Global Cardiac Ablation Devices Market Research Report: Forecast (2022-27)

By Product (Water-cooled radiofrequency ablation, Temperature-Controlled Radiofrequency Ablators, Tissue Contact Probes, Microwave Thermotherapy Devices, Others (Robotic Catheter M...anipulation Systems, Ultrasound Ablation Systems, etc.)), By Technology (Radiofrequency (RF) Ablation, Cryoablation Device, Laser Ablation, Electrical Ablators, Microwave Ablation, Ultrasound Ablation), By Application (Cardiac Rhythm Management, Tachycardia, Atrial Fibrillation and Flutter, Open Surgery), By End-Users (In-patient, Outpatient), By Region (North America, South America, Europe, Middle East & Africa, Asia-Pacific), By Company (Abbott Laboratories, Medtronic plc, Olympus Corporation, Johnson & Johnson (Biosense Webster, Inc.), Boston Scientific Corporation, CONMED Corporation, AngioDynamics, Inc., CardioFocus Inc., Stryker Corporation, MicroPort Inc., Stereotaxis Inc., Teleflex Incorporated, Lepu Medical Technology, Avanos Medical, AtriCure, Others) Read more

- Healthcare

- Mar 2022

- Pages 262

- Report Format: PDF, Excel, PPT

Market Definition

Cardiac Ablation is the practice that uses energy to make small scars in the heart tissues. It prevents distinctive electrical signals that move through the heart and generate an uneven heartbeat. It can also be used to treat Atrial Fibrillation (AFib), a type of uneven heartbeat. Ablation is performed routinely using Radiofrequency (RF) and Cryoballoon (CB) catheters, with RF catheters being the most widely used technology. So, cardiac ablation devices are those devices that are used as a minimally invasive option to treat AFib.

Atrial fibrillation (AFib) affects 37,574 million people globally (0.51 percent of the population), and its prevalence has risen by 33% over the last 20 years. In 2021, around 11.92 million people in Europe suffered from AFib, i.e., likely to increase by up to 70% by 2030. Moreover, by 2050, Europe is projected to have the greatest increase in AF patients compared to other regions globally.

Market Insights

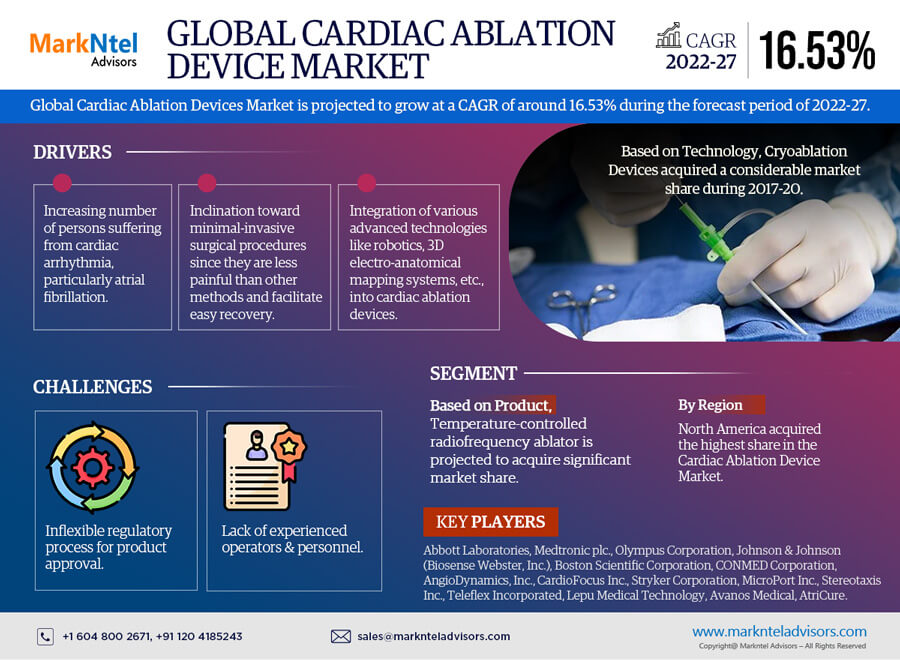

The Global Cardiac Ablation Devices Market is projected to grow at a CAGR of around 16.53% during the forecast period, i.e., 2022-27. The global market has experienced significant growth during 2017-19, owing to the mushrooming elderly population across North America, Europe, China, and Japan. According to WHO, people aged 60 & above are projected to be over 1.4 billion by 2030.

Over the last few years, the number of persons suffering from cardiac arrhythmia, particularly atrial fibrillation, has skyrocketed globally, which, in turn, has surged the number of patients suffering from high blood pressure, heart attacks, strokes, etc. The mounting inclination toward minimal-invasive surgical procedures since they are less painful than other methods and facilitate easy recovery is driving the market.

| Report Coverage | Details |

|---|---|

| Study Period | Historical Data: 2017-20 |

| Base Year: 2021 | |

| Forecast Period: 2022-27 | |

| CAGR (2022-2027) | 16.53% |

| Regions Covered | North America: USA, Canada, Mexico |

| Europe: Germany, UK, Spain, France, Italy | |

| Asia-Pacific: China, Japan, India, South Korea, Australia, Rest of Asia Pacific | |

| South America: Brazil, Rest of South America | |

| Middle East & Africa: UAE, Saudi Arabia, South Africa, Rest of Middle East & Africa | |

| Key Companies Profiled |

Abbott Laboratories, Medtronic plc, Olympus Corporation, Johnson & Johnson (Biosense Webster, Inc.), Boston Scientific Corporation, CONMED Corporation, AngioDynamics, Inc., CardioFocus Inc., Stryker Corporation, MicroPort Inc., Stereotaxis Inc., Teleflex Incorporated, Lepu Medical Technology, Avanos Medical, AtriCure Others |

| Unit Denominations | USD Million/Billion |

Besides, the integration of various advanced technologies like robotics, 3D electro-anatomical mapping systems, etc., into cardiac ablation devices, coupled with escalating collaborations among companies to offer advanced devices, are also creating revenue-generating opportunities for the market.

Moreover, mergers & acquisitions among start-ups & well-established players operating in cardiac ablation technology are also on the rise. The existing cardiac ablation solution providers are focused on expanding their device portfolio and gaining access to new technologies & geographies via strategic events.

Impact of COVID-19 on the Global Cardiac Ablation Devices Market

The Covid-19 pandemic has been a catalyst in the growth of the Global Cardiac Ablation Devices Market. According to the United States Department of Veterans Affairs, the number of cardiac patients has soared immensely after the pandemic. Moreover, the intensity of cardiac diseases has also increased massively among the existing cardiac patients worldwide.

According to Washington University, the risk of heart failure has increased by around 72%, heart attacks by 63%, & strokes by 52% among the patients who had mild cardiac disease symptoms before the pandemic. The same trend has been observed in other countries like Germany, the UK, Sweden, Japan, India, GCC, France, etc. This sudden increase in the number of cardiac patients is projected to soar the demand for cardiac ablation devices in the coming years.

Market Segmentation:

By Product:

- Water-cooled radiofrequency ablation

- Temperature-Controlled Radiofrequency Ablator

- Tissue Contact Probes

- Microwave Thermotherapy Devices

- Others (Robotic Catheter Manipulation Systems, Ultrasound Ablation Systems, etc.)

Based on the Product, a Temperature-controlled radiofrequency ablator is projected to grab significant market share in the global cardiac ablation device market. The radiofrequency ablation technology-based devices are considered highly effective in ventricular tachycardia (VT) treatment (100% success rate in eliminating VT from patients.)

- In 2019, Medtronic plc acquired EPIX Therapeutics, Inc. (EPIX), the manufacturer of a novel, catheter-based, temperature-controlled cardiac ablation system that uses radiofrequency energy to create scar tissue in the heart during an ablation procedure.

By Technology:

- Radiofrequency (RF) Ablation

- Cryoablation Device

- Laser Ablation

- Electrical Ablators

- Microwave Ablation

- Ultrasound Ablation

Here, Cryoablation Devices acquired a considerable market share during 2017-20, and the same trend is anticipated to prevail over the forecast years. These devices have shown higher efficiency in preventing atrial arrhythmia recurrence than other techniques. The strategic collaborations among different companies toward developing Atrial Fibrillation devices using Cryoablation technology are driving the market. Besides, emerging economies like India & China are considered attractive markets to launch cryoablation devices due to the rising number of cases of AFib. In 2020, the rate of AFib in both these countries was in the range of 1% to 4%.

Across China, around 1.8% of the population are diagnosed with AFib based on either a medical history or a single time-point ECG screen. According to the European Society of Cardiology, the efficacy of cryoablation exceeds 70%-80%, and use cases of this therapy are rising significantly in both countries. As a result, Cryoablation Devices would witness surging demand in the forthcoming years.

- In 2019, Philips and Medtronic joined forces to develop an integrated, image-guided system for treating common heart rhythm disorder Paroxysmal Atrial Fibrillation (PAF). It uses Philips' dielectric imaging & navigation system to facilitate cryoablation without extensive X-ray imaging. Moreover, with the collaboration, Medtronic would also facilitate sales of products on behalf of Philips to provide an innovative, integrated image guidance solution for cryoablation procedures.

- In 2021, Medtronic launched the Arctic Front Cardiac Cryoablation Catheter System, the first and only cryoballoon catheter approved by the Central Drugs Standard Control Organization (CDSCO) for the treatment of Atrial Fibrillation (AFib) in India.

On the other hand, the demand for laser ablation technology is also propelling significantly, owing to the rising approvals by the government to use laser technology in ablation devices for the treatment of AF due to low radiation exposure.

- In 2017, the Japanese Ministry of Health, Labour, & Welfare granted market clearance for the CardioFocus HeartLight Endoscopic Ablation System for the treatment of paroxysmal AF. The HeartLight System is a visually guided laser balloon technology for controlled & consistent Pulmonary Vein Isolation (PVI) treatment of AF.

- Additionally, in 2020, the U.S. Food and Drug Administration (FDA) cleared the next-generation CardioFocus Inc. HeartLight X3 Endoscopic Laser Ablation System for the treatment of drug-refractory recurrent symptomatic PAF.

By Application:

- Cardiac Rhythm Management

- Tachycardia

- Atrial Fibrillation and Flutter

- Open Surgery

Atrial Fibrillation and flutter witnessing astronomical growth in the global market as it is among the most common heart rhythm disorder among the geriatric population, owing to which the risk of heart failure and stroke has increased substantially. In 2017, around 37.57 million prevalent cases and 3.05 million incident cases of AF were projected globally. The surging approval by the government on ablation devices to treat AF and substantial rise in death rates from atrial fibrillation especially in Europe, North America, and the Asia-Pacific region are thriving the market growth. Moreover, the soaring number of ablation device manufacturers across the developing countries & the significant surge in the prevalence rate of atrial fibrillation among Medicare fee-for-service (FFS) beneficiaries are expected to fuel the market growth for cardiac ablation devices in the forthcoming period. Around 1–3% of the population suffers from atrial fibrillation (AF) in Europe. 14.4 million people over 65 in the EU are expected to have AF by 2060.

- In 2021, The U.S. Food and Drug Administration (FDA) cleared Medtronic's DiamondTemp Ablation (DTA) system to treat patients with recurrent, symptomatic paroxysmal atrial fibrillation (AF).

By End-Users:

- In-patient

- Outpatient

Of both, In-patients held the highest share in the Global Cardiac Ablation Device Market in 2021, primarily due to the surging incidences of cardiovascular diseases among the elderly population worldwide, coupled with the increasing number of hospitalizations due to AFib. Besides, the adoption of MRI ablation centers in hospitals to offer cost-effective treatment for cardiac arrhythmias is another crucial aspect driving the market through In-patients.

- According to the Centers for Disease Control and Prevention (CDC), more than 750,000 hospitalizations occur each year due to AFib in the United States.

Regional Landscape

Geographically, the Global Cardiac Ablation Devices Market expands across:

- North America

- South America

- Europe

- The Middle East & Africa

- Asia-Pacific

Of all regions globally, North America acquired the highest share in the Cardiac Ablation Device Market in the historical period since it is an early adopter of advanced technologies in cardiac ablation. Favorable reimbursement policies for cardiac ablation procedures, the extensive presence of giant market players like Johnsons & Johnsons, Abbott, CardioFocus, etc., and mounting incidences of cardiac diseases, especially AFib, in the geriatric population, are the prime factors driving the regional market.

- According to the Centers for Disease Control and Prevention (CDC), Atrial Fibrillation (AFib) was the underlying cause of death of around 26,535 people in 2019. Along with this, the prevalence of AFib in the United States is estimated to rise to 12.1 million in 2030.

Besides, the launch of advanced technologies in cardiac ablation devices and massive funding by companies to develop devices used in catheter ablation procedures shall further boost the regional market. Moreover, the increasing government approvals for cardiac ablation systems and a soaring number of ablation procedures for AFib are other crucial aspects projected to boost the demand for cardiac ablation devices over the forecast years.

- In 2021, Acutus Medical received FDA approval to initiate its Atrial Fibrillation (AF) Investigational Device Exemption (IDE) clinical trial for the AcQBlate Force Sensing Ablation Catheter & System.

- In 2020, Boston Scientific launched DIRECTSENSE Technology, a tool for monitoring the effect of radiofrequency (RF) energy delivery during cardiac ablation procedures in the US market.

- In 2021, the US Food and Drug Administration (FDA) approved the Amplatzer Amulet Left Atrial Appendage (LAA) Occluder of Abbott to help treat patients suffering from atrial fibrillation.

- According to the CDC, 12.1 million residents in the US are projected to have Atrial Fibrillation in 2030.

- In the same year, FDA approved Medtronic's Arctic Front Family of Cardiac Cryoablation Catheters for the treatment of recurrent symptomatic paroxysmal AF as an alternative to the AAD therapy in the US.

Market Dynamics:

Key Driver: Surging Incidences of Atrial Fibrillation Worldwide

Atrial Fibrillation (AF) has been a common type of arrhythmia in which the heart beats rapidly or slowly. It can either result in strokes or heart failure and happens mainly due to excessive intake of alcohol & caffeine, sedentary lifestyle, smoking, consumption of dietary supplements, etc. Due to this, heart diseases, high blood pressure, chronic heart diseases, thyroid, obesity, etc., have increased substantially. AF often coexists with heart failure as well as obesity in the aging population.

Moreover, the prevalence of AF is higher among people aged 65 & above. The escalating geriatric population in both developed & developing countries like the US, Japan, countries of Western Europe, and India & China are expected to propel the incidence rate of AF in the coming years.

As a result, it would accelerate the demand for cardiac ablation devices over the forecast years. Japan, China, etc., are amongst the most impacted countries by AFib in 2022. With the continuous growth in the aging population in Japan, an estimated 1 million patients are expected to have AFib by 2030, as reported by the European Society of Cardiology.

Besides, the steady rise in AFib-related hospital admissions, mounting inclination toward cardiac ablation for AFib treatment, and investments made by several companies in this sector to maximize their revenue are other crucial aspects anticipated to drive the market during 2022-27.

- In 2021, Boston Scientific acquired Farapulse for USD 295 million to expand its market share of cardiac Ablation devices. The company had been an investor of 27% in Farapulse since 2014, but the recent acquisition would provide 100% ownership to Boston Scientific.

Key Trend in the Global Cardiac Ablation Devices Market

- Adoption of Robotic Navigation Systems for Magnetic Cardiac Ablation

The Robotic Navigation System is 70% to 80% faster than the previous one & offers more flexibility. This system allows optimal catheter stability and reproducible catheter movements to obtain better results. The system has been efficient in doing ablation of both simple and complex arrhythmias, mainly atrial fibrillation. The usage of robotic navigation systems has been announced by several companies specializing in cardiac ablation devices. In addition, the FDA approval on their usage has also been registering an uptrend. For instance, the Stereotaxis robotic navigation of magnetic ablation catheter received FDA approval in 2020.

Recent Developments by Leading Companies

- In 2022, Medtronic acquired Affera Inc. to expand its cardiac ablation portfolio. Affera designs & manufactures electrophysiology (EP) cardiac mapping & navigation systems and catheter-based cardiac ablation technologies. The company aims to establish its footprint in the cardiac ablation space.

- In 2020, Biosense Webster launched CARTO 3 System Version 7 and the CARTO PRIME mapping module to advance the treatment of complex arrhythmias. CARTO PRIME is powered with improvised mapping capabilities that help significantly reduce ablation times compared to standard mapping algorithms.

- In 2020, Boston Scientific Corporation acquired Farapulse, Inc., a privately-held company developing a pulsed-field ablation (PFA) system for the treatment of atrial fibrillation (AF) and other cardiac arrhythmias.

Key Questions Answered in the Market Research Report:

- What are the overall statistics or estimates (Overview, Size- By Value, Forecast Numbers, Segmentation, Shares) of the Global Cardiac Ablation Devices Market?

- What are the region-wise industry size, growth drivers, and challenges?

- What are the key innovations, opportunities, current & future trends, and regulations in the Global Cardiac Ablation Devices Market?

- Who are the key competitors, their key strengths & weaknesses, and how do they perform in the Global Cardiac Ablation Devices Market based on the competitive benchmarking matrix?

- What are the key results derived from surveys conducted during the Global Cardiac Ablation Devices Market study?

Frequently Asked Questions

- Introduction

- Research Process

- Assumption

- Market Segmentation

- Market Definition

- Executive Summary

- Global Cardiac Ablation Device Market Trends & Insights

- Global Cardiac Ablation Device Market Regulation & Policy, By Country

- Global Cardiac Ablation Device Market Dynamics

- Growth Drivers

- Challenges

- Impact Analysis

- Global Cardiac Ablation Device Market Hotspot and Opportunities

- Global Cardiac Ablation Device Market Outlook, 2017- 2027

- Market Size and Analysis

- By Revenues in USD Million

- Market Share and Analysis

- By Product

- Water-cooled radiofrequency ablation

- Temperature-Controlled Radiofrequency Ablators

- Tissue Contact Probes

- Microwave Thermotherapy Devices

- Others (Robotic Catheter Manipulation Systems, Ultrasound Ablation Systems, etc.)

- By Technology

- Radiofrequency (RF) Ablation

- Cryoablation Device

- Laser Ablation

- Electrical Ablators

- Microwave Ablation

- Ultrasound Ablation

- By Application

- Cardiac Rhythm Management

- Tachycardia

- Atrial Fibrillation and Flutter

- Open Surgery

- By End-Users

- In-patient

- Outpatient

- By Region

- North America

- South America

- Europe

- Middle East & Africa

- Asia-Pacific

- By Company

- Competition Characteristics

- Revenue Shares

- Competitor Placement in MarkNtel Quadrant

- By Product

- Market Size and Analysis

- North America Cardiac Ablation Device Outlook, 2017- 2027

- Market Size and Analysis

- By Revenues in USD Million

- Market Share and Analysis

- By Product

- By Technology

- By Application

- By End-Users

- By Country

- The US

- Canada

- Mexico

- The US Cardiac Ablation Device Outlook, 2017- 2027

- Market Size and Analysis

- By Revenues in USD Million

- Market Share and Analysis

- By Technology

- By Application

- Market Size and Analysis

- Canada Cardiac Ablation Device Outlook, 2017- 2027

- Market Size and Analysis

- By Revenues in USD Million

- Market Share and Analysis

- By Technology

- By Application

- Market Size and Analysis

- Mexico Cardiac Ablation Device Outlook, 2017- 2027

- Market Size and Analysis

- By Revenues in USD Million

- Market Share and Analysis

- By Technology

- By Application

- Market Size and Analysis

- Market Size and Analysis

- South America Cardiac Ablation Device Outlook, 2017- 2027

- Market Size and Analysis

- By Revenues in USD Million

- Market Share and Analysis

- By Product

- By Technology

- By Application

- By End-Users

- By Country

- Brazil

- Rest of South America

- Brazil Cardiac Ablation Device Outlook, 2017- 2027

- Market Size and Analysis

- By Revenues in USD Million

- Market Share and Analysis

- By Technology

- By Application

- Market Size and Analysis

- Market Size and Analysis

- Europe Cardiac Ablation Device Outlook, 2017- 2027

- Market Size and Analysis

- By Revenues in USD Million

- Market Share and Analysis

- By Product

- By Technology

- By Application

- By End-Users

- By Country

- The UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

- The UK Cardiac Ablation Device Outlook, 2017- 2027

- Market Size and Analysis

- By Revenues in USD Million

- Market Share and Analysis

- By Technology

- By Application

- Market Size and Analysis

- Germany Cardiac Ablation Device Outlook, 2017- 2027

- Market Size and Analysis

- By Revenues in USD Million

- Market Share and Analysis

- By Technology

- By Application

- Market Size and Analysis

- France Cardiac Ablation Device Outlook, 2017- 2027

- Market Size and Analysis

- By Revenues in USD Million

- Market Share and Analysis

- By Technology

- By Application

- Market Size and Analysis

- Italy Cardiac Ablation Device Outlook, 2017- 2027

- Market Size and Analysis

- By Revenues in USD Million

- Market Share and Analysis

- By Technology

- By Application

- Market Size and Analysis

- Spain Cardiac Ablation Device Outlook, 2017- 2027

- Market Size and Analysis

- By Revenues in USD Million

- Market Share and Analysis

- By Technology

- By Application

- Market Size and Analysis

- Market Size and Analysis

- Middle East & Africa Cardiac Ablation Device Outlook, 2017- 2027

- Market Size and Analysis

- By Revenues in USD Million

- Market Share and Analysis

- By Product

- By Technology

- By Application

- By End-Users

- By Country

- UAE

- Saudi Arabia

- South Africa

- Rest of Middle East & Africa

- UAE Cardiac Ablation Device Outlook, 2017- 2027

- Market Size and Analysis

- By Revenues in USD Million

- Market Share and Analysis

- By Technology

- By Application

- Market Size and Analysis

- Saudi Arabia Cardiac Ablation Device Outlook, 2017- 2027

- Market Size and Analysis

- By Revenues in USD Million

- Market Share and Analysis

- By Technology

- By Application

- Market Size and Analysis

- South Africa Cardiac Ablation Device Outlook, 2017- 2027

- Market Size and Analysis

- By Revenues in USD Million

- Market Share and Analysis

- By Technology

- By Application

- Market Size and Analysis

- Market Size and Analysis

- Asia-Pacific Cardiac Ablation Device Outlook, 2017- 2027

- Market Size and Analysis

- By Revenues in USD Million

- Market Share and Analysis

- By Product

- By Technology

- By Application

- By End-Users

- By Country

- China

- Japan

- India

- South Korea

- Australia

- Rest of Asia Pacific

- China Cardiac Ablation Device Outlook, 2017- 2027

- Market Size and Analysis

- By Revenues in USD Million

- Market Share and Analysis

- By Technology

- By Application

- Market Size and Analysis

- Japan Cardiac Ablation Device Outlook, 2017- 2027

- Market Size and Analysis

- By Revenues in USD Million

- Market Share and Analysis

- By Technology

- By Application

- Market Size and Analysis

- India Cardiac Ablation Device Outlook, 2017- 2027

- Market Size and Analysis

- By Revenues in USD Million

- Market Share and Analysis

- By Technology

- By Application

- Market Size and Analysis

- South Korea Cardiac Ablation Device Outlook, 2017- 2027

- Market Size and Analysis

- By Revenues in USD Million

- Market Share and Analysis

- By Technology

- By Application

- Market Size and Analysis

- Australia Cardiac Ablation Device Outlook, 2017- 2027

- Market Size and Analysis

- By Revenues in USD Million

- Market Share and Analysis

- By Technology

- By Application

- Market Size and Analysis

- Market Size and Analysis

- Global Cardiac Ablation Device Market Key Strategic Imperatives for Success and Growth

- Competitive Outlook

- Competition Matrix

- By Application Portfolio

- Brand Specialization

- Target Markets

- Target By Applications

- Research & Development

- Strategic Alliances

- Strategic Initiatives

- Company Profiles (Business Description, By Application Segments, Business Segments, Financials, Strategic Alliances/ Partnerships, Future Plans)

- Abbott Laboratories

- Medtronic plc

- Olympus Corporation

- Johnson & Johnson (Biosense Webster, Inc.)

- Boston Scientific Corporation

- CONMED Corporation

- AngioDynamics, Inc.

- CardioFocus Inc.

- Stryker Corporation

- MicroPort Inc.

- Stereotaxis Inc.

- Teleflex Incorporated

- Lepu Medical Technology

- Avanos Medical

- AtriCure

- Others

- Competition Matrix

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making