Global Cognitive Electronic Warfare Market Research Report: Forecast (2022-27)

By Capability (Electronic Attack, Electronic Protection, Electronic Support, Electronic Intelligence), By Platform (Navy, Airborne, Land, Space), By Region (North America, South Am...erica, Europe, the Middle East & Africa, Asia-Pacific), By Competitors (Cobham Advanced Electronics Solutions, BAE Systems, Elbit Systems, General Dynamics Corporation, Israel Aerospace Industries, L3 Harris Technologies Inc, Leonardo SPA, Lockheed Martin Corporation, Northrup Grumman Corporation, Raytheon Technologies Corporation, SAAB AB, Textron Inc., Thales Group, Ultra Electronic Group, Teledyne Technologies, Others) Read more

- Aerospace & Defense

- Mar 2022

- Pages 224

- Report Format: PDF, Excel, PPT

Market Definition

Cognitive Electronic Warfare uses Artificial Intelligence (AI) & Machine Learning algorithms to sense, protect, and communicate through signals such as radio frequency & infrared or radar frequency to detect operational security issues & provides hypotheses to rectify them. The cognitive electronic warfare systems, with their wide application in the military combat scenarios, have extensively grown their demand in militaries across the world. With network-centric warfare taking center stage in the military operations & the need to jam & counter-jam the systems the demand for cognitive electronic warfare systems has grown in the global market during 2017-2021.

Market Insights

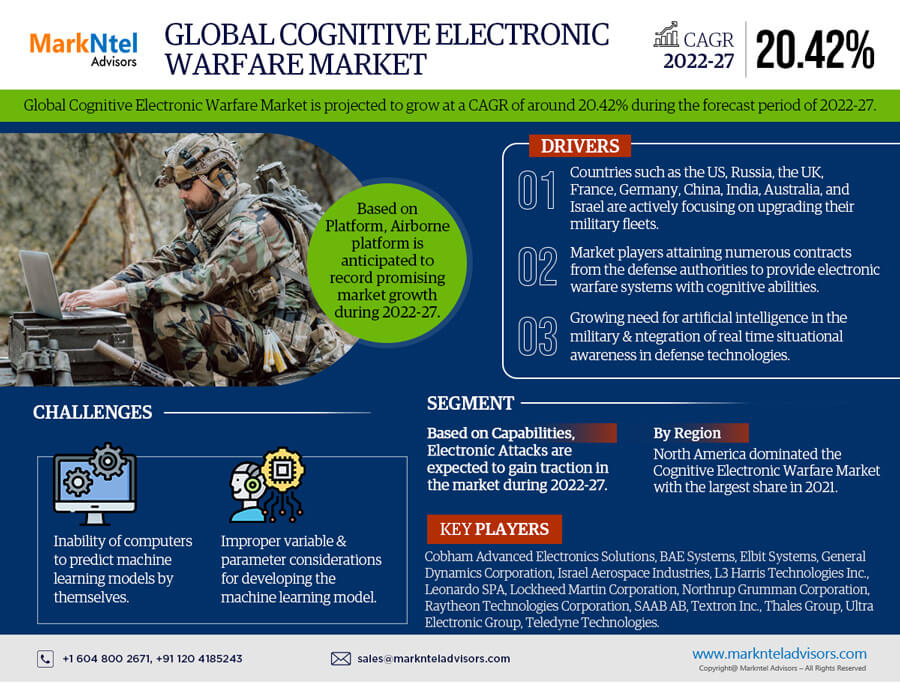

The Global Cognitive Electronic Warfare Market is projected to record more than USD 1 billion in terms of size, with around 20.42% CAGR during the forecast period, i.e., 2022-27. Cognitive Electronic Warfare (EW) systems use machine learning algorithms to detect new or unknown threats. These systems can understand different patterns based on high-quality signal data. Several militaries & companies from countries like the US, Russia, the UK, France, China, and Australia are actively striving toward developing advanced cognitive EW systems for future battlefield platforms. The Global Cognitive Electronic Warfare Market is still at a nascent stage. China, the US, and Russia are the major countries where cognitive electronic warfare systems have started gaining traction

| Report Coverage | Details |

|---|---|

| Study Period | Historical Data: 2017-20 |

| Base Year: 2021 | |

| Forecast Period: 2022-27 | |

| CAGR(2022-27) | 20.42% |

| Regions Covered | North America: USA, Rest of North America |

| Europe: Germany, France, UK, Russia, Italy, Spain, Rest of Europe | |

| Asia-Pacific: China, India, Australia, South Korea, Rest of Middle East & Africa | |

| Middle East & Africa: Israel, Turkey, South Africa, Rest of Middle East & Africa | |

| Key Companies Profiled | Cobham Advanced Electronics Solutions, BAE Systems, Elbit Systems, General Dynamics Corporation, Israel Aerospace Industries, L3 Harris Technologies Inc, Leonardo SPA, Lockheed Martin Corporation, Northrup Grumman Corporation, Raytheon Technologies Corporation, SAAB AB, Textron Inc., Thales Group, Ultra Electronic Group, Teledyne Technologies Others |

| Unit Denominations | USD Million/Billion |

The Global Cognitive Electronic Warfare Market is undergoing constant evolution, with various technological developments, mainly due to the increasing importance of Artificial Intelligence-based electronic warfare systems & the mounting demand for enhanced situational awareness among military forces. The need for new technologically advanced electronic warfare systems is increasing continuously worldwide. The major economies across the globe are developing electronic warfare capabilities to ensure next-generation defense mechanisms and simultaneously attacking the enemy targets with utmost precision to minimize the collateral damage.

Presently, the most accepted technology is the adaptive electronic warfare system that selects its action from a pre-programmed electronic attack whenever a change in the surroundings is recognized. Adaptive electronic warfare systems could be well-used for manipulating or disabling an enemy’s radars through radar jamming and deception, which involves saturating the enemy radar with wrong information. It operates with a feedback mechanism between the transmitter & receiver independent of the environment. However, an adaptive electronic warfare system is ineffective against a new or unknown threat. Furthermore, radar technology and military communications have achieved unparalleled levels of sophistication that are no longer predictable. It, in turn, has given rise to a technologically advanced electronic warfare system termed a cognitive electronic warfare system, which encircles all the techniques that could counter modern warfare systems.

Moreover, several companies like BAE Systems, Lockheed Martin Corporation, Elbit Systems, General Dynamics Corporation, L3 Harris Technologies, Leonardo S.p.A, DEWC Systems, Raytheon Technologies, and SAAB AB have received numerous contracts from the defense authorities of these countries for providing electronic warfare systems having cognitive abilities.

Key Trend in the Market

- Integration of Next-generation Jammers

Next-generation jammers are technologically advanced jammers that allow aircraft to hide from smart radars. They utilize cognitive algorithms to autonomously detect signals & respond quickly to keep the aircraft safe. The advanced airborne attack capability provided by the next generation jammer allows the aircraft to enter the enemy’s airspace since it jams the radars within certain frequencies. These jammers are being procured actively by defense organizations globally & fitted on airborne platforms. The US Navy, Chinese Navy & Air force, and Russian Defense Forces are the prime users of next-generation jamming solutions. In 2021, the US navy planned to spend around USD180 million on procuring next-generation jammers. The plan was improvised further in 2022, with the total investment raising to USD245 million.

Market Segmentation

Based on Capabilities:

- Electronic Attack

- Electronic Protection

- Electronic Support

- Electronic Intelligence

Here, the Electronic Attack segment is expected to gain traction during the forecast period 2022-2027, witnessed by the interminable cyberattacks by the Republic of China & Russia in territories such as the US, Taiwan, and India. Further, the increasing cyber threats from China & Russia have contributed to an increase in the demand for investments in R&D activities in Electronic Attack, Cognitive Electronic Warfare Market globally. For instance:

- In February 2020, the Ukraine Cyber Authorities accused unnamed Russian internet networks of attacks on Ukraine security and defense websites to disseminate malicious documents through a web-based system.

Based on Platform:

- Navy

- Airborne

- Land

- Space

Of them all, the Airborne platform is anticipated to record promising market growth during 2022-27. Governments worldwide are increasingly inclining toward enabling Machine Learning & AI techniques in fighter jets & Unmanned Aerial Vehicles (UAVs) to defeat next-generation enemy Integrated Air-Defense Systems (IADS). Cognitive Warfare Systems are highly efficient in collecting real-time data through Radio Frequency (RF) & machine learning algorithms & offer geographical & political protection against transnational wars.

Hence, significant investments in airborne warfare are being witnessed globally. For instance, in June 2021, the US Department of Defense (DoD) leaders planned to invest USD874 million in 2022 in AI-related technologies to boost deterrence against potential adversaries like China & Russia. However, the growth of land-based platforms is expected to outperform other platforms in the coming years.

Based on Regions:

Geographically, the market expands across:

- North America

- South America

- Europe

- The Middle East & Africa

- Asia-Pacific

Of all regions globally, North America dominated the Cognitive Electronic Warfare Market in 2021. Currently, the US leads the regional market, and the same trend is likely to be followed till 2027. Most cognitive electronic warfare system manufacturers, along with the government agencies, are extensively investing in developing the latest technological products, such as Artificial Intelligence & Machine Learning-based cognitive electronic warfare systems, for improving electronic warfare capabilities, thereby leading to high revenue generation.

Moreover, the proliferation of RF machine learning systems programs, IDECM programs, etc., by the US defense forces is expected to generate significant demand for cognitive electronic warfare systems in the near future. However, with the extensive presence of leading market players & the intense competition among them, North America is the most technologically advanced region. The companies across the region are securing contracts from end-users like defense forces & government agencies for developing technologically advanced electronic warfare systems to be installed on various platforms.

Recent Developments by Leading Companies

- In April 2020, Elbit Systems received a contract worth USD103 million from a few Asian countries (probably India) for providing technologically advanced electronic suites for their Air Force.

- In November 2019, BAE Systems received a contract worth USD71 million from the US Army for providing the AN/AAR-57 Common Missile Warning System (CMWS). This system is highly technologically advanced & can protect against sophisticated threats.

- In November 2016, BAE Systems received a contract worth USD13.3 million from DARPA for developing cognitive electronic warfare technologies for the Adaptive Radar Countermeasures (ARC) project.

Market Dynamics:

Key Driver: Rising Need for Artificial Intelligence (AI)-Enabled Warfare Systems to Combat Dynamic Threats

Army officials globally face frequent problems related to false signals & intercepts during a war. An adaptive electronic warfare system cannot combat new or unknown threat environments since it utilizes pre-programmed approaches. Thus, according to defense experts, a cognitive electronic warfare system suffices in such a situation as it diminishes potential risks. Machine learning algorithms used by the cognitive electronic warfare systems can characterize & assess electromagnetic spectrum signals emitted from enemy radars as known or unknown threats. China, the US, and Russia are the key countries spending substantially on procuring technologically advanced cognitive electronic warfare systems.

Furthermore, the US Department of Defense budget focused on AI research & development for FY 2020 & FY 2021 was USD4 billion & USD841 million, respectively. In addition, China is another important country that is significantly investing in AI-based R&D. The EW strategy is a government initiative that focuses on suppressing, degrading, and disrupting the enemy’s electronic equipment. Further, the massive amount of data generated by sensors & communication networks has given rise to artificial intelligence to handle it.

Possible Challenge: Issues Associated with the Interpretation of Machine Learning Models

Computers cannot predict machine learning models by themselves, which acts as a limitation & infuses the need for humans to understand the output from a machine learning model since it helps analyze crucial patterns & predictions. Defense authorities are increasingly using machine learning models for storing & analyzing high-quality data gathered from sensor & communication networks. The systems used by the military are not technologically advanced and are hence, unable to store large amounts of data and require frequent re-programming. Machine learning-based electronic warfare systems can overcome this challenge. However, these systems have some drawbacks associated with improper variable & parameter considerations for developing the machine learning model.

Models like decision trees require a significant amount of understanding, owing to which defense authorities are increasingly focusing on training staff on predictive analytics. In addition, minute data errors lead to false output in machine learning models, which is a significant threat to end-users. Hence, complexity in comprehending the interpretability of machine learning models, frequent validation procedures, and the requirement of rigorous training to understand & implement machine learning models make it a prominent challenge for the adoption of these systems.

Growth Opportunity: Upcoming Government Plans for Defense Modernization

Since many countries worldwide are witnessing an increasing number of border threats, foreign interventions, & terrorism acts, governments are massively investing in modernizing their defense sectors and strengthening the domestic defense, communication systems, border security, etc. It includes setting up dedicated infrastructure & facilities to integrate such a disruptive warfare ecosystem. In the coming years, government spending on such solutions would skyrocket to mitigate the immediate risks. For instance:

- In November 2021, the Indian Navy received an advanced Electronic Warfare (EW) suite, 'Shakti,' developed by the Defense Research and Development Organization (DRDO) to detect, identify, classify, and jam the advanced radars.

In June 2021, the Indonesian government announced a 3-year plan to spend USD 125 billion to upgrade & modernize its military sector.

Key Questions Answered in the Market Research Report:

- What are the overall statistics or estimates (Overview, Size- By Value, Forecast Numbers, Segmentation, Shares) of the Global Cognitive Electronic Warfare Market?

- What are the region-wise industry size, growth drivers, and challenges?

- What are the key innovations, opportunities, current & future trends, and regulations in the Global Cognitive Electronic Warfare Market?

- Who are the key competitors, their key strengths & weaknesses, and how do they perform in the Global Cognitive Electronic Warfare Market based on the competitive benchmarking matrix?

- What are the key results derived from surveys conducted during the Global Cognitive Electronic Warfare Market study?

Frequently Asked Questions

- Introduction

- Vehicle Type Definition

- Research Process

- Market Segmentation

- Assumptions

- Preface

- Executive Summary

- Impact of COVID-19 on Global Cognitive Electronic Warfare

- Global Cognitive Electronic Warfare Trends & Insights

- Global Cognitive Electronic Warfare Market Next Generation Technology Integration

- Artificial Intelligence

- Machine Learning

- Artificial Intelligence

- Global Cognitive Electronic Warfare Market Dynamics

- Drivers

- Challenges

- Global Cognitive Electronic Warfare Market Restructuring

- Mergers & Acquisitions

- Strategic Collaborations, Joint Ventures

- Global Cognitive Electronic Warfare Market Regulations & Policies

- Global Cognitive Electronic Warfare Market Key Initiatives Undertaken by Various Countries

- The US

- China

- Russia

- India

- Israel

- Global Cognitive Electronic Warfare Market Ongoing Projects, By Countries

- Japan

- Brazil

- Canada

- Poland

- Pakistan

- Global Cognitive Electronic Warfare Market Supply Chain Analysis

- Global Cognitive Electronic Warfare Market Hotspots & Opportunities

- Global Cognitive Electronic Warfare Market Outlook, 2017-2027F

- Market Size & Analysis

- By Revenues (USD Billion)

- Market Share & Analysis

- By Capability

- Electronic Attack

- Electronic Protection

- Electronic Support

- Electronic Intelligence

- By Platform

- Navy

- Airborne

- Land

- Space

- By Region

- North America

- South America

- Europe

- Middle East & Africa

- Asia Pacific

- By Capability

- Market Size & Analysis

- North America Cognitive Electronic Warfare Market Outlook, 2017-2027F

- Market Size & Analysis

- By Revenues (USD Billion)

- Market Share & Analysis

- By Capability

- By Platform

- By Country

- The United States

- Rest of North America

- The United States Cognitive Electronic Warfare Market Outlook, 2017-2027F

- Market Size & Analysis

- By Revenues (USD Billion)

- Market Share & Analysis

- By Capability

- By Platform

- Market Size & Analysis

- Market Size & Analysis

- South America Cognitive Electronic Warfare Market Outlook, 2017-2027F

- Market Size & Analysis

- By Revenues (USD Billion)

- Market Share & Analysis

- By Capability

- By Platform

- Market Size & Analysis

- Europe Cognitive Electronic Warfare Market Outlook, 2017-2027F

- Market Size & Analysis

- By Revenues (USD Billion)

- Market Share & Analysis

- By Capability

- By Platform

- By Country

- Germany

- France

- The UK

- Russia

- Italy

- Spain

- Rest of Europe

- Germany Cognitive Electronic Warfare Market Outlook, 2017-2027F

- Market Size & Analysis

- By Revenues (USD Billion)

- Market Share & Analysis

- By Capability

- By Platform

- Market Size & Analysis

- France Cognitive Electronic Warfare Market Outlook, 2017-2027F

- Market Size & Analysis

- By Revenues (USD Billion)

- Market Share & Analysis

- By Capability

- By Platform

- Market Size & Analysis

- The UK Cognitive Electronic Warfare Market Outlook, 2017-2027F

- Market Size & Analysis

- By Revenues (USD Billion)

- Market Share & Analysis

- By Capability

- By Platform

- Market Size & Analysis

- Russia Cognitive Electronic Warfare Market Outlook, 2017-2027F

- Market Size & Analysis

- By Revenues (USD Billion)

- Market Share & Analysis

- By Capability

- By Platform

- Market Size & Analysis

- Italy Cognitive Electronic Warfare Market Outlook, 2017-2027F

- Market Size & Analysis

- By Revenues (USD Billion)

- Market Share & Analysis

- By Capability

- By Platform

- Market Size & Analysis

- Spain Cognitive Electronic Warfare Market Outlook, 2017-2027F

- Market Size & Analysis

- By Revenues (USD Billion)

- Market Share & Analysis

- By Capability

- By Platform

- Market Size & Analysis

- Market Size & Analysis

- Middle East & Africa Cognitive Electronic Warfare Market Outlook, 2017-2027F

- Market Size & Analysis

- By Revenues (USD Billion)

- Market Share & Analysis

- By Capability

- By Platform

- By Country

- Israel

- Turkey

- South Africa

- Rest of Middle East & Africa

- Israel Cognitive Electronic Warfare Market Outlook, 2017-2027F

- Market Size & Analysis

- By Revenues (USD Billion)

- Market Share & Analysis

- By Capability

- By Platform

- Market Size & Analysis

- Turkey Cognitive Electronic Warfare Market Outlook, 2017-2027F

- Market Size & Analysis

- By Revenues (USD Billion)

- Market Share & Analysis

- By Capability

- By Platform

- Market Size & Analysis

- South Africa Cognitive Electronic Warfare Market Outlook, 2017-2027F

- Market Size & Analysis

- By Revenues (USD Billion)

- Market Share & Analysis

- By Capability

- By Platform

- Market Size & Analysis

- Market Size & Analysis

- Asia Pacific Cognitive Electronic Warfare Market Outlook, 2017-2027F

- Market Size & Analysis

- By Revenues (USD Billion)

- Market Share & Analysis

- By Capability

- By Platform

- By Country

- China

- India

- Australia

- South Korea

- Rest of Asia Pacific

- China Cognitive Electronic Warfare Market Outlook, 2017-2027F

- Market Size & Analysis

- By Revenues (USD Billion)

- Market Share & Analysis

- By Capability

- By Platform

- Market Size & Analysis

- India Cognitive Electronic Warfare Market Outlook, 2017-2027F

- Market Size & Analysis

- By Revenues (USD Billion)

- Market Share & Analysis

- By Capability

- By Platform

- Market Size & Analysis

- Australia Cognitive Electronic Warfare Market Outlook, 2017-2027F

- Market Size & Analysis

- By Revenues (USD Billion)

- Market Share & Analysis

- By Capability

- By Platform

- Market Size & Analysis

- South Korea Cognitive Electronic Warfare Market Outlook, 2017-2027F

- Market Size & Analysis

- By Revenues (USD Billion)

- Market Share & Analysis

- By Capability

- By Platform

- Market Size & Analysis

- Market Size & Analysis

- Global Cognitive Electronic Warfare Market Key Strategic Imperatives for Growth & Success

- Company Profiles

- Cobham Advanced Electronics Solutions

- BAE Systems

- Elbit Systems

- General Dynamics Corporation

- Israel Aerospace Industries

- L3 Harris Technologies Inc

- Leonardo SPA

- Lockheed Martin Corporation

- Northrup Grumman Corporation

- Raytheon Technologies Corporation

- SAAB AB

- Textron Inc.

- Thales Group

- Ultra Electronic Group

- Teledyne Technologies

- Others

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making