GCC Expanded Polystyrene Market Research Report: Forecast (2023-2028)

By Type, (White, Grey & Silver, Black), By Production Method (In-Situ Suspension, Post-impregnation Suspension), By End User (Building & Construction, Electrical and Electronics, P...ackaging, Automotive, Others (Automotive, Healthcare, Agriculture, etc.)), By Country (The UAE, Saudi Arabia, Oman, Kuwait, Bahrain, Qatar), By Company (BASF, Kaneka Corp., SIBUR Holding, BEWI, SUNPOR, Synthos, TotalEnergies, SABIC, Sundolitt Ltd., UNIPOL, Ravago Manufacturing, Styro Qatar, Al Muhaidib Polystyrene Production Company, and Kuwait Styrene Company (TKSC)) Read more

- Chemicals

- Jun 2023

- Pages 198

- Report Format: PDF, Excel, PPT

Market Definition

Expanded Polystyrene (EPS) is a type of rigid & closed-cell thermoplastic foam material created by polymerizing solid beads of polystyrene derived from styrene monomer. These polystyrene beads contain an expansion gas, mainly pentane, i.e., dissolved within it. EPS has unique properties like lightweight structure, thermal insulation capabilities, and resistance to moisture, owing to which it finds applications in various industries like construction, packaging, automotive, etc.

Market Insights & Analysis: GCC Expanded Polystyrene Market (2023-28)

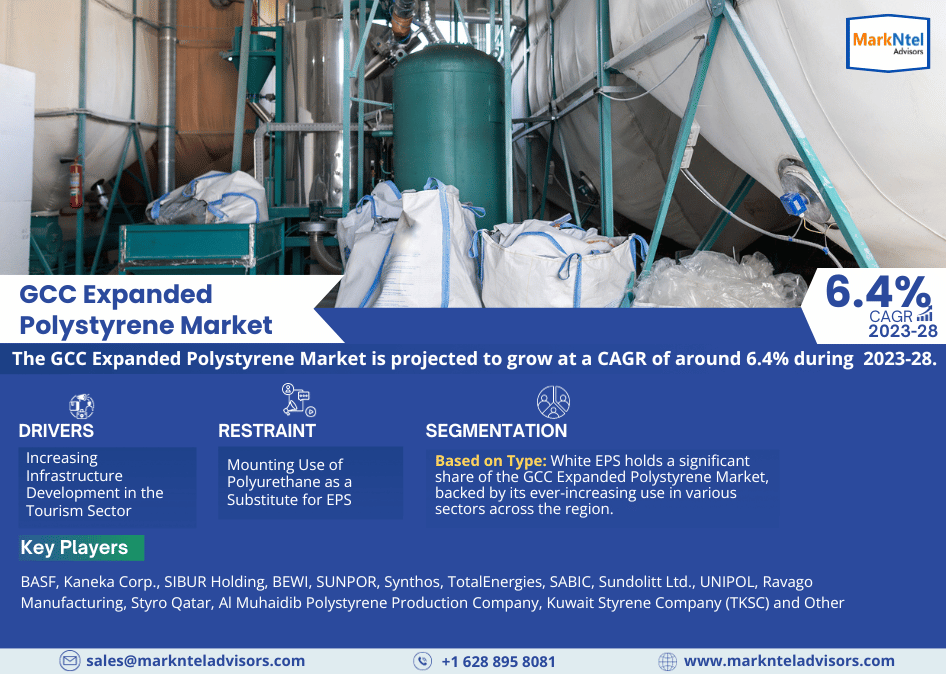

The GCC Expanded Polystyrene Market is projected to grow at a CAGR of around 6.4% during the forecast period, i.e., 2023-28. The growth of the market would be propelled by the burgeoning demand for EPS in construction, packaging, cold chain logistics, & automotive sectors, among others, for thermal insulation in buildings, packaging of various products, and temperature-controlled transportation of goods. These industries are witnessing significant growth in the GCC region, backed by increasing FDI (Foreign Direct Investment) and enhanced government support.

Moreover, rapid urbanization and various ongoing & upcoming infrastructure development projects are further creating the demand for EPS. Many countries, such as Saudi Arabia, the United Arab Emirates, and Qatar, have ambitious long-term development plans, such as Saudi Vision 2030, the UAE Vision 2031, and Qatar National Vision 2030, focused on diversifying their economies away from oil & gas and improving infrastructure, including housing, urban development, and transportation. These infrastructural development activities are accelerating construction activities in the region and, in turn, infusing the demand for EPS.

| Report Coverage | Details |

|---|---|

| Study Period | Historical Data: 2018-21 |

| Base Year: 2022 | |

| Forecast Period: 2023-28 | |

| CAGR (2023-2028) | 6.4% |

| Country Covered | The UAE, Saudi Arabia, Oman, Kuwait, Bahrain, Qatar |

| Key Companies Profiled | BASF, Kaneka Corp., SIBUR Holding, BEWI, SUNPOR, Synthos, TotalEnergies, SABIC, Sundolitt Ltd., UNIPOL, Ravago Manufacturing, Styro Qatar, Al Muhaidib Polystyrene Production Company, Kuwait Styrene Company (TKSC) and Other |

| Unit Denominations | USD Million/Billion |

Along with this, the packaging industry in the GCC is also flourishing at a prominent pace, driven by high demand from the food & beverage and pharmaceutical industries and additionally supported by the booming e-commerce sector. The growing population levels, improving disposable incomes, and changing consumer preferences are all augmenting the demand for packaged food & beverages and, consequently, packaging solutions made from EPS like cups, containers, & foam.

Furthermore, the increasing focus of these industries on sustainable packaging is also amplifying the demand for EPS packaging solutions, which have low carbon footprints & involve energy-efficient manufacturing processes. Additionally, immense government support and incentives like subsidies & tax rebates for EV (Electric Vehicle) buyers are attracting EV manufacturers, including NWTN, M Glory, etc., to set up plants in the region, particularly in Saudi Arabia and the UAE. Thus, the demand for EPS-based automotive components & packaging materials is on the rise, which is spurring growth in the GCC Expanded Polystyrene Market.

GCC Expanded Polystyrene Market Driver:

Increasing Infrastructure Development in the Tourism Sector - GCC countries like the UAE, Qatar, & Saudi Arabia have recognized the potential of tourism for diversifying their economy, owing to which they have developed comprehensive tourism development strategies to attract more tourists. In line with this, several hotels, resorts, entertainment venues, etc., are being constructed across the region, i.e., pushing the demand for EPS for insulation in walls, roofs, & floors. Saudi Arabia aims to increase the tourism sector's contribution to the EPS demand to more than 10% and attract 100 million annual visits by 2030. Similarly, the UAE aims to welcome 40 million hotel guests by 2031, i.e., in line with the UAE Tourism Strategy 2031. Consequently, the region is witnessing an increasing number of hotel construction projects. As of 2023, there are 159,424 hotel rooms under contract for development, and Saudi Arabia is at the forefront of tourism development, with a pipeline of 100,071 hotel rooms. Hence, the rise in construction activities associated with the tourism sector is projected to drive the GCC Expanded Polystyrene Market during 2023-28.

GCC Expanded Polystyrene Market Restraint:

Mounting Use of Polyurethane as a Substitute for EPS - The growing popularity of polyurethane as a substitute material for EPS poses new challenges for the market players in terms of increased competition. The construction sector, i.e., a major procurer of EPS, is now slowly shifting toward polyurethane due to its better insulation performance & thermal properties. Similarly, it is also being used for manufacturing car seats, furniture, & other consumer goods. Hence, the surging demand for polyurethane as an alternative to EPS is likely to hinder the growth of the GCC Expanded Polystyrene Market in the coming years.

GCC Expanded Polystyrene Market Growth Opportunity:

The Intensifying Race to Build Green Infrastructure & Sustainable Solutions - Most countries in the GCC region, such as Qatar, the UAE, Saudi Arabia, etc., have signed international agreements & accords, like the Paris Agreement, in order to reduce greenhouse emissions. Since these countries have prioritized sustainable development & green building practices to construct energy-efficient structures, the demand for EPS solutions is on the rise as it enhances the energy efficiency of buildings by reducing the need for excessive heating or cooling. Similarly, with the rising focus of these countries on sustainability across sectors like e-commerce, retail, food & beverage, etc., the demand for eco-friendly packaging is further expected to surge and, consequently, help companies to capitalize on the trend by offering sustainable & customizable EPS packaging solutions.

GCC Expanded Polystyrene Market Driver Key Trend:

Growing Utilization of Expanded Polystyrene for 3D Printing - The use of Expanded Polystyrene (EPS) for 3D printing is a growing trend in the region as it provides lightweight components to several industries like automotive, construction, & transportation. Moreover, the combination of additive manufacturing with EPS has opened new possibilities in prototyping, product development, and customized manufacturing. Additionally, the construction of various infrastructures, such as 3D-printed mosques, houses, etc., is on the horizon, i.e., pushing the demand for EPS for 3D printing. Furthermore, by using EPS as a printing material, construction companies are leveraging benefits like faster construction, reduced material waste, and improved energy efficiency in buildings, thereby driving the market.

GCC Expanded Polystyrene Market (2023-28): Segmentation Analysis

GCC Expanded Polystyrene Market report by MarkNtel Advisors includes segmentation analysis based on the Type, Production Method, and End-User. This breakdown allows businesses to identify specific market segments and tailor their marketing and product strategies accordingly, maximizing their chances of success in the market.

Based on Type:

- White

- Grey & Silver

- Black

Of these three, white EPS holds a significant share of the GCC Expanded Polystyrene Market, backed by its ever-increasing use in various sectors across the region. In the building & construction industry, white EPS witnesses maximum demand due to its excellent insulation properties and the fact that it does not leach any substances into the ground, which makes it environmentally friendly. Moreover, it is also being adopted increasingly by sports equipment manufacturers for foaming applications in products like boxing pads, hockey pads, & helmets, among others. The versatility of white EPS also extends to packaging applications, including electronics & consumer goods as well as food packaging. The rise in population levels and the flourishing e-commerce sector in the region are fueling the growth of the consumer goods industry and, consequently, the expanded polystyrene market.

Based on End-User:

- Building & Construction

- Electrical & Electronics

- Packaging

- Others (Automotive, Healthcare, Agriculture, etc.)

Here, the building & construction sector holds a prominent market share owing to massive investments in various infrastructure development projects like transportation networks, smart cities, etc., by the UAE, Saudi Arabia, & Qatar. Moreover, as these countries have established long-term strategic initiatives for residential, commercial, & industrial real estate, the pursuit of these plans would support construction activities in the region and create a pipeline of projects that would enhance the demand for EPS in the coming years.

In addition, the demand for EPS from the electrical & electronics vertical has also surged notably in recent years. The rapidly rising manufacturing activities are generating a high demand for EPS products as insulation materials & packaging solutions for electronics. Moreover, the UAE & Saudi Arabia are actively pursuing economic diversification strategies for reducing economic dependency on oil & gas. The expansion of the manufacturing industry, including the electrical & electronics sector, aligns well with these strategies as electronic manufacturing is likely to surge, which, consequently, would boost the demand for EPS and spur growth in the GCC Expanded Polystyrene Market in the years to come.

GCC Expanded Polystyrene Market Regional Projection

Geographically, the GCC Expanded Polystyrene Market expands across:

- The UAE

- Saudi Arabia

- Oman

- Kuwait

- Bahrain

- Qatar

Of all countries in the GCC region, the UAE has emerged as a key market for Expanded Polystyrene due to ever-increasing construction activities in the country. Moreover, the flourishing packaging industry, backed by electronics, consumer goods, and food sectors, is another prominent contributor to the growing demand for EPS in the UAE. Moreover, the country's massive investments in infrastructure development projects associated with transportation systems and airports are further boosting the EPS demand. Furthermore, to diversify the economy, the UAE government is actively working on the expansion of the tourism sector, owing to which hotel & resort construction are booming in the country. As of 2023 Q1, the UAE has 108 such projects, which include 28,973 hotel rooms altogether on the horizon. Hence, the escalating demand for EPS in the construction sector is driving the UAE Expanded Polystyrene Market.

Gain a Competitive Edge with Our GCC Expanded Polystyrene Market Report

- The sample report seeks to acquaint you with the layout and the overall research content.

- The deliberate utilization of the report may further streamline operations while maximizing your revenue.

- To gain an unmatched competitive advantage in your industry, you can customize the report by adding more segments and specific countries suiting your needs.

- For a better understanding of the contemporary market scenario, feel free to connect to our knowledgeable analysts.

Frequently Asked Questions

GCC Expanded Polystyrene Market Research Report (2023-2028) - Table of Contents

- Market Segmentation

- Introduction

- Product Definition

- Research Process

- Assumptions

- Executive Summary

- GCC Expanded Polystyrene (EPS) Market Trends & Developments

- GCC Expanded Polystyrene (EPS) Market Dynamics

- Drivers

- Challenges

- GCC Expanded Polystyrene (EPS) Market Hotspot & Opportunities

- GCC Expanded Polystyrene (EPS) Market Regulations and Policy

- GCC Expanded Polystyrene (EPS) Market Supply Chain Analysis

- GCC Expanded Polystyrene (EPS) Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenues (USD Million)

- By Quantity Sold (Thousand Tons)

- Market Size & Analysis

- By Type

- White - Market Size & Forecast 2018-2028F, Thousand Tons

- Grey & Silver- Market Size & Forecast 2018-2028F, Thousand Tons

- Black- Market Size & Forecast 2018-2028F, Thousand Tons

- By Production Method

- In-Situ Suspension- Market Size & Forecast 2018-2028F, Thousand Tons

- Post-impregnation Suspension- Market Size & Forecast 2018-2028F, Thousand Tons

- By End User

- Building & Construction- Market Size & Forecast 2018-2028F, Thousand Tons

- Electrical and Electronics- Market Size & Forecast 2018-2028F, Thousand Tons

- Packaging- Market Size & Forecast 2018-2028F, Thousand Tons

- Automotive- Market Size & Forecast 2018-2028F, Thousand Tons

- Others (Automotive, Healthcare, Agriculture, etc.)- Market Size & Forecast 2018-2028F, Thousand Tons

- By Country

- The UAE

- Saudi Arabia

- Oman

- Kuwait

- Bahrain

- Qatar

- By Competition

- Competition Characteristics

- Market Share & Analysis

- By Type

- Market Size & Analysis

- The UAE Expanded Polystyrene (EPS) Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenues (USD Million)

- By Quantity Sold (Thousand Tons)

- Market Share & Analysis

- By Type- Market Size & Forecast 2018-2028F, Thousand Tons

- By Production Method- Market Size & Forecast 2018-2028F, Thousand Tons

- By End User- Market Size & Forecast 2018-2028F, Thousand Tons

- Market Size & Analysis

- Saudi Arabia Expanded Polystyrene (EPS) Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenues (USD Million)

- By Quantity Sold (Thousand Tons)

- Market Share & Analysis

- By Type- Market Size & Forecast 2018-2028F, Thousand Tons

- By Production Method- Market Size & Forecast 2018-2028F, Thousand Tons

- By End User- Market Size & Forecast 2018-2028F, Thousand Tons

- Market Size & Analysis

- Oman Expanded Polystyrene (EPS) Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenues (Thousand Tons)

- By Quantity Sold (Thousand Tons)

- Market Share & Analysis

- By Type- Market Size & Forecast 2018-2028F, Thousand Tons

- By Production Method- Market Size & Forecast 2018-2028F, Thousand Tons

- By End User- Market Size & Forecast 2018-2028F, Thousand Tons

- Market Size & Analysis

- Kuwait Expanded Polystyrene (EPS) Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenues (USD Million)

- By Quantity Sold (Thousand Tons)

- Market Share & Analysis

- By Type- Market Size & Forecast 2018-2028F, Thousand Tons

- By Production Method- Market Size & Forecast 2018-2028F, Thousand Tons

- By End User- Market Size & Forecast 2018-2028F, Thousand Tons

- Market Size & Analysis

- Bahrain Expanded Polystyrene (EPS) Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenues (USD Million)

- By Quantity Sold (Thousand Tons)

- Market Share & Analysis

- By Type- Market Size & Forecast 2018-2028F, Thousand Tons

- By Production Method- Market Size & Forecast 2018-2028F, Thousand Tons

- By End User- Market Size & Forecast 2018-2028F, Thousand Tons

- Market Size & Analysis

- Qatar Expanded Polystyrene (EPS) Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenues (USD Million)

- By Quantity Sold (Thousand Tons)

- Market Share & Analysis

- By Type- Market Size & Forecast 2018-2028F, Thousand Tons

- By Production Method- Market Size & Forecast 2018-2028F, Thousand Tons

- By End User- Market Size & Forecast 2018-2028F, Thousand Tons

- Market Size & Analysis

- GCC Expanded Polystyrene (EPS) Market Key Strategic Imperatives for Success & Growth

- Competitive Outlook

- Company Profiles

- BASF

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- TotalEnergies

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- SABIC

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Ravago Manufacturing

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Styro

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Kuwait Styrene Company (TKSC)

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Kuwait Polymer

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- STYROQ

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Al-Musaha Al-Mushtaraka Company

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Unitech Qatar

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- BASF

- Company Profiles

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making