Global Armored Vehicles Market Research Report: Forecast (2023-2028)

By Platform (Combat Vehicles, Combat Support Vehicles, Unmanned Armored Ground Vehicles), By System (Engines, Turret Drives, Ammunition Handling Systems, Fire Control Systems, Arma...ments, Ballistic Armor, Countermeasure System, Command and Control System, Power System, Others), By Type (Electric, Conventional), By Mode of Operation (Manned, Unmanned), By Mobility (Wheeled, [4X4, 6X6, 8X8, Others], Tracked), By Sales Channel (OEM, Retrofit), By Region (North America, South America, Europe , The Middle East & Africa, Asia-Pacific), By Company (L3Harris Technologies, Inc., Hanwha Group, General Dynamics Corporation, Lockheed Martin Corporation, Northrop Grumman, Oshkosh Defense, LLC, BAE Systems, Thales Group, ST Engineering, Mitsubishi Heavy Industries, Textron Systems, Denel Soc Ltd, FNSS, Arquus, Iveco Defence Vehicles, Others) Read more

- Aerospace & Defense

- Apr 2023

- Pages 194

- Report Format: PDF, Excel, PPT

Market Definition

Armored Vehicles are armed military, commercial, or passenger vehicles, shielded with complete or partial armor plating for protection against bullets, fragments, missiles, projectiles, shells, shrapnel, and weapon systems. Mostly called armed combat vehicles, they come in combination with innovative weaponry, technology, electronics, etc., and can move on continuous tracks or wheels. They play a vital role in reconnaissance, combat, battlefield, etc., with modern versions integrated with advanced technology such as programmable ammunition, autoloaders, and active protection systems.

Market Insights & Analysis: Global Armored Vehicles Market (2023-28)

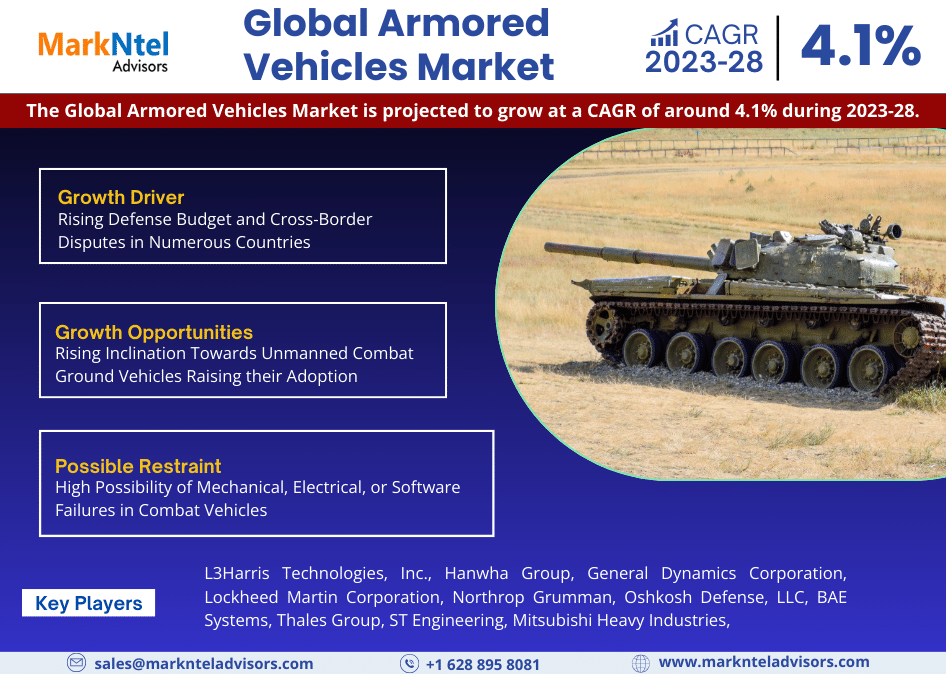

The Global Armored Vehicles Market is projected to grow at a CAGR of around 4.1% during the forecast period, i.e., 2023-28. The market growth is majorly carried by the rising defense expenditure of several countries as a response to the rising geopolitical tension and cross-border disputes in numerous regions, leading to increased necessity for military vehicles with bulletproof and other features. In addition, technological advancement in combat vehicles, with added features providing more safety, the scope of modification, and advanced functionality, is adding to the market’s expansion.

Moreover, military forces around the globe are integrating modernization programs into their vehicles to replace their legacy armored vehicles to facilitate new equipment, and new force structure is further raising the adoption of military and combat vehicles. Additionally, integrating Programmable Ammunition and adopting Active Protective Systems (APS) into vehicles further accelerates the industry.

| Report Coverage | Details |

|---|---|

| Study Period | Historical Data: 2018-21 |

| Base Year: 2022 | |

| Forecast Period: 2023-28 | |

| CAGR (2023-2028) | 4.1% |

| Regions Covered | North America: US, Canada, Mexico |

| Europe: Germany, The UK, France, Spain, Italy, Rest of Europe | |

| Asia-Pacific: China, India, Japan, South Korea, Australia, Rest of Asia-Pacific | |

| South America: Brazil, Argentina, Rest of South America | |

| Middle East & Africa: The UAE, Saudi Arabia, Turkey, Israel , South Africa, Rest of Middle East & Africa | |

| Key Companies Profiled | L3Harris Technologies, Inc., Hanwha Group, General Dynamics Corporation, Lockheed Martin Corporation, Northrop Grumman, Oshkosh Defense, LLC, BAE Systems, Thales Group, ST Engineering, Mitsubishi Heavy Industries, Textron Systems, Denel Soc Ltd, FNSS, Arquus, Iveco Defence Vehicles, Others |

| Unit Denominations | USD Million/Billion |

However, the safety risk of personnel and endangering vehicles with the high possibility of mechanical, electrical, or software failures in combat vehicles due to working in a threatening environment, etc., is bound to hinder the market projection. On the contrary, the high inclination of defense authorities toward Unmanned Combat Ground Vehicles for their added safety and advanced features to perform operations on command without endangering an operator or operator’s safety is raising their adoption, facilitating positive market fluctuation.

Global Armored Vehicles Market Key Driver:

Rising Defense Budget and Cross-Border Disputes in Numerous Countries - Increasing defense expenditure and budget in several countries with rising cross-border disputes has primarily driven the market. The prevalence of conflicts, terrorist activities, and wars worldwide requires numerous countries to strengthen their military equipment and vehicles, fueling market expansion. Likewise, growing emphasis on the sustainability of military vehicles and personnel safety through added advanced safety features with increasing humanitarian missions also adds to the market acceleration. For instance,

- In April 2021, Israel’s Ministry of Defense (MOD) signed a contract with Israel Aerospace Industries (IAI) to manufacture and supply nine Z-MAG all-terrain vehicles to the Israel Defense Forces (IDF), with an option to order 21 additional units.

Global Armored Vehicles Market Possible Restraint:

High Possibility of Mechanical, Electrical, or Software Failures in Combat Vehicles - Armored combat vehicles, though built to withstand harsh situations on the battlefield, are still prone to numerous mechanical, electrical, or software malfunctions, such as component breakdowns, software jams, etc. In addition, they are bound to face logistic strain by continuous cross-country operations, mechanical failures due to high-speed traversing, and more. Since these failures and malfunctions are hard to rectify by rescue and recovery teams, leading to the vehicle and personnel endangerment, such losses could hamper the market expansion. Moreover, failure detection is also not always possible due to the vehicle's difficult interior build-up and functioning, leading to more restraint on industrial growth.

Global Armored Vehicles Market Growth Opportunity:

Rising Inclination Towards Unmanned Combat Ground Vehicles Raising their Adoption - The unmanned combat ground vehicles on the battlefield reduce casualties, as they can perform critical and hazardous tasks currently carried out by personnel, endangering their safety. The adoption and inclination of various militaries towards such vehicles are creating lucrative opportunities for the industry. The increased requirement and demand for unmanned vehicles for intelligence, surveillance, and Reconnaissance (ISR) and combat operations are opening new avenues for industrial flow. Additionally, the growing military budget of several countries is increasing their affordability, supporting market expansion.

Global Armored Vehicles Market Key Trend:

Integration of Programmable Ammunition and Adoption of Active Protective System (APS) - The twin-ammo-feed or multiple-ammo-feed designs enabling change in the ammunition type made possible through Programmable Ammunition have reduced the complexity of various ammo types. Programmable Ammunition's advantages and easy operation has raised its adoption, pushing the market forward, with its flexibility to weapon platforms for firing and interchanging different types of ammunition.

Additionally, the trending adoption of Active Protection Systems (APS) for their detection and counteracting features has further accelerated the industrial arc. Added features of launchers, tracking radar, sensors, and countermeasure munitions, protecting combating vehicles from grenades and anti-tank guided missiles, also add to the industrial acceleration.

Global Armored Vehicles Market (2023-28): Segmentation Analysis

The Global Armored Vehicles Market study of MarkNtel Advisors evaluates & highlights the major trends & influencing factors in each segment & includes predictions for the period 2023–2028 at the global, regional, and national levels. Based on the Platform, and System the market has been further classified as:

Based on Platform,

- Combat Vehicles

- Main Battle Tanks

- Infantry Fighting Vehicles

- Armored Personal Carriers

- Armored Amphibious Vehicles

- Mine-Resistant Ambush Protected Vehicles

- Light Armored Vehicles

- Others (Self Propelled Howitzers, Air Defence Vehicles, etc.)

- Combat Support Vehicles

- Armored Supply Trucks

- Armored Command and Control Vehicles

- Repair and Recovery Vehicles

- Others (Bridge laying Tanks, Mine Clearance Vehicles, etc.)

- Unmanned Armored Ground Vehicles

Here, Combat Vehicles are expected to garner the highest market share in the forthcoming years following their high revenue contribution in the historical period. It is attributed to the rising demand for numerous combat vehicles, such as Armored Personnel Carriers and Light Armored Vehicles (LAVs). Additionally, the concerns and insurance to secure military personnel’s safety are increasing the requirement for Mine-Resistant Ambush Protected Vehicles as they ensure the safe deployment of infantry in battlefields and high-threat areas, extending the industrial expansion. For instance,

- In July 2020, Mahindra Emirates Vehicle Armoring FZ LLC launched its high-tech Mine Resistant Ambush Protected Specialty (MRAPS) vehicle, equipped with interrogator arms capable of lifting roadside Improvised Explosive Devices (IEDs).

The rising concerns of countries about safety and defense result in governments raising defense expenditure which further upscales the market. Moreover, initiatives to strengthen the armed forces increase the demand for Main Battle Tanks (MBTs), further extending the market acceleration.

Based on System,

- Engines

- Turret Drives

- Ammunition Handling Systems

- Fire Control Systems

- Armaments

- Ballistic Armor

- Countermeasure System

- Command and Control System

- Power System

- Others (Navigation System, Observation and Display Systems, etc.)

Among others, Armaments acquired a significant market share in the historical period and are anticipated to follow the same flow in the forecast period, owing to the rising requirement for remote weapon stations, anti-tank guided missile (AGTM) launchers, and other armaments worldwide. Additionally, Engines are also expected to register a significant hike in the market share as a result of the high requirement for durable and robust diesel engines. Moreover, due to the modernization programs of main battle tanks, there is increasing demand for turbine engines, extending the market acceleration further.

Global Armored Vehicles Market Regional Projection

Geographically, the Global Armored Vehicles Market expands across:

- North America

- South America

- Europe

- Middle East & Africa

- Asia-Pacific

Globally, North America dominated the market with the largest market share in the historical period owing to the highest military budget of the US government with ongoing modernization research programs, combined with the presence of significant defense and military equipment manufacturer companies. With US Army being the largest consumer of combat or military vehicles, it is expected to raise the demand for advanced vehicles. Additionally, with US Army continuing to invest in autonomous vehicle technology and other advancements to develop next-generation armed vehicles is likely to bode well for the industry.

On the other hand, Asia Pacific is expected to register the highest market growth in the coming years due to the increasing military budget to strengthen defense and military power in several countries. Besides, with countries like India, South Korea, and China investing heavily in procuring and developing advanced military vehicles, spending in research and development activities to enhance numerous sectors of their defense and improve border patrolling, especially against terrorism raising demand for medium-sized LPVs for patrolling operations are expected to strengthen the market reach. For instance,

- In March 2021, the Indian Ministry of Defense signed an agreement of INR 1,056 Crore (USD 144 million) with Mahindra Defense Systems Ltd (MDSL) to supply 1,300 Light Specialist Vehicles (LSVs) to the Army.

Global Armored Vehicles Industry Recent Developments

- In January 2022, Oshkosh Defence, LLC launched its first hybrid-electric Joint Light Tactical Vehicle (JLTV)

- In April 2021, L3Harris Technologies and American Rheinmetall Vehicles signed an agreement to develop the U.S. Army’s new Optionally Manned Fighting Vehicle (OMFV) to replace the Bradley Infantry Fighting Vehicle.

Gain a Competitive Edge with Our Global Armored Vehicles Market Report

- Global Armored Vehicles Market report provides a detailed and thorough analysis of market size, growth rate, competitive landscape, and key players. This comprehensive analysis helps businesses gain a holistic understanding of the market dynamics and make informed decisions.

- This report also highlights current market trends and future projections, allowing businesses to identify emerging opportunities and potential challenges. By understanding market forecasts, companies can align their strategies and stay ahead of the competition.

- Global Armored Vehicles Market report aids in assessing and mitigating risks associated with entering or operating in the market.

- The report would help in understanding market dynamics, regulatory frameworks, and potential challenges, businesses can develop strategies to minimize risks and optimize their operations.

Frequently Asked Questions

Global Armored Vehicles Market Research Report (2023-2028) - Table of Contents

- Market Segmentation

- Introduction

- Product Definition

- Research Process

- Assumptions

- Executive Summary

- Global Armored Vehicles Market Trends & Insights

- Global Armored Vehicles Market Dynamics

- Growth Drivers

- Challenges

- Global Armored Vehicles Market Hotspot & Opportunities

- Global Armored Vehicles Market Policies & Regulations

- Global Armored Vehicles Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenue (USD Million)

- Market Share & Analysis

- By Platform

- Combat Vehicles

- Main Battle Tanks

- Infantry Fighting Vehicles

- Armored Personal Carriers

- Armored Amphibious Vehicles

- Mine-Resistant Ambush Protected Vehicles

- Light Armored Vehicles

- Others (Self Propelled Howitzers, Air Defence Vehicles, etc.)

- Combat Support Vehicles

- Armored Supply Trucks

- Armored Command and Control Vehicles

- Repair and Recovery Vehicles

- Others (Bridge laying Tanks, Mine Clearance Vehicles, etc.)

- Unmanned Armored Ground Vehicles

- Combat Vehicles

- By System

- Engines

- Turret Drives

- Ammunition Handling Systems

- Fire Control Systems

- Armaments

- Ballistic Armor

- Countermeasure System

- Command and Control System

- Power System

- Others (Navigation System, Observation and Display Systems, etc.)

- By Type

- Electric

- Conventional

- By Mode of Operation

- Manned

- Unmanned

- By Mobility

- Wheeled

- 4X4

- 6X6

- 8X8

- Others (10X10, 12X12, etc.)

- Tracked

- Wheeled

- By Sales Channel

- OEM

- Retrofit

- By Region

- North America

- South America

- Europe

- The Middle East & Africa

- Asia-Pacific

- By Competitors

- Competition Characteristics

- Market Share & Analysis

- By Platform

- Market Size & Analysis

- North America Armored Vehicles Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenue (USD Million)

- Market Share & Analysis

- By Platform

- By System

- By Type

- By Mode of Transportation

- By Mobility

- By Sales Channel

- By Country

- The US

- Canada

- Mexico

- The US Armored Vehicles Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenue (USD Million)

- Market Share & Analysis

- By Platform

- By System

- By Mobility

- Market Size & Analysis

- Canada Armored Vehicles Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenue (USD Million)

- Market Share & Analysis

- By Platform

- By System

- By Mobility

- Market Size & Analysis

- Mexico Armored Vehicles Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenue (USD Million)

- Market Share & Analysis

- By Platform

- By System

- By Mobility

- Market Size & Analysis

- Market Size & Analysis

- South America Armored Vehicles Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenue (USD Million)

- Market Share & Analysis

- By Platform

- By System

- By Type

- By Mode of Transportation

- By Mobility

- By Sales Channel

- By Country

- Brazil

- Argentina

- Rest of South America

- Brazil Armored Vehicles Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenue (USD Million)

- Market Share & Analysis

- By Platform

- By System

- By Mobility

- Market Size & Analysis

- Argentina Armored Vehicles Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenue (USD Million)

- Market Share & Analysis

- By Platform

- By System

- By Mobility

- Market Size & Analysis

- Market Size & Analysis

- Europe Armored Vehicles Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenue (USD Million)

- Market Share & Analysis

- By Platform

- By System

- By Type

- By Mode of Transportation

- By Mobility

- By Sales Channel

- By Country

- The UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

- The UK Armored Vehicles Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenue (USD Million)

- Market Share & Analysis

- By Platform

- By System

- By Mobility

- Market Size & Analysis

- Germany Armored Vehicles Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenue (USD Million)

- Market Share & Analysis

- By Platform

- By System

- By Mobility

- Market Size & Analysis

- France Armored Vehicles Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenue (USD Million)

- Market Share & Analysis

- By Platform

- By System

- By Mobility

- Market Size & Analysis

- Italy Armored Vehicles Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenue (USD Million)

- Market Share & Analysis

- By Platform

- By System

- By Mobility

- Market Size & Analysis

- Spain Armored Vehicles Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenue (USD Million)

- Market Share & Analysis

- By Platform

- By System

- By Mobility

- Market Size & Analysis

- Market Size & Analysis

- The Middle East & Africa Armored Vehicles Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenue (USD Million)

- Market Share & Analysis

- By Platform

- By System

- By Type

- By Mode of Transportation

- By Mobility

- By Sales Channel

- By Country

- The UAE

- Saudi Arabia

- Turkey

- Israel

- South Africa

- Rest of Middle East & Africa

- The UAE Armored Vehicles Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenue (USD Million)

- Market Share & Analysis

- By Platform

- By System

- By Mobility

- Market Size & Analysis

- Saudi Arabia Armored Vehicles Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenue (USD Million)

- Market Share & Analysis

- By Platform

- By System

- By Mobility

- Market Size & Analysis

- Turkey Armored Vehicles Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenue (USD Million)

- Market Share & Analysis

- By Platform

- By System

- By Mobility

- Market Size & Analysis

- Israel Armored Vehicles Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenue (USD Million)

- Market Share & Analysis

- By Platform

- By System

- By Mobility

- Market Size & Analysis

- South Africa Armored Vehicles Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenue (USD Million)

- Market Share & Analysis

- By Platform

- By System

- By Mobility

- Market Size & Analysis

- Market Size & Analysis

- Asia-Pacific Armored Vehicles Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenue (USD Million)

- Market Share & Analysis

- By Platform

- By System

- By Type

- By Mode of Transportation

- By Mobility

- By Sales Channel

- By Country

- China

- Japan

- South Korea

- India

- Australia

- Rest of Asia Pacific

- China Armored Vehicles Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenue (USD Million)

- Market Share & Analysis

- By Platform

- By System

- By Mobility

- Market Size & Analysis

- Japan Armored Vehicles Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenue (USD Million)

- Market Share & Analysis

- By Platform

- By System

- By Mobility

- Market Size & Analysis

- South Korea Armored Vehicles Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenue (USD Million)

- Market Share & Analysis

- By Platform

- By System

- By Mobility

- Market Size & Analysis

- India Armored Vehicles Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenue (USD Million)

- Market Share & Analysis

- By Platform

- By System

- By Mobility

- Market Size & Analysis

- Australia and Armored Vehicles Market Outlook, 2018-2028F

- Market Size & Analysis

- By Revenue (USD Million)

- Market Share & Analysis

- By Platform

- By System

- By Mobility

- Market Size & Analysis

- Market Size & Analysis

- Global Armored Vehicles Market Key Strategic Imperatives for Success & Growth

- Competition Outlook

- Competition Matrix

- Target Markets

- Research & Development

- Collaborations & Strategic Alliances

- Key Business Expansion Initiatives

- Business Restructuring- Mergers, Acquisitions, JVs

- Strategic Initiatives

- Company Profiles (Business Description, Product Segments, Business Segments, Financials, Strategic Alliances/ Partnerships, Future Plans)

- L3Harris Technologies, Inc.

- Hanwha Group

- General Dynamics Corporation

- Lockheed Martin Corporation

- Northrop Grumman

- Oshkosh Defense, LLC

- BAE Systems

- Thales Group

- ST Engineering

- Mitsubishi Heavy Industries

- Textron Systems

- Denel Soc Ltd

- FNSS

- Arquus

- Iveco Defence Vehicles

- Others

- Competition Matrix

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making