UAE Sunflower Oil Market Research Report: Forecast (2022-27)

By Application (Food, Feed, Industrial) By Region (Dubai, Abu Dhabi, Sharjah, Northern Emirates) By Companies (Abu Dhabi Vegetable Oil Company, United Foods Company, The Savola Gr...oup, IFFCO Group, Rafael Salgado S.A., Cargill Incorporated, Amira Nature Foods Ltd., Archer-Daniels-Midland Company, Sime Darby Plantation Berhad) Read more

- Food & Beverages

- May 2022

- Pages 189

- Report Format: PDF, Excel, PPT

Market Definition

Sunflower oil can be defined as fatty oil extracted from the seeds of the common sunflower and is used chiefly in foods, soaps, varnishes, and paints. Sunflower oil provides more Vitamin E than any other vegetable oil. It is a combination of monounsaturated & polyunsaturated fats with low saturated fat levels. The growth in health consciousness among the individuals in the UAE is contributing significantly to the rise in the sales of sunflower oil.

Market Insights

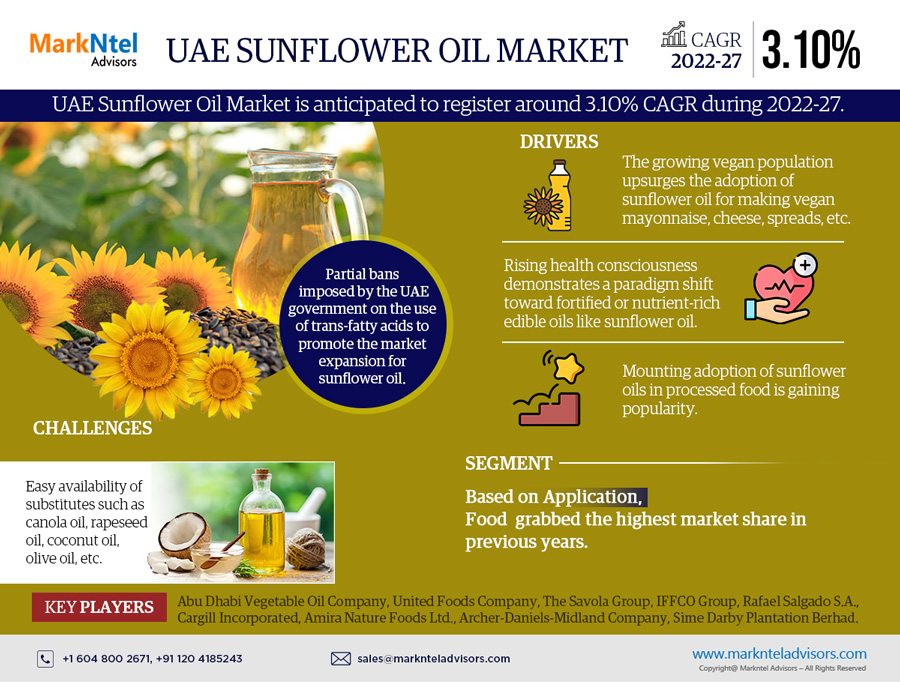

The UAE Sunflower Oil Market is anticipated to register around 3.10% CAGR in terms of quantity sold during the forecast period, i.e., 2022-27. The market growth of sunflower oil in the UAE experienced a moderate increase during the historical period on account of various health benefits associated with it & the growing utilization of healthy cooking oils in food processing industries. According to National Sunflower Association, the sunflower oil contains more Vitamin E as compared to any other edible oil & is valued for its subtle taste & frying benefits.

| Report Coverage | Details |

|---|---|

| Study Period | Historical Data: 2017-20 |

| Base Year: 2021 | |

| Forecast Period: 2022-27 | |

| CAGR (2022-2027) | 3.10% |

| Key Companies Profiled | Abu Dhabi Vegetable Oil Company, United Foods Company, The Savola Group, IFFCO Group, Rafael Salgado S.A., Cargill Incorporated, Amira Nature Foods Ltd., Archer-Daniels-Midland Company, Sime Darby Plantation Berhad |

| Unit Denominations | USD Million/Billion |

Moreover, high amounts of vitamins, polyunsaturated fatty acids, and monounsaturated fats help in preventing various illnesses & other risks. High-oleic sunflower oil is an ideal source of monounsaturated fatty acids used in maintaining cardiac health & good cholesterol in the body. Further, by the research conducted by Cleveland Clinic Abu Dhabi, more than half of the UAE residents have been affected by heart disease during their lifetime as of 2021.

Therefore, the rising consumption of sunflower oil would help in reducing the risks of coronary heart disease by lowering the bad cholesterol in the body. Hence, surging the demand for sunflower oil in the market. Besides, the rising government inclination boost tourism has a positive impact on the hospitality sector. The increasing presence of international hotel chain in the country is further projected to fuel the demand for sunflower oil in the forthcoming period. For instance, in 2021, The Dorchester Collection announced to open its first the Lana hotel in the Dubai, UAE by Q4 2022.

Key Trends in the UAE Sunflower Oil Market

- Advancement in Reducing the Trans-Fatty Acid

Trans-fats increase the risk of cardiovascular diseases & type 2 diabetes by lowering the good cholesterol & increasing the bad cholesterol levels in the human body. The increase in heart diseases, diabetes, obesity, and high blood pressure in patients decreases the average life span by 10% to 20% in the UAE. In addition, about 36% of the deaths are caused due to cardiovascular diseases. According to Arab health 2020, about 10,000 people suffer heart stroke every year in the UAE, majorly due to lack of exercise, lifestyle, diabetes, and obesity. Therefore, the UAE government has imposed a partial ban on Trans-fats as it is the primary reason for health hazards that needs to be eliminated from edible oil. For instance:

- In 2020, the Ministry of Economy announced to ban trans fat in the UAE by the end of 2023 by replacing it with healthier fat & oils. This would prevent the production & supply of hydrogenated oil in the country.

- In 2018, World Health Organization (WHO) released REPLACE –six strategic guidelines for the elimination of trans-fatty acid products from the global food supply. This initiative has been helpful in gradually eliminating cardiovascular disease & obesity.

Market Segmentation

Based on Application

- Food

- Feed

- Industrial

Among them, Food segment grabbed the highest market share in 2021 in the UAE Sunflower oil market owing to its vast applications in the food processing industries, hotels, restaurants etc. It is primarily used as cooking oil for both domestic & commercial food processing units & is extensively used for frying & production of emulsions, sauces, and margarine formulations. The high-oleic sunflower oil could be used in extremely high temperatures & for a variety of different food formulations, including spreads, coatings, fillings, and confectionery products. Besides, the baking industry has a vast application of sunflower oil in the preparation of a broad range of delicacies such as cakes, cookies, muffins, and bread, as the baking consistencies could be easily managed by sunflower oil without compromising the health benefits of the consumers.

Moreover, frying, roasting, cooking, baking, and salads are all major applications of sunflower oil, which are performed by both household & commercial food sectors in the country. Furthermore, the continuous innovation & product expansion in the food processing industries would propel the utilization of healthy cooking oils, which further augment the growth of sunflower oil in the country.

Market Dynamics

Key Drivers: Burgeoning Lifestyle Disorders

The high income of the residents of the UAE & surging expenditure on the consumption of fast foods has led to various diseases. Obesity, diabetes, heart disease, and other chronic diseases are primarily the result of excessive consumption of packaged & junk food. Besides, the high calorific packaged food & beverages combined with least to no physical activity has been the main factor for the increasing lifestyle disorders in the country. Thus, the consumers have inclined towards adopting a healthy lifestyle that includes the consumption of healthy oil such as sunflower oil as a remedy for curing gastrointestinal diseases, obesity, and fatty liver diseases. According to World Obesity Federation (WOF), 2020, significant growth in overweight & obesity has been observed in the population of the UAE. Edible oils have been a prime factor in the growth of obesity due to a large amount of fatty acid it contains.

Possible Restraint: Availability of Substitutes

Owing to the presence of substitutes such as canola oil, rapeseed oil, coconut oil, olive oil, etc., sunflower oil has been facing considerable competition in increasing its market share in the overall UAE Edible Oil market. In addition, oils such as canola & coconut offer more nutritional value at a lesser price than sunflower in the market. In comparison, it is observed that canola oil is around 20% less expensive than sunflower oil. Thus, due to the prevalence of more substitutes & being an expensive product, the sunflower oil market is facing challenges in penetrating the market at a higher pace in the UAE.

Key Questions Answered in the Market Research Report:

- What are the overall statistics or estimates (Overview, Market Size- By Value, Forecast Numbers, Segmentation, Shares) of the UAE Sunflower Oil Market?

- What are the region-wise industry size, growth drivers, and challenges?

- What are the key innovations, opportunities, current & future trends, and regulations in the UAE Sunflower Oil Market?

- Who are the key competitors, their key strengths & weaknesses, and how do they perform in the UAE Sunflower Oil Market based on the competitive benchmarking matrix?

- What are the key results derived from surveys conducted during the UAE Sunflower Oil Market study?

Frequently Asked Questions

- Introduction

- Product Definition

- Research Process

- Market Segmentation

- Assumptions

- Executive Summary

- Impact of COVID-19 on UAE Sunflower Oil Market

- UAE Sunflower Oil Market Trends & Insights

- UAE Sunflower Oil Market Dynamics

- Drivers

- Challenges

- UAE Sunflower Oil Market Regulations & Policies

- Custom Duties & Other Import Tax

- Sops & Subsidies

- Other Government Schemes

- UAE Sunflower Oil Market Supply Chain Statistics

- Margin at Various Levels

- Product Prices at Various Levels of Supply Chain

- UAE Sunflower Oil Market Import & Export Statistics

- UAE Refined Deodorized Sunflower Oil Prices, By Companies

- UAE Sunflower Oil Market Per Capita Annual Consumption

- UAE Sunflower Oil Market Hotspots & Opportunities

- UAE Sunflower Oil Market Outlook, 2017-2027

- Market Size & Analysis

- By Revenue (USD Million)

- By Quantity Sold (in Metric Tons)

- Market Share & Analysis

- By Application

- Food

- Feed

- Industrial

- By Region

- Dubai

- Abu Dhabi

- Sharjah

- Northern Emirates

- By Companies

- Competition Characteristics

- Market Share of Top Companies

- By Application

- Market Size & Analysis

- Competitive Benchmarking

- Competition Matrix

- Product Portfolio

- Target Markets

- Target End Users

- Research & Development

- Strategic Alliances

- Strategic Initiatives

- Company Profiles (Business Description, Product Offering, Strategic Alliances or Partnerships, etc.)

- Abu Dhabi Vegetable Oil Company

- United Foods Company

- The Savola Group

- IFFCO Group

- Rafael Salgado S.A.

- Cargill Incorporated

- Amira Nature Foods Ltd.

- Archer-Daniels-Midland Company

- Sime Darby Plantation Berhad

- Competition Matrix

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making