GCC Financial Cards & Payments Market Research Report: Forecast (2024-2030)

GCC Financial Cards & Payments Market - By Type (Card [Credit Card, Debit Card, Charge Card, Prepaid Card]), By Type of Payments (B2B, B2C, C2C, C2B [E-Commerce Shopping, Payments ...at POS Terminals, Others]), By Type of Transactions (Domestic, Foreign), By Card Issuing Institution (Banking, Non-Banking), and others Read more

- FinTech

- Feb 2023

- Pages 178

- Report Format: PDF, Excel, PPT

Market Definition

Financial cards are part of the overall payment system issued by a financial or any other institution, such as a bank, to a customer that enables its owner (the cardholder) to access the funds in the customer's designated financial accounts. There are several types of financial cards used by individual users such as credit cards, debit cards, charge cards, and prepaid cards and they are used for domestic and foreign type of transactions.

Market Insights & Analysis: GCC Financial Cards & Payments Market (2024-30):

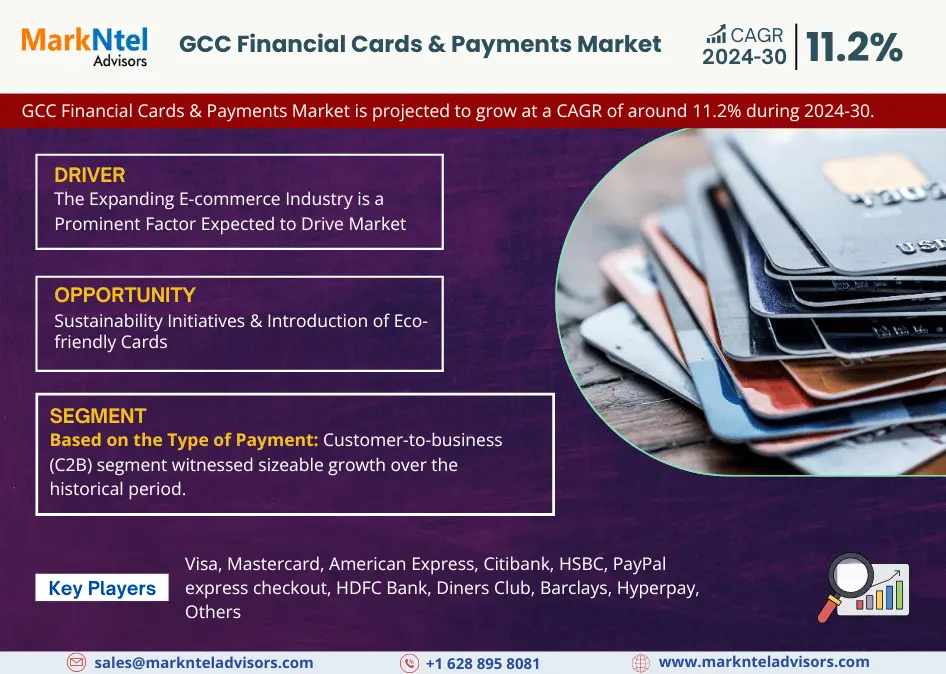

The GCC Financial Cards & Payments Market is projected to grow at a CAGR of around 11.2% during the forecast period, i.e., 2024-30. Factors such as the expanding e-commerce industry, regulatory changes in Islamic banking, growing international transaction volume, high internet penetration rate, and increasing requirements for credit facilities, among others, have stimulated the number of users of financial cards and payments in the Gulf region. The visionary efforts taken up by the governments of the UAE, Saudi Arabia, Qatar, etc., towards promoting digitalization in various sectors have increased the usage of facilities, such as mobile banking, internet banking, etc. Therefore, the rising utilization of these services has elevated the demand for financial cards and payments in the region.

| Report Coverage | Details |

|---|---|

| Study Period | Historical Data: 2019-22 |

| Base Year: 2023 | |

| Forecast Period: 2024-30 | |

| CAGR (2024-2030) | 11.2% |

| Country Covered | Saudi Arabia, The UAE, Qatar, Bahrain, Kuwait, Oman |

| Key Companies Profiled | Visa, Mastercard, American Express, Citibank, HSBC, PayPal express checkout, HDFC Bank, Diners Club, Barclays, Hyperpay, Others |

| Unit Denominations | USD Million/Billion |

Moreover, technological advancements in product offerings like the integration of blockchain into transactions for greater security shall also pave the way for the GCC Financial Cards & Payments Market expansion and generate remunerative opportunities for the leading players. Additionally, the growing trend of online shopping after the pandemic in the GCC has consequently heightened the usage of digital banking operations. As a result, there has been a consumer shift in the preference for purchasing online through financial cards and payment modes.

Notably, due to the increased risk of contamination through constant touch on point-of-sale terminals, the demand for tap & pay-enabled debit and credit cards has been budding at a significant rate. Hence, it is expected that the demand for financial cards and payments will witness an uptick in demand in the region during the forecast period. However, growing cases of fraudulent activities using these cards might restrain the fledged growth of the GCC Financial Cards & Payments market in the coming years.

Furthermore, as the living standards and economic conditions of the people in the GCC are dynamic, the utilization of financial cards like credit cards is also accelerating rapidly, thus elevating the GCC Financial Cards & Payments Market size in the forthcoming years.

GCC Financial Cards & Payments Market Driver:

Expanding E-commerce Industry – The growing e-commerce industry across the GCC region has well-supported the Financial Cards & Payments Market over the historical years. The countries, such as the UAE, Saudi Arabia, Qatar, etc., have witnessed a significant surge in online retail sales due to high investments by global retail players in the lucrative market. The countries, including the UAE, Qatar, Kuwait, and Bahrain have almost 100% of the population with internet and mobile phone access.

Due to this, the transactional volume of payments made via financial cards, such as debit cards, prepaid cards, credit cards, etc., has increased considerably. Moreover, the Dubai Chamber of Commerce and Industry forecasts e-commerce to generate USD8 billion in sales by the year 2025. Hence, it is expected that the ever-growing e-commerce market in the region will increase the demand for financial cards and payments in the forecast years.

GCC Financial Cards & Payments Market Opportunity:

Sustainability Initiatives & Introduction of Eco-friendly Cards – As nowadays, sustainability is becoming a priority worldwide, and many of the regions or regional countries are focusing on reducing the usage of things that emit carbon emissions. Similarly, in the GCC region governments & other businesses are taking several initiatives to reduce carbon footprints. As part of the sustainability efforts, banks are providing eco-friendly cards made of recycled materials & promoting paperless statements & digital receipts. Hence, this action underlines the dynamic nature of the GCC Financial Cards & Payments Market, further creating an opportunistic arena.

GCC Financial Cards & Payments Market Trend:

Digital Revolution & Fintech Improvement – There is a rapid digital transformation, with a strong focus on fintech innovation across the GCC region. This, in turn, is creating a profitable trend for financial card providers to make individuals aware of advanced payment solutions, such as contactless payments, mobile banking services, and digital wallets. Moreover, these advanced technologies are meeting the surfacing demands of individuals & businesses. Hence, driven by the inclusion of cutting-edge solutions, the GCC Financial Cards & Payments Market is predicted to witness growth in the future years

GCC Financial Cards & Payments Market (2024-30): Segmentation Analysis

The GCC Financial Cards & Payments Market study of MarkNtel Advisors evaluates & highlights the major trends & influencing factors in each segment & includes predictions for the period 2024–2030 at the national level. As per the analysis, the market has been further classified as:

Based on the Type of Payment:

- B2B

- B2C

- C2C

- C2B

- E-Commerce Shopping

- Payments at POS Terminals

- Others

Customer-to-business (C2B) segment witnessed sizeable growth over the historical period. The rising penetration of the internet & smartphones in the GCC region has expanded the scope of financial cards and payments for e-commerce activity. The trend of shopping through e-commerce portals has gained noteworthy traction in countries such as the UAE, Saudi Arabia, Qatar, etc. The rising inclination of consumers towards online shopping as it offers a convenient, enjoyable, and secure digital experience has flourished the adoption of cashless payment methods, such as debit cards, and credit cards, among others.

GCC Financial Cards & Payments Market (2024-30): Regional Projection

Geographically, the GCC Financial Cards & Payments Market expands across:

- Saudi Arabia

- The UAE

- Qatar

- Bahrain

- Kuwait

- Oman

The UAE is anticipated to acquire the largest market share during the forecast period. It owes principally to the country having numerous shopping complexes, the establishment of luxury brands, and plenty of things to shop for, encouraging the utilization of financial cards & payments to make transactions conveniently.

Besides, the massive influx of tourists, pilgrims, and migrants in the country is also augmenting the demand for these transactional services across commercial areas like hotels, restaurants, cafes, shopping malls, retail stores, online platforms, and other locations. Hence, the need for QR-code-based payment systems is gaining momentum and backing the UAE Financial Cards & Payments Market growth.

Gain a Competitive Edge with Our GCC Financial Cards & Payments Market Report

- GCC Financial Cards & Payments Market Report by MarkNtel Advisors provides a detailed & thorough analysis of market size & share, growth rate, competitive landscape, and key players. This comprehensive analysis helps businesses gain a holistic understanding of the market dynamics & make informed decisions.

- This report also highlights current market trends & future projections, allowing businesses to identify emerging opportunities & potential challenges. By understanding market forecasts, companies can align their strategies & stay ahead of the competition.

- GCC Financial Cards & Payments Market Report aids in assessing & mitigating risks associated with entering or operating in the market. By understanding market dynamics, regulatory frameworks, and potential challenges, businesses can develop strategies to minimize risks & optimize their operations.

Frequently Asked Questions

- Market Segmentation

- Introduction

- Product Definition

- Research Process

- Assumptions

- Executive Summary

- Impact of COVID-19 on GCC Financial Cards & Payments Market

- GCC Financial Cards & Payments Market Customer Survey & Consumer Insights

- By Type of Transaction

- By Banking Experience

- By Frequency of Transactions from Card

- By Purpose of Transaction

- Key Benefits of Using Financial Card to the Customer

- GCC Financial Cards & Payments Market Outlook

- Penetration of Financial Cards

- Digital Developments

- ATM Expansion

- POS Terminals

- GCC Financial Cards & Payments Market Trends & Insights

- GCC Financial Cards & Payments Market Dynamics

- Growth Drivers

- Challenges

- GCC Financial Cards & Payments Market Policies, Regulations, & ICT Compliance

- GCC Financial Cards & Payments Market Hotspot & Opportunities

- GCC Financial Cards & Payments Market Outlook, 2019-2030F

- Market Size & Analysis

- Number of Cards (Units)

- Number of Transactions (Units)

- Transaction Value (USD Million)

- Market Share & Analysis

- By Type of Card

- Credit Card

- Debit Card

- Charge Card

- Prepaid Card

- By Type of Payments

- B2B

- B2C

- C2C

- C2B

- E-Commerce Shopping

- Payments at POS Terminals

- Others

- By Type of Transactions

- Domestic

- Foreign

- By Card Issuing Institution

- Banking

- Non-Banking

- By Country

- Saudi Arabia

- The UAE

- Qatar

- Bahrain

- Kuwait

- Oman

- By Company

- Competition Characteristics

- Revenue Shares

- By Type of Card

- Market Size & Analysis

- Saudi Arabia Financial Cards & Payments Market Outlook, 2019-2030F

- Market Size & Analysis

- Number of Cards (Units)

- Number of Transactions (Units)

- Transaction Value (USD Million)

- Market Share & Analysis

- By Type of Card

- By Type of Payments

- By Type of Transactions

- By Card Issuing Institution

- Market Size & Analysis

- The UAE Financial Cards & Payments Market Outlook, 2019-2030F

- Market Size & Analysis

- Number of Cards (Units)

- Number of Transactions (Units)

- Transaction Value (USD Million)

- Market Share & Analysis

- By Type of Card

- By Type of Payments

- By Type of Transactions

- By Card Issuing Institution

- Market Size & Analysis

- Qatar Financial Cards & Payments Market Outlook, 2019-2030F

- Market Size & Analysis

- Number of Cards (Units)

- Number of Transactions (Units)

- Transaction Value (USD Million)

- Market Share & Analysis

- By Type of Card

- By Type of Payments

- By Type of Transactions

- By Card Issuing Institution

- Market Size & Analysis

- Bahrain Financial Cards & Payments Market Outlook, 2019-2030F

- Market Size & Analysis

- Number of Cards (Units)

- Number of Transactions (Units)

- Transaction Value (USD Million)

- Market Share & Analysis

- By Type of Card

- By Type of Payments

- By Type of Transactions

- By Card Issuing Institution

- Market Size & Analysis

- Kuwait Financial Cards & Payments Market Outlook, 2019-2030F

- Market Size & Analysis

- Number of Cards (Units)

- Number of Transactions (Units)

- Transaction Value (USD Million)

- Market Share & Analysis

- By Type of Card

- By Type of Payments

- By Type of Transactions

- By Card Issuing Institution

- Market Size & Analysis

- Oman Financial Cards & Payments Market Outlook, 2019-2030F

- Market Size & Analysis

- Number of Cards (Units)

- Number of Transactions (Units)

- Transaction Value (USD Million)

- Market Share & Analysis

- By Type of Card

- By Type of Payments

- By Type of Transactions

- By Card Issuing Institution

- Market Size & Analysis

- GCC Financial Cards & Payments Market Key Strategic Imperatives for Success & Growth

- Competition Outlook

- Competition Matrix

- Product Portfolio

- Strategic Alliances

- Strategic Initiatives

- Discounts

- Strategic Tie-ups for Market Penetration

- Geographical Expansion

- Company Profiles of Top Companies (Business Description, Product Segments, Business Segments, Financials, Strategic Alliances/ Partnerships, Future Plans)

- Visa

- Mastercard

- American Express

- Citibank

- HSBC

- PayPal express checkout

- HDFC Bank

- Diners Club

- Barclays

- Hyperpay

- Others

- Competition Matrix

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making