Bahrain Diesel Generator Market Research Report: Forecast (2023-2028)

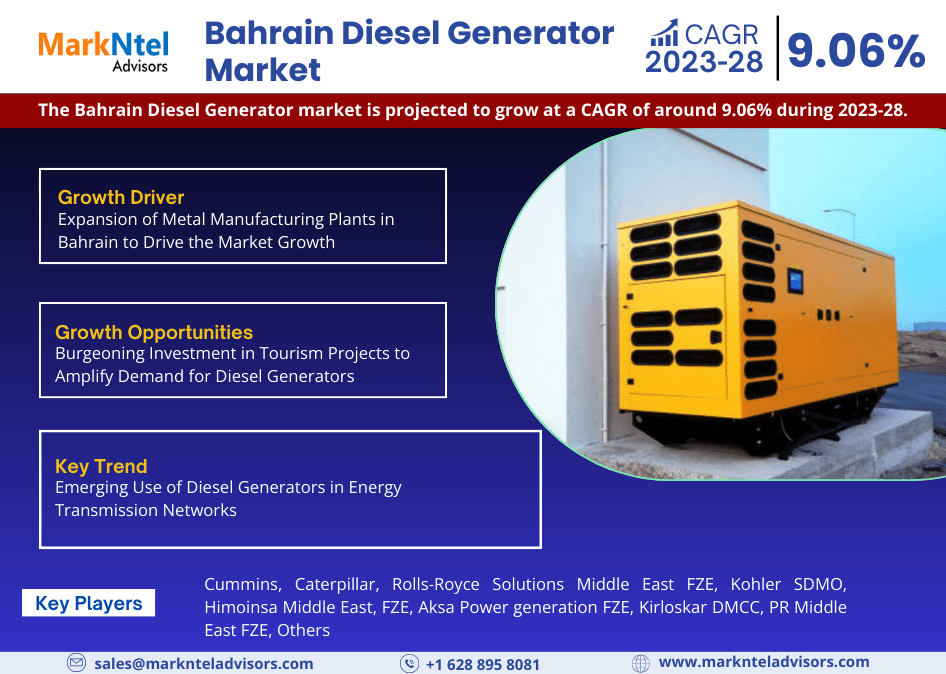

By KVA Rating Up to 75KVA, 75.1 KVA to 375 KVA, 375.1 to 750 KVA, 750.1 KVA to 1000 KVA, Above 1000 KVA, By Type Stand By, Prime & Continuous Power, Peak Shaving, By End Users Resi...dential, Commercial (Hospitality, Retail, Educational Institutions, etc.), Healthcare, Government & Transport (Airports, Metro Stations, Govt. Buildings, Religious Centres, etc.), Oil & Gas, Industrial (Manufacturing Facilities, Assembly Units, etc.), Equipment Rental Companies, By Company (Cummins, Caterpillar, Rolls-Royce Solutions Middle East FZE, Kohler SDMO, Himoinsa Middle East, FZE, Aksa Power generation FZE, Kirloskar DMCC, PR Middle East FZE, Others) Read more

- Energy

- Feb 2023

- Pages 102

- Report Format: PDF, Excel, PPT

Market Insights & Analysis: Bahrain Diesel Generator Market (2023-28)

The Bahrain Diesel Generator market is projected to grow at a CAGR of around 9.06% during the forecast period, i.e., 2023-28. Various factors, such as providing power supply at construction sites, residential & commercial spaces, and others, have contributed to the market growth. The country experienced a rapid rebound in the economy & the resumption of construction projects influenced the surge in demand for diesel generators in 2020-2021.

Furthermore, various incentives like tax exemptions on business & individual income & capital gains, 100% foreign ownership of companies & branch offices in Bahrain, and easy repatriation of funds have helped to attract foreign investment. With the surge in greenfield investment & FDI inflow, the non-oil sectors like tourism, manufacturing, healthcare, and the pharmaceutical industry majorly benefitted, attributing to the improved demand for diesel power generation systems.

| Report Coverage | Details |

|---|---|

| Study Period | Historical Data: 2018-21 |

| Base Year: 2022 | |

| Forecast Period: 2023-28 | |

| CAGR (2023-2028) | 9.06% |

| Key Companies Profiled | Cummins, Caterpillar, Rolls-Royce Solutions Middle East FZE, Kohler SDMO, Himoinsa Middle East, FZE, Aksa Power generation FZE, Kirloskar DMCC, PR Middle East FZE, Others |

| Unit Denominations | USD Million/Billion |

The role of private sector companies in developing non-oil sectors has also supported the rising number of leisure & business travelers and the growth of the expatriate population in the country. According to CEIC Data, the population of Bahrain has surged from 1.501 million in 2017 to 1.75 million in 2022. This growth in the population has accelerated the construction of commercial & residential buildings, resulting in a significant demand for diesel generators during the forecast period to ensure an uninterrupted power supply.

Market Dynamics

Growth Driver: Expansion of Metal Manufacturing Plants in Bahrain to Drive the Market Growth

During the historical period, the rapid expansion of metal manufacturing plants in Bahrain, such as aluminum, steel, and others, to improve the country's economy by attracting various metal downstream projects from foreign countries heightened the requirement for diesel generators as a backup power source. Furthermore, metal manufacturing companies in Bahrain, such as Aluminum Bahrain (Alba), Universal Rolling (Unirol), etc., are expanding their manufacturing plant, which is further projected to uplift the demand for diesel generators as a power backup at these sites. For instance,

- In 2022, Aluminium Bahrain (Alba) BSC company in the city of Askar expanded its metal manufacturing plant to produce additional 1 million metric tons of aluminum.

Thus, the expansion of metal manufacturing plants in Bahrain would also facilitate the demand for these generators, thus elevating the Bahrain Diesel Generator Market size in the forthcoming years.

Growth Opportunities: Burgeoning Investment in Tourism Projects to Amplify Demand for Diesel Generators

Recent macroeconomic shocks, such as the COVID-19 pandemic & the decline in global oil prices, had a significant impact on the nation's tourism industry. Thus, to revive the tourism sector, the government of Bahrain announced Economic Recovery Plan in 2021, which includes tourism infrastructure projects such as the construction of five-man-made islands & several other projects worth USD30 billion. Construction of such projects on a large scale would require diesel generators for prime electricity requirements to operate construction equipment & supply power for staff accommodation.

Further, the government of Bahrain wants to reduce its dependence on oil exports, which has driven investments in infrastructure projects that would support the growth of the tourism sector in the country. For instance,

- In 2022, the government invested more than USD10 billion in tourism infrastructure projects, such as new hotels & museums, providing strong support for tourism & leisure activities in Bahrain.

The development of the tourism industry would surge demand for diesel generators for construction purposes in the years to come. The requirement for standby diesel generators is anticipated to soar owing to the rising need for reliable power supply in hotels, resorts, and other facilities in the forthcoming years.

Key Trend: Emerging Use of Diesel Generators in Energy Transmission Networks

Bahrain has witnessed a surge in electricity demand in recent years due to higher economic activity, which has resulted in a significant change in terms of streaming transmission as well as growing energy production. According to the International Energy Association (IEA), the total energy supply by source from oil in Bahrain surged from 88,879 Tera Joule (TJ) to 101,287 TJ between 2018-2020.

With the rising consumption of natural gas & oil to produce electricity, the use of diesel generators for energy transmission in the country has improved significantly. The country is also witnessing an expansion in industries such as transportation, hospitality, real estate, etc., owing to the government’s efforts to strengthen the economy. Hence, to manage this growing demand & to provide a power supply for backup in the sectors such as industrial, transportation, etc., the need for diesel generators would positively rise in the coming years.

Moreover, the energy demand is further projected to grow with the soaring population, economic development, and expansion of industries in the country. Therefore, to cater to the growing demand for energy in the country & rising transmission projects to support the energy production capacity, the need for standby diesel generators is expected to elevate between 2023-28.

Possible Restraint: Limited Expansion Opportunities in the Country to Impede the Market Growth

The income from oil & gas has been consistently fostering the development of Bahrain. However, fluctuations in global oil prices have forced the country to seek financial help from its GCC allies. Despite this, the country has seen significant growth in the non-hydrocarbon sector, particularly the manufacturing sector in recent years.

Nonetheless, the country's tourism sector & development are heavily reliant on its regional neighbors. As the country is connected by road to Saudi Arabia, it witnesses a high influx of visitors from KSA, owing primarily to the ease of stringent Islamic regulations in Bahrain. Moreover, Bahrain's low population compared to its neighbors causes the tourism & hospitality sectors to rely on incoming tourists from regional countries & other continents.

Hence, the seasonality of the country's tourism industry limits the advancement of its commercial & hospitality infrastructure, which further limits the country's sales opportunities for diesel gensets.

Market Segmentation

By Type

- Stand By

- Prime & Continuous Power

- Peak Shaving

Of them all, the Standby Generator market is thriving on the back of the increasing energy & constant power supply needs of the end-users, raising the requirement for emergency power backup sources. Further, diesel generators of this type are widely used in the healthcare, utilities, and commercial sectors such as manufacturing, rental, telecommunications, government, and transportation sectors, where any interruption in the power supply is unacceptable. As a result, the surging demand for standby uninterrupted power supply to various sectors is expected to escalate sales of Standby Diesel Generator models during 2023-28.

By End User

- Residential

- Commercial

- Healthcare

- Government & Transport

- Oil & Gas

- Industrial

- Equipment Rental Companies

The Commercial Sector dominated the market in the historic years and is expected to follow the same trend during the forecast period. The commercial sector consisting of retail complexes, co-working spaces, etc., has been growing in the country due to the favorable business environment & tax exemptions by the government for personal & business income. This has resulted in attracting expatriates & foreign companies to set up offices in the country, contributing to the demand for office spaces and subsequently enhancing the demand for diesel generators in both 75.1 kVA to 350 kVA & 350.1 kVA to 750kVA capacity.

Recent Developments by the Leading Companies

- 2022: Caterpillar launched a new diesel generator line Cat GC series in the Middle East region with ratings ranging from 33kVA-1500kVA. The generator series also offers options for low-sound attenuated solutions.

Gain a Competitive Edge with Our Bahrain Diesel Generator Market Report

- Bahrain Diesel Generator Market Report by MarkNtel Advisors provides a detailed & thorough analysis of market size & share, growth rate, competitive landscape, and key players. This comprehensive analysis helps businesses gain a holistic understanding of the market dynamics & make informed decisions.

- This report also highlights current market trends & future projections, allowing businesses to identify emerging opportunities & potential challenges. By understanding market forecasts, companies can align their strategies & stay ahead of the competition.

- Bahrain Diesel Generator Market Report aids in assessing & mitigating risks associated with entering or operating in the market. By understanding market dynamics, regulatory frameworks, and potential challenges, businesses can develop strategies to minimize risks & optimize their operations.

Frequently Asked Questions

- Market Segmentation

- Introduction

- Product Definition

- Research Process

- Assumptions

- Executive Summary

- Macroeconomic Outlook

- Bahrain Diesel Generator Market Porters Five Forces Analysis

- Bahrain Diesel Generator Market Supply Chain Analysis

- Bahrain Diesel Generator Market Trends & Insights

- Bahrain Diesel Generator Market Dynamics

- Drivers

- Challenges

- Bahrain Diesel Generator Market Growth Opportunities & Hotspots

- Bahrain Diesel Generator Market Policy & Regulations

- Bahrain Diesel Generator Market Outlook, 2018-2028F

- Market Size & Outlook

- Revenues (USD Million)

- Units Sold

- Market Share & Outlook

- By KVA Rating

- Up to 75KVA

- 75.1 KVA to 375 KVA

- 375.1 to 750 KVA

- 750.1 KVA to 1000 KVA

- Above 1000 KVA

- By Type

- Stand By

- Prime & Continuous Power

- Peak Shaving

- By End Users

- Residential

- Commercial (Hospitality, Retail, Educational Institutions, etc.)

- Healthcare

- Government & Transport (Airports, Metro Stations, Govt. Buildings, Religious Centres, etc.)

- Oil & Gas

- Industrial (Manufacturing Facilities, Assembly Units, etc.)

- Equipment Rental Companies

- By Company

- Market Share

- Competition Characteristics

- By KVA Rating

- Market Size & Outlook

- Bahrain Up to 75KVA Diesel Generator Market Outlook, 2018-2028F

- Market Size & Outlook

- Revenues

- Units Sold

- Market Share & Outlook

- By Type

- By End Users

- By Company

- Market Size & Outlook

- Bahrain 75.1 KVA to 375KVA Diesel Generator Market Outlook, 2018-2028F

- Market Size & Outlook

- Revenues

- Units Sold

- Market Share & Outlook

- By Type

- By End Users

- By Company

- Market Size & Outlook

- Bahrain 375.1 KVA to 750KVA Diesel Generator Market Outlook, 2018-2028F

- Market Size & Outlook

- Revenues

- Units Sold

- Market Share & Outlook

- By Type

- By End Users

- By Company

- Market Size & Outlook

- Bahrain 750.1 KVA to 1,000 KVA Diesel Generator Market Outlook, 2018-2028F

- Market Size & Outlook

- Revenues

- Units Sold

- Market Share & Outlook

- By Type

- By End Users

- By Company

- Market Size & Outlook

- Bahrain Above 1000 KVA Diesel Generator Market Outlook, 2018-2028F

- Market Size & Outlook

- Revenues

- Units Sold

- Market Share & Outlook

- By Type

- By End Users

- By Company

- Market Size & Outlook

- Bahrain Diesel Generator Market Key Strategic Imperatives for Growth & Success

- Competitive Benchmarking

- Competition Matrix

- Product Portfolio

- Target Markets

- Target End Users

- Research & Development

- Strategic Alliances

- Company Profiles (Business Description, Product Offering, Strategic Alliances or Partnerships, etc.)

- Cummins

- Caterpillar

- Rolls-Royce Solutions Middle East FZE

- Kohler SDMO

- Himoinsa Middle East, FZE

- Aksa Power generation FZE

- Kirloskar DMCC

- PR Middle East FZE

- Others

- Competition Matrix

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making