GCC Tire Market Research Report: Forecast (2022-2027)

By Vehicle Type (Passenger Cars (SUV, Sedan, Hatchback & Bakkies), Light Commercial Vehicles (Light Trucks,Light Buses,Pickup trucks & Vans), Medium & Heavy Commercial Vehicles (Bu...s,Truck), Two Wheelers (Moped,Scooters,Motorcycles), Off the Road (OTR) (Earthmoving Equipment,Material Handling Equipment,Industrial & Mining Equipment), By Demand Category (OEM,Replacement), By Type of Tire (Radial,Bias), By Season (All Season,Summer), By Rim Size (Up to 12”,12.1” to 15”,15.1.” to 18”,18.1” to 20”, 20.1” to 22.5”, 22.6” to 26”,26.1” to 35”,35.1” to 47”,Above 47”), By Price Category (Low, Medium, High), By Country (The UAE,Saudi Arabia,Qatar,Oman,Kuwait,Bahrain) By Competitors (Hankook,Bridgestone,Goodyear,Michelin,Continental,Toyo,Kumho,Apollo,Others) Read more

- Tire

- Mar 2022

- Pages 176

- Report Format: PDF, Excel, PPT

Market Definition

The tire industry across the Gulf was driven formerly by imports, with massive penetration of Chinese tires owing to their easy availability & affordability. However, over recent years, the region has been witnessing an increasing establishment of new automakers & tire manufacturers.

The GCC tire industry offers the assurance of high-quality tires with superior durability, owing to which their demand is escalating swiftly. Hence, its growth prospect in gulf countries is highly opportunistic for the leading tire manufacturers over the coming years.

Market Insights

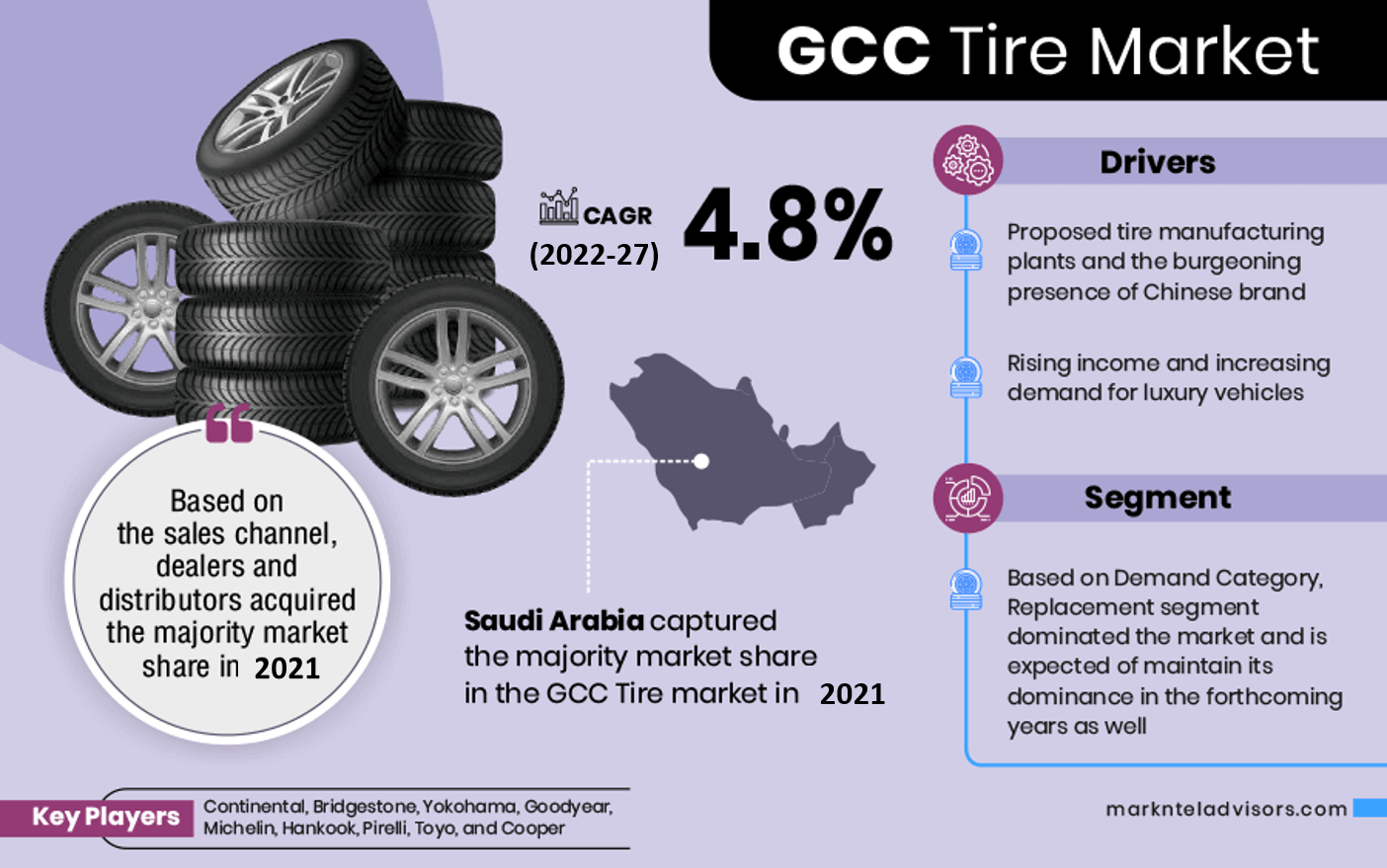

The GCC Tire Market is projected to grow at a CAGR of around 4.8% during the forecast period, i.e., 2022-27. The growth of the market is likely to be driven primarily by the rapidly increasing vehicle sales across the GCC region, owing prominently to the improving economy, changing living standards, & growing preference for private vehicle ownership, i.e., propelling the demand for vehicles and directly impacting the tire market.

Besides, the mounting focus of governments of different countries across the region on infrastructural developments is displaying a rapid acceleration in construction projects, i.e., surging the need for heavy vehicles and, as a result, for tires. It is instigating tire manufacturers to increase their production capacities and meet the increasing end-user requirements, thereby driving the market. Moreover, favourable government policies are playing a vital role in attracting foreign investments, establishing new production facilities, & enhancing the import & export business of tires & automobiles.

Furthermore, with the mounting influx of tourism, pilgrims, & migrants across the GCC, the construction of residential complexes, hotels, shopping malls, highways, & airports, among others, is also escalating swiftly. It, in turn, is augmenting the demand for heavy construction equipment and positively influencing the tire market across the GCC region.

| Report Coverage | Details |

|---|---|

| Study Period | Historical Data: 2017-20 |

| Base Year: 2021 | |

| Forecast Period: 2022-27 | |

| CAGR(2022-27) | 4.8% |

| Regions Covered | GCC: UAE, Saudi Arabia, Oman, Qatar, Bahrain, Kuwait |

| Key Companies Profiled | Hankook,Bridgestone,Goodyear,Michelin,Continental,Toyo,Kumho,Apollo,Others |

| Unit Denominations | USD Million/Billion |

Impact of Covid-19 on the GCC Tire Market

The advent of Covid-19 in 2020 had a decelerating effect on most industries across the GCC, yet the tire industry witnessed moderate impacts. With the imposition of stringent movement restrictions & lockdowns, the leading players in the market observed several challenges associated with the development & distribution of tires.

International travel & trade were put on a temporary halt, and the influx of migrants & tourism substantially declined and caused severe economic fluctuations. Besides, the hampered transportation & logistics sector resulted in the delayed or canceled deliveries of pre-produced tires.

Moreover, the disruptions in the supply chain of raw materials, shortage of labor, demand-supply gaps, & shut down of manufacturing units, among others, were other prominent challenges that introduced massive revenue losses for the leading players in the GCC Tire Market.

However, since the economy of GCC countries relies immensely on the construction sector, governments of some countries allowed its operations amidst the crisis, which fueled the demand for heavy vehicle & construction equipment and, consequently, for tires.

With the gradual improvement in the pandemic situation, governments uplifted the restrictions and allowed the recommencement of market operations. As a result, the leading players increased their production capacities to meet the burgeoning tire demand across the region. Currently, they are working on introducing new product lines to expand their visibility & contribute to the recovery of the market growth.

Market Segmentation

Based on the Vehicle Type:

- Passenger Cars

- Light Commercial Vehicles

- Medium & Heavy Commercial Vehicles (MHCV)

- Off the Road (OTR)

- Two Wheelers

Here, Passenger Cars are projected to display the fastest growth in the GCC Tire Market during the forecast period. It owes principally to their growing sales due to the swiftly improving economic status, changing living standards, and a surging inclination toward private ownership of vehicles, thereby expanding the vehicle fleet and directly impacting the tire market across GCC.

Besides, better road connectivity & network across cities are also augmenting the adoption of vehicles for transportation. Moreover, favorable government policies are attracting substantial foreign manufacturers of tires to establish their manufacturing facilities across GCC and offer an extensive range of tires & vehicles to consumers.

Furthermore, the growing influx of migrants & tourists is another prominent aspect fueling the sales of passenger vehicles for commercial use like cabs, taxis, etc., thereby positively influencing the GCC Tire Market through 2027.

Country Landscape

Geographically, the GCC Tire Market expands across:

- Saudi Arabia

- UAE

- Qatar

- Kuwait

- Bahrain

- Oman

Of all countries across the GCC region, the UAE is more likely to display the fastest growth in the Tire Market during 2022-27, owing principally to the mounting demand for tires due to the increasing vehicle fleet in the country. It is generating lucrative growth opportunities for the leading players to increase their production capacities & fuel the overall market growth in the coming years.

Besides, rapidly increasing construction activities due to the growing government focus on infrastructural developments, in line with Vision 2030, are infusing the demand for heavy commercial vehicles & construction equipment and, in turn, propelling the demand for tires in the country.

Key Questions Answered in the Market Research Report:

- What are the overall statistics or estimates (Overview, Size- By Value, Forecast Numbers, Segmentation, Shares) of the GCC Tire Market?

- What are the country-wise industry size, growth drivers, and challenges?

- What are the key innovations, opportunities, current & future trends, and regulations in the GCC Tire Market?

- Who are the key competitors, their key strengths & weaknesses, and how do they perform in the GCC Tire Market based on the competitive benchmarking matrix?

- What are the key results derived from surveys conducted during the GCC Tire Market study?

Frequently Asked Questions

- Introduction

- Product Definition

- Research Process

- Assumptions

- Market Segmentation

- Preface

- Executive Summary

- Impact of COVID-19 on GCC Tire Market

- Expert Verbatim-Interview Excerpts of industry experts

- GCC Tire Market Analysis, 2017-2027F

- Market Size & Analysis

- Revenues in (USD Billion)

- Units Sold in Million

- Market Share & Analysis

- By Vehicle Type

- Passenger Cars

- SUV

- Sedan

- Hatchback & Bakkies

- Light Commercial Vehicles (LCV)

- Light Trucks

- Light Buses

- Pickup trucks & Vans

- Medium & High Commercial Vehicles

- Bus

- Truck

- Two Wheelers

- Moped

- Scooters

- Motorcycles

- Off the Road (OTR)

- Earthmoving Equipment

- Material Handling Equipment

- Industrial & Mining Equipment

- Passenger Cars

- By Demand Type

- OEM

- Replacement

- By Type of Tire

- Radial

- Bias

- By Season

- All Season

- Summer

- By Rim Size

- Upto 12

- 12.1” to 15”

- 15.1.” to 18”

- 18.1” to 20”

- 20.1” to 22.5”

- 22.6” to 26”

- 26.1” to 35”

- 35.1” to 47”

- Above 47”

- By Price Category

- Low

- Medium

- High

- By Country

- Saudi Arabia

- UAE

- Qatar

- Kuwait

- Bahrain

- Oman

- By Company

- Market Shares, By Revenue

- Strategic Factorial Indexing

- Competitor Placement in MarkNtel Quadrant

- By Vehicle Type

- Market Attractiveness Index

- By Type of Vehicle

- By Demand Type

- By Type of Tire

- By Season

- By Rim Size

- By Price Category

- By Country

- By Competitors

- Total Units Sold

- Market Share

- Market Size & Analysis

- Saudi Arabia Tire Market Analysis, 2022

- Market Size & Analysis

- Units Sold in Million

- Revenues in USD Billion

- Market Share & Analysis

- By Vehicle Type

- By Demand Type

- By Type of Tire

- By Season

- By Rim Size

- By Price Category

- Market Size & Analysis

- UAE Tire Market Analysis, 2022

- Market Size & Analysis

- Units Sold in Million

- Revenues in USD Billion

- Market Share & Analysis

- By Vehicle Type

- By Demand Type

- By Type of Tire

- By Season

- By Rim Size

- By Price Category

- Market Size & Analysis

- Qatar Tire Market Analysis, 2022

- Market Size & Analysis

- Units Sold in Million

- Revenues in USD Billion

- Market Share & Analysis

- By Vehicle Type

- By Demand Type

- By Type of Tire

- By Season

- By Rim Size

- By Price Category

- Market Size & Analysis

- Bahrain Tire Market Analysis, 2022

- Market Size & Analysis

- Units Sold in Million

- Revenues in USD Billion

- Market Share & Analysis

- By Vehicle Type

- By Demand Type

- By Type of Tire

- By Season

- By Rim Size

- By Price Category

- Market Size & Analysis

- Kuwait Tire Market Analysis, 2022

- Market Size & Analysis

- Units Sold in Million

- Revenues in USD Billion

- Market Share & Analysis

- By Vehicle Type

- By Demand Type

- By Type of Tire

- By Season

- By Rim Size

- By Price Category

- Market Size & Analysis

- Oman Tire Market Analysis, 2022

- Market Size & Analysis

- Units Sold in Million

- Revenues in USD Billion

- Market Share & Analysis

- By Vehicle Type

- By Demand Type

- By Type of Tire

- By Season

- By Rim Size

- By Price Category

- Market Size & Analysis

- GCC Tire Market Value Chain Analysis

- Key Stakeholders in Value Chain

- Margin at Various Levels

- GCC Tire Market Regulations, Policies, Regulation, Product Benchmarks

- GCC Tire Market Trends & Insights

- GCC Tire Market Dynamics

- Drivers

- Challenges

- Impact Analysis

- GCC Tire Market Hotspot & Opportunities

- GCC Tire Market Key Strategic Imperatives for Success & Growth

- GCC Tire Market Import & Export Statistics

- Competition Outlook

- Competition Matrix

- Product Portfolio

- Target Markets

- Research & Development

- Strategic Alliances

- Strategic Initiatives

- Company Profiles of Top Companies (Business Description, Product Segments, Business Segments, Financials, Strategic Alliances/ Partnerships, Future Plans)

- Hankook

- Bridgestone

- Goodyear

- Michelin

- Continental

- Toyo

- Kumho

- Apollo

- Competition Matrix

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making