipal, and industrial uses that have fueled the need for water analytical instruments for water & wastewater treatment in the historical years. In addition, the inclination of GCC nations towards establishing a sustainable, efficient, equitable, and secure water resource management system that would promote sustainable socio-economic development is expected to proliferate the demand for water analytical instruments in the region.

| Report Coverage | Details |

|---|---|

| Study Period | Historical Data: 2017-20 |

| Base Year: 2021 | |

| Forecast Period: 2022-27 | |

| CAGR (2022-2027) | 5.28% |

| Country Covered | The UAE, Saudi Arabia, Bahrain, Kuwait, Oman, Qatar |

| Key Companies Profiled | Honeywell, General Electric, Swan Analytical Middle East FZE, Endress+Hauzer Group Services AG, ABB, Burgan Equipment CO., Hanna Instruments, Hatch, Xylem, Others |

| Unit Denominations | USD Million/Billion |

Under this, the Water Science and Technology Association, Bahrain, in the 12th Gulf Water Conference, announced a unified GCC water management strategy 2016-2035 to foster joint initiatives & strengthen the capabilities of each country in achieving a national, integrated, efficient, and sustainable management of their water resources.

Hence, the rising initiatives of the GCC nations to adopt a sustainable consumption of water by incorporating advanced water treatment strategies are expected to lead to the growth of the GCC Water Analytical Instruments Market during 2022-2027.

Key Market Trend in the Market

- Rising Adoption of Automated Water Analytical Instruments in Pharmaceutical Industries

Water is one of the major commodities used in the pharma industries that acts as a solvent in the processing, manufacturing, and formulation of pharmaceutical products, active pharmaceutical ingredients (APIs), and intermediates. It is also used for producing a finished product, as a cleaning agent for rinsing vessels & equipment, and as a primary packaging material. In addition, since water is used extensively in the pharmaceutical industry, pharmaceutical companies are required to determine the pH levels of water to determine whether it is suitable for the production of parent pharma products, for example, non-portable water, portable water, purified water, bacteriostatic water, etc.

The proliferation of pharmaceutical production activities in the GCC countries, such as the UAE, and Saudi Arabia, among others, to cater to the emerging medical needs of the individuals & support their economic well-being is anticipated to offer potential growth opportunities to the GCC Water Analytical Instruments market in the forecast years.

Impact of COVID-19 on the GCC Water Analytical Instruments Market

As a result of the COVID-19 pandemic in 2020, the GCC Water Analytical Instruments market saw a positive impact on revenue growth. The rising concern of GCC nations towards the treatment of sewage water & wastewater resources due to an increase in the transmission of COVID-19 virus through the water contamination from sewage water sources has significantly increased the need for water analytical instruments. For instance, in 2020, the Saudi Government conducted an RT-qPCR test of sewage water & identified the presence of SARS-CoV-2 strains in the water resources. This raised concerns, which led to a boost in the water treatment activities in Saudi Arabia.

Besides, the rising concerns over the spread of virus diseases among the residents & growing efforts of GCC nations to preserve water resources are anticipated to heighten the growth opportunities for the GCC Water Analytical Instruments market in the upcoming year.

Market Segmentation

Based on the Product Type:

- pH Meter & Oxygen Reduction Potential (ORP) Analyzer

- Dissolved Oxygen Meter

- Conductivity Meter

- Turbidity Meter

- Flame Photo Meter

- Photo Flori Meter

Of them all, the Conductivity Meter captured a considerable market share in the GCC Water Analytical Instruments market during 2017-21. An increase in health risks associated with the contamination in decentralized water distribution networks & resources is a key factor that derived the demand for conductivity & turbidity meters in GCC. Furthermore, toxins, pesticides, salts, metals, etc., present in food & beverage industry wastewater as well as pharmaceutical wastewater, have made water analytical instruments necessary for reuse in agricultural fields, hydraulic fracturing, etc., in order to limit water waste.

Additionally, the wide application of conductivity & turbidity instruments in water treatment plants to monitor the chemical & mineral composition of potable water is expected to generate a positive trend in the GCC Water Analytical Instruments market during 2022-2027.

Based on the End User:

- Power Plants

- Water Treatment Plants

- Food & Beverage Industries

- Oil & Gas

- Laboratories & Clinical Applications

- Chemical Industries

Among them, the Power Plants dominated the GCC Water Analytical Instruments market during 2017-2021. Increased energy production due to rising demand for power led to a significant increase in the need for water analytical instruments like pH meters, ORP meters, etc., to avoid unplanned plant shutdowns due to corrosion of pipes & other plant parts. Moreover, the rising investments in power plant development projects to cater to the emerging need for power in residential units, industries, etc., across the GCC is expected to accelerate the need for water analytical instruments. Some of the projects include:

- The construction of an Independent Steam & Power Plant (ISPP) with a power generation capacity of 700 to 900 MW & a desalination plant with a capacity of 24,00 cubic meters/day in Saudi Arabia is set to be completed by 2023.

- In addition, the construction of the Independent Water and Power Plant (IWPP) project at Al Dur, Bahrain with a capacity of 1,500 megawatts including 50 million imperial gallons per day of the reverse osmosis-based desalination plant is slated to be completed by 2022.

Regional Landscape

Geographically, the GCC Water Analytical Instruments Market expands across:

- The UAE

- Saudi Arabia

- Bahrain

- Kuwait

- Oman

Of all the countries in the GCC, Saudi Arabia has been portraying a noticeable market growth since 2017. This is due to the growing desalination activities in the region to meet household & industrial water needs sustainably. The water & wastewater treatment industry in Saudi Arabia is one of the largest among the GCC nations, with Dammam, Riyadh, and Jeddah being the major cities driving enormous potential for the revenue growth of the Saudi Arabia Water Analytical Instruments market.

In Addition, growing initiatives by the Saudi government to develop centralized wastewater treatment infrastructure across Najran & Al Baha, two of the prominent tourist places in the country, with an aim to support the emerging water needs of tourists & residents, are expected to boost the demand for water analytical instruments in the nation during 2022-2027.

Recent Development by Leading Companies:

- In 2021, the government of UAE awarded the Taweelah project, the country’s first reverse osmosis project in Abu Dhabi, to ABB group to build a desalination plant in Taweelah, which is to be equipped with water desalination equipment.

- In 2019, Xylem Inc., signed a Memorandum of Understanding with the Saudi Arabian General Investment Authority (SAGIA) to develop & localize advanced water & wastewater products & technologies to address water challenges in Saudi Arabia.

Market Dynamics:

Key Driver: Growing Focus of GCC Nations Towards Food, Water, and Energy Security to Drive the Market Growth

To eliminate the food crisis and boost self-sufficiency of utilities such as food, water & energy, and reduce overdependence on regions, such as Europe, Asia-Pacific, and North America, among others, the GCC countries are increasingly working to promote the food & energy sectors of the region. However, the absence of an adequate amount of water to support the production of food & energy has significantly increased the demand for wastewater treatment facilities in the region. This has contributed enormously to the demand for water analytical instruments such as flame photometers, photo flori meters, etc.

Furthermore, the growing inclination of the GCC nations, such as Oman in developing fisheries to improve self-sufficiency has promoted the need for water analytical instruments owing to the presence of contaminants such as Polychlorinated Biphenyls (PCBs), Polybrominated diphenyl ethers (PBDEs), dioxins, etc., to reduce fish fatality in the region. In addition, the consumption of fish contaminated by PCBs by humans can lead to infant development problems and can cause risks associated with liver and immune system functioning. The rising partnerships for the development of fisheries in the GCC countries are expected to provide lucrative opportunities for the water analytical instrument market in the upcoming years. For instance,

- In 2021, ALEC Engineering and Contracting, LLC, signed a strategic partnership with Norway-based MAT Filtration Technologies & Mat Kuling to initiate the development of land-based aquaculture & water treatment projects.

Possible Restraint: Lack of Available Infrastructure & High Maintenance Costs of Analytical Instruments to Hinder the Market Growth

The higher upfront & maintenance cost, which is over 15% of the cost of the analytical instrument, may pose a challenge for the revenue growth of water analytical instrument providers in developing GCC nations such as Bahrain & Oman. Moreover, less developed wastewater treatment infrastructure & limited manufacturing base in Bahrain in comparison to other GCC nations such as the UAE, Saudi Arabia, etc., may hinder the demand for analytical instruments.

Key Questions Answered in the Market Research Report:

- What are the overall statistics or estimates (Overview, Size - By Value, Forecast Numbers, Segmentation, Shares) of the GCC Water Analytical Instruments Market?

- What is the region-wise industry size, growth drivers, and challenges?

- What are the key innovations, opportunities, current & future trends, and regulations in the GCC Water Analytical Instruments Market?

- Who are the key competitors, their key strengths & weaknesses, and how do they perform in the GCC Water Analytical Instruments Market based on the competitive landscape?

- What are the key results derived from surveys conducted during the GCC Water Analytical Instruments Market study?

Frequently Asked Questions

- Introduction

- Product Definition

- Research Process

- Assumptions

- Market Segmentation

- Executive Summary

- Impact of COVID-19 on GCC Water Analytical Instruments Market

- GCC Water Analytical Instruments Market Trends & Insights

- GCC Water Analytical Instruments Market Dynamics

- Growth Drivers

- Challenges

- GCC Water Analytical Instruments Market Policies, Regulations, Product Standards

- GCC Water Analytical Instruments Market Hotspot & Opportunities

- GCC Water & Wastewater Treatment Market Outlook

- GCC Water Analytical Instruments Market Outlook, 2017-2027F

- Market Size & Analysis

- By Revenue (USD Million)

- Market Share & Analysis

- By Product Type

- pH Meter & Oxygen Reduction Potential (ORP) Analyser

- Dissolved Oxygen Meter

- Conductivity Meter

- Turbidity Meter

- Flame Photo Meter

- Photo Flori Meter

- Others (Spectrophotometer, COD Digester, Colorimeter, Leal Test Apparatus, etc.,)

- By End User

- Power Plants

- Water & Waste-water Treatment Plants

- Food & Beverage

- Oil & Gas

- Laboratories & Pharmaceutical

- Chemical

- Others (Automotive, Pools, etc.)

- By Country

- The UAE

- Saudi Arabia

- Bahrain

- Kuwait

- Oman

- Qatar

- By Company

- Competition Characteristics

- Revenue Shares

- By Product Type

- Market Size & Analysis

- The UAE Water Analytical Instruments Market Outlook, 2017-2027F

- Market Size & Analysis

- By Revenue (USD Million)

- Market Share & Analysis

- By Product Type

- By End User

- Market Size & Analysis

- Saudi Arabia Water Analytical Instruments Market Outlook, 2017-2027F

- Market Size & Analysis

- By Revenue (USD Million)

- Market Share & Analysis

- By Product Type

- By End User

- Market Size & Analysis

- Bahrain Water Analytical Instruments Market Outlook, 2017-2027F

- Market Size & Analysis

- By Revenue (USD Million)

- Market Share & Analysis

- By Product Type

- By End User

- Market Size & Analysis

- Kuwait Water Analytical Instruments Market Outlook, 2017-2027F

- Market Size & Analysis

- By Revenue (USD Million)

- Market Share & Analysis

- By Product Type

- By End User

- Market Size & Analysis

- Oman Water Analytical Instruments Market Outlook, 2017-2027F

- Market Size & Analysis

- By Revenue (USD Million)

- Market Share & Analysis

- By Product Type

- By End User

- Market Size & Analysis

- Qatar Water Analytical Instruments Market Outlook, 2017-2027F

- Market Size & Analysis

- By Revenue (USD Million)

- Market Share & Analysis

- By Product Type

- By End User

- Market Size & Analysis

- GCC Water Analytical Instruments Market Key Strategic Imperatives for Success & Growth

- Competition Outlook

- Competition Matrix

- Product Portfolio

- Target Markets

- Research & Development

- Strategic Alliances

- Strategic Initiatives

- Company Profiles of top companies (Business Description, Product Segments, Business Segments, Financials, Strategic Alliances/ Partnerships, Future Plans)

- Honeywell

- General Electric

- Swan Analytical Middle East FZE

- Endress+Hauzer Group Services AG

- ABB

- Burgan Equipment CO.

- Hanna Instruments

- Hach

- Xylem

- Others

- Competition Matrix

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making