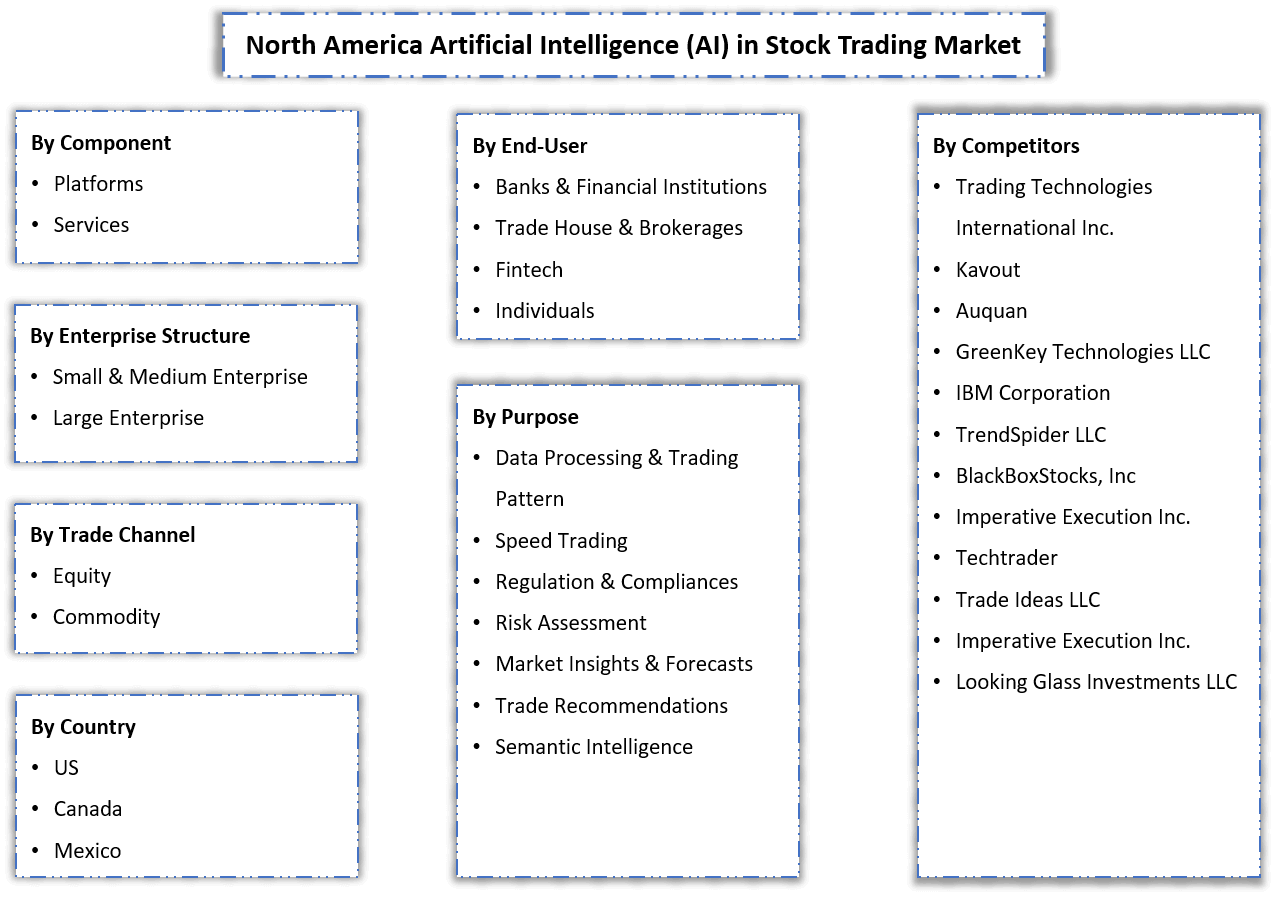

By Component (Platforms, Services), By Purpose (Data Processing & Trading Pattern, Speed Trading, Regulation & Compliances, Risk Assessment, Market Insights & Forecasts, Trade Recommendations, Semanti... ... mmendations, Semantic Intelligence, Others), By Enterprise Structure (Small & Medium Enterprise, Large Enterprise, Others), By End-User (Banks & Financial Institutions, Trade House & Brokerages, Fintech , Individuals), By Trade Channel (Equity, Commodity), By Country (The US, Canada, Mexico), By Company (Trading Technologies International Inc., Kavout, Auquan, GreenKey Technologies LLC, IBM Corporation, TrendSpider LLC, BlackBoxStocks, Inc, Imperative Execution Inc., Techtrader, Trade Ideas LLC, Imperative Execution Inc., Looking Glass Investments LLC) Read more

- ICT & Electronics

- Mar 2023

- 187

- PDF, Excel, PPT

Market Definition

Artificial Intelligence (AI) is a comprehensive simulation of human intelligence in machines with extensive application in different verticals. Its integration with stock trading platforms, in the form of Robo-advisors, is already trending.

Market Insights

The North America Artificial Intelligence (AI) in Stock Trading Market is projected to grow at a CAGR of more than 50% during the forecast period, i.e., 2023-28. AI & other data-science technologies have simplified the stock trading workflow by enabling easy & real-time identification of complex trading patterns across varied markets. Besides, they have also reduced communication complexity and enhanced business processes & customer care interactions. Hence, the coming years will likely be highly optimistic for AI in the stock trading industry. With increasing innovations in AI & machine learning, payment processors, banks, and other financial organizations are now able to detect fraud & make informed decisions. In addition, the capability of AI to gather & classify unbiased information, recognize stock patterns, and effectively perform stock analysis is expected to propel the industry in the coming years.

| Report Coverage | Details |

|---|---|

| Study Period | Historical Data: 2018-21 |

| Base Year: 2022 | |

| Forecast Period: 2023-28 | |

| CAGR (2023-2028) | 50% |

| Country Covered | The US, Canada, Mexico |

| Key Companies Profiled | Trading Technologies International Inc., Kavout, Auquan, GreenKey Technologies LLC, IBM Corporation, TrendSpider LLC, BlackBoxStocks, Inc, Imperative Execution Inc., Techtrader, Trade Ideas LLC, Imperative Execution Inc., Looking Glass Investments LLC |

| Unit Denominations | USD Million/Billion |

Further, incorporating AI-based Chatbots into online trading platforms provides users with various services like frequently asked questions, faster access to real-time market estimates, account reports, notifications about active traders, etc. These Chatbots help users monitor loads of trading data pointers and execute transactions at preferred prices. They also enable human analysts to study the market accurately and assist trading companies in efficiently alleviating risks to offer higher returns. Backed by such features, the integration of Artificial intelligence in Stock Trading platforms has become frequent in recent years, compelling service providers to expand their portfolios in the coming years. Besides, the surging requirements for customized trading solutions from credit unions, government banks, etc., alongside rapid integration of the mobile application with trading platforms, are other crucial factors expected to drive the demand for AI in stock trading over the forecast years.

Moreover, with prominent companies like GreenKey Technologies & Auquan actively participating in the industry developments, the Artificial Intelligence (AI) Stock Trading Market in North America is projected to attain considerable growth through 2028. The AI in Stock Trading platform of GreenKey Technologies uses speech recognition & natural language processing technology for a quicker search through conversions, notes, and financial data. Numerous financial experts are using this AI-based platform to filter through insights, trending companies, and other real-time stock market information, encouraging industry enlargement. On the other hand, the Auquan platform for AI in stock trading enables analysts from different backgrounds to generate algorithms & trading strategies and solve investment challenges. Consequently, investors can make an informed decision and enjoy the benefits without hiring high-cost in-house expertise.

- Introduction

- Market Segmentation

- Product Definition

- Research Process

- Assumptions

- Executive Summary

- North American Artificial Intelligence (AI) in Stock Trading Market Start-up Ecosystem

- Entrepreneurial Activity

- Year on Year Funding Received

- Funding Received by Top Companies

- Key Investors Active in the Market

- Series Wise Funding Received

- Seed Funding

- Angel Investing

- Venture Capitalists (VC) Funding

- Others

- Impact of COVID-19 on the North American Artificial Intelligence (AI) in Stock Trading Market

- North American Artificial Intelligence (AI) in Stock Trading Market Policies, Regulations, Product Standards

- North American Artificial Intelligence (AI) in Stock Trading Market Trends & Insights

- North American Artificial Intelligence (AI) in Stock Trading Market Dynamics

- Growth Drivers

- Challenges

- Impact Analysis

- North American Artificial Intelligence (AI) in Stock Trading Market Hotspot & Opportunities

- North American Artificial Intelligence (AI) in Stock Trading Market Key Strategic Imperatives for Success & Growth

- North America Artificial Intelligence (AI) in Stock Trading Market Analysis, 2018-2028F

- Market Size & Analysis

- By Revenue

- Market Share & Analysis

- By Component

- Platforms

- Services

- By Purpose

- Data Processing & Trading Pattern

- Speed Trading

- Regulation & Compliances

- Risk Assessment

- Market Insights & Forecasts

- Trade Recommendations

- Semantic Intelligence

- Others

- By Enterprise Structure

- Small & Medium Enterprise

- Large Enterprise

- Others

- By End-User

- Banks & Financial Institutions

- Trade House & Brokerages

- Fintech

- Individuals

- By Trade Channel

- Equity

- Commodity

- By Country

- The US

- Canada

- Mexico

- By Company

- Competition Characteristics

- Market Share & Analysis

- Competitive Matrix

- By Component

- Market Size & Analysis

- The US Artificial Intelligence (AI) in Stock Trading Market Analysis, 2018-2028F

- Market Size and Analysis

- By Revenue

- Market Share and Analysis

- By Component

- By Purpose

- By Enterprise Structure

- By End-User

- By Trade Channel

- Market Size and Analysis

- Canada Artificial Intelligence (AI) in Stock Trading Market Analysis, 2018-2028F

- Market Size and Analysis

- By Revenue

- Market Share and Analysis

- By Component

- By Purpose

- By Enterprise Structure

- By End-User

- By Trade Channel

- Market Size and Analysis

- Mexico Artificial Intelligence (AI) in Stock Trading Market Analysis, 2018-2028F

- Market Size and Analysis

- By Revenue

- Market Share and Analysis

- By Component

- By Purpose

- By Enterprise Structure

- By End-User

- By Trade Channel

- Market Size and Analysis

- Competitive Outlook

- Product Portfolio

- Target Markets

- Target End Users

- Manufacturing Units

- Research & Development

- Strategic Alliance

- Strategic Initiatives

- Company Profile (Business Description, Product Offering, Business Segments, Financials, Strategic Alliances or Partnerships, Future Plans)

- Trading Technologies International Inc.

- Kavout

- Auquan

- GreenKey Technologies LLC

- IBM Corporation

- TrendSpider LLC

- BlackBoxStocks, Inc

- Imperative Execution Inc.

- Techtrader

- Trade Ideas LLC

- Imperative Execution Inc.

- Looking Glass Investments LLC

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making