UAE Oilfield Chemicals Market Research Report: Forecast (2023-2028)

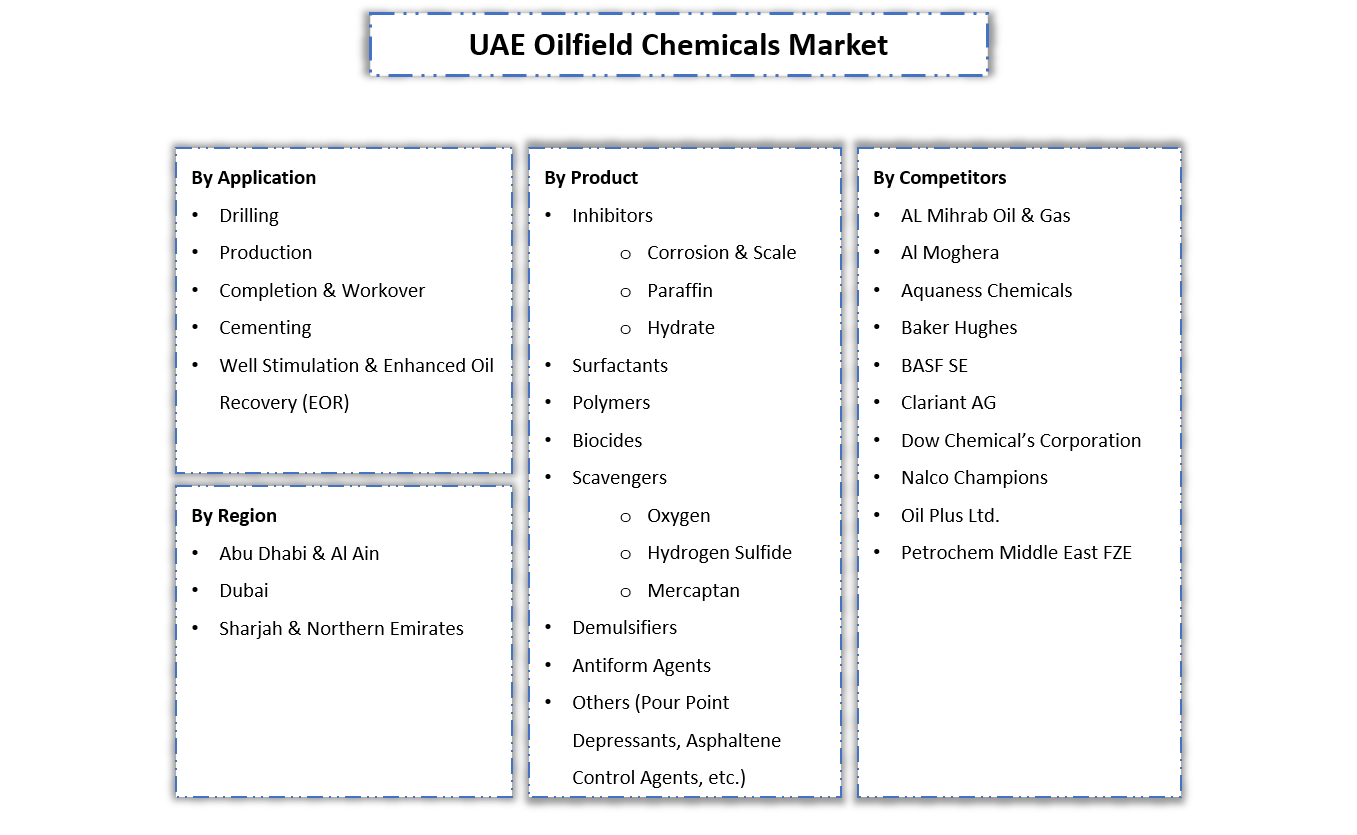

By Application (Drilling, Production, Completion & Workover, Cementing, Well Stimulation & Enhanced Oil Recovery [EOR]), By Product (Inhibitors, Surfactants, Polymers, Biocides, Sc...avengers, Demulsifiers, Antiform Agents, Others), By Region (Abu Dhabi & Al Ain, Dubai, Sharjah & Northern Emirates), By Company (AL Mihrab Oil & Gas, Al Moghera, Aquaness Chemicals, Baker Hughes, BASF SE, Clariant AG, Dow Chemical’s Corporation, Nalco Champions, Oil Plus Ltd., Petrochem Middle East FZE) Read more

- Chemicals

- May 2023

- 111

- CM10242

Market Definition

Oilfield Chemicals are chemical substances of varying compounds used in oil and gas extraction activities and operations to improve the oil drilling process's productivity and efficiency and reduce the formation of metal scales and decline in water quantity in oil wells during exploration and drilling operations. As drilling fluids, the chemicals are used as clay control, biocides, suspension, fibers, rheology chemicals, and more. Similarly, as drillers, they are also used as membrane sealing solutions and specialized cement to stop losses.

Market Insights & Analysis: The UAE Oilfield Chemicals Market (2023-28)

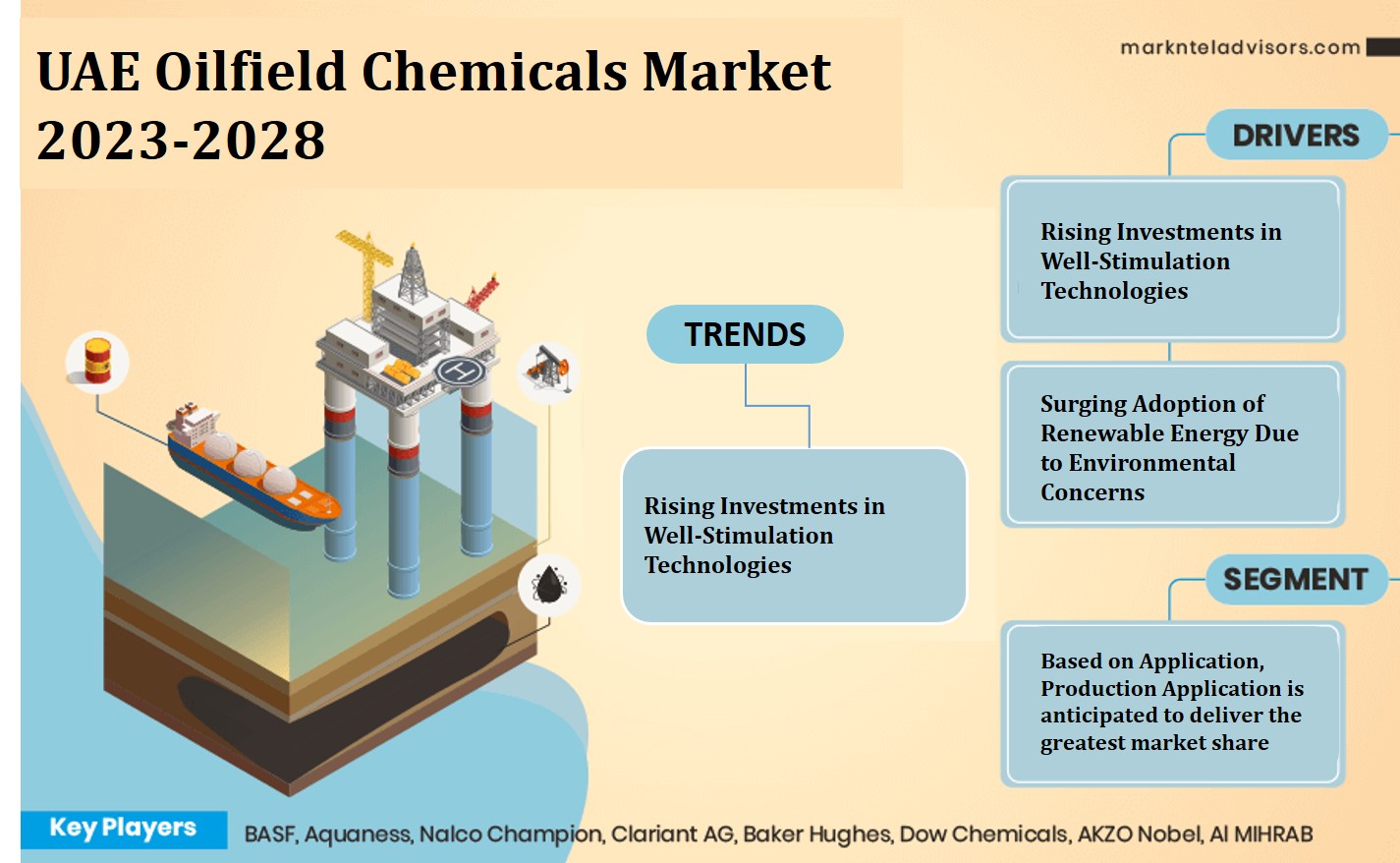

The UAE Oilfield Chemicals Market is projected to grow at a CAGR of around 4.2% during the forecast period, i.e., 2023-28. The market growth is accredited to the rising applications of chemicals in numerous operations such as production, drilling, well stimulation, oil recovery, cementing, etc. With a vast populace and consumer base relying on the conventional form of energy obtained from oil and fuel reservoirs, the industry will likely tread positively in the forecasting period. Besides, the explorations and discovery of new oil fields, combined with increased production and well-stimulation of established reservoirs, will likely fuel the demand for oilfield chemicals extending the market ascension.

| Report Coverage | Details |

|---|---|

| Study Period | Historical Data: 2018-21 |

| Base Year: 2022 | |

| Forecast Period: 2023-28 | |

| CAGR (2023-2028) | 4.2% |

| Region Covered | Abu Dhabi & Al Ain, Dubai, Sharjah & Northern Emirates |

| Key Companies Profiled | AL Mihrab Oil & Gas, Al Moghera, Aquaness Chemicals, Baker Hughes, BASF SE, Clariant AG, Dow Chemical’s Corporation, Nalco Champions, Oil Plus Ltd., Petrochem Middle East FZE |

| Unit Denominations | USD Million/Billion |

Additionally, the rising investments towards the improvement of well-stimulation technologies by numerous market participants are also adding to the industrial flow. At the same time, the increasing demand for cementing fluids will likely bode well for the industry's future. Furthermore, the improved technological advancements resulting in a rise in scope for enhanced chemical efficiency and quality will likely extend the industrial expansion.

However, the surging shift to renewable energy and sustainable production of power due to environmental concerns could hamper the flow of the market. On the contrary, increasing collaborative activities among businesses and the establishment of new businesses in numerous sectors, such as automotive and electronics, due to the goal of diversifying the economy, are likely to open new lucrative opportunities, therefore enhancing the UAE Oilfield Chemicals Market size.

Market Dynamics

Key Driver: Rising Investments in Well-stimulation Technologies

Well stimulation refers to the process of arbitration performed on an oil or gas well to surge the production flow. Advancements in stimulation technologies due to increased research and development activities by market participants are lowering the costs while improving the efficiency of good stimulation to cater to the high natural gas and crude oil requirement, which is driving the industry.

As a result, the enhanced oil recovery and advancement in oil extraction processes are accelerating the industry. Additionally, to deliver the increased electricity and power requirement, especially for commercial and residential utilization, the fuel extraction services are likely to strengthen, adding to the market value.

Possible Restraint: Surging Adoption of Renewable Energy Due to Environmental Concerns

Environmental awareness leading to the prevalent shift to the adoption of renewable energy and sustainable production of power could hamper the market flow. Since the production of sustainable energy is compelling a decrease in the demand for oil and gas, the market acceleration is likely to be restrained, as it may impact exploration, production, and drilling activities.

Furthermore, numerous goals to achieve zero emissions in the coming years are promoting using renewable energy sources over conventional sources restraining the industrial ascension. Moreover, environmental-related policies and concerns regarding oil and fuel extraction and production could also hamper the market flow.

Growth Opportunity: Increasing Collaborative Activities & Business Establishments

To expand and establish their business overseas, numerous market players are collaborating and strengthening their bonds to improve their productivity, which is opening new market opportunities for the industry. Besides, the rising demand for cementing fluids will likely bode well for the industry's future. Moreover, the diversification of the economy in the country, leading to the establishment of new businesses and expansion of numerous sectors such as automotive, electrical, etc., are likely to develop new opportunities for the industry.

Key Trend: Research & Development Activities to Improve Chemical Solutions

The rapid technological advancements resulting in an increased scope of improvement in the quality and efficiency of chemical solutions are adding to the market acceleration. Moreover, massive investments by the key participants and competition to improve chemical solutions and launch products further support the upward market graph.

Market Segmentation

Based on Application

- Drilling

- Production

- Completion & Workover

- Cementing

- Well Stimulation & Enhanced Oil Recovery (EOR)

Among all, Production segment is anticipated to acquire the greatest market share in the forecast years, following its dominance in the market during the historical period. It is owned by the burgeoning utilization and requirement of such oils and chemicals in numerous production processes for varying purposes, such as inhibiting corrosion, hydrate formation, and scale deposition.

Other than these, the production chemicals are also used as asphaltene inhibitors, demulsifies, and other uses to enhance the recovery of hydrocarbons and more. Moreover, the booming demand for energy and crude oil production is adding to the market value. Besides, since the chemicals enhance processes such as drilling, cementing optimization, and novel fuel-source development techniques like fracturing, the industry is likely to expand in the coming years.

Additionally, as the chemicals are extensively utilized to lower the surface tension between fluids and solids during the process of drilling and completion, therefore, the drilling segment is also projected to register steady growth in the forecast period. Furthermore, the utilization of production chemicals in existing oil reservoirs aiming to maximize the well's productivity, which is possible even after the peak oil period of the well is achieved, is collectively securing the industry's flow.

Based on Product

- Inhibitors

- Corrosion & Scale

- Paraffin

- Hydrate

- Surfactants

- Polymers

- Biocides

- Scavengers

- Oxygen

- Hydrogen Sulfide

- Mercaptan

- Demulsifiers

- Antiform Agents

- Others (Pour Point Depressants, Asphaltene Control Agents, etc.)

Inhibitors are projected to capture the largest share of the UAE Oilfield Chemicals Market during the forecast period. It is aided by the prevalent use of Corrosion & Scale inhibitors in the well-established oil & gas industry in the region to prevent the formation of scale from blocking or hampering fluid flow through pipelines, valves, and pumps used in the production and processing of oil. Moreover, the surging utilization of scale inhibitors to prevent the accumulation of insoluble crystals and scale build-up in the form of scales is further augmenting the industrial expansion.

In addition, Demulsifier product is also expected to register considerable growth in the forthcoming years due to their increasing applications across both onshore and offshore oil production operations, for instance, for the separation of oil emulsion and water. Furthermore, besides the increasing demand for derivatives of oil, including petroleum, diesel is compelling a rise in drilling activities, upscaling the usage of demulsifiers and accelerating the industry forward. Similarly, Biocides are also anticipated to experience steady market flow, as the microbial attack inhibition capabilities of the biocides are likely to increase their demand in offshore and inshore operations.

Recent Developments in the UAE Oilfield Chemicals Market

- In April 2023, Black & Veatch awarded Baker Hugh the contract to provide two compressor trains for Petronas’s floating LNG (FLNG) facility in Malaysia.

- In October 2022, Clariant AG completed the acquisition of BASF’s U.S. Attapulgite business assets, strengthening Clariant’s position in the industry for the purification of edible oils and renewable fuels.

Gain a Competitive Edge with Our UAE Oilfield Chemicals Market Report

- The UAE Oilfield Chemicals Market Report by Markntel Advisors provides a detailed & thorough analysis of market size & share, growth rate, competitive landscape, and key players. This comprehensive analysis helps businesses gain a holistic understanding of the market dynamics & make informed decisions.

- This report also highlights current market trends & future projections, allowing businesses to identify emerging opportunities & potential challenges. By understanding market forecasts, companies can align their strategies & stay ahead of the competition.

- The UAE Oilfield Chemicals Market Report aids in assessing & mitigating risks associated with entering or operating in the market. By understanding market dynamics, regulatory frameworks, and potential challenges, businesses can develop strategies to minimize risks & optimize their operations.

Frequently Asked Questions

- Introduction

- Market Segmentation

- Product Definition

- Research Process

- Assumptions

- Executive Summary

- UAE Market Overview

- Expert Verbatim- What our Experts Say?

- UAE Oilfield Chemicals Market Analysis, 2018-2028F

- Market Size & Analysis

- By Revenues

- By Quantity Sold

- Market Share & Analysis

- By Application

- Drilling

- Production

- Completion & Workover

- Cementing

- Well Stimulation & Enhanced Oil Recovery (EOR)

- By Product

- Inhibitors

- Corrosion & Scale

- Paraffin

- Hydrate

- Surfactants

- Polymers

- Biocides

- Scavengers

- Oxygen

- Hydrogen Sulfide

- Mercaptan

- Demulsifiers

- Antiform Agents

- Others (Pour Point Depressants, Asphaltene Control Agents, etc.)

- Inhibitors

- By Region

- Abu Dhabi & Al Ain

- Dubai

- Sharjah & Northern Emirates

- By Company

- Revenue Shares

- Strategic Factorial Indexing

- Competitor Placement in MarkNtel Quadrant

- By Application

- Market Attractiveness Index

- By Application

- By Product

- By Region

- Market Size & Analysis

- UAE Drilling Market Analysis, 2018-2028F

- Market Size & Analysis

- By Revenues

- By Quantity Sold

- Market Share & Analysis

- By Product

- Market Size & Analysis

- UAE Production Market Analysis, 2018-2028F

- Market Size & Analysis

- By Revenues

- By Quantity Sold

- Market Share & Analysis

- By Product

- Market Size & Analysis

- UAE Completion Market Analysis, 2018-2028F

- Market Size & Analysis

- By Revenues

- By Quantity Sold

- Market Share & Analysis

- By Product

- Market Size & Analysis

- UAE Cementing Market Analysis, 2018-2028F

- Market Size & Analysis

- By Revenues

- By Quantity Sold

- Market Share & Analysis

- By Product

- Market Size & Analysis

- UAE Well Simulation & Enhanced Oil Recovery Market Analysis, 2018-2028F

- Market Size & Analysis

- By Revenues

- By Quantity Sold

- Market Share & Analysis

- By Product

- Market Size & Analysis

- UAE Oilfield Chemicals Market Policies, Regulations, Product Standards

- UAE Oilfield Chemicals Market: Value Chain Analysis

- UAE Oilfield Chemicals Market Trends & Insights

- UAE Oilfield Chemicals Dynamics

- Drivers

- Challenges

- Impact Analysis

- UAE Oilfield Chemicals Hotspots & Opportunities

- UAE Oilfield Chemicals Market Key Strategic Imperatives for Success & Growth

- Competition Outlook

- Competition Matrix

- Product Portfolio

- Applications

- Research & Development

- Manufacturing Facilities

- Strategic Alliances

- Strategic Initiatives

- Company Profiles of top companies (Business Description, Product Segments, Business Segments, Financials, Strategic Alliances/ Partnerships, Future Plans)

- AL Mihrab Oil & Gas

- Al Moghera

- Aquaness Chemicals

- Baker Hughes

- BASF SE

- Clariant AG

- Dow Chemical’s Corporation

- Nalco Champions

- Oil Plus Ltd.

- Petrochem Middle East FZE

- Competition Matrix

- Disclaimer