Asia-Pacific Ethylene Market Research Report: Forecast (2024-2030)

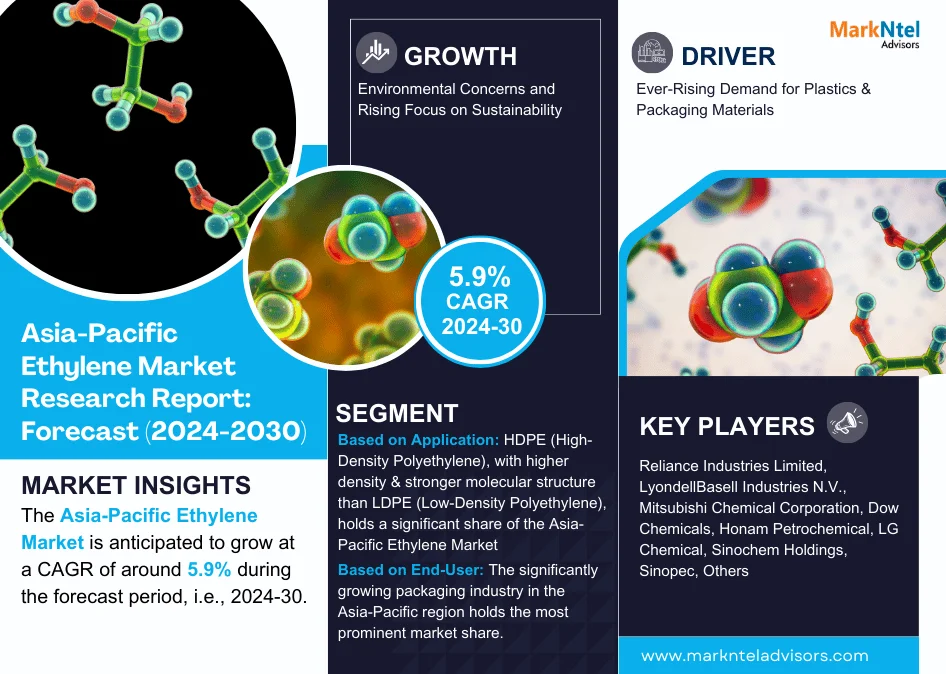

Asia-Pacific Ethylene Market Report - By Application (High-Density Polyethylene, Low-Density Polyethylene, Ethylene Oxide, Ethyl Benzene, Others), By End-User (Chemicals, Building ...& Construction, Food & Beverages, Personal Care, Automotive, Packaging, Textile, Others), By Feedstock (Naphtha, Natural Gas), By Country, (China, Japan, India, South Korea, South East Asia, Oceania, Rest of Asia-Pacific) By Company (Reliance Industries Limited, LyondellBasell Industries N.V., Mitsubishi Chemical Corporation, Dow Chemicals, Honam Petrochemical, LG Chemical, Sinochem Holdings, Sinopec, Others) Read more

- Chemicals

- Jul 2024

- Pages 167

- Report Format: PDF, Excel, PPT

Market Definition

Ethylene (C2H4) is a colorless & flammable hydrocarbon gas that belongs to the family of olefins and used as a feedstock by chemical manufacturers for the production of various chemicals like PE (Polyethylene), Ethylene Oxide, Ethylene Dichloride, Ethylene Benzene, and Vinyl Acetate, among other compounds.

Market Insights & Analysis: Asia-Pacific Ethylene Market (2024-30)

The Asia-Pacific Ethylene Market is anticipated to grow at a CAGR of around 5.9% during the forecast period, i.e., 2024-30. The growth of the market would be propelled mainly by the burgeoning demand for PE (Polyethylene) from the packaging industry, particularly from China, India, & Japan. Improved consumer lifestyles in these countries have created a high demand for quality-based plastic for daily use products. Besides, urbanization and population growth are augmenting the expansion of the construction & automotive sector and, consequently, fueling the demand for plastics.

Asia-Pacific has a rapidly expanding packaging sector, fueled mainly by e-commerce growth and changing consumer preferences, owing to which polyethylene is in high demand for packaging applications in food & beverages, personal care, & industrial packaging. Moreover, the mounting need for infrastructure development, including transportation networks, water supply systems, & housing projects, is another prominent aspect driving the ethylene market in Asia-Pacific. Ethylene-based products like HDPE pipes & fittings are being extensively used in these infrastructure activities owing to their superior strength, flexibility, & corrosion resistance.

| Report Coverage | Details |

|---|---|

| Study Period | Historical Data: 2019-22 |

| Base Year: 2023 | |

| Forecast Period: 2024-30 | |

| CAGR (2024-2030) | 5.9% |

| Country Covered | China, Japan, India, South Korea, South East Asia, Oceania, Rest of Asia-Pacific |

| Key Companies Profiled | Reliance Industries Limited, LyondellBasell Industries N.V., Mitsubishi Chemical Corporation, Dow Chemicals, Honam Petrochemical, LG Chemical, Sinochem Holdings, Sinopec, Others |

| Unit Denominations | USD Million/Billion |

Furthermore, the booming automotive sector in Asia-Pacific, backed by rising disposable incomes, urbanization, and increased mobility requirements, is another significant contributor to the ethylene market growth, owing mainly to the extensive use of ethylene derivatives in various automotive applications, including fuel systems, interior components, & electrical wiring. In addition, the rapidly increasing availability of natural gas, i.e., the primary feedstock for ethylene production, coupled with the strong government support for the growth of the petrochemical industry in various countries, would also drive the Asia-Pacific Ethylene Market through 2028.

Asia-Pacific Ethylene Market Driver:

Ever-Rising Demand for Plastics & Packaging Materials - The growing middle-class populace and changing lifestyles in Asia-Pacific are leading to rapidly increasing consumption of packaged goods, which require ethylene-based products like polyethylene for packaging purposes. Since the packaging industry, including food & beverages, personal care products, and e-commerce packaging, is a major consumer of ethylene, its significant growth in Asia-Pacific is driving the ethylene market. In addition, the construction sector is also boosting the demand for polyethylene. With massive investments in infrastructure development, ethylene-based products like pipes, fittings, & construction materials are in high demand, i.e., another prominent aspect projected to drive the Asia-Pacific Ethylene Market during 2024-30.

Asia-Pacific Ethylene Market Growth Restraint:

Environmental Concerns and Rising Focus on Sustainability - With rising concerns over climate change, pollution, & waste management, environmental regulations & sustainability considerations are becoming increasingly crucial in Asia-Pacific. Consequently, stricter norms on emissions, waste disposal, & recycling are being implemented across the region. The petrochemical industry, including ethylene production, contributes significantly to GHG (Greenhouse Gas) emissions & environmental pollution, owing to which there is mounting pressure on the sector to adopt cleaner & more sustainable practices, thereby presenting challenges for the Asia-Pacific Ethylene Market, as it requires hefty investments in technologies & processes that reduce environmental impact. Hence, aspects like meeting stricter emissions standards, implementing recycling & waste management practices, and developing more sustainable feedstock sources can restrict the market growth in the coming years.

Asia-Pacific Ethylene Market (2024-30): Segmentation Analysis

The Asia-Pacific Ethylene Market study from MarkNtel Advisors analyses the major trends in each sub-segment and includes predictions for the period 2024-2030 at the country, and national levels. The market has been segmented in our analysis based on application and end-user.

Based on Application:

- High-Density Polyethylene

- Low-Density Polyethylene

- Ethylene Oxide

- Ethyl Benzene

- Others (Vinyl Acetate, etc.)

Of them all, HDPE (High-Density Polyethylene), with higher density & stronger molecular structure than LDPE (Low-Density Polyethylene), holds a significant share of the Asia-Pacific Ethylene Market. It owes to various ongoing & upcoming infrastructure development activities, urbanization, and the rapidly growing packaging sector in the region. The construction sector requires HDPE for wiring, tube, & pipes owing to its high chemical & UV resistance, and the packaging industry relies on HDPE for its excellent barrier properties & durability.

HDPE is used extensively in packaging materials, including bottles, containers, as well as industrial packaging. It is also utilized in the production of pipes & fittings for various industries, including water distribution, gas transportation, and irrigation systems. In addition, HDPE is used in the manufacturing of geomembranes, which are used for environmental protection & containment applications. Advancements in HDPE production technology have enhanced its performance characteristics and expanded its application possibilities. Furthermore, the development of new grades of HDPE with improved strength, impact resistance, & processing capabilities is further accelerating its demand in Asia-Pacific and, in turn, fueling the overall growth of the ethylene market.

Based on End-User:

- Chemicals

- Building & Construction

- Food & Beverages

- Personal Care

- Automotive

- Packaging

- Textile

- Others (Glass, Medical, Pulp & Paper, etc.)

Here, the significantly growing packaging industry in the Asia-Pacific region holds the most prominent market share. It ascribes to the extensive use of ethylene & its derivatives, particularly polyethylene, in packaging applications across various verticals. Population growth, urbanization, changing consumer lifestyles, and the flourishing e-commerce sector are driving the packaging industry, where polyethylene, owing to its excellent durability, flexibility, chemical resistance, & barrier properties, is used largely in numerous applications, including plastic bags, films, containers, & bottles, among other packaging formats.

Additionally, it is employed in packaging for food & beverages, personal care products, household goods, industrial packaging, etc. The ever-growing need for efficient & sustainable packaging solutions, rising consumer expectations for convenient & safe packaging, and stringent regulations on packaging materials are augmenting the demand for polyethylene in the packaging sector and, in turn, stimulating the growth of the Asia-Pacific Ethylene Market.

Asia-Pacific Ethylene Market Country Projection:

- China

- India

- Japan

- South Korea

- South East Asia

- Oceania

Of all countries in Asia-Pacific, China is currently the largest ethylene market, which owes to its large population, rapidly growing economy, and well-established petrochemical industry, driving significant demand for ethylene and its derivatives. The country has made significant investments in expanding its ethylene production capacity. The government has supported the development of petrochemical complexes and encouraged investments in ethylene plants, which has led to the establishment of several large-scale ethylene facilities across the country.

Moreover, China has built a strong presence in the entire ethylene value chain, from production to downstream industries. Several companies have vertically integrated operations, which allow them to control the complete process from raw material procurement to end-product manufacturing, which results in enhanced efficiency & cost-effectiveness.

Furthermore, the Chinese government has implemented several policies, including tax incentives, subsidies, & favorable regulations, while encouraging hefty investments & domestic production for the growth of the petrochemical industry, including the ethylene sector. Hence, these aspects are spurring growth in the China Ethylene Market and creating lucrative prospects for the companies operating in the industry.

Asia-Pacific Ethylene Industry Recent Developments

- On 22 May 2023, Sinopec signed a key terms agreement with KazMunayGaz, the national operator of the oil & gas industry of Kazakhstan, for developing a polyethylene project in the Atyrau Region in Xi'an, China.

- On 28 March 2023, Lotte Chemical Indonesia, a subsidiary of South Korean-based Lotte Group, successfully secured financing for the construction of a petrochemical complex in Banten Province, Indonesia. The project, upon its completion in 2025, will manufacture 1 million tons of Ethylene and 520,000 tons of Propylene each year.

Gain a Competitive Edge with Our Asia-Pacific Ethylene Market Report

- The sample report seeks to acquaint you with the layout and the overall research content.

- The deliberate utilization of the report may further streamline operations while maximizing your revenue.

- To gain an unmatched competitive advantage in your industry, you can customize the report by adding more segments and specific countries suiting your needs.

- For a better understanding of the contemporary market scenario, feel free to connect to our knowledgeable analysts.

Frequently Asked Questions

- Market Segmentation

- Introduction

- Product Definition

- Research Process

- Assumptions

- Preface

- Executive Summary

- Impact of COVID-19 on Asia-Pacific Ethylene Market

- Asia-Pacific Ethylene Market Porter’s Five Forces Model

- Threat of New Entrants

- Bargaining Power of Suppliers

- Bargaining Power of Buyers

- Threat of Substitutes

- Intensity of Competition

- Asia-Pacific Ethylene Market Trends & Insights

- Asia-Pacific Ethylene Market Dynamics

- Growth Drivers

- Challenges

- Asia-Pacific Ethylene Market Policies & Regulations

- Asia-Pacific Ethylene Market Hotspot & Opportunities

- Asia-Pacific Ethylene Supply Chain Analysis

- Asia-Pacific Ethylene Market Outlook, 2019-2030F

- Market Size & Analysis

- Market Revenues (USD Million)

- Quantity Sold (Thousand Tons)

- Market Share & Analysis

- By Application

- High-Density Polyethylene

- Low-Density Polyethylene

- Ethylene Oxide

- Ethyl Benzene

- Others (Vinyl Acetate, Vinyl Acetate, etc.)

- By Feedstock

- Naphtha

- Natural Gas

- By End-User Industry

- Chemicals

- Building & Construction

- Food & Beverages

- Personal Care

- Automotive

- Packaging

- Textile

- Others (Glass, Medical, Pulp & Paper, etc.)

- By Country

- China

- Japan

- India

- South Korea

- South East Asia

- Oceania

- Rest of Asia-Pacific

- By Competitors

- Competition Characteristics

- Market Share & Analysis

- By Application

- Market Size & Analysis

- China Ethylene Market Outlook, 2019-2030F

- Market Size & Analysis

- Market Revenues (USD Million)

- Quantity Sold (Thousand Tons)

- Market Share & Analysis

- By Application

- By End-User Industry

- Market Size & Analysis

- Japan Ethylene Market Outlook, 2019-2030F

- Market Size & Analysis

- Market Revenues (USD Million)

- Quantity Sold (Thousand Tons)

- Market Share & Analysis

- By End-User Industry

- Market Size & Analysis

- India Ethylene Market Outlook, 2019-2030F

- Market Size & Analysis

- Market Revenues (USD Million)

- Quantity Sold (Thousand Tons)

- Market Share & Analysis

- By End-User Industry

- Market Size & Analysis

- South Korea Ethylene Market Outlook, 2019-2030F

- Market Size & Analysis

- Market Revenues (USD Million)

- Quantity Sold (Thousand Tons)

- Market Share & Analysis

- By End-User Industry

- Market Size & Analysis

- Vietnam Asia Ethylene Market Outlook, 2019-2030F

- Market Size & Analysis

- Market Revenues (USD Million)

- Quantity Sold (Thousand Tons)

- Market Share & Analysis

- By End-User Industry

- Market Size & Analysis

- Thailand Ethylene Market Outlook, 2019-2030F

- Market Size & Analysis

- Market Revenues (USD Million)

- Quantity Sold (Thousand Tons)

- Market Share & Analysis

- By End-User Industry

- Market Size & Analysis

- Indonesia Ethylene Market Outlook, 2019-2030F

- Market Size & Analysis

- Market Revenues (USD Million)

- Quantity Sold (Thousand Tons)

- Market Share & Analysis

- By End-User Industry

- Market Size & Analysis

- Australia & New Zealand Ethylene Market Outlook, 2019-2030F

- Market Size & Analysis

- Market Revenues (USD Million)

- Quantity Sold (Thousand Tons)

- Market Share & Analysis

- By End-User Industry

- Market Size & Analysis

- Asia-Pacific Ethylene Market Key Strategic Imperatives for Success & Growth

- Competition Outlook

- Competition Matrix

- Target Markets

- Research & Development

- Collaborations & Strategic Alliances

- Key Business Expansion Initiatives

- Business Restructuring- Mergers, Acquisitions, JVs

- Strategic Initiatives

- Company Profiles (Business Description, Product Segments, Business Segments, Financials, Strategic Alliances/ Partnerships, Future Plans)

- Reliance Industries Limited

- LyondellBasell Industries N.V.

- Mitsubishi Chemical Corporation

- Dow Chemicals

- Honam petrochemical

- LG chemical

- Sinochem Holdings

- Sinopec

- PetroChina

- Hengli Petrochemical

- Indian Oil Corporation Limited

- Haldia Petrochemicals Limited

- Others

- Competition Matrix

- Disclaimer

MarkNtel Advisors follows a robust and iterative research methodology designed to ensure maximum accuracy and minimize deviation in market estimates and forecasts. Our approach combines both bottom-up and top-down techniques to effectively segment and quantify various aspects of the market. A consistent feature across all our research reports is data triangulation, which examines the market from three distinct perspectives to validate findings. Key components of our research process include:

1. Scope & Research Design At the outset, MarkNtel Advisors define the research objectives and formulate pertinent questions. This phase involves determining the type of research—qualitative or quantitative—and designing a methodology that outlines data collection methods, target demographics, and analytical tools. They also establish timelines and budgets to ensure the research aligns with client goals.

2. Sample Selection and Data Collection In this stage, the firm identifies the target audience and determines the appropriate sample size to ensure representativeness. They employ various sampling methods, such as random or stratified sampling, based on the research objectives. Data collection is carried out using tools like surveys, interviews, and observations, ensuring the gathered data is reliable and relevant.

3. Data Analysis and Validation Once data is collected, MarkNtel Advisors undertake a rigorous analysis process. This includes cleaning the data to remove inconsistencies, employing statistical software for quantitative analysis, and thematic analysis for qualitative data. Validation steps are taken to ensure the accuracy and reliability of the findings, minimizing biases and errors.

4. Data Forecast and FinalizationThe final phase involves forecasting future market trends based on the analyzed data. MarkNtel Advisors utilize predictive modeling and time series analysis to anticipate market behaviors. The insights are then compiled into comprehensive reports, featuring visual aids like charts and graphs, and include strategic recommendations to inform client decision-making