Press Release Description

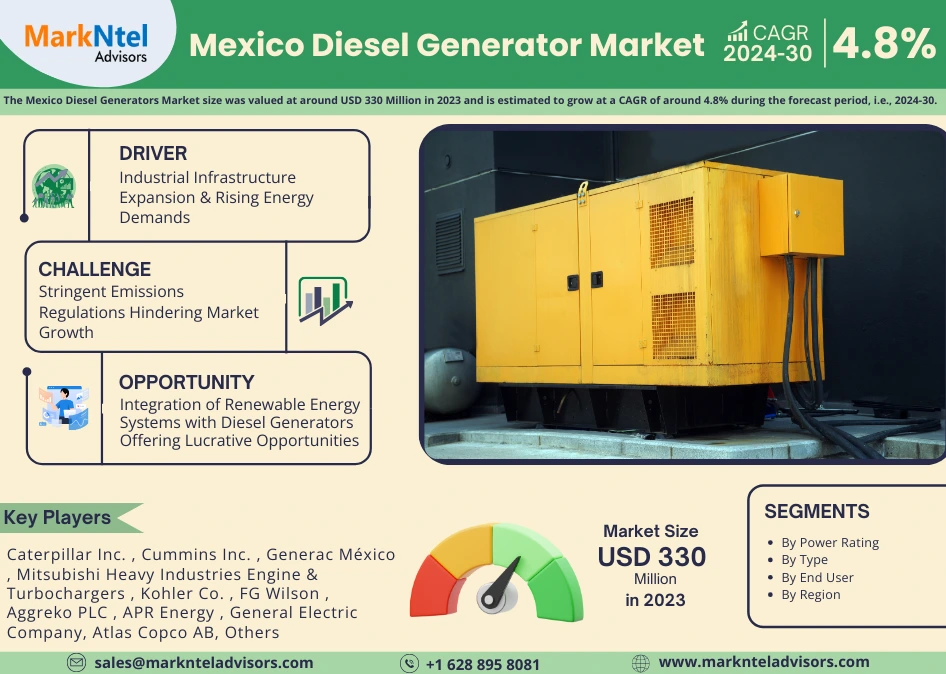

A USD 330 Billion Mexico Diesel Generators Market to Grow at a CAGR of Around 4.8% During 2024-30

The Mexico Diesel Generators Market size was valued at about USD 330 million in 2023 and is anticipated to grow at a CAGR of around 4.8% during the forecast period of 2024-30, cites MarkNtel Advisors in the recent research report. The market's growth has been largely driven by substantial government investments in the construction sector. These investments have been part of a broader initiative that spans numerous infrastructure projects, aiming to enhance public facilities and urban development across the country. Hence, with the increasing number of construction projects, the demand for diesel generators has improved, as they are largely applied at construction sites to effectively operate construction devices.

Further, Mexico's speedy industrial expansion has sparked a surge in the demand for uninterrupted electrical power, elevating diesel generators to a crucial position in the country's energy landscape. With industries expanding, the demand for dependable energy resources, whether or not as primary or emergency backups, has become paramount. This has been particularly vital in areas where the electrical grid lacks reliability or during peak energy consumption periods when the grid falls short. Diesel generators offer a flexible and dependable solution, ensuring industrial operations remain undisrupted, thus maintaining productivity and safety standards. Consequently, they are increasingly adopted across various sectors, such as manufacturing, mining, and data centers, where power outages cause significant operational disruptions and financial losses.

Additionally, Mexico's industrial sector, a major electricity consumer, is experiencing substantial government investments for expansion. As industrial sectors grow, the demand for diesel generators will also escalate. This dual demand for industrial expansion and heightened energy needs is poised to drive significant growth in the Mexico Diesel Generators Market. Further, the market is expected to expand, bolstered by the continuous need for reliable power across essential sectors such as industry, manufacturing, and healthcare. While renewable energy sources and gas generators are becoming more prevalent, they are unlikely to fully meet the country's standalone power requirements. Diesel generators, thus, remain indispensable for providing critical backup power and ensuring operational stability across various industries. The anticipated resurgence in construction and ongoing industrial development is likely to sustain the demand for diesel generators in the years ahead, further states the research report, “Mexico Diesel Generators Market Analysis, 2024.”

Mexico Diesel Generators Market Segmentation Analysis

750.1 KVA-1000 KVA Segment Holds a Major Market Share

Based on the power rating, the market is further bifurcated into below 5 KVS, 5 KVA to 75 KVA, 75.1 KVA to 375 KVA, 375.1 to 750 KVA, 750.1 KVA to 1000 KVA, and above 1000 KVA. In recent years, diesel generators with power ratings between 750.1 KVA to 1000 KVA have captured the largest market share and are expected to dominate the market during 2024–30. This dominance is attributed to the growing need for continuous energy supply in high-demand operations throughout numerous commercial sectors, including mining, oil & gas, manufacturing, and construction. These industries require robust power solutions to maintain continuous and efficient operations, driving the demand for higher-capacity diesel generators.

Conversely, diesel generators within the power range of 75.1 KVA to 375 KVA are projected to see growth, particularly driven by their expanding use in the residential and commercial sectors, as well as among small & medium enterprises (SMEs). This surge in demand is largely due to the adaptability and suitability of these generators for smaller-scale operations, which require reliable power solutions to support everyday business activities and safeguard against unexpected power disruptions.

The Residential Sector Leads the Mexico Diesel Generators Market

The residential sector is poised for rapid market growth due to increasing power cuts and rising load demands on primary grids. Diesel generators are sought after as reliable secondary power sources during transmission losses and distribution network failures, driving their demand among Mexican households. Moreover, the surge in residential construction projects in Mexico, propelled by demographic shifts, urbanization, and migration, will further boost the demand for diesel generators in the residential segment.

Competitive Landscape

With strategic initiatives such as mergers, collaborations, and acquisitions, the leading market companies, including Caterpillar Inc., Cummins Inc., Generac México, Mitsubishi Heavy Industries Engine & Turbochargers, Kohler Co., FG Wilson, Aggreko PLC, APR Energy, General Electric Company, Atlas Copco AB, and others, are looking forward to strengthening their market positions.

Key Questions Answered in the Research Report

- What are the industry’s overall statistics or estimates (Overview, Market Size- By Value, Forecast Numbers, Segmentation, Market Shares)?

- What are the market trends influencing the current scenario of the market?

- What key factors would propel and impede the industry across the country?

- How has the industry been evolving in terms of geography & product adoption?

- How has the competition been shaping up across the country?

- How have the buying behavior, customer inclination, and expectations from product manufacturers been evolving during 2019-30?

- Who are the key competitors, and what strategic partnerships or ventures are they coming up with to stay afloat during the projected time frame?

We offer flexible licensing options to cater to varying organizational needs. Choose the pricing pack that best suits your requirements:

Buy NowNeed Assistance?

WRITE AN EMAIL

sales@marknteladvisors.comCustomization Offered

100% Safe & Secure

Strongest encryption on the website to make your purchase safe and secure