Press Release Description

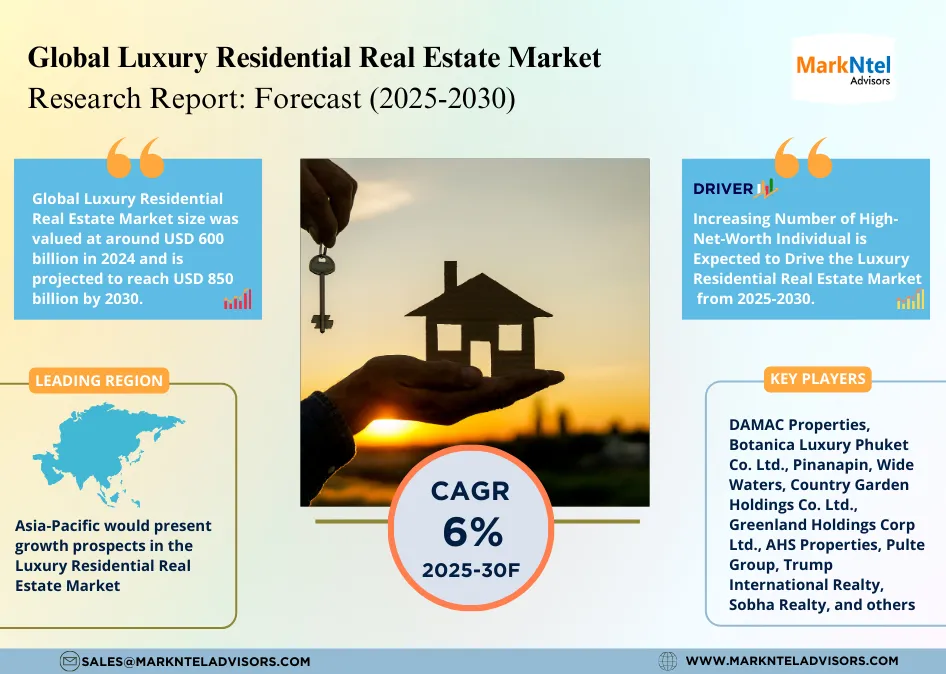

Luxury Residential Real Estate Market to Reach USD850 Billion by 2030 Due to Increasing Number of High-Net-Worth Individuals

The Global Luxury Residential Real Estate Market size was valued at around USD600 billion in 2024 and is projected to reach USD850 billion by 2030. Along with this, the market is estimated to grow at a CAGR of around 6% during the forecast period, i.e., 2025-30, cites MarkNtel Advisors in the recent research report.

The Luxury Residential Real Estate Global Market is experiencing rapid growth, driven by various factors. Secondary homes and vacation properties have emerged as an important factor since wealthy buyers are looking for a large, private escape for leisure, usually in picturesque or exclusive locations. On the other hand, shared ownership models and fractional investment are increasing affordability in these luxury estates. This allows greater inclusion of more investors to co-own high-end properties without the burden of full ownership price. Global government initiatives like friendly tax charter, investment incentives, and infrastructural developments further boost the market growth, making it interesting for foreign investors to buy these luxury residential properties. Also, the services for personalizing luxury experiences boost the demand for expensive residential properties. The developers and service providers are striving towards exclusive facilities and personalized services. They cater to rich customers' tastes and habits and enhance the whole value proposition and allure of luxury properties.

Several noteworthy trends are emerging in the market. The growing demand for seamless spaces that connect the indoors and outdoors and take on a more natural living environment is a significant trend. The rising investments for long-term returns coupled with the luxury of unique experiences are also pushing the market growth. New luxury locations with auspicious climates and economic opportunities entice affluent people. Additionally, Gen X and "She-Elites" are driving demand for multi-generational living spaces. The use of utility renewable energy sources in luxury residential homes is gaining further traction for demonstrating engagement in sustainability and eco-friendly practices, further states the research report, “Global Luxury Residential Real Estate Market Analysis, 2025.”

Global Luxury Residential Real Estate Market Segmentation Analysis

Villas are the Most Preferred Type of Luxury Residential Real Estate

Based on the type, the market is further bifurcated into Flats, Condos, Penthouses, Townhouses, Villas, Mansions, and Others. The Villas segment holds the majority share of the Global Luxury Residential Real Estate Market, approximately 35%. Villas have traditionally offered immense privacy, space, and exclusivity qualities that are much liked by affluent buyers. The properties typically have large ground areas, swimming pools, and beautiful gardens to form the backdrop of luxurious living. Villas are usually set in choice locations, whether in panoramic coastal regions, posh neighborhoods, or tranquil rural country spaces, that add to the initial appeal. There is much customization and personalization allowed in the villa, which means that the owner can create a home tailored to their tastes and personal lifestyle. Architecturally elegant and uniquely styled, the villas serve as a status symbol for the owner. The possibility to include modern facilities, green technologies, and luxurious amenities makes them even more attractive. These factors make the villa one of the largest segments of the luxury residential real estate industry, catering to the peculiarities of high-net-worth individuals.

Asia-Pacific Leads the Luxury Residential Real Estate Industry Globally

Asia-Pacific dominates the Global Luxury Residential Real Estate Market. It holds around a 40% proportion of the global market. The speedy boom of economies in countries like China, India, and Singapore has dramatically increased the range of high-net-worth people seeking out luxury properties. Urbanization in main cities like Hong Kong, Tokyo, and Shanghai fueled demand for luxury houses. Furthermore, the region's appeal as an international business hub draws wealthy expatriates and investors. Additionally, government authorities' attractive policies regarding foreign investment in real estate further augment the regional market growth. Moreover, a growing desire among individuals for elegant & luxurious residential houses in Asia-Pacific is also creating a substantial demand for the regional market players.

Competitive Landscape

With strategic initiatives such as mergers, collaborations, and acquisitions, the leading market companies, including Sotheby's International Realty, Lambert & Co., Emaar Properties, Trump International Realty, Elite Homes, Grosvenor Group, DAMAC Properties, Botanica Luxury Phuket Co. Ltd., Pinanapin, Wide Waters, Country Garden Holdings Co. Ltd., Greenland Holdings Corp Ltd., AHS Properties, Pulte Group, Trump International Realty, Sobha Realty, and others are looking forward to strengthening their market positions.

Key Questions Answered in the Research Report

- What are the industry’s overall statistics or estimates (Overview, Size- By Value, Forecast Numbers, Segmentation, Shares)?

- What are the trends influencing the current scenario of the market?

- What key factors would propel and impede the industry across the globe?

- How has the industry been evolving in terms of geography & product adoption?

- How has the competition been shaping up across various regions?

- How have buying behavior, customer inclination, and expectations from product manufacturers been evolving during 2020-30?

- Who are the key competitors, and what strategic partnerships or ventures are they coming up with to stay afloat during the projected time frame?

We offer flexible licensing options to cater to varying organizational needs. Choose the pricing pack that best suits your requirements:

Buy NowNeed Assistance?

WRITE AN EMAIL

sales@marknteladvisors.comCustomization Offered

100% Safe & Secure

Strongest encryption on the website to make your purchase safe and secure