UAE Snacks Market Research Report: Forecast (2024-2029)

By Product Type (Sweet Biscuits, Snack Bars and Fruit Snacks, Savory Snacks, Ice Cream, Sugar Confectionery, Chocolate Confectionery), By Distribution Channel (Online, Offline, (Hy...permarket & Supermarket, Convenience Store), Others (Specialty Store, etc.)), By Packaging Type (Cans, Container & Boxes, Bags & Pouches), By Region (Dubai, Abu Dhabi & Al Ain, Sharjah & Northern Emirates), By Company (Mars Inc., PepsiCo Inc., Nestle Middle East, Kellog Co., Mondelez International Inc., IFFCO Group, Ferrero & Related Parties, National Food Industries LLC (NFI), Savola Group, Perfetti Van Mella Group, and Others) Read more

- Food & Beverages

- Oct 2023

- Pages 132

- Report Format: PDF, Excel, PPT

Market Definition

Snacks are small, typically portable food items consumed between meals or as a quick, casual food option. They are often chosen for their convenience, ease of consumption, and ability to satisfy cravings or provide a quick energy boost. They come in a wide variety of forms, flavors, and types, catering to different tastes & dietary preferences.

Market Insights & Analysis: The UAE Snacks Market (2024-29):

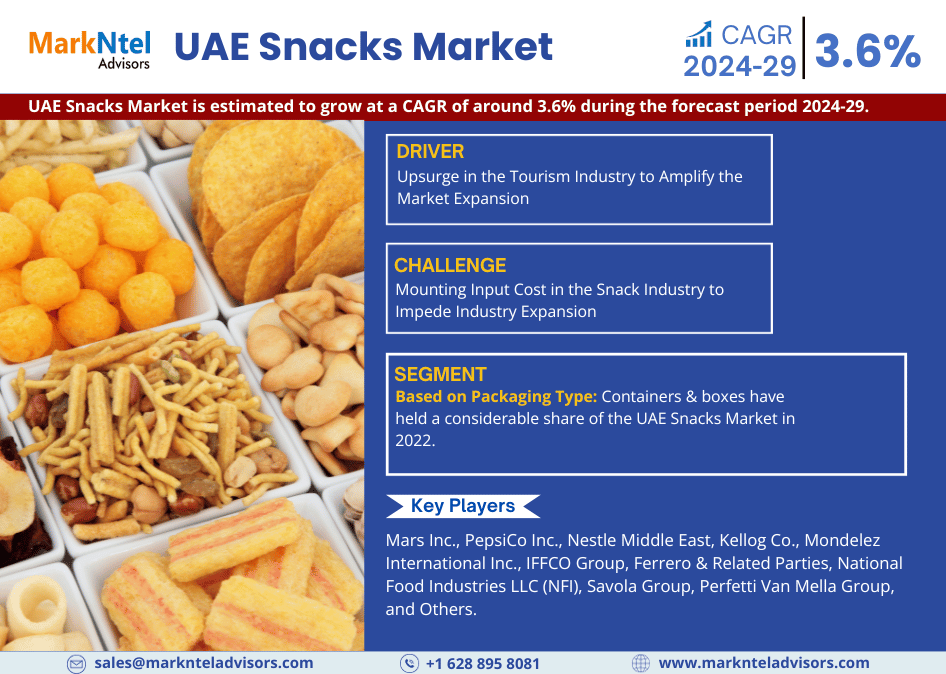

The UAE Snacks Market is estimated to grow at a CAGR of around 3.6% during the forecast period, i.e., 2024-29. The growth is driven by rising disposable income, the presence of a young & dynamic population, a heightened shift in e-commerce, and increasing female workforce participation. The rising affluence, bolstered by a strong economy, has led to raised disposable income, resulting in a greater willingness to spend on convenient snacks. With a mix of nationals & expatriates, there is a growing demand for on-the-go snack options. Busy lifestyles, characterized by longer working hours & commutes, have further fueled the need for readily available snacks in recent years.

Moreover, the inflated penetration of e-commerce in the country has further boosted the snack market size in recent years. According to the Emirates News Agency, the UAE made online purchases across all categories during 2021 compared to 2020, with an average of around 75% of respondents typically purchasing online. This allowed snack manufacturers & retailers to reach a broader audience by offering a wide range of products.

| Report Coverage | Details |

|---|---|

| Study Period | Historical Data: 2019-22 |

| Base Year: 2023 | |

| Forecast Period: 2024-29 | |

| CAGR (2024-2029) | 3.6% |

| Region Covered | Dubai, Abu Dhabi & Al Ain, Sharjah & Northern Emirates |

| Key Companies Profiled | Mars Inc., PepsiCo Inc., Nestle Middle East, Kellog Co., Mondelez International Inc., IFFCO Group, Ferrero & Related Parties, National Food Industries LLC (NFI), Savola Group, Perfetti Van Mella Group, and Others. |

| Unit Denominations | USD Million/Billion |

Further, the offers, subscription patterns, and buy now pay later options have further escalated the purchase of snacks in bulk through e-commerce, which has fostered the Snacks Market in the UAE. Also, the increasing female workforce participation rate in the UAE, driven by government initiatives like the UAE Vision 2021 and the National Strategy for Empowerment of Emirati Women, has surged to more than 60% in 2023 from about 53% in 2018, as per the International Labor Organization 2023. This trend, supported by both public & private sector policies, is expected to continue, enhancing the industry.

With more women in the workforce, there would be a shift in consumption patterns. As many working women would choose convenient & on-the-go snacks to accommodate their busy schedules, the UAE Snacks Market size is poised to enhance in the years ahead.

The UAE Snacks Market Driver

Upsurge in the Tourism Industry to Amplify the Market Expansion – During the historical period, the tourism sector played a significant role in the UAE Snacks Market. According to the Dubai Chamber of Commerce, Dubai itself welcomed around 14.5 million tourists to the country in 2022 & 8.5 million in the first half of 2023. The surging arrival of travelers contributed to increased consumption of on-the-go snacks, such as packaged nuts, chips, and chocolates, as the tourist looks for quick & easy refreshment during their travels, instigating the UAE Snack Market size.

Moreover, to enhance the tourism industry and accommodate increasing passengers, Abu Dhabi & Dubai are increasingly expanding & constructing new airports and terminals. This would drive the market growth of snacks in the coming years, as new airport terminals are designed with state-of-the-art retail spaces, prioritizing passenger experience.

The UAE Snacks Market Opportunity

Surging Halal Industry in the Country – The UAE is positioning itself as the center of the global Halal food industry, taking advantage of its strategic location while also taking a leadership role in defining international quality standards & processes for this growing food category. The UAE government has shown commitment to strengthening the halal industry in recent years. Few of the initiatives include facilitating halal certification processes, setting standards, and promoting the export of halal products.

Snack businesses, aligning with these Halal standards, aong with concerted efforts by the government would create a promising opportunity for the Snacks Market for UAE in the coming years ensuring quality and compliance position it's a reliable source of Halal snacks.

The UAE Snacks Market Challenge

Mounting Input Cost in the Snack Industry to Impede Industry Expansion – The rising input cost in the snacks industry of the UAE, owing to the fluctuating raw material prices, rising labor costs, energy & packaging materials costs, exchange rate fluctuations, etc., is hindering the growth. The workforce in the snack industry is predominantly composed of expatriates, contributing to rising costs associated with work visas, recruitment processes, and accommodation for expatriate workers.

This cost burden poses a significant challenge for small- & medium-sized snack businesses, which are finding it challenging to absorb the escalating labor costs. The risky financial landscape is potentially leading to adverse outcomes such as business closures or limited growth opportunities for these enterprises.

Additionally, the rising cost of raw materials, particularly grains, impacted by factors like the Russia-Ukraine War & adverse weather conditions, has led to an increase in global food prices. These developments are expected to drive up the production costs of snacks, including items like biscuits & cookies. Consequently, consumers in the country may experience higher prices for snacks in the near future, further creating a challenge for the UAE Snacks Market expansion.

The UAE Snacks Market Trend

Growing Adoption of Plant-based Snacks – The UAE is witnessing a growing health & wellness consciousness among its citizens due to the rising prevalence of obesity, healthcare awareness campaigns, growing government healthcare initiatives, etc. The obesity rate in the UAE has been increasing for the past few years owing to fat-rich fast food consumption, sedentary lifestyles, and harsh climatic conditions. About two-thirds of the local adults are suffering from obesity, with around 42% overweight and 28% obese, leading to sicknesses like hypertension, cholesterol issues, and type 2 diabetes.

With an increasing number of citizens becoming health-conscious, there is a growing demand for plant-based snacks that align with healthier lifestyle choices. Plant-based snacks, rich in nutrients, lower in unhealthy fats, and help to reduce the risk of various diseases such as cancer, stroke, diabetes, etc., are catering to the booming demand for healthier snack options in the country and are anticipated to be a trending aspect in the UAE Snacks Market during the forthcoming years.

The UAE Snacks Market (2024-29): Segmentation Analysis

The UAE Snacks Market study of MarkNtel Advisors evaluates & highlights the major trends & influencing factors in each segment & includes predictions for the period 2024–2029. In accordance to the analysis, the market has been further classified as:

Based on Product Type:

- Sweet Biscuits, Snacks Bars, and Fruit Snacks

- Savory Snacks

- Ice Cream

- Sugar Confectionery

- Chocolate Confectionery

Based on the product type segment, the market is further bifurcated into Sweet Biscuits, Snack Bars, and fruit snacks, Savory Snacks, Ice Cream, sugar confectionery, and Chocolate Confectionery. Of them, Chocolate Confectionery held the major market share in 2022 owing to the soaring demand driven by the country's young population.

Moreover, the retail sector is thriving, fueled by tourism recovery & government initiatives. According to the Dubai Chamber of Commerce, retail sales in the UAE grew by around 13% in 2020-22 and are expected to maintain around 6.6% annual growth by 2025. This signifies that there would be opening of more supermarkets & hypermarkets in the UAE during the forecast period, offering a wide range of chocolate confectioneries & contributing to the expansion of the Snack Market in the country.

Based on Packaging Type:

- Cans

- Container & Boxes

- Bags & Pouches

Containers & boxes have held a considerable share of the UAE Snacks Market in 2022. This is due to a surge in snack sales through e-commerce, escalating emphasis on hygiene, and rising demand for premium snacks. The country's consumers increasingly demand a heightened concern for food hygiene, including snacks.

They are increasingly seeking snacks that are properly sealed to preserve freshness, leading to a higher preference for snacks packaged in containers in recent years, particularly those made from materials like polypropylene (PP). These materials offer excellent heat tolerance, making them particularly suitable for packaging snacks in a hot climate.

Moreover, the rising launch of economical, small packaged, and super-saver bulk container & boxes packaged snacks by the biggest companies, such as Kellogg's, Koala Picks, etc., have been highly adopted by consumers in recent years. Therefore, these packages have demonstrated increasing popularity due to the enhanced value they provide to consumers.

The UAE Snacks Market (2024-29): Regional Projection

Geographically, the UAE Snacks Market expands across:

- Dubai

- Abu Dhabi & Al Ain

- Sharjah & Northern Emirates

Dubai had the largest market share in 2023 due to the emergence of the region as a hub for various cultural festivals & events, its diverse population, and retail expansion. In recent years, Dubai hosted various cultural events & festivals such as Dubai Expo2020, Dubai Shopping Festival, International Jazz Festival, etc. These events lead to heightened consumption of snacks due to the exchange of snacks as part of hospitality, presence of vendor stalls, etc., contributing to seasonal spikes in snack sales, which has escalated Dubai’s share in the UAE snack Market in the coming years.

Gain a Competitive Edge with Our The UAE Snacks Market Report

- The UAE Snacks Market Report by MarkNtel Advisors provides a detailed & thorough analysis of market size, growth rate, competitive landscape, and key players. This comprehensive analysis helps businesses gain a holistic understanding of the market dynamics & make informed decisions.

- This report also highlights current market trends & future projections, allowing businesses to identify emerging opportunities & potential challenges. By understanding market forecasts, companies can align their strategies & stay ahead of the competition.

- The UAE Snacks Market Report aids in assessing & mitigating risks associated with entering or operating in the market. By understanding market dynamics, regulatory frameworks, and potential challenges, businesses can develop strategies to minimize risks & optimize their operations.

Frequently Asked Questions

UAE Snacks Market Research Report (2023-2028) - Table of Contents

- Market Segmentation

- Introduction

- Product Definition

- Research Process

- Assumptions

- Executive Summary

- The UAE Snacks Consumer Behavior Analysis

- Consumer Spending

- Proportion of Consumer Shopping, By Channel

- Offline

- Supermarket/Grocery Store

- Convenience Store/Corner Shop

- Online

- Offline

- Top Ranking Food Brands

- The UAE Snacks Market Trends & Developments

- The UAE Snacks Market Dynamics

- Drivers

- Challenges

- The UAE Snacks Market Hotspot & Opportunities

- The UAE Snacks Market Regulations and Policy

- The UAE Snacks Market Outlook, 2019-2029F

- Market Size & Analysis

- By Revenues (USD Million)

- By Volume (Thousand Tons and Million Liters for Ice Cream)

- Market Size & Analysis

- By Product Type

- Sweet Biscuits, Snack Bars and Fruit Snacks - Market Size & Forecast 2019-2029, (Thousand Tons)

- Savory Snacks - Market Size & Forecast 2019-2029, (Thousand Tons)

- Ice Cream - Market Size & Forecast 2019-2029, (Million Liters)

- Sugar Confectionery - Market Size & Forecast 2019-2029, (Thousand Tons)

- Chocolate Confectionery - Market Size & Forecast 2019-2029, (Thousand Tons)

- By Distribution Channel

- Online - Market Size & Forecast 2019-2029, (USD Million)

- Offline - Market Size & Forecast 2019-2029, (USD Million)

- Hypermarket & Supermarket

- Convenience Store

- Others (Specialty Store, etc.)

- By Packaging Type

- Cans - Market Size & Forecast 2019-2029, (USD Million)

- Container & Boxes - Market Size & Forecast 2019-2029, (USD Million)

- Bags & Pouches - Market Size & Forecast 2019-2029, (USD Million)

- By Region

- Dubai

- Abu Dhabi & Al Ain

- Sharjah & Northern Emirates

- By Competition

- Market Share & Analysis

- Top Selling Brands

- Competition Characteristics

- By Product Type

- Market Size & Analysis

- The UAE Sweet Biscuits, Snack Bars, and Fruit Snacks Market Outlook, 2019-2029F

- Market Size & Analysis

- By Revenues (USD Million)

- By Volume (Thousand Tons)

- Market Size & Analysis

- By Type

- Wafers - Market Size & Forecast 2019-2029, (Thousand Tons)

- Sweet Biscuits - Market Size & Forecast 2019-2029, (Thousand Tons)

- Snack Bars - Market Size & Forecast 2019-2029, (Thousand Tons)

- Fruit Snacks - Market Size & Forecast 2019-2029, (Thousand Tons)

- Others (Crackers, Puffs, etc.) - Market Size & Forecast 2019-2029, (Thousand Tons)

- By Packaging Type - Market Size & Forecast 2019-2029, (USD Million)

- By Type

- Market Size & Analysis

- The UAE Savory Snacks Market Outlook, 2019-2029F

- Market Size & Analysis

- By Revenues (USD Million)

- By Volume (Thousand Tons)

- Market Size & Analysis

- By Type

- Salty Snacks - Market Size & Forecast 2019-2029, (Thousand Tons)

- Nuts, Seeds and Trail Mixes - Market Size & Forecast 2019-2029, (Thousand Tons)

- Savory Biscuits - Market Size & Forecast 2019-2029, (Thousand Tons)

- Others (Potato Chips, Pretzel, etc.) - Market Size & Forecast 2019-2029, (Thousand Tons)

- By Packaging Type - Market Size & Forecast 2019-2029, (USD Million)

- By Type

- Market Size & Analysis

- The UAE Ice Cream Market Outlook, 2019-2029F

- Market Size & Analysis

- By Revenues (USD Million)

- By Volume (Million Liters)

- Market Size & Analysis

- By Type

- Impulse Ice Cream - Market Size & Forecast 2019-2029, (Million Liters)

- Take-Home Ice Cream - Market Size & Forecast 2019-2029, (Million Liters)

- Others - Market Size & Forecast 2019-2029, (Million Liters)

- By Packaging Type - Market Size & Forecast 2019-2029, (USD Million)

- By Type

- Market Size & Analysis

- The UAE Sugar Confectionery Market Outlook, 2019-2029F

- Market Size & Analysis

- By Revenues (USD Million)

- By Volume (Thousand Tons)

- Market Size & Analysis

- By Type

- Toffees, Caramels and Nougat - Market Size & Forecast 2019-2029, (Thousand Tons)

- Pastilles, Gummies, Jellies and Chews - Market Size & Forecast 2019-2029, (Thousand Tons)

- Medicated Confectionery - Market Size & Forecast 2019-2029, (Thousand Tons)

- Boiled Sweets - Market Size & Forecast 2019-2029, (Thousand Tons)

- Others (Mints, Lollipops, etc.) - Market Size & Forecast 2019-2029, (Thousand Tons)

- By Packaging Type - Market Size & Forecast 2019-2029, (USD Million)

- By Type

- Market Size & Analysis

- The UAE Chocolate Confectionery Market Outlook, 2019-2029F

- Market Size & Analysis

- By Revenues (USD Million)

- By Volume (Thousand Tons)

- Market Size & Analysis

- By Type

- Countlines - Market Size & Forecast 2019-2029, (Thousand Tons)

- Tablets - Market Size & Forecast 2019-2029, (Thousand Tons)

- Others (Chocolate Pouches and Bags, etc.) - Market Size & Forecast 2019-2029, (Thousand Tons)

- By Packaging Type - Market Size & Forecast 2019-2029, (USD Million)

- By Type

- Market Size & Analysis

- The UAE Snacks Market Key Strategic Imperatives for Growth & Success

- Competition Outlook

- Company Profiles

- Mars, Inc.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- PepsiCo Inc.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Nestle Middle East

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Kellog Co

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Mondelez International Inc.

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- IFFCO Group

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Ferrero & Related Parties

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- National Food Industries LLC (NFI)

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Savola Group Co

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Perfetti Van Melle Group

- Business Description

- Product Portfolio

- Strategic Alliances or Partnerships

- Recent Developments

- Financial Details

- Others

- Others

- Mars, Inc.

- Company Profiles

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making