Brazil Sanitary Protection Market Research Report: Forecast (2023-28)

By Type (Sanitary Pads, Panty Liners, Tampons, Menstrual Cups), By Nature of Product (Disposable, Reusable), By Sales Channel (Online Stores, Offline Stores), By End User (Househol...ds, Commercial (Hospitals, Educational Institutes, etc.)), By Region (North, North East, Central West, South East, South), By Company (Procter & Gamble, Unicharm Corp., Essity AB, Kimberly Clark, Ontex, Unilever, Johnson & Johnson, Kao Corporation, Natracare, Sirona Hygiene Pvt. Ltd., and Others) Read more

- FMCG

- Jun 2023

- Pages 97

- Report Format: PDF, Excel, PPT

Market Definition

Sanitary protection products consist of female hygiene products, including sanitary pads, tampons, menstrual cups, etc. These products are available in both disposable & reusable types and comes in different sizes as per the women’s need.

Market Insights & Analysis: Brazil Sanitary Protection Market (2023-28)

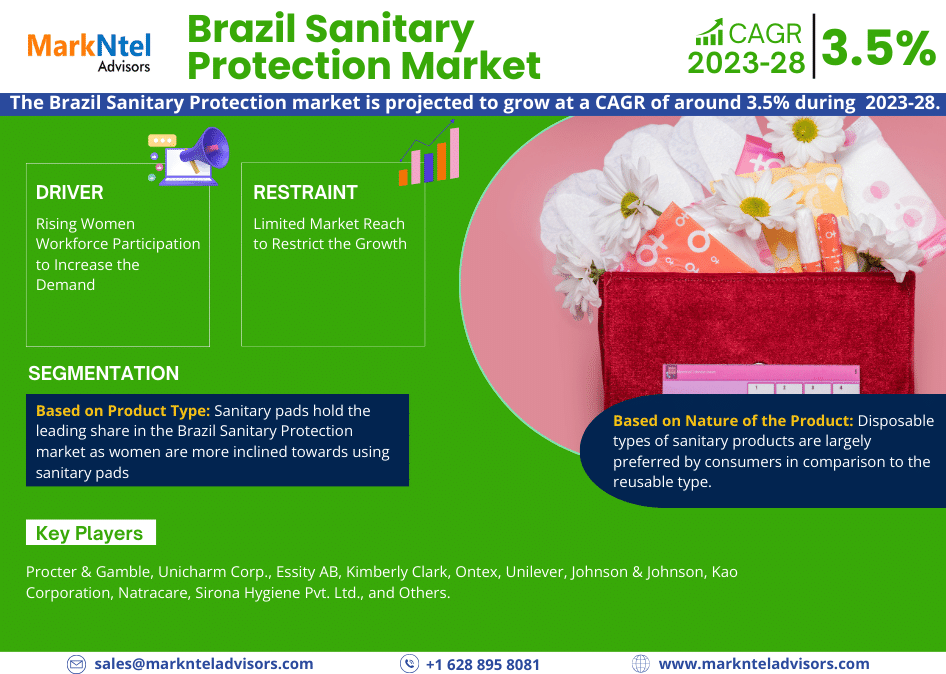

The Brazil Sanitary Protection market size is valued at around USD 698 million in 2024 and is projected to grow at a CAGR of around 3.5% during the forecast period, i.e., 2023-28. The major factor attributing to its growth is the rising women's workforce in the country which has the awareness about the benefits of using sanitary protection products and has the financial ability to purchase them. The country is currently in its developing stage, resulting in numerous economic opportunities in several fields, such as IT, communication, retail, etc. These new economic opportunities, coupled with favorable government policies, have contributed to higher women’s participation in the economic periphery of Brazil resulting in increasing the overall household income which eventually resulted in higher sales of sanitary protection products.

| Report Coverage | Details |

|---|---|

| Study Period | Historical Data: 2018-21 |

| Base Year: 2022 | |

| Forecast Period: 2023-28 | |

| CAGR (2023-2028) | 3.5% |

| Region Covered | North, North East, Central West, South East, South |

| Key Companies Profiled | Procter & Gamble, Unicharm Corp., Essity AB, Kimberly Clark, Ontex, Unilever, Johnson & Johnson, Kao Corporation, Natracare, Sirona Hygiene Pvt. Ltd., and Others. |

| Market Value (2024) | USD 698 million |

Along with it, the rising awareness among women towards safe sanitation, have also led to the widespread adoption of sanitary protection products such as sanitary pads, tampons and others because the use of sanitary protection products helps in preventing Urinary Tract Infection and other such diseases. Social media & the high penetration of the internet has resulted in improving awareness about safe sanitation & hygiene practices. Owing to this, women are increasingly adopting sanitation products such as disposable tampons & pads, menstrual cups, etc. Further, the installation of sanitary pads vending machines in public places such as schools, offices, airports, etc., the Brazilian government initiated to improve women's health & educate them about safe sanitation. These initiatives are widely contributing to increasing sales of sanitary pads in the country.

Moreover, the growing awareness about environment-friendly & biodegradable sanitary products is supplementing the market demand for pads manufactured using natural & sustainable raw material such as menstrual cups & sanitary pads made of straw & banana leaf waste, which are disposable & does not lead to pollution. Therefore, the sustainability of these products has also emerged as a crucial factor for the rising adoption of sanitary protection products, especially within the urban areas of the country. Thus, leading to the growth of the Brazil Sanitary Protection market in the future years.

Brazil Sanitary Protection Market Key Driver:

Rising Women Workforce Participation to Increase the Demand - Brazil has witnessed a rise in its women workforce participation in recent years due to the growing economic opportunities in the country & the acceptance of women working outside the home. Inclusive & favorable government policies increase women’s participation in the economy. These programs include equal remuneration at the workplace, childcare facilities, and parental leaves, hence have led to a growth in the number of working women in the country. For instance, women’s workforce participation in Brazil grew from 42.6% in 2020 to 43.1% in 2021, stated the World Bank. This structural change has led to increased awareness among women about menstrual hygiene & sanitation, as well as the serious health issue that can happen to women if safe sanitation practices are not followed. Owing to this there has been an increase in the adoption of sanitation protection products, especially disposable sanitary pads.

In addition, the proactive steps of the government & civil society have also led to the deep penetration of disposable sanitary pads into the hinterland & rural parts of the country. Further, in the coming years, the adoption of sanitary protection products is expected to grow due to the constantly rising working women population in the country. This, in turn, would positively impact the growth of the market.and optimize their operations.

Brazil Sanitary Protection Market Possible Restraint:

Limited Market Reach to Restrict the Growth - Although sanitary products are a necessity & their use is mainly restricted to the urban & working class. Still, many rural parts of the country lack access to feminine hygiene products. In 2021, nearly 29.4% of the country’s population lived in poverty, stated the government of Brazil. Due to this, access to sanitary products & menstrual hygiene products is very limited in such households. In Brazil, the market for these products is largely restricted to urban cities such as Salvador, Rio de Janeiro, etc. Thus, deep penetration of sanitary products into the rural areas of the country is the highest challenge for the market growth.

Growth Opportunity: Rising Number of Women-related Health Issues

Proper sanitation & maintenance of good hygiene have now become mandatory practices as women-related health infections, such as Unitary Tract Infections, Yeast Infections, etc., are rising in the country. Due to this, the use of sanitary pads & practicing a safe menstrual hygiene routine becomes essential. The rising awareness about this health issues & the constant promotion of using sanitary protection products has led to the growing adoption of menstrual products such as tampons, sanitary pads, menstrual cups, etc., among women. In addition, the COVID-19 pandemic also resulted in the higher adoption of sanitary products among women to maintain proper sanitation. Therefore, the rising awareness among women to include best menstrual hygiene practices in their routine to prevent infections is emerging as an opportunity for sanitary product manufacturers in Brazil. Therefore, creating a positive market outlook for the growth of the market in the coming years.

Brazil Sanitary Protection Market Key Trend:

reference of Women to Use Sustainable & Eco-Friendly Sanitary Products - Sanitary product manufacturing companies such as Procter & Gamble, Unicharm, etc., are now shifting towards using sustainable & eco-friendly raw materials such as agricultural straws, banana waste, and fibers. They are beneficial for the environment as well as women’s health, as these sustainable sanitary products are made up of agricultural waste, which is safe on human skin. For instance:

- In 2021, EcoCiclo launched its 100% biodegradable, non-toxic, and vegan menstrual pads in the country. It is expected to attract the niche market in the urban parts of the country which is more aware about using biodegradable & eco-friendly sanitary pads.

In addition, the marketing & promotion, coupled with constant awareness being spread by NGOs & civil society such as Bill & Melinda Gates Foundation, UNICEF, etc., has also led to the higher adoption of disposable & biodegradable menstrual pads. Further, sustainable raw material, which primarily includes agricultural waste, is also easily available in Brazil. As a result, production becomes cost-effective & convenient, resulting in the increasing sales of biodegradable & reusable sanitary products in Brazil.

Brazil Sanitary Protection Market (2023-28): Segmentation Analysis

Based on Product Type:

- Sanitary Pads

- Panty Liners

- Tampons

- Menstrual Cups

Based on product type, sanitary pads hold the leading share in the Brazil Sanitary Protection market as women are more inclined towards using sanitary pads because their use is more convenient compared to other products such as tampons & menstrual cups. Sanitary pads offer better absorbency & leakage protection and allow the user a hassle-free experience. In addition to it, sanitary pads can be easily disposed of as against menstrual cups & reusable cloth pads, hence the adoption of sanitary pads is higher. Further, the availability of sanitary pads in several categories & sizes has also made their use more convenient leading to their higher demand in the country, therefore contributing to the growth of the Brazil Sanitary Protection market.

Based on Nature of the Product:

- Disposable

- Reusable

According to the nature of the product, disposable types of sanitary products are largely preferred by consumers in comparison to the reusable type. As these types of sanitary products are easy to carry, convenient to use, and can be discarded easily while maintaining proper hygiene. This reduces the risk of infections and urinary diseases among women as a result its usage is higher. Further, disposable sanitary products such as pads are more familiar to be used and culturally acceptable owing to which the demand for disposable sanitary products is more in comparison to others, leading to the growth of the Brazil Sanitary Protection market.

Gain a Competitive Edge with Our Brazil Sanitary Protection Market Report

- Brazil Sanitary Protection Market report provides a detailed and thorough analysis of market size, growth rate, competitive landscape, and key players. This comprehensive analysis helps businesses gain a holistic understanding of the market dynamics and make informed decisions.

- This report also highlights current market trends and future projections, allowing businesses to identify emerging opportunities and potential challenges. By understanding market forecasts, companies can align their strategies and stay ahead of the competition.

- Brazil Sanitary Protection Market report aids in assessing and mitigating risks associated with entering or operating in the market.

- The report would help in understanding market dynamics, regulatory frameworks, and potential challenges, businesses can develop strategies to minimize risks

Frequently Asked Questions

Brazil Sanitary Protection Market Research Report (2023-2028) - Table of Contents

- Market Segmentation

- Introduction

- Product Definition

- Research Process

- Assumptions

- Executive Summary

- Brazil Sanitary Protection Market Regulations, Standards & Certifications

- Brazil Sanitary Protection Market Trends & Insights

- Brazil Sanitary Protection Market Dynamics

- Drivers

- Challenges

- Brazil Sanitary Protection Market Outlook, 2018-2028

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Type

- Sanitary Pads

- Panty Liners

- Tampons

- Menstrual Cups

- By Nature of Product

- Disposable

- Reusable

- By Sales Channel

- Online Stores

- Offline Stores

- Hypermarket/ Supermarket

- Pharmacy

- Retail Stores

- Specialty Stores

- By End User

- Households

- Commercial (Hospitals, Educational Institutes, etc.)

- By Type

- By Region

- North

- North East

- Central West

- South East

- South

- By Competitors

- Market Share & Analysis

- Competition Characteristics

- Market Size & Analysis

- North Brazil Sanitary Protection Market Outlook, 2018-2028

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Type

- By Nature

- By Sale Channel

- By End Users

- Market Size & Analysis

- North East Brazil Sanitary Protection Market Outlook, 2018-2028

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Type

- By Nature

- By Sale Channel

- By End Users

- Market Size & Analysis

- Central West Brazil Sanitary Protection Market Outlook, 2018-2028

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Type

- By Nature

- By Sale Channel

- By End Users

- Market Size & Analysis

- South East Brazil Sanitary Protection Market Outlook, 2018-2028

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Type

- By Nature

- By Sale Channel

- By End Users

- Market Size & Analysis

- South Brazil Sanitary Protection Market Outlook, 2018-2028

- Market Size & Analysis

- By Revenues (USD Million)

- Market Share & Analysis

- By Type

- By Nature

- By Sale Channel

- By End Users

- Market Size & Analysis

- Competition Outlook

- Competition Matrix

- Product Portfolio

- Target Markets

- Research & Development

- Strategic Alliances

- Strategic Initiatives

- Company Profiles (Business Description, Product Segments, Business Segments, Financials, Strategic Alliances/ Partnerships, Future Plans)

- Procter & Gamble

- Unicharm Corp.

- Essity AB

- Kimberly Clark

- Ontex

- Uniliver

- Johnson & Johnson

- Kao Corporation

- Natracare

- Sirona Hygiene Pvt. Ltd.

- Others

- Competition Matrix

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making